Dealing with PDF forms online is definitely very easy using our PDF editor. You can fill in utah tc limited company here without trouble. Our editor is consistently evolving to present the best user experience possible, and that is because of our dedication to continual development and listening closely to feedback from customers. This is what you would want to do to get going:

Step 1: Simply click on the "Get Form Button" at the top of this webpage to access our pdf file editing tool. Here you will find all that is required to work with your document.

Step 2: The tool will give you the opportunity to change your PDF file in various ways. Enhance it with customized text, adjust what is originally in the PDF, and place in a signature - all possible within minutes!

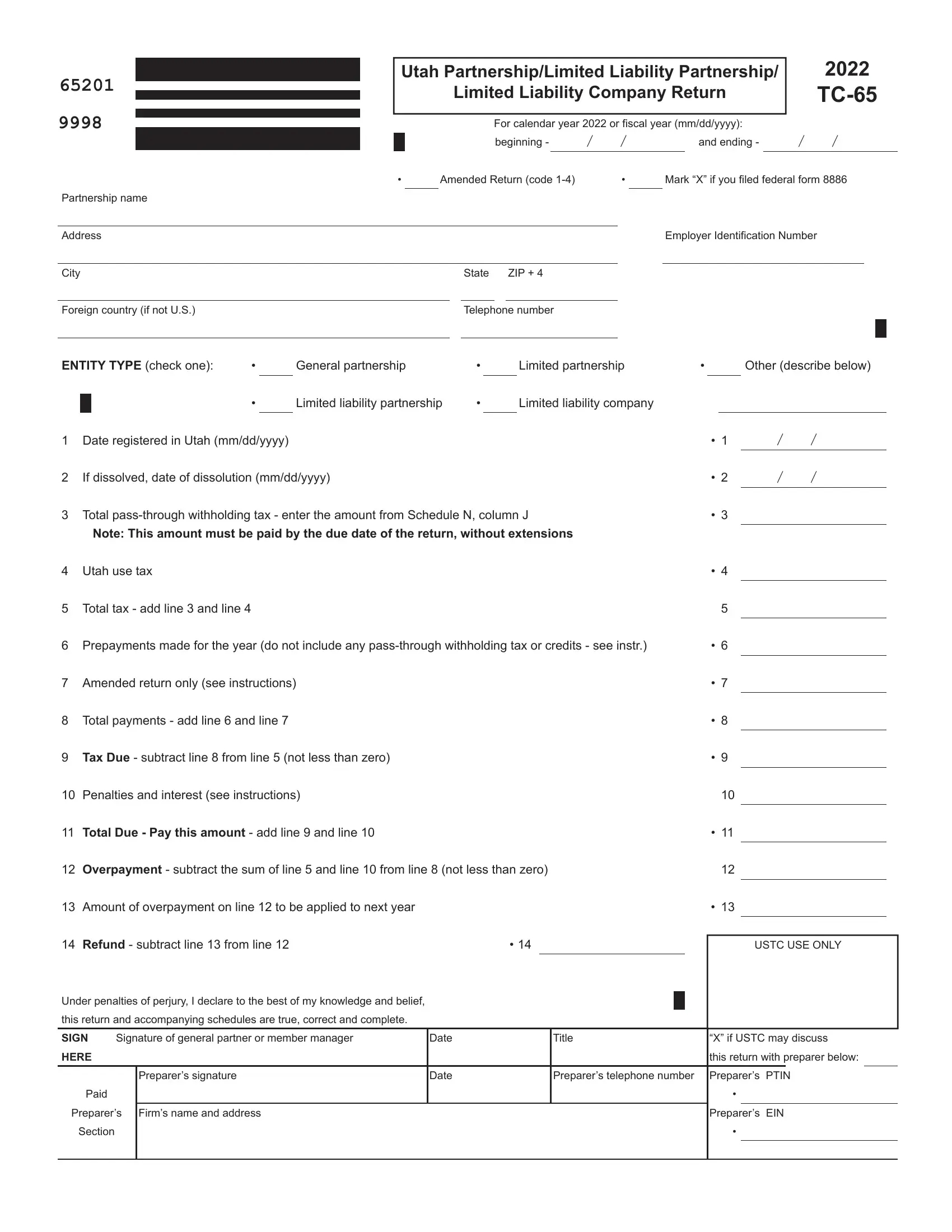

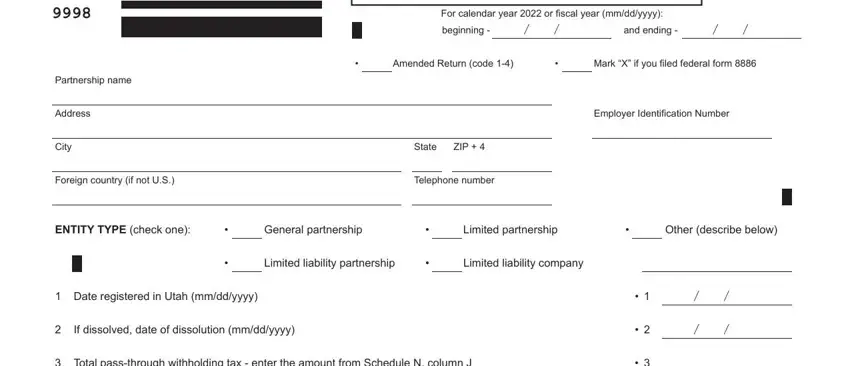

If you want to complete this PDF document, be sure to type in the necessary information in every blank field:

