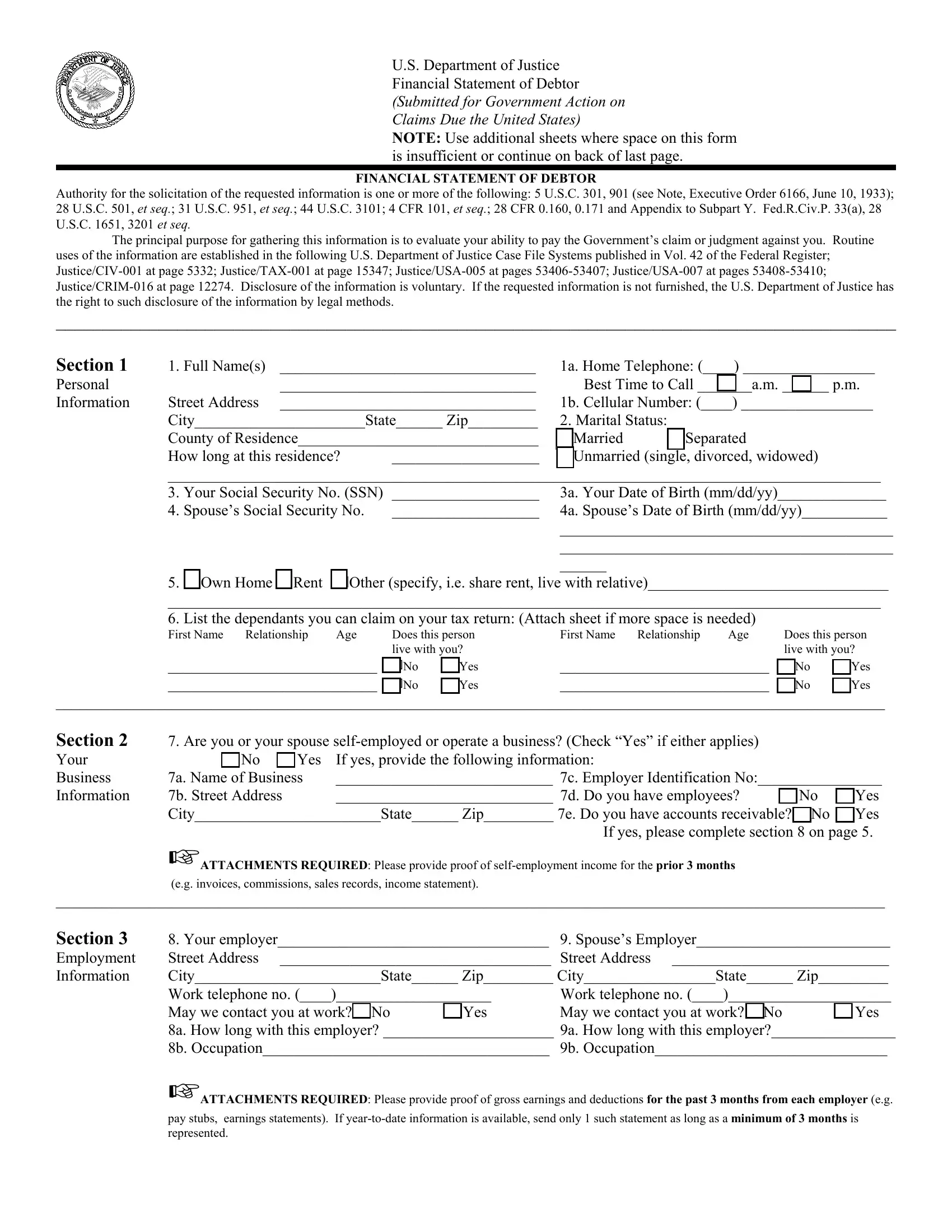

U.S. Department of Justice

Financial Statement of Debtor (Submitted for Government Action on Claims Due the United States)

NOTE: Use additional sheets where space on this form is insufficient or continue on back of last page.

FINANCIAL STATEMENT OF DEBTOR

Authority for the solicitation of the requested information is one or more of the following: 5 U.S.C. 301, 901 (see Note, Executive Order 6166, June 10, 1933); 28 U.S.C. 501, et seq.; 31 U.S.C. 951, et seq.; 44 U.S.C. 3101; 4 CFR 101, et seq.; 28 CFR 0.160, 0.171 and Appendix to Subpart Y. Fed.R.Civ.P. 33(a), 28 U.S.C. 1651, 3201 et seq.

