Any time you want to fill out wells fargo personal financial statement, you don't have to download and install any sort of programs - simply give a try to our online PDF editor. To make our editor better and easier to utilize, we consistently come up with new features, taking into account feedback from our users. If you're looking to begin, this is what it will take:

Step 1: Click on the orange "Get Form" button above. It will open up our tool so that you could start filling out your form.

Step 2: When you launch the PDF editor, you'll see the form ready to be completed. In addition to filling out various blanks, you might also do many other actions with the form, such as adding your own text, editing the original text, inserting images, signing the form, and a lot more.

It really is easy to complete the pdf following this helpful tutorial! Here is what you should do:

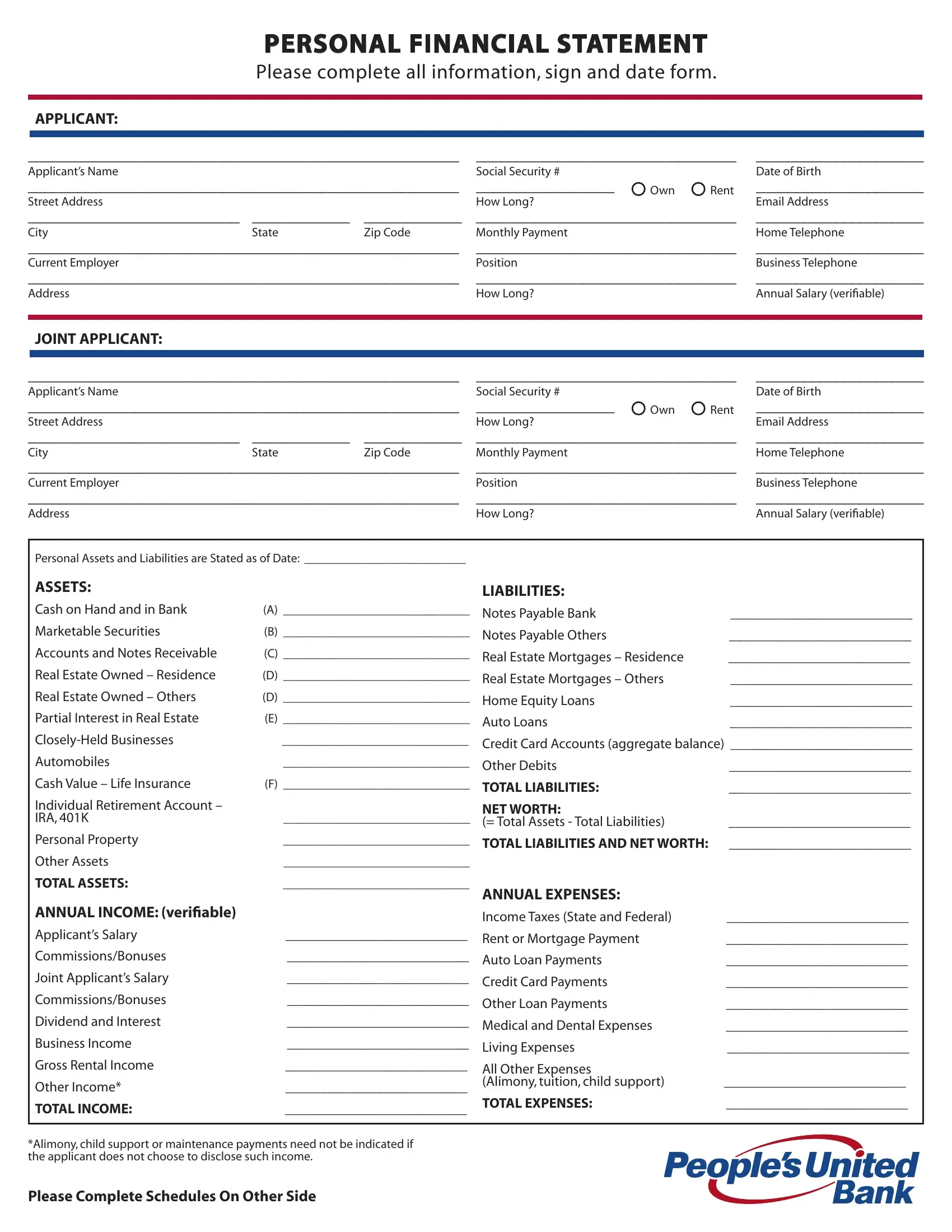

1. It is recommended to fill out the wells fargo personal financial statement accurately, therefore be careful when working with the areas that contain these specific blank fields:

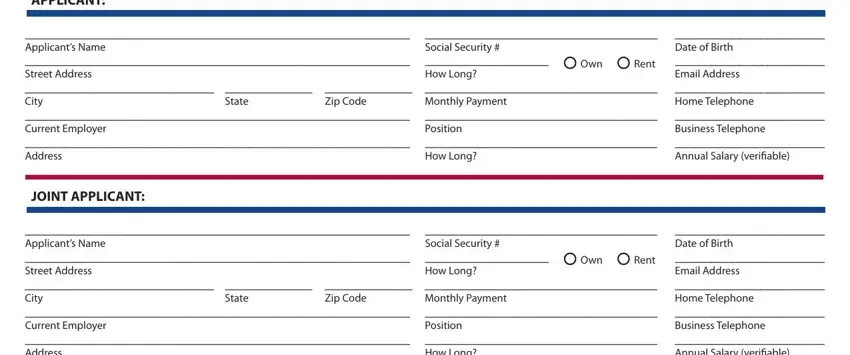

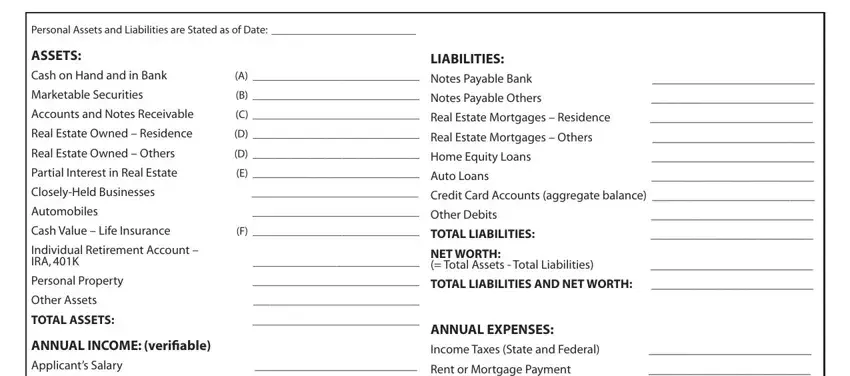

2. Right after filling out the previous section, head on to the next step and complete all required particulars in all these blanks - Applicants Name Street, Personal Assets and Liabilities, ASSETS, LIABILITIES, Cash on Hand and in Bank, Notes Payable Bank, Marketable Securities, Notes Payable Others, Accounts and Notes Receivable, Real Estate Mortgages Residence, Real Estate Owned Residence D, Real Estate Mortgages Others, Real Estate Owned Others, Home Equity Loans, and Partial Interest in Real Estate E.

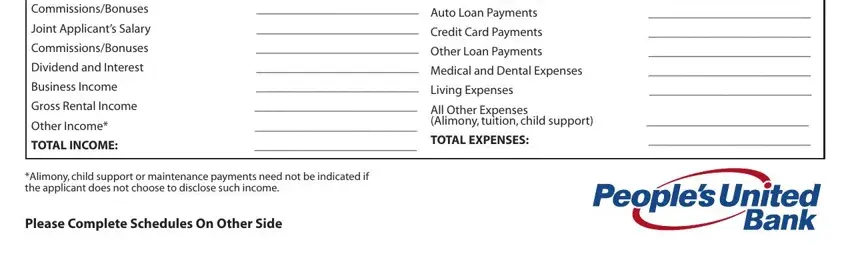

3. This third stage is going to be straightforward - complete all the blanks in CommissionsBonuses, Joint Applicants Salary, CommissionsBonuses, Dividend and Interest, Rent or Mortgage Payment, Auto Loan Payments, Credit Card Payments, Other Loan Payments, Medical and Dental Expenses, Business Income, Living Expenses, Gross Rental Income, Other Income, TOTAL INCOME, and All Other Expenses Alimony tuition in order to complete the current step.

