The PDF editor which you'll use was designed by our leading software engineers. One could fill out the usaa direct deposit form No Download Needed document easily and conveniently with our software. Just follow this procedure to start out.

Step 1: Select the orange "Get Form Now" button on the website page.

Step 2: When you have entered the usaa direct deposit form No Download Needed edit page, you'll see all actions it is possible to use with regards to your document within the top menu.

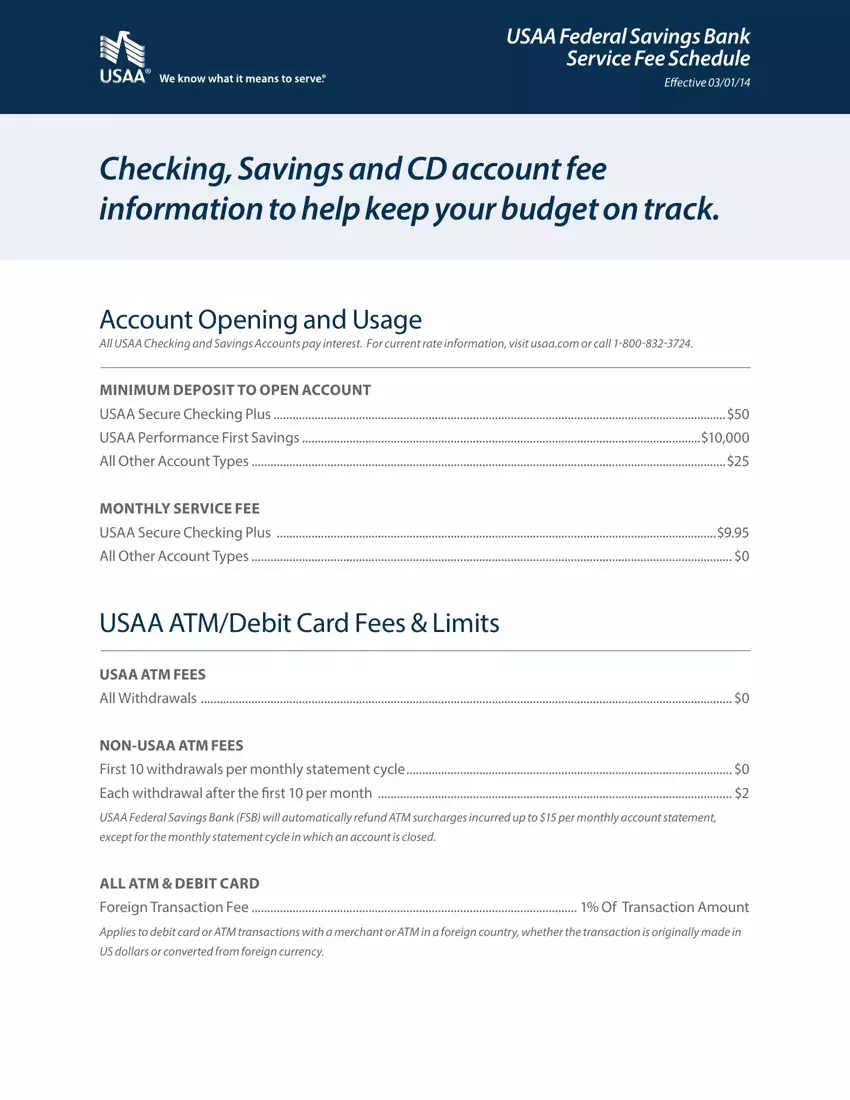

These particular parts are in the PDF template you'll be filling in.