The principal purpose for gathering this information is to evaluate your ability to pay the Government’s claim or judgment against you. Routine uses of the information are established in the following U.S. Department of Justice Case File Systems published in Vol. 42 of the Federal Register; Justice/CIV-001 at page 5332; Justice/TAX-001 at page 15347; Justice/USA-005 at pages 53406-53407; Justice/USA-007 at pages 53408-53410; Justice/CRIM-016 at page 12274. Disclosure of the information is voluntary. If the requested information is not furnished, the U.S. Department of Justice has the right to such disclosure of the information by legal methods.

__________________________________________________________________________________________

Section 1 |

1. |

|

Full Name(s) |

_________________________________ |

1a. |

Home Telephone: (____) _________________ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Personal |

|

|

|

|

_________________________________ |

|

|

Best Time to Call _______a.m. |

______ p.m. |

Information |

Street Address |

_________________________________ |

1b. Cellular Number: (____) _________________ |

|

City______________________State______ Zip_________ |

2. Marital Status: |

|

|

|

|

|

|

|

County of Residence_______________________________ |

G |

Married |

G |

Separated |

|

How long at this residence? |

___________________ |

G |

|

|

|

|

Unmarried (single, divorced, widowed) |

|

|

|

|

|

|

|

|

|

|

____________________________________________________________________________________________ |

|

3. |

|

Your Social Security No. (SSN) |

___________________ |

3a. |

Your Date of Birth (mm/dd/yy)______________ |

|

4. |

Spouse’s Social Security No. |

___________________ |

4a. |

Spouse’s Date of Birth (mm/dd/yy)___________ |

|

|

|

|

|

|

|

|

|

|

___________________________________________ |

|

|

|

|

|

|

|

|

|

|

___________________________________________ |

|

|

|

|

|

|

|

|

|

|

______ |

|

|

|

|

|

|

5.G Own Home GRent GOther (specify, i.e. share rent, live with relative)_______________________________

____________________________________________________________________________________________

6.List the dependants you can claim on your tax return: (Attach sheet if more space is needed)

First Name Relationship |

Age |

Does this person |

First Name Relationship |

Age |

Does this person |

|

|

live with you? |

|

|

live with you? |

___________________________ |

QNo |

QYes |

___________________________ |

QNo |

QYes |

___________________________ |

QNo |

QYes |

___________________________ |

QNo |

QYes |

___________________________________________________________________________________________________________

Section 2 |

7. Are you or your spouse self-employed or operate a business? (Check “Yes” if either applies) |

|

Your |

G No G Yes |

If yes, provide the following information: |

|

Business |

7a. Name of Business |

____________________________ |

7c. Employer Identification No:________________ |

Information |

7b. Street Address |

____________________________ |

7d. Do you have employees? |

Q No Q Yes |

City________________________State______ Zip_________ 7e. Do you have accounts receivable? Q No Q Yes

If yes, please complete section 8 on page 5.

OATTACHMENTS REQUIRED: Please provide proof of self-employment income for the prior 3 months

(e.g. invoices, commissions, sales records, income statement).

___________________________________________________________________________________________________________

Section 3 |

8. Your employer___________________________________ |

9. Spouse’s Employer_________________________ |

Employment |

Street Address ___________________________________ |

Street Address ____________________________ |

Information |

City________________________State______ Zip_________ City_________________State______ Zip_________ |

|

Work telephone no. (____)____________________ |

Work telephone no. (____)_____________________ |

|

May we contact you at work? Q No |

Q Yes |

May we contact you at work? Q No |

Q Yes |

|

8a. How long with this employer? ______________________ 9a. How long with this employer?________________ |

|

8b. Occupation_____________________________________ |

9b. Occupation______________________________ |

OATTACHMENTS REQUIRED: Please provide proof of gross earnings and deductions for the past 3 months from each employer (e.g.

pay stubs, earnings statements). If year-to-date information is available, send only 1 such statement as long as a minimum of 3 months is represented.

Name_____________________________________SSN______________________ Page 2

__________________________________________________________________________________________

Section 4

Other

Income

Information

10. Do you receive income from sources other than your own business or your employer? (Check all that apply.)

G |

Pension |

G |

Social Security |

G |

Other (specify, e.g. child support, alimony, rental)_______________ |

|

|

|

|

|

|

OATTACHMENTS REQUIRED: Please provide proof of pension/social security/other income for the past 3 months from each payor,

including any statements showing deductions. If year-to-date information is available, send only 1 statement as long as 3 months is represented.