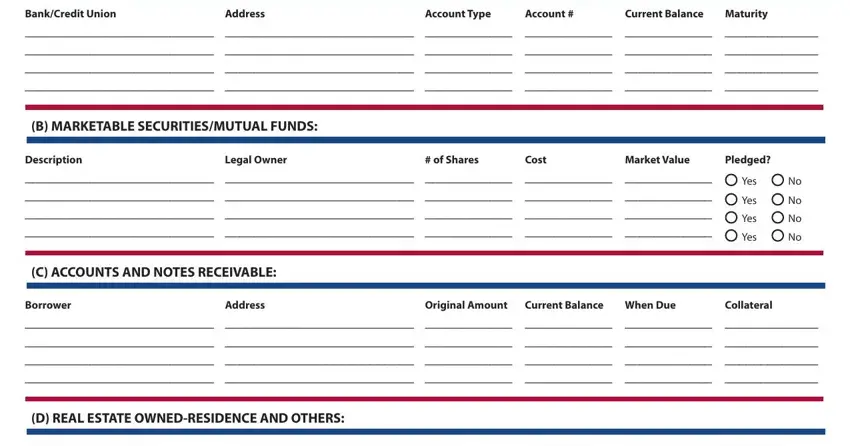

4. This subsection arrives with all of the following blank fields to enter your particulars in: Address, BankCredit Union, Current Balance, Account Type, Account, Maturity, B MARKETABLE SECURITIESMUTUAL FUNDS, Legal Owner, Description, Market Value, of Shares, Cost, Pledged, Yes No Yes No Yes No Yes No, and C ACCOUNTS AND NOTES RECEIVABLE.

Always be very attentive when filling out Account and Address, since this is the part where a lot of people make some mistakes.

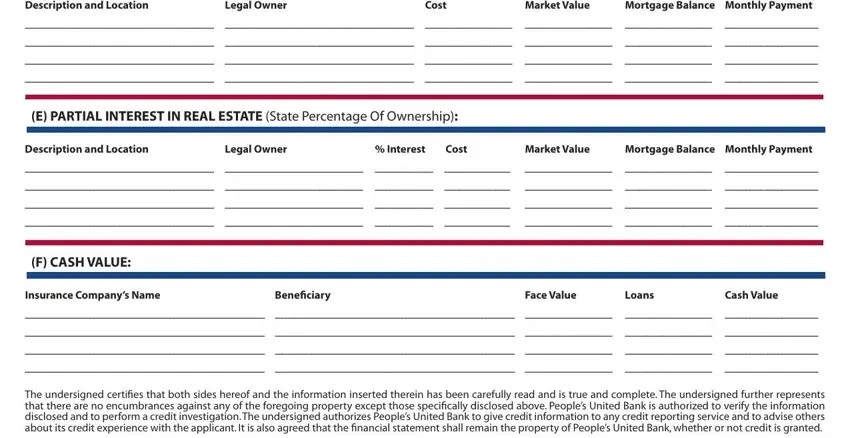

5. Finally, this last portion is what you should finish before finalizing the document. The blank fields in question are the following: Legal Owner, Description and Location Mortgage, Market Value, Cost, E PARTIAL INTEREST IN REAL ESTATE, Legal Owner, Description and Location Mortgage, Interest Cost, Market Value, F CASH VALUE, Insurance Companys Name, Beneficiary, Face Value, Cash Value, and Loans.

Step 3: Before addressing the next stage, make certain that all blanks are filled out the right way. Once you verify that it is good, press “Done." Get hold of your wells fargo personal financial statement once you sign up at FormsPal for a free trial. Immediately get access to the form in your FormsPal cabinet, with any edits and changes all synced! FormsPal guarantees your information privacy by having a protected system that never saves or distributes any sensitive information provided. Feel safe knowing your docs are kept safe every time you use our services!