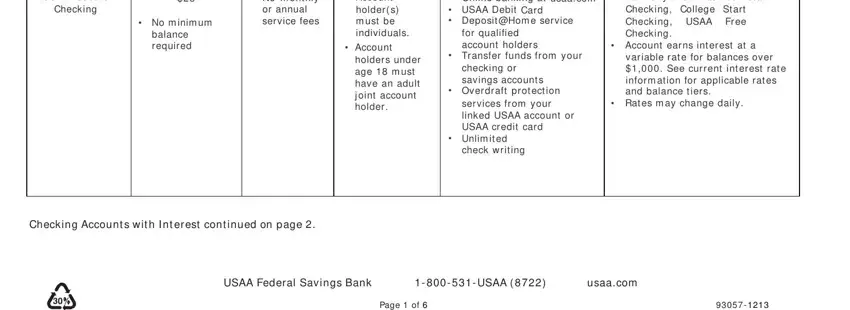

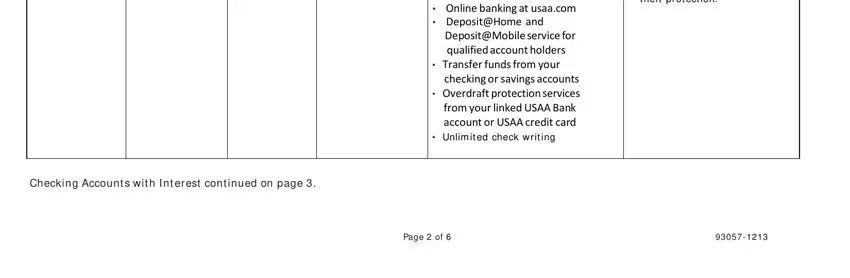

Inside the segment m ay receive Prot ect MyI D t heft, credit ors if your wallet is lost, Online banking at usaacom, DepositMobile service for, checking or savings accounts, Unlim it ed check writ ing, Checking Account s wit h I nt er, and Page of enter the details which the program demands you to do.

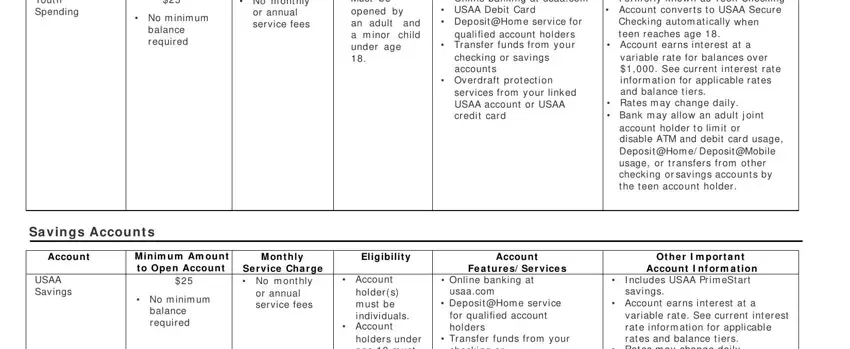

Provide the relevant information in the Yout h Spending, M inim um Am ount t o Ope n, No m inim um balance required, M ont hly Se r vice Cha r ge No m, Must be, opened by an adult and a m inor, Account Fe a t ur e s Se r vice s, checking or savings account s, Overdraft prot ect ion, services from your link ed USAA, Ot he r I m por t a nt Account I, Account ear ns int erest at a, variable rat e for balances over, Rat es m ay change daily Bank m, and Sa vings Account s field.

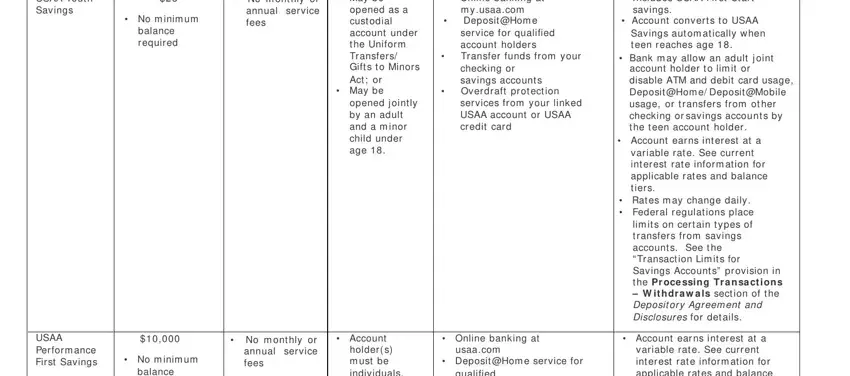

The USAA Yout h Savings, M inim um Am ount t o Ope n, No m inim um balance required, M ont hly Se r vice Cha r ge No m, May be, opened as a cust odial account, opened j ointly by an adult and a, Online banking at m yusaacom, service for qualified account, Transfer funds from your, checking or savings account s, services from your linked USAA, USAA Perform ance First Savings, No m inim um balance required, and No m ont hly or annual service box will be the place to indicate the rights and obligations of each side.

Look at the fields Remote Deposit Capture and Similar, Your Ability to Withdraw Funds, and The availability periods described and thereafter fill them in.

Step 3: Once you have hit the Done button, your form should be ready for export to any type of electronic device or email address you indicate.

Step 4: Generate duplicates of your form - it can help you prevent upcoming issues. And don't be concerned - we are not meant to display or view the information you have.