____________________________________________________________________________________________________________________________________

Section 5 |

11. CHECKING ACCOUNTS. List all checking accounts. (If you need additional space, attach a separate sheet.) |

Banking, |

|

Type of |

Full name of Bank, Credit |

|

|

Current Account |

Investment, |

|

Account |

Union or Institution |

|

Bank Account No. |

Balance |

|

|

|

|

|

|

|

|

|

|

|

Cash, Credit |

11a. |

Checking |

Name_____________________ |

___________________ |

$______________ |

|

and Life |

|

|

Address____________________ |

|

|

|

|

|

|

Insurance Information |

|

City/State/Zip_______________ |

|

|

|

|

|

|

|

11b. |

Checking |

Name______________________ |

___________________ |

$______________ |

|

|

|

|

Address____________________ |

|

|

|

|

|

|

|

|

|

City/State/Zip_______________ |

|

|

|

|

|

|

|

11c. |

Total Checking Accounts Balances |

|

$ |

|

|

|

|

____________________________________________________________________________________________ |

|

12. OTHER ACCOUNTS. List all accounts, including brokerage, savings and money market, not listed in 11. |

|

|

Type of |

Full name of Bank, Credit |

|

|

Current Account |

|

|

Account |

Union or Institution |

|

Bank Account No. |

|

Balance |

|

|

12a. |

__________ |

Name_____________________ |

___________________ |

$______________ |

|

|

|

|

Address____________________ |

|

|

|

|

|

|

|

|

|

City/State/Zip_______________ |

|

|

|

|

|

|

|

12b. |

__________ |

Name______________________ |

___________________ |

$______________ |

|

|

|

|

Address____________________ |

|

|

|

|

|

|

|

|

|

City/State/Zip_______________ |

|

|

|

|

|

|

|

12c. |

Total Other Account Balances |

|

|

|

|

|

|

OATTACHMENTS REQUIRED: Please include your current bank statements (checking, savings, money market and brokerage accounts)

for the past 3 months for all accounts.

____________________________________________________________________________________________

13.INVESTMENTS. List all investment assets below. Include stocks, bonds, mutual funds, stock options, certificates of deposits and retirement assets such as IRAs, Keogh and 401(k) plans.

|

|

Number of |

|

Current |

Loan |

|

Name of Company |

Shares/Units |

|

Value |

|

Amount (if any) |

13a. |

__________________________ |

____________ |

$____________ |

$___________ |

13b. |

__________________________ |

____________ |

$____________ |

$___________ |

13c. |

__________________________ |

____________ |

$____________ |

$___________ |

Used as collateral on loan?

G No |

G Yes |

G No |

G Yes |

G No |

G Yes |

13d. Total Investments

__________________________________________________________________________________________________________

14.CASH ON HAND. Include any money that you have that is not in the bank. 14a. Total Cash on Hand

Name_____________________________________SSN______________________ Page 3

__________________________________________________________________________________________________________

|

|

|

|

|

|

|

|

|

|

|

Section 5 |

15. AVAILABLE CREDIT. List all lines of credit, including credit cards. ( If you need additional space, attach a |

continued |

separate sheet.) |

|

|

|

|

|

|

|

|

Full Name of |

|

|

|

|

Minimum |

|

|

|

Credit Institution |

|

Credit Limit |

Amount Owed |

Payment |

|

15a. |

Name___________________________ |

___________ |

______________ |

$____________ |

|

|

|

Address_________________________ |

|

|

|

|

|

|

|

|

City/State/Zip_____________________ |

|

|

|

|

|

|

15b. |

|

Name___________________________ |

___________ |

______________ |

$____________ |

|

|

|

Address_________________________ |

|

|

|

|

|

|

|

|

City/State/Zip_____________________ |

|

|

|

|

|

|

15c. |

Total Minimum Payments |

|

|

|

|

|

|

|

____________________________________________________________________________________________ |

|

16. LIFE INSURANCE. Do you have life insurance with a cash value? |

G No |

G Yes |

|

|

|

(Term Life Insurance does not have a cash value.) |

|

|

|

|

16a. |

Name of Insurance Company__________________________________________________ |

|

16b. Policy Number(s)___________________________________________________________ |

|

16c. |

Owner of Policy____________________________________________________________ |

|

16d. Current Cash Value $___________________ |

16e. Outstanding Loan Balance $____________________ |

Subtract “Outstanding Loan Balance: line 16e from “Current Cash Value” line 16d = 16f

OATTACHMENTS REQUIRED: Please include a statement from the life insurance companies that includes type and cash/loan

value amounts. If currently borrowed against, include loan amount and date of loan.

