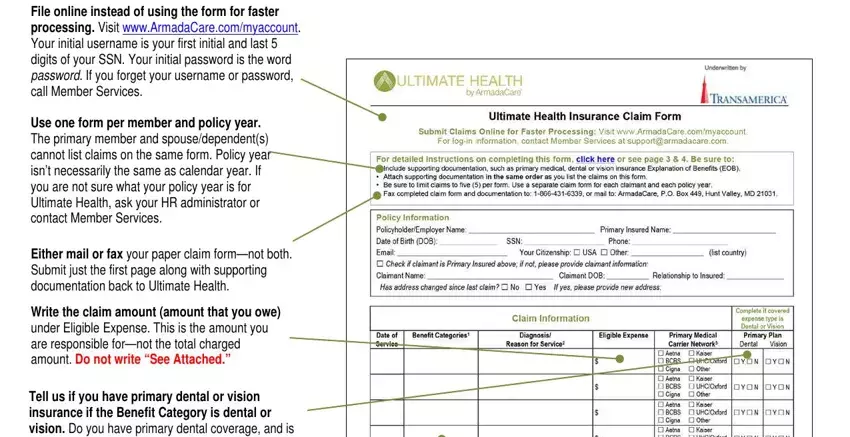

For log-in information, contact Member Services at 1-855-943-4595

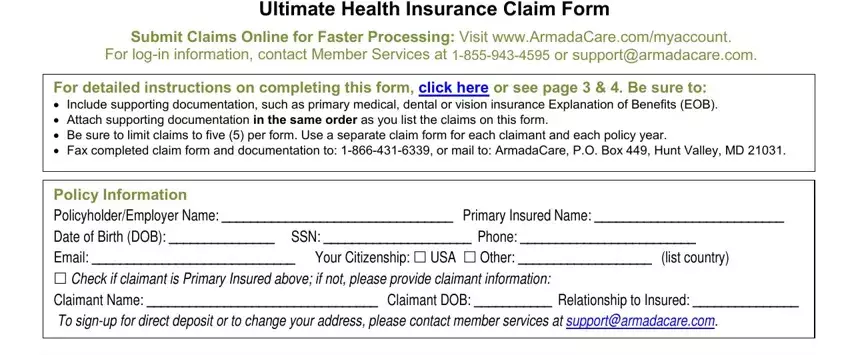

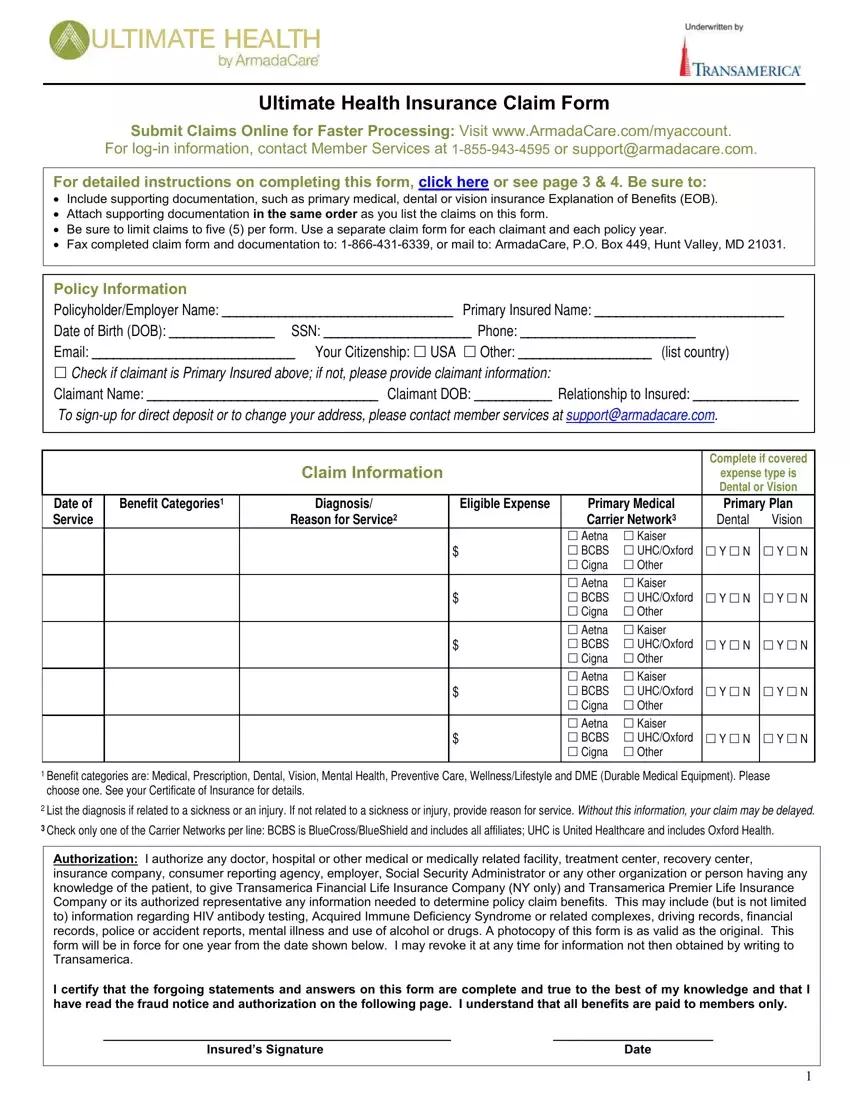

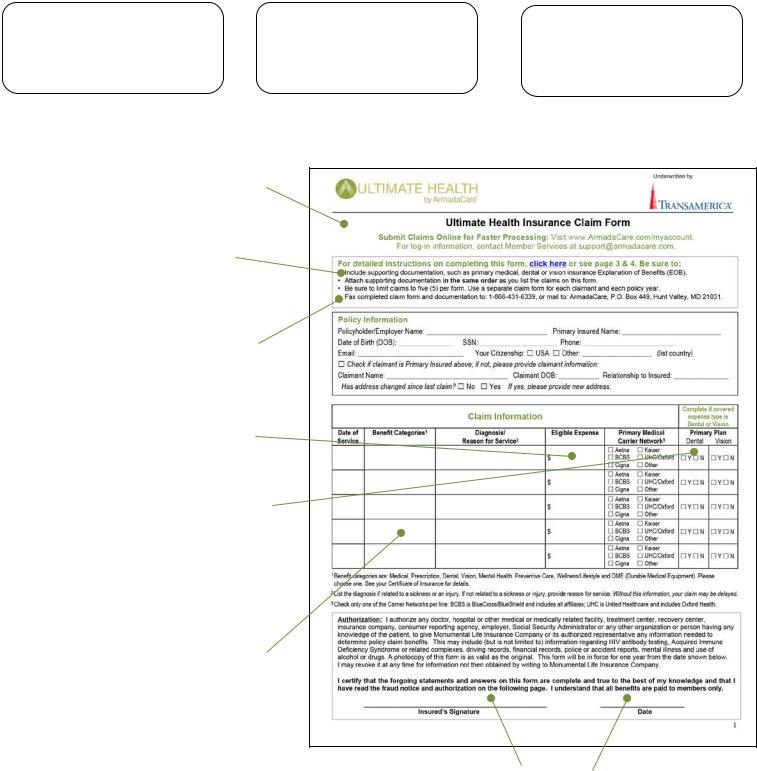

Ultimate Health Insurance Claim Form

Submit Claims Online for Faster Processing: Visit www.ArmadaCare.com/myaccount. or support@armadacare.com.

For detailed instructions on completing this form, click here or see page 3 & 4. Be sure to:

•Include supporting documentation, such as primary medical, dental or vision insurance Explanation of Benefits (EOB).

•Attach supporting documentation in the same order as you list the claims on this form.

•Be sure to limit claims to five (5) per form. Use a separate claim form for each claimant and each policy year.

•Fax completed claim form and documentation to: 1-866-431-6339, or mail to: ArmadaCare, P.O. Box 449, Hunt Valley, MD 21031.

Policy Information

Policyholder/Employer Name: _________________________________ Primary Insured Name: ___________________________

Date of Birth (DOB): _______________ SSN: _____________________ Phone: _________________________

Email: _____________________________ Your Citizenship: USA Other: ___________________ (list country)

Check if claimant is Primary Insured above; if not, please provide claimant information:

Claimant Name: _________________________________ Claimant DOB: ___________ Relationship to Insured: _______________

To sign-up for direct deposit or to change your address, please contact member services at support@armadacare.com.

Complete if covered

expense type is Dental or Vision

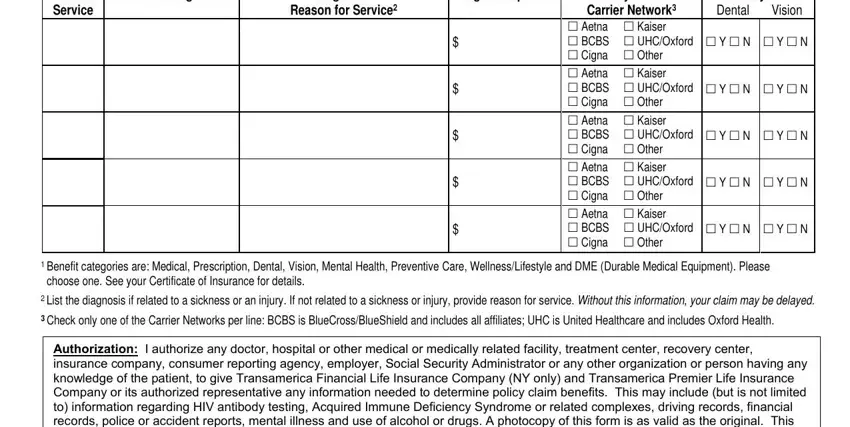

Benefit Categories1 |

Diagnosis/ |

Eligible Expense |

Primary Medical |

Primary Plan |

|

Reason for Service2 |

|

Carrier Network3 |

Dental |

Vision |

|

|

|

Aetna |

Kaiser |

|

|

|

|

$ |

BCBS |

UHC/Oxford |

Y N |

Y N |

|

|

|

Cigna |

Other |

|

|

|

|

|

|

|

|

|

|

|

|

Aetna |

Kaiser |

|

|

|

|

$ |

BCBS |

UHC/Oxford |

Y N |

Y N |

|

|

|

Cigna |

Other |

|

|

|

|

|

|

|

|

|

|

|

|

Aetna |

Kaiser |

|

|

|

|

$ |

BCBS |

UHC/Oxford |

Y N |

Y N |

|

|

|

Cigna |

Other |

|

|

|

|

|

|

|

|

|

|

|

|

Aetna |

Kaiser |

|

|

|

|

$ |

BCBS |

UHC/Oxford |

Y N |

Y N |

|

|

|

Cigna |

Other |

|

|

|

|

|

|

|

|

|

|

|

|

Aetna |

Kaiser |

|

|

|

|

$ |

BCBS |

UHC/Oxford |

Y N |

Y N |

|

|

|

Cigna |

Other |

|

|

|

|

|

|

|

|

|

1Benefit categories are: Medical, Prescription, Dental, Vision, Mental Health, Preventive Care, Wellness/Lifestyle and DME (Durable Medical Equipment). Please choose one. See your Certificate of Insurance for details.

2List the diagnosis if related to a sickness or an injury. If not related to a sickness or injury, provide reason for service. Without this information, your claim may be delayed.

3Check only one of the Carrier Networks per line: BCBS is BlueCross/BlueShield and includes all affiliates; UHC is United Healthcare and includes Oxford Health.

Authorization: I authorize any doctor, hospital or other medical or medically related facility, treatment center, recovery center, insurance company, consumer reporting agency, employer, Social Security Administrator or any other organization or person having any knowledge of the patient, to give Transamerica Financial Life Insurance Company (NY only) and Transamerica Premier Life Insurance Company or its authorized representative any information needed to determine policy claim benefits. This may include (but is not limited to) information regarding HIV antibody testing, Acquired Immune Deficiency Syndrome or related complexes, driving records, financial records, police or accident reports, mental illness and use of alcohol or drugs. A photocopy of this form is as valid as the original. This form will be in force for one year from the date shown below. I may revoke it at any time for information not then obtained by writing to Transamerica.

I certify that the forgoing statements and answers on this form are complete and true to the best of my knowledge and that I have read the fraud notice and authorization on the following page. I understand that all benefits are paid to members only.

__________________________________________________ |

_______________________ |

Insured’s Signature |

Date |

1

Claim Fraud Warning

Your state may require the following notice: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

State Specific Notices:

Alabama: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or who knowingly presents false information in an application for insurance is guilty of a crime and may be subject to restitution fines or confinement in prison, or any combination thereof.

Alaska: A person who knowingly and with intent to injure, defraud, or deceive an insurance company files a claim containing false, incomplete, or misleading information may be prosecuted under state law.

Arizona: For your protection, Arizona law requires the following statement to appear on this form. Any person who knowingly presents a false or fraudulent claim for payment of a loss is subject to criminal and civil penalties.

Arkansas, District of Columbia, Louisiana, Rhode Island, Texas, West Virginia: Any person who knowingly presents a false or fraudulent claim for payment of a loss or benefit or knowingly presents false information in application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

California: For your protection, California law requires the following to appear on this form. Any person who knowingly presents false or fraudulent claim for the payment of a loss is guilty of a crime and may be subject to fines and confinement in state prison.

Colorado: It is unlawful to knowingly provide false, incomplete, or misleading facts or information to any insurance company for the purpose of defrauding or attempting to defraud the company. Penalties may include imprisonment, fines, denial of insurance and civil damages. Any insurance company or agents of an insurance company who knowingly provides false, incomplete, or misleading facts or information to a policyholder or claimant for the purpose of defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable from insurance proceeds shall be reported to the Colorado Division of Insurance within the Department of Regulatory Agencies.

Delaware, Idaho, Indiana: Any person who knowingly, and with intent to injure, defraud or deceive any insurer, files a statement of claim containing any false, incomplete or misleading information is guilty of a felony.

Florida: Any person who knowingly and with intent to injure, defraud, or deceive any insurer files a statement of claim or an application containing any false, incomplete, or misleading information is guilty of a felony of the third degree.

Kentucky, Pennsylvania:Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information or conceals for the purpose of misleading, information concerning any fact material thereto commits a fraudulent insurance act, which is a crime and subjects such person to criminal and civil penalties.

Maine, Tennessee, Virginia, Washington: It is a crime to knowingly provide false, incomplete, or misleading information to an insurance company for the purpose of defrauding the company. Penalties include imprisonment, fines, and denial of insurance benefits.

Maryland: Any person who knowingly or willfully presents a false or fraudulent claim for payment of a loss or benefit or who knowingly or willfully presents false information in an application for insurance is guilty of a crime and may be subject to fines and confinement in prison.

Minnesota: A person who files a claim with intent to defraud or helps commit a fraud against an insurer is guilty of a crime.

New Hampshire: Any person who, with a purpose to injure, defraud or deceive any insurance company, files a statement of claim containing any false, incomplete or misleading information is subject to prosecution and punishment for insurance fraud, as provided in RSA 638:20.

New Jersey: Any person who knowingly files a statement of claim containing any false or misleading information is subject to criminal and civil penalties.

New York: Any person who knowingly and with intent to defraud any insurance company or other person files an application for insurance or statement of claim containing any materially false information, or conceals for the purpose of misleading, information concerning any fact material thereto, commits a fraudulent insurance act, which is a crime, and shall also be subject to a civil penalty not to exceed five thousand dollars and the stated value of the claim for each such violation.

Ohio: Any person that knowingly presents false information in an application for insurance or life settlement contract is guilty of a crime and may be subject to fines and confinement in prison.

Oklahoma: WARNING: Any person who knowingly, and with intent to injure, defraud or deceive any insurer, makes any claim for the proceeds of an insurance policy containing any false, incomplete or misleading information is guilty of a felony.

2

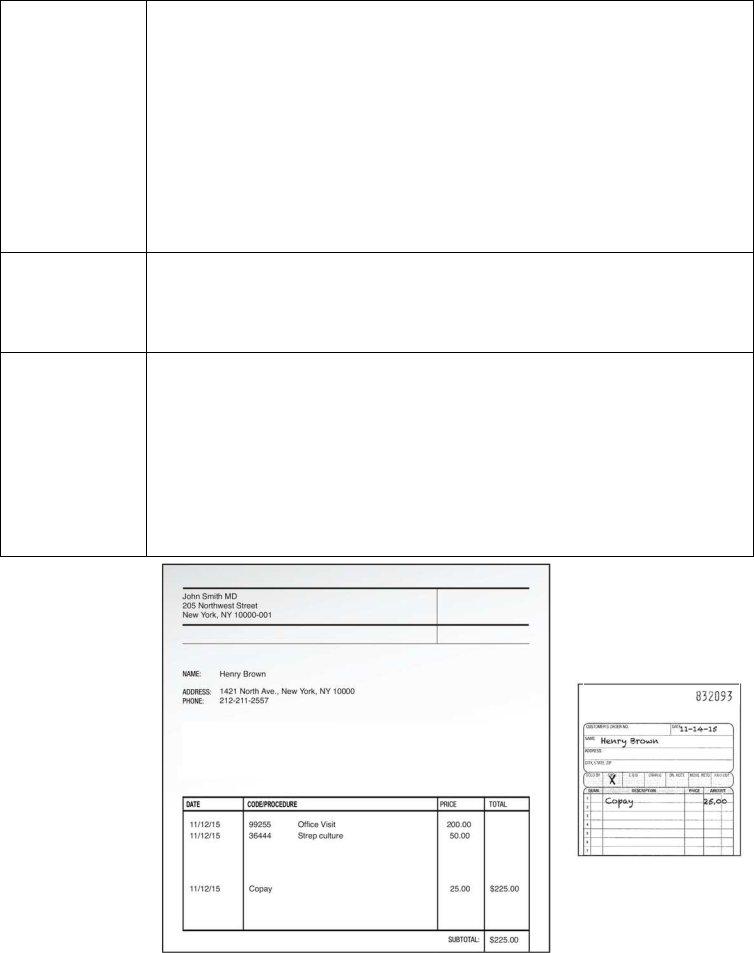

What Documentation Do I Need?

|

|

» Submit an Explanation of Benefits (EOB) from your primary insurance as |

|

|

documentation for most all claims. Include all EOB pages (with footnotes and YTD |

|

|

deductible summary) even if denied by your primary plan. |

|

All Claims |

» Exceptions where a detailed receipt can be submitted in replace of an EOB are noted in |

|

this chart. Detailed receipts must show date service provided, description of service and |

|

|

|

|

amount owed, provider name and patient name. See example below. |

|

|

» Do not submit statements that are not itemized and say “Balance Forward,” “Previous |

|

|

Balance Due,” or “Paid on Account” or pre-treatment estimates. |

|

|

|

|

Doctor Co-Pays |

» Submit detailed receipt (no EOB required). |

|

|

|

|

Out-of-Network |

» Submit balance bill invoice along with primary plan’s EOB and indicate OON on claim |

|

(OON) Provider |

form. |

»Submit Rx receipt that includes patient name, drug name, filled date and charged amount.

Prescriptions

»No cash or credit card receipts or cancelled checks accepted.

»Do not black out the name of the drug on the Rx receipt.

Over-the-Counter |

» Prescription required; submit prescription and detailed receipt. |

Medications |

|

|

|

Massage Therapy |

» Prescription required; submit prescription and detailed receipt. |

|

|

Vision |

» Submit EOB if you have primary vision insurance; if not, submit detailed receipt. |

|

|

Dental |

» Submit EOB if you have primary dental insurance; if not, submit detailed receipt. |

|

|

Executive |

» If self-pay/not covered by primary insurance, submit contract and invoice. |

|

Physicals |

» If accepted (even partially) by primary insurance, submit EOB. |

|

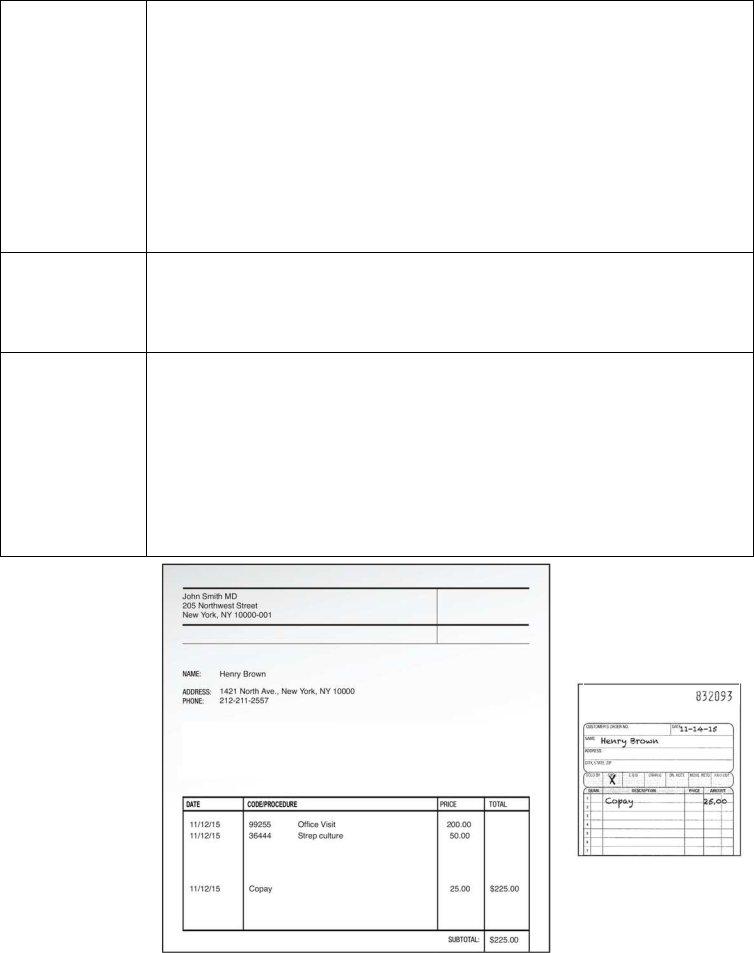

Good Receipt

Example

Shows:

»Date Service Provided

»Description of Service and Amount Owed

»Provider Name and Patient Name