1. The utah tc limited company involves specific details to be typed in. Make sure the next fields are filled out:

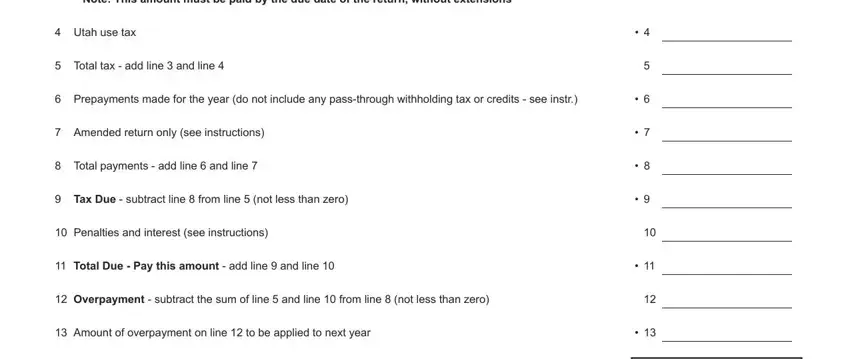

2. Soon after the previous array of blanks is completed, go on to enter the applicable details in these: Note This amount must be paid by, Utah use tax, Total tax add line and line, Prepayments made for the year do, Amended return only see, Total payments add line and, Tax Due subtract line from line, Penalties and interest see, Total Due Pay this amount add, Overpayment subtract the sum of, Amount of overpayment on line to, cid, cid, cid, and cid.

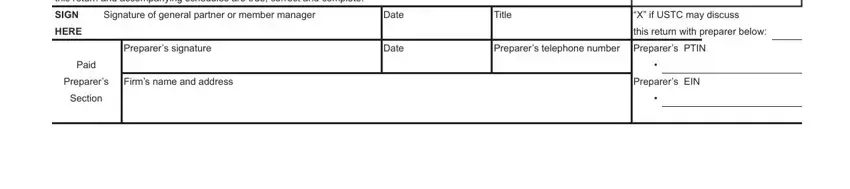

3. Completing this return and accompanying, SIGN, Signature of general partner or, HERE, Preparers signature, Paid, Preparers, Firms name and address, Section, Date, Date, Title, X if USTC may discuss, this return with preparer below, and Preparers telephone number is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Be very attentive when filling out SIGN and X if USTC may discuss, as this is where a lot of people make mistakes.