___________________________________________________________________________________________________________

Section 6 |

17. OTHER INFORMATION. Respond to the following questions related to your financial condition: |

Other |

(Attach a separate sheet if you need more space.)Information |

|

17a. Do you have a safe deposit box? G No G Yes |

|

If yes, please include the name and address of location of box, the box number and the contents below: |

|

____________________________________________________________________________________________ |

|

____________________________________________________________________________________________ |

17b. Do you have a will? G No

G Yes; if yes, where is it kept?_______________________________________

17c. Are there any garnishments against your wages? G No G Yes

If yes, who is the creditor?___________________ Date of Judgment____________ Amount of debt $_______

17d. Are there any judgments against you? G No |

G Yes |

If yes, who is the creditor?___________________ Date of Judgment____________ Amount of debt $_______

17e. Are you a party to a lawsuit? G No |

G Yes |

|

If yes, amount of suit $____________ |

Possible completion date_____________ |

Court________________ |

Subject matter of suit________________________________________________________________________

17f. Did you ever file bankruptcy? G No |

G Yes |

|

If yes, date filed_______________________ |

Date discharged ___________________ |

17g. In the past 10 years did you transfer any assets out of your name for less than their actual value? G No G Yes

If yes, what asset?_____________________________ Value of asset at time of transfer $_________________

When was it transferred?_________________ To whom was it transferred? ____________________________

17h. Do you anticipate any increase in household income in the next 2 years? G No |

G Yes |

If yes, why will the income increase?____________________________ (Attach sheet if you need more space.)

How much will it increase? ___________________________________

17i. Are you a beneficiary of a trust or an estate? G No |

G Yes |

If yes, name of the trust or estate____________________ |

Anticipated amount to be received $____________ |

When will the amount be received?____________________ |

17j. Are you a participant in a profit sharing plan? G No |

G Yes |

If yes, name of plan____________________________________ Value in plan $__________________

Purchase Date

Name of Lender

*Current Value

Monthly Payment

Description

(year, make, model)

18. PURCHASED AUTOMOBILES, TRUCKS AND OTHER LICENSED ASSETS. Include boats, RV’s, motorcycles, trailers, etc. (If you need additional space, attach a separate sheet.)

Current

Loan

Balance

Name_____________________________________SSN______________________ Page 4

__________________________________________________________________________________________

Section 7

Assets and

Liabilities

*Current |

|

|

|

|

|

Value is |

18a. |

____________________ |

____________ |

___________ |

$______ |

the amount |

|

____________________ |

|

|

|

you could |

|

____________________ |

|

|

|

sell the |

|

|

|

|

|

asset for today |

18b. |

____________________ |

____________ |

___________ |

$______ |

____________________

____________________

LEASED AUTOMOBILES, TRUCKS AND OTHER LICENSED ASSETS. Include boats, RV’s,

motorcycles, trailers, etc. (If you need additional space, attach a separate sheet.) |

|

|

|

|

|

Name and |

|

|

|

Description |

Lease |

Address of |

Lease |

Monthly |

|

(year, make, model) |

Balance |

Lessor |

Date |

Payment |

18c. |

____________________ |

|

_____________________ |

__________ |

$________ |

|

____________________ |

|

|

|

|

|

____________________ |

|

|

|

|

18d. |

____________________ |

|

_____________________ |

__________ |

$________ |

|

____________________ |

|

|

|

|

|

_____________________ |

|

|

|

|

OATTACHMENTS REQUIRED: Please include your current statement from lender with monthly car payment and current

balance of the loan for each vehicle purchased or leased.

____________________________________________________________________________________________

20.REAL ESTATE. List all real estate you own. (If you need additional space, attach a separate sheet.) Street Address, City

State, Zip, County |

Date |

Purchase |

*Current |

Loan |

Monthly |

Lender/Lien Holder |

Purchased |

Price |

Value |

Balance |

Pymt |

20a.______________________ |

____________ |

$_________ |

|

|

$________ |

_________________________ |

|

|

|

|

|

_________________________ |

|

|

|

|

|

20b.______________________ |

____________ |

$_________ |

|

|

$________ |

_________________________ |

|

|

|

|

|

_________________________ |

|

|

|

|

|

____________________________________________________________________________________________

21.PERSONAL ASSETS. List all personal assets below. (If you need additional space, attach a separate sheet.) Furniture/Personal effects includes the total current market value of your household such as furniture and appliances Other Personal Assets includes all artwork, jewelry, collections, antiques or other assets

