In today's complex financial landscape, numerous homeowners find themselves facing challenging circumstances that make it difficult to keep up with mortgage payments. Recognizing this, the Uniform Borrower Assistance Form (UBAF) serves as a crucial tool for those seeking to navigate temporary or long-term financial hardships. This comprehensive document requires borrowers to provide detailed information about their current situation, including their intentions regarding their home, the property's status, real estate taxes, homeowner's insurance premiums, bankruptcy filings, credit counseling involvement, and any additional liens on the property. Furthermore, the form delves into the borrower's income, expenses, and assets, offering a holistic view of their financial standing. Submission of this form, alongside required income and hardship documentation, initiates the evaluation process for various mortgage relief solutions, such as modification, forbearance, or other assistance programs tailored to prevent foreclosure. By signing the UBAF, borrowers must certify the truthfulness of the provided information, which is subject to verification by the servicer or authorized parties, underlining the seriousness and legal implications of the assistance request process. Through this form, borrowers are given the opportunity to articulate their hardship and seek appropriate relief measures, illustrating a structured approach to addressing financial distress and fostering a pathway toward resolution.

| Question | Answer |

|---|---|

| Form Name | Uniform Borrower Assistance Form |

| Form Length | 5 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min 15 sec |

| Other names | uniform borrower assistance form 2019, uniform borrower assistance form 2018, uniform borrower assistant form, universal form 710 october 2016 |

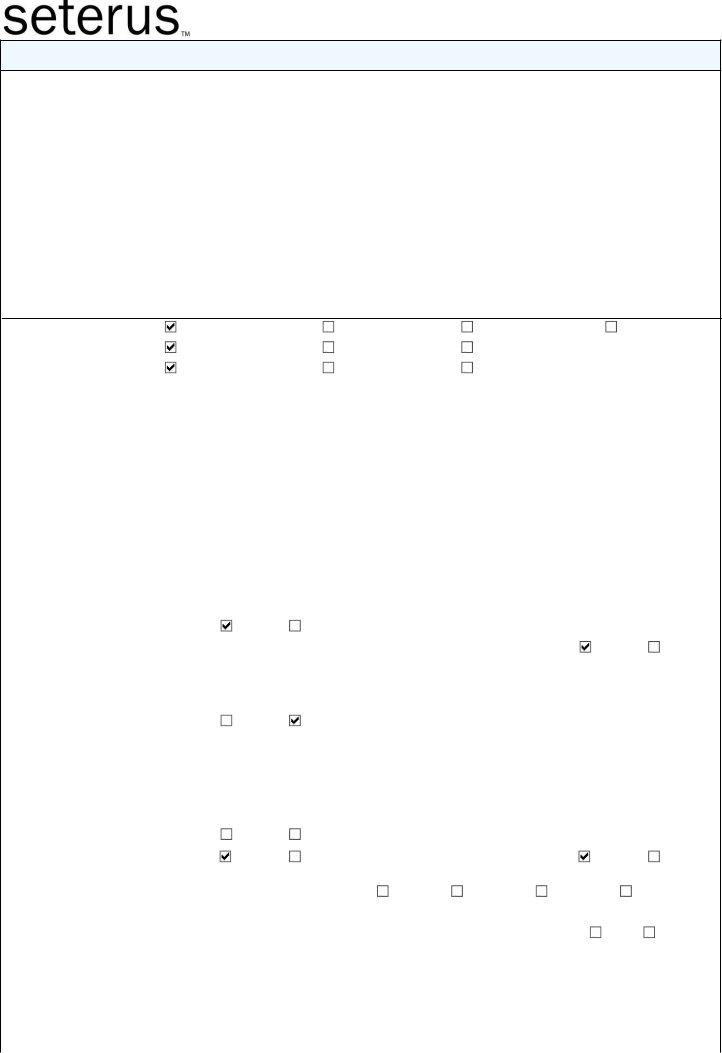

Loan Number: 1004848

UNIFORM BORROWER ASSISTANCE FORM

If you are experiencing a temporary or

On Page 2, you must disclose information about all of your income, expenses, and assets. Page 3 also lists the required income documentation that you must submit in support of your request for assistance. Then on Page 4, you must complete the Hardship Affidavit in which you disclose the nature of your hardship. It also tells you the required documentation that you must submit in support of your hardship claim.

NOTICE: In addition, when you sign and date this form, you will make important certifications, representations and agreements, including certifying that all of the information in this Borrower Assistance Form is accurate and truthful and any identified hardship has contributed to your submission of this request for mortgage relief.

REMINDER: The Borrower Response Package you need to return consists of: (1) this completed, signed and dated Borrower Assistance Form; (2) completed and signed IRS Form

|

I want to: |

|

Keep the Property |

|

Vacate the Property |

Sell the Property |

Undecided |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

The property is currently: |

My Primary Residence |

|

A Second Home |

An Investment Property |

|

||||||||

|

The property is currently: |

Owner Occupied |

|

Renter occupied |

Vacant |

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BORROWER |

|

|

|

|

|

|

|

|

|

|

|||

|

BORROWER'S NAME: John Loan Mod |

|

|

|

|

|

||||||||

|

SOCIAL SECURITY |

|

DATE OF BIRTH |

NO. OF |

|

|

SOCIAL SECURITY |

|

DATE OF BIRTH |

NO. OF |

||||

|

NUMBER |

|

Sep 12, 1978 |

DEPENDENTS: |

|

NUMBER |

|

Sep 20, 1978 |

DEPENDENTS: |

|||||

|

678 - 68 - 8767 |

|

|

|

|

|

|

678 - 68 - 8767 |

|

|

|

|

|

|

|

HOME PHONE NUMBER WITH AREA CODE |

|

|

|

HOME PHONE NUMBER WITH AREA CODE |

|

|

|||||||

|

(342) 534 - 3425 |

|

|

|

|

|

|

(523) 453 - 2534 |

|

|

|

|

|

|

|

CELL OR WORK NUMBER WITH AREA CODE |

|

|

CELL OR WORK NUMBER WITH AREA CODE |

|

|||||||||

|

(305) 606 - 2360 |

|

|

|

|

|

|

(234) 324 - 3243 |

|

|

|

|

|

|

|

MAILING ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1111 1st St, New Roads, LA 12121. |

|

|

|

|

|

|

|

|

|

|

|||

|

PROPERTY ADDRESS (IF SAME AS MAILING ADDRESS, JUST WRITE SAME) |

EMAIL ADDRESS |

|

|

|

|||||||||

|

1111 1st St, New Roads, LA 12121. |

|

|

|

|

craig@pixelfusion.com |

|

|

||||||

|

|

|

|

|

|

|

||||||||

|

Is the property listed for sale? |

|

Yes |

No |

|

Have you contacted a |

||||||||

|

If yes: |

|

|

|

|

|

|

|

|

|

|

Yes |

No |

|

|

what was the listing date? ___________________ |

|

|

If yes: |

|

|

|

|

|

|||||

|

Have you received an offer on the property? |

|

|

|

Counselor's Name: John SMoth |

|

|

|

||||||

|

|

|

|

|

Yes |

No |

|

Agency's Name: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

_______________________________________________ |

||||||

|

Date of offer: ___________________ |

|

|

|

Counselor's Phone Number: (987) 897 - 9879 Ext 89789 |

|||||||||

|

Amount of Offer: $ 0.00 |

|

|

|

|

|

Counselor's Email Address: |

|

|

|

||||

|

Agent's Name: |

|

|

|

|

|

john@counselor.com |

|

|

|

||||

|

Agent's Phone Number: |

|

|

|

|

_______________________________________________ |

||||||||

|

Is the property for sale by owner? |

|

Yes |

No |

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|||||

|

Do you have condominium or |

|

Yes |

No |

|

Have you filed for bankruptcy? |

|

Yes |

No |

|||||

|

homeowner association (HOA) fees? |

|

|

|

If yes: |

|

|

|

|

|

||||

|

If yes: Total monthly amount: $ 100.00 |

|

|

|

Chapter 7 |

Chapter 11 |

Chapter 12 |

Chapter 13 |

||||||

|

Amount Past Due: $ __________________ |

|

|

Filing date: ___________________ |

|

|

||||||||

|

Name and address fees are paid to: |

|

|

|

Has your bankruptcy been discharged? |

Yes |

No |

|||||||

|

______________________________________________ |

|

|

|

|

|

|

|

||||||

|

__________________________________________ |

|

Bankruptcy case number: |

___________________ |

||||||||||

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Updated February 2013 |

F054D |

Page 1 of 5 |

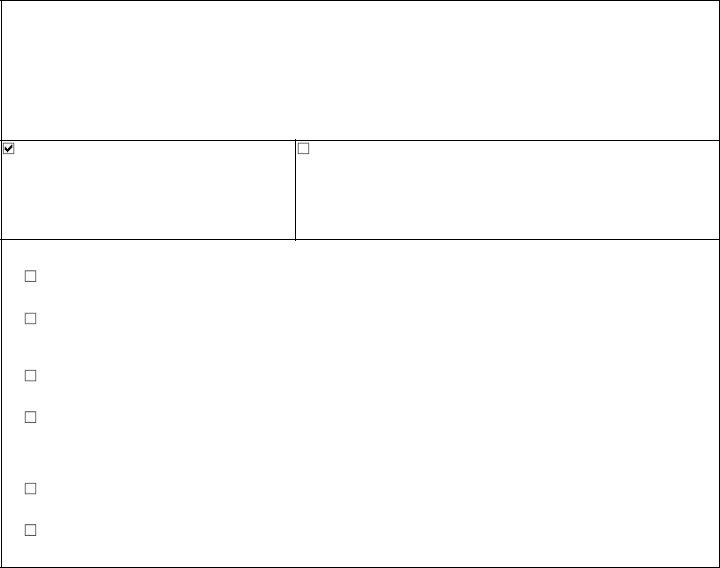

Loan Number: 1004848

Is any borrower an active duty service member? |

|

|

|

|

|

|

|

Yes |

No |

||

Is any borrower the spouse or dependent of an active duty service member? |

|

|

|

|

Yes |

No |

|||||

Has any borrower been deployed away from his/her primary residence or recently received a Permanent Change of |

Yes |

No |

|||||||||

Station order? |

|

|

|

|

|

|

|

|

|

|

|

Is any borrower the surviving spouse of a deceased service member who was on active duty at the time of death? |

Yes |

No |

|||||||||

Is any borrower a dependent of a deceased service member who was on active duty at the time of death? |

Yes |

No |

|||||||||

|

|

|

|

|

|

|

|

|

|||

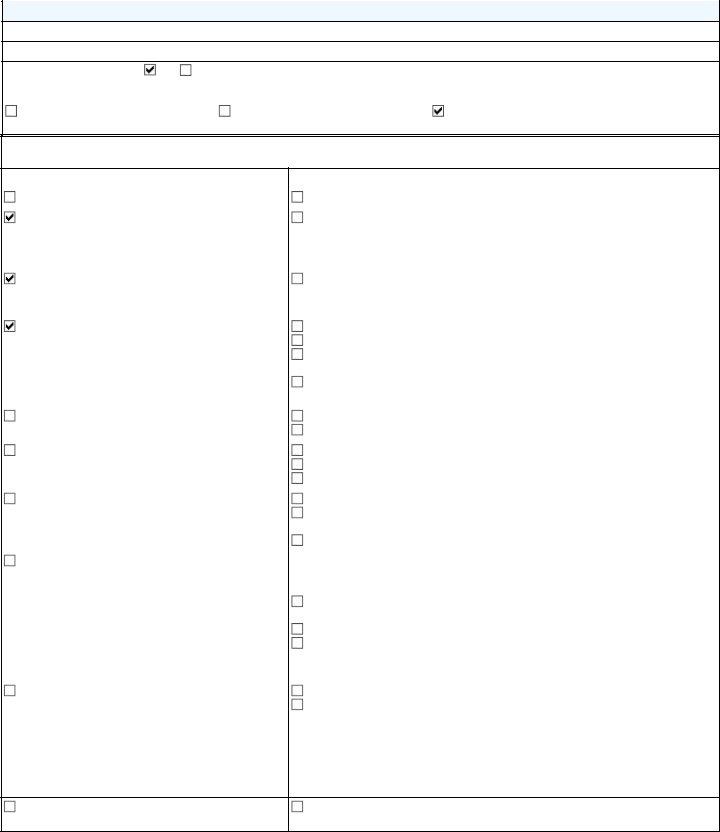

Monthly Household Income |

|

|

|

Household Assets (associated with |

|

||||||

|

|

|

|

|

|

|

the property and/or borrower(s) |

|

|||

Gross wages |

|

|

|

$4,400.00 |

|

Checking Account(s) |

|

|

$3,400.00 |

||

|

|

|

|

|

|

|

|

|

|

|

|

Overtime |

|

|

|

$0 |

|

Checking Account(s) |

|

|

$ |

||

|

|

|

|

|

|

|

|

|

|

|

|

Child Support / Alimony* |

|

|

|

$0 |

|

Savings / Money Market |

|

|

$1,000.00 |

||

|

|

|

|

|

|

|

|

|

|

|

|

|

$0 |

|

CDs |

|

|

$ |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

Taxable SS benefits or other monthly income from |

|

$0 |

|

Stocks / Bonds |

|

|

$0 |

||||

annuities or retirement plans |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tips, commissions, bonus and |

$0 |

|

Other Cash on Hand |

|

|

$200.00 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

Rents Received |

|

|

|

$0 |

|

Other Real Estate (estimated value) |

|

$0 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

Unemployment Income |

|

|

|

$0 |

|

Other_____________ |

|

|

$374,000.00 |

||

|

|

|

|

|

|

|

|

|

|

|

|

Food Stamps/Welfare |

|

|

|

$0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other_____________ |

|

|

|

$0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total (Gross income) |

|

|

|

$4,400.00 |

|

Total (assets) |

|

|

$378,600.00 |

||

|

|

|

MONTHLY HOUSEHOLD EXPENSES/DEBT |

|

|

|

|||||

Monthly Debt Expenses |

|

|

|

|

|

Monthly Household Expenses |

|

|

|||

First mortgage payment |

$1,872.96 |

|

Cable |

|

|

|

$50.00 |

|

Tuition |

|

$0 |

|

|

|

|

|

|

|

|

|

|||

Second mortgage payment |

$0 |

|

Bankruptcy trustee |

|

$ |

|

Gas / fuel / oil for vehicle |

$ |

|||

|

|

|

payments |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

||

Homeowner's Insurance |

$237.11 |

|

Bus / transit / parking |

|

$0 |

|

Ground rent / land lease |

|

$ |

||

|

|

|

|

|

|

|

|

|

|

||

Property taxes |

$110.00 |

|

Internet |

|

$0 |

|

Health insurance |

|

$150.00 |

||

|

|

|

|

|

|

|

|

|

|

||

Credit cards / installment |

$325.00 |

|

Charitable giving |

|

$0 |

|

Medical bills |

|

$0 |

||

loans(total minimum |

|

|

|

|

|

|

|

|

|

|

|

payment / mo.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Car lease payments |

$125.00 |

|

Child care |

|

$155.00 |

|

Life insurance |

|

$ |

||

|

|

|

|

|

|

|

|

|

|

||

HOA/condo fees/property |

$100.00 |

|

Clothes |

|

$0 |

|

Prescriptions |

|

$ |

||

maintenance |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

Mortgage payments on |

$0 |

|

Entertainment |

|

$325.00 |

|

Phones (land and/or cell) |

$0 |

|||

other properties |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

Alimony payments |

|

|

Legal / court costs |

|

$ |

|

Food |

|

$0 |

||

|

|

|

|

|

|

|

|

|

|||

Child support payments |

$0 |

|

Tax payments |

|

$ |

|

Gas / electricity / fuel oil / |

$0 |

|||

|

|

|

|

|

|

|

|

|

water / sewer / garbage |

|

|

|

|

|

|

|

|

|

|

|

|

||

Other |

$0 |

|

Vehicle insurance |

|

$350.00 |

|

Other |

|

$0 |

||

|

|

|

|

|

|

|

|

|

|||

Total (debt expenses) |

|

|

Total (household expenses) |

|

|

$3,800.07 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

Updated February 2013 |

F054D |

Page 2 of 5 |

Loan Number: 1004848

If subordinate lien(s) or any other lien(s) exist on the subject property, please enter information on the lien(s) below:

Lien Holder's Name: |

Balance and Interest Rate: |

Loan Number: |

Lien Holder's Phone Number: |

__________________________ |

0.00/1.000 |

_________________________ |

|

__________________________ |

|

|

|

__ |

|

|

|

|

/ |

|

|

|

|

|

|

|

/ |

|

|

|

REQUIRED INCOME DOCUMENTATION |

|

|

Do you earn a salary or hourly wage?

For each borrower who is a salaried employee or paid by the hour, include paystub(s) reflecting the most recent 30 days' earnings and documentation reflecting

Are you

For each borrower who receives self employed income, include a complete, signed individual federal income tax return and, as applicable, the business tax return; AND either the most recent signed and dated quarterly or

Do you have any additional sources of income? Provide for each borrower as applicable:

"Other Earned Income" such as bonuses, commissions, housing allowance, tips, or overtime:

Reliable

Social Security, disability or death benefits, pension, public assistance, or adoption assistance:

Documentation showing the amount and frequency of the benefits, such as letters, exhibits, disability policy or benefits statement from the provider, and

Documentation showing the receipt of payment, such as copies of the two most recent bank statements showing deposit amounts. Rental income:

Copy of the most recent filed federal tax return with all schedules, including Schedule

If rental income is not reported on Schedule

Investment income:

Copies of the two most recent investment statements or bank statements supporting receipt of this income. Alimony, child support, or separation maintenance payments as qualifying income:*

Copy of divorce decree, separation agreement, or other written legal agreement filed with a court, or court decree that states the amount of the alimony, child support, or separation maintenance payments and the period of time over which the payments will be received, and

Copies of your two most recent bank statements or other

*Notice: Alimony, child support, or separate maintenance income need not be revealed if you do not choose to have it considered for repaying this loan.

Updated February 2013 |

F054D |

Page 3 of 5 |

Loan Number: 1004848

HARDSHIP AFFIDAVIT

I am requesting review of my current financial situation to determine whether I qualify for temporary or permanent mortgage relief options.

Date Hardship Began is: May 10, 2012

Has your hardship ended? No |

Yes If yes, what date was it resolved? ___________________________ |

|

|

|

|

My hardship situation is: |

|

|

|

|

|

|

|

(greater than 12 months) |

I am having difficulty making my monthly payment because of reasons set forth below: (Please check all that apply and submit required documentation demonstrating your hardship)

If Your Hardship is: |

Then the Required Hardship Documentation is: |

Unemployment |

No hardship documentation required |

|

|

Reduction in Income: a hardship that has caused a |

No hardship documentation required |

decrease in your income due to circumstances outside |

|

your control (e.g., elimination of overtime, reduction in |

|

regular working hours, a reduction in base pay) |

|

Increase in Housing Expenses: a hardship that has |

No hardship documentation required |

caused an increase in your housing expenses due to |

|

circumstances outside your control |

|

Divorce or legal separation; Separation of |

Divorce decree signed by the court; OR |

Borrowers unrelated by marriage, civil union or similar |

Separation agreement signed by the court; OR |

domestic partnership under applicable law |

Current credit report evidencing divorce, separation, or |

|

has a different address; OR |

|

Recorded quitclaim deed evidencing that the |

|

|

Death of a borrower or death of either the primary |

Death certificate; OR |

or secondary wage earner in the household |

Obituary or newspaper article reporting the death |

Doctor's certificate of illness or disability; OR |

|

of a |

Medical bills; OR |

member |

Proof of monthly insurance benefits or government assistance (if applicable) |

Disaster (natural or |

Insurance claim; OR |

impacting the property or Borrower's place of |

Federal Emergency Management Agency grant or Small Business |

employment |

Administration loan; OR |

|

Borrower or Employer property located in a federally declared disaster area |

Distant employment transfer / Relocation |

For |

|

or actual PCS orders. |

|

For employment transfers/new employment: |

|

Copy of signed offer letter or notice from employer showing transfer to a new |

|

employment location; OR |

|

Pay stub from new employer; OR |

|

If none of these apply, provide written explanation |

|

In addition to the above, documentation that reflects the amount of any relocation |

|

assistance provided, if applicable (not required for those with PCS orders). |

Business Failure |

Tax return from the previous year (including all schedules) AND |

|

Proof of business failure supported by one of the following: |

Bankruptcy filing for the business; or

Two months recent bank statements for the business account evidencing cessation of business activity; or

Most recent signed and dated quarterly or

Other: a hardship that is not covered above |

Written explanation describing the details of the hardship and relevant |

|

documentation |

Updated February 2013 |

F054D |

Page 4 of 5 |

Loan Number: 1004848

I certify, acknowledge, and agree to the following:

1.All of the information in this Borrower Assistance Form is truthful and the hardship that I have identified contributed to my need for mortgage relief.

2.The accuracy of my statements may be reviewed by the Servicer, owner or guarantor of my mortgage, their agent(s), or an authorized third party*, and I may be required to provide additional supporting documentation. I will provide all requested documents and will respond timely to all Servicer, or authorized third party*, communications.

3.Knowingly submitting false information may violate Federal and other applicable law.

4.If I have intentionally defaulted on my existing mortgage, engaged in fraud or misrepresented any fact(s) in connection with this request for mortgage relief or if I do not provide all required documentation, the Servicer may cancel any mortgage relief granted and may pursue foreclosure on my home and/or pursue any available legal remedies.

5.The Servicer is not obligated to offer me assistance based solely on the representations in this document or other documentation submitted in connection with my request.

6.I may be eligible for a trial period plan, repayment plan, or forbearance plan. If I am eligible for one of these plans, I agree that:

a.All the terms of this Acknowledgment and Agreement are incorporated into such plan by reference as if set forth in such plan in full.

b.My first timely payment under the plan will serve as acceptance of the terms set forth in the notice of the plan sent by the Servicer.

c.The Servicer's acceptance of any payments under the plan will not be a waiver of any acceleration of my loan or foreclosure action that has occurred and will not cure my default unless such payments are sufficient to completely cure my entire default under my loan.

d.Payments due under a trial period plan for a modification will contain escrow amounts. If I was not previously required to pay escrow amounts, and my trial period plan contains escrow amounts, I agree to the establishment of an escrow account and agree that any prior waiver is revoked. Payments due under a repayment plan or forbearance plan may or may not contain escrow amounts. If I was not previously required to pay escrow amounts and my repayment plan or forbearance plan contains escrow amounts, I agree to the establishment of an escrow account and agree that any prior escrow waiver is revoked.

7.A condemnation notice has not been issued for the property.

8.The Servicer or authorized third party* will obtain a current credit report on all borrowers obligated on the Note.

9.The Servicer or authorized third party* will collect and record personal information that I submit in this Borrower Response Package and during the evaluation process. This personal information may include, but is not limited to: (a) my name, address, telephone number, (b) my social security number, (c) my credit score, (d) my income, and (e) my payment history and information about my account balances and activity. I understand and consent to the Servicer or authorized third party*, as well as any investor or guarantor (such as Fannie Mae or Freddie Mac), disclosing my personal information and the terms of any relief or foreclosure alternative that I receive to the following:

a.Any investor, insurer, guarantor, or servicer that owns, insures, guarantees, or services my first lien or subordinate lien (if applicable) mortgage loan(s) or any companies that perform support services to them; and

b.The U.S. Department of Treasury, Fannie Mae and Freddie Mac, in conjunction with their responsibilities under the Making Home Affordable program, or any companies that perform support services to them.

10.I consent to being contacted concerning this request for mortgage assistance at any telephone number, including mobile telephone number, or email address I have provided to the Lender/Servicer/ or authorized third party*. By checking this box

,I also consent to being contacted by text messaging.

*An authorized third party may include, but is not limited to, a counseling agency, Housing Finance Agency (HFA) or other similar entity that is assisting me in obtaining a foreclosure prevention alternative.

_______________________ |

__________ |

_______________________ |

__________ |

Borrower Signature |

Date |

Date |

Updated February 2013 |

F054D |

Page 5 of 5 |