When using the online tool for PDF editing by FormsPal, you are able to fill in or change yyyy here and now. Our team is committed to making sure you have the ideal experience with our editor by continuously releasing new features and upgrades. With all of these updates, working with our editor becomes better than ever! This is what you'd want to do to get going:

Step 1: Open the PDF inside our editor by hitting the "Get Form Button" above on this webpage.

Step 2: This tool helps you modify PDF files in a range of ways. Change it with customized text, correct what's already in the PDF, and add a signature - all within a few clicks!

This document requires particular data to be filled in, hence be sure to take the time to fill in precisely what is requested:

1. It's vital to complete the yyyy accurately, hence be mindful while filling in the sections that contain all of these blank fields:

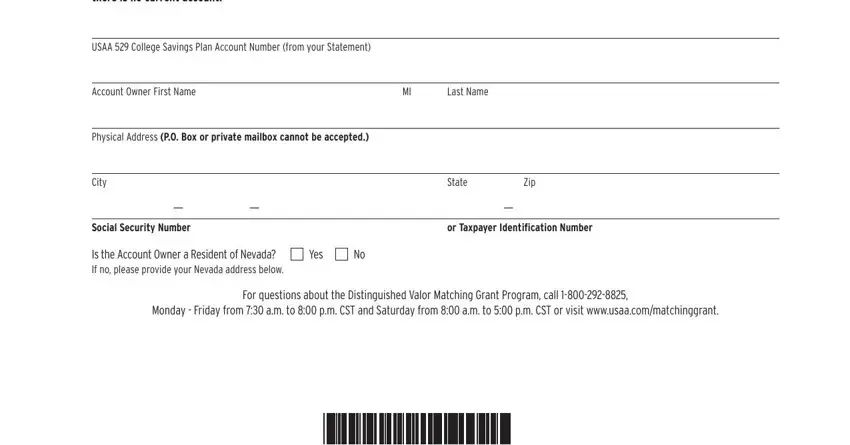

2. Given that this array of fields is done, it is time to insert the necessary particulars in Note A USAA College Savings Plan, USAA College Savings Plan Account, Account Owner First Name, Last Name, Physical Address PO Box or private, City, State, Zip, Social Security Number, or Taxpayer Identiication Number, Is the Account Owner a Resident of, Yes, For questions about the, and Monday Friday from am to pm CST so you're able to move on further.

It is possible to make a mistake while filling out your or Taxpayer Identiication Number, for that reason be sure you look again before you'll finalize the form.

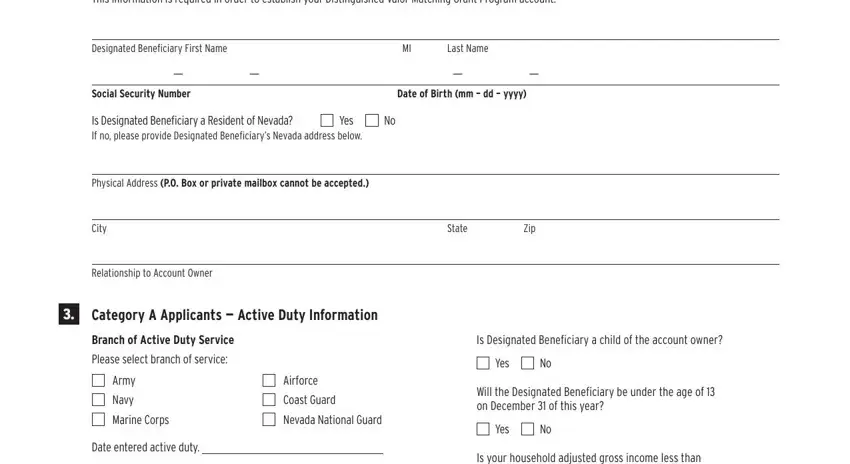

3. Through this part, look at This information is required in, Designated Beneiciary First Name, Last Name, Social Security Number, Date of Birth mm dd yyyy, Is Designated Beneiciary a, Yes, Physical Address PO Box or private, City, Relationship to Account Owner, State, Zip, Category A Applicants Active, Branch of Active Duty Service, and Please select branch of service. These must be taken care of with greatest precision.

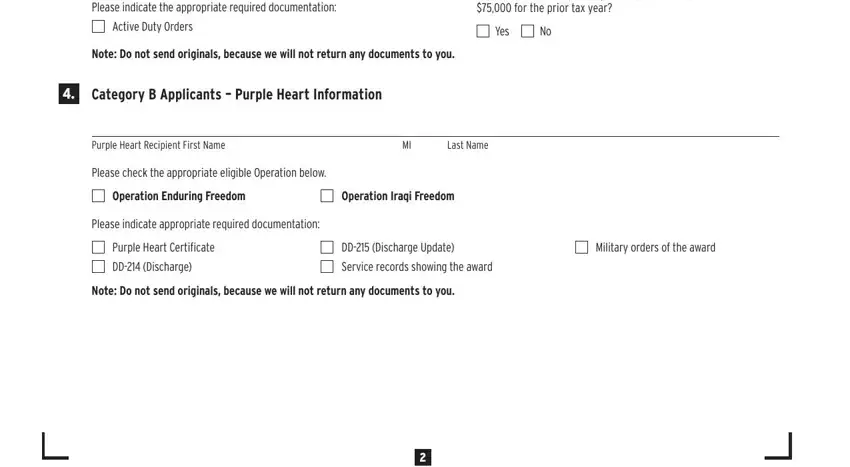

4. This specific paragraph comes with all of the following blanks to focus on: Please indicate the appropriate, Active Duty Orders, Note Do not send originals because, Category B Applicants Purple, Is your household adjusted gross, Yes, Purple Heart Recipient First Name, Last Name, Please check the appropriate, Operation Enduring Freedom, Operation Iraqi Freedom, Please indicate appropriate, Purple Heart Certiicate, DD Discharge, and DD Discharge Update.

Step 3: Once you've glanced through the information provided, just click "Done" to finalize your form. Sign up with us today and instantly use yyyy, ready for downloading. Every edit you make is handily kept , enabling you to customize the document later as required. FormsPal offers protected form editor devoid of personal data recording or sharing. Feel comfortable knowing that your information is safe with us!