|

|

Current |

Loan |

|

Monthly |

Date of |

|

Description |

Value |

Balance |

Lender |

Payment |

Final Pymt |

21a. |

Furniture/Personal Effects $___________ |

$__________ |

_____________ |

$_________ |

_________ |

|

Other: (List below) |

|

|

|

|

|

21b. |

Artwork |

$___________ |

$__________ |

_____________ |

$_________ |

_________ |

21c. |

Jewelry |

$___________ |

$__________ |

_____________ |

$_________ |

_________ |

21d. |

____________________ |

$___________ |

$__________ |

_____________ |

$_________ |

_________ |

21e. |

____________________ |

$___________ |

$__________ |

_____________ |

$_________ |

_________ |

Name_____________________________________SSN______________________ Page 5

__________________________________________________________________________________________________________

Section 7

continued |

22. BUSINESS ASSETS. List all business assets and encumbrances below, include Uniform Commercial Code filings. (If you need |

|

additional space, attach a separate sheet.) Tools used in Trade or Business includes the basic tools or books used to conduct your business, |

|

excluding automobiles. Other Business Assets includes machinery, equipment, inventory or other assets. |

|

|

|

|

|

|

Current |

Loan |

|

Monthly |

Date of |

|

|

Description |

|

Value |

Balance |

Lender |

Payment |

Final Pymt |

|

22a. |

Tools used in Trade/ |

|

|

|

|

|

|

|

|

|

Business |

$___________ |

$__________ |

_____________ |

$_________ |

_________ |

|

|

Other: (List below) |

|

|

|

|

|

|

|

|

22b. |

Machinery |

$___________ |

$__________ |

_____________ |

$_________ |

_________ |

|

22c. |

Equipment |

$___________ |

$__________ |

_____________ |

$_________ |

_________ |

|

22d. |

____________________ |

$___________ |

$__________ |

_____________ |

$_________ |

_________ |

|

22e. |

____________________ |

$___________ |

$__________ |

_____________ |

$_________ |

_________ |

__________________________________________________________________________________________

Section 8 |

23. ACCOUNTS/NOTES RECEIVABLE. List all accounts separately, including contracts awarded, but not |

Accounts/ |

started. (If you need additional space, attach a separate sheet.) |

|

|

Notes |

|

|

|

|

Receivable |

Description |

Amount Due |

Date Due |

Age of Account |

Use only if |

23a. |

Name_____________________________ |

$__________ |

___________ |

Q 0-30 days |

needed |

|

Address___________________________ |

|

|

Q 30-60 days |

|

|

City/State/Zip_______________________ |

|

|

Q 60-90 days |

|

|

|

|

|

Q 90+ days |

|

____________________________________________________________________________________________ |

|

23b. |

Name_____________________________ |

$__________ |

___________ |

Q 0-30 days |

|

|

Address___________________________ |

|

|

Q 30-60 days |

|

|

City/State/Zip_______________________ |

|

|

Q 60-90 days |

|

|

|

|

|

Q 90+ days |

|

____________________________________________________________________________________________ |

|

23c. |

Name_____________________________ |

$__________ |

___________ |

Q 0-30 days |

|

|

Address___________________________ |

|

|

Q 30-60 days |

|

|

City/State/Zip_______________________ |

|

|

Q 60-90 days |

|

|

|

|

|

Q 90+ days |

|

____________________________________________________________________________________________ |

|

23d. |

Name_____________________________ |

$__________ |

___________ |

Q 0-30 days |

|

|

Address___________________________ |

|

|

Q 30-60 days |

|

|

City/State/Zip_______________________ |

|

|

Q 60-90 days |

|

|

|

|

|

Q 90+ days |

|

____________________________________________________________________________________________ |

|

23e. |

Name_____________________________ |

$__________ |

___________ |

Q 0-30 days |

|

|

Address___________________________ |

|

|

Q 30-60 days |

|

|

City/State/Zip_______________________ |

|

|

Q 60-90 days |

|

|

|

|

|

Q 90+ days |

|

____________________________________________________________________________________________ |

|

23f. |

Name_____________________________ |

$__________ |

___________ |

Q 0-30 days |

|

|

Address___________________________ |

|

|

Q 30-60 days |

|

|

City/State/Zip_______________________ |

|

|

Q 60-90 days |

|

|

|

|

|

Q 90+ days |

|

|

Add “Amount Due” from lines 23a through 23f = 23g |

|

|