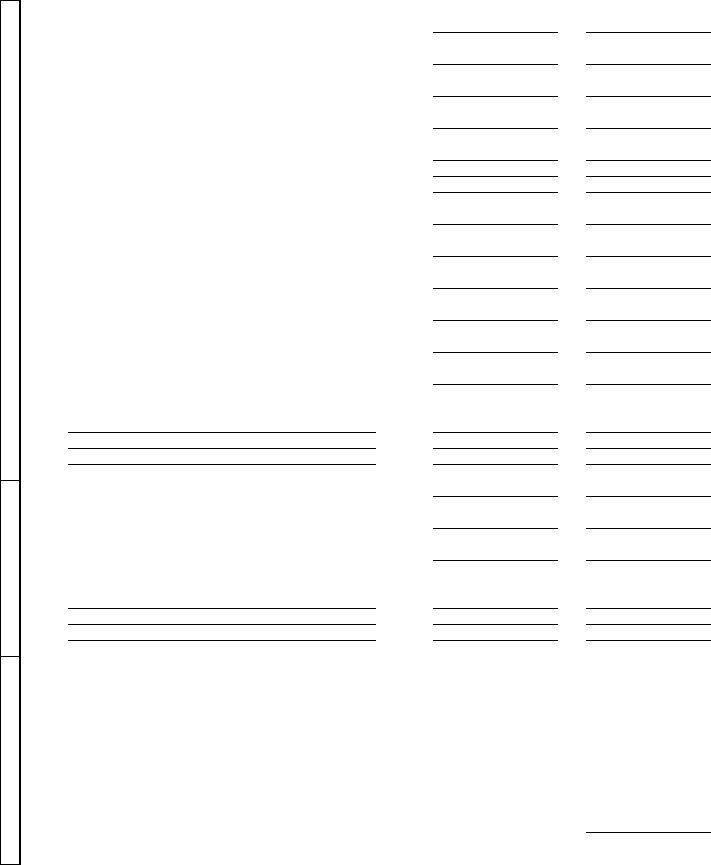

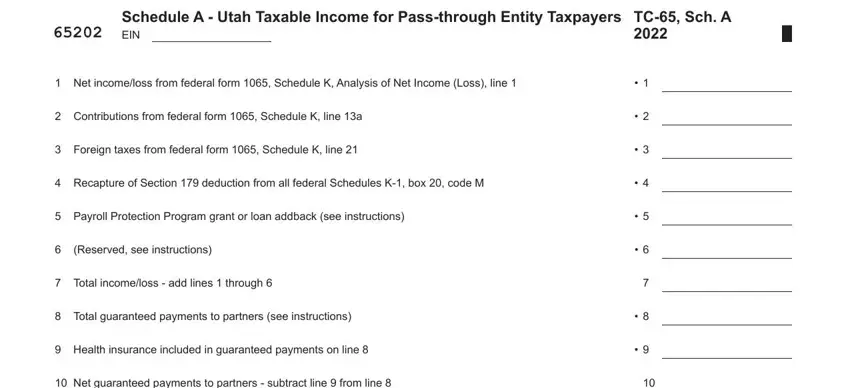

4. This particular subsection comes next with the next few fields to consider: Schedule A Utah Taxable Income, USTC ORIGINAL FORM, Net incomeloss from federal form, Contributions from federal form, Foreign taxes from federal form, Recapture of Section deduction, Payroll Protection Program grant, Reserved see instructions, Total incomeloss add lines, Total guaranteed payments to, Health insurance included in, Net guaranteed payments to, cid, cid, and cid.

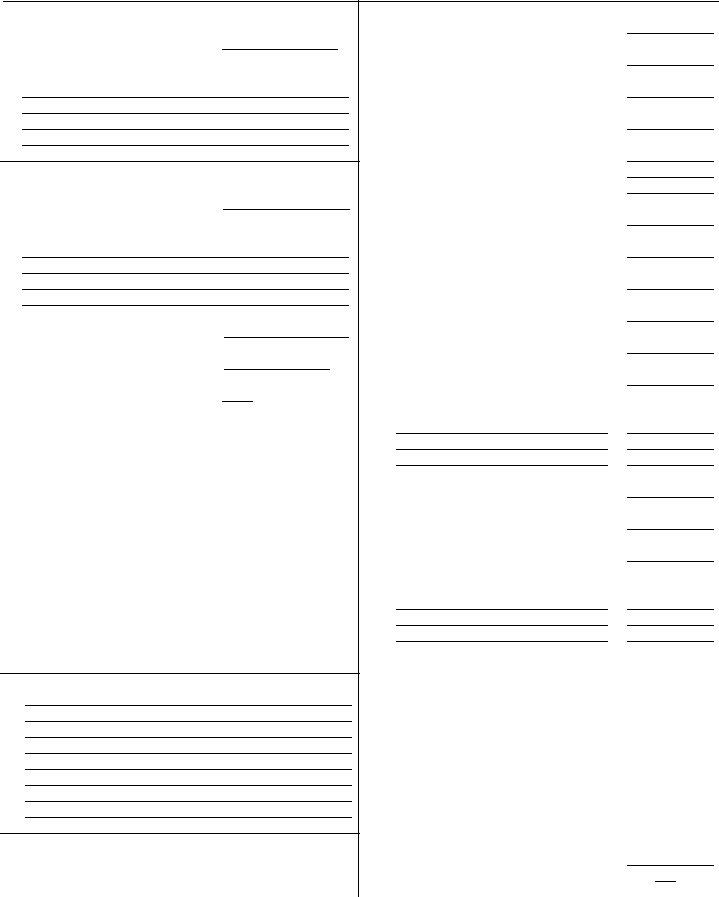

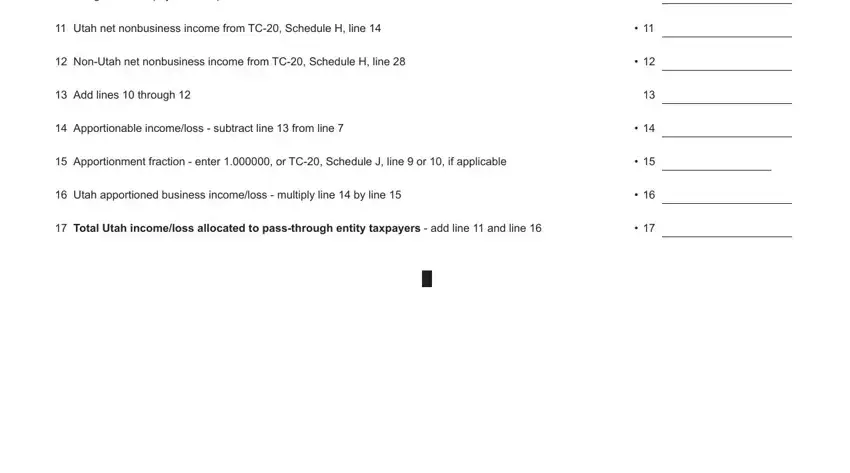

5. To finish your document, this last segment involves a couple of extra blank fields. Filling in Net guaranteed payments to, Utah net nonbusiness income from, NonUtah net nonbusiness income, Add lines through, Apportionable incomeloss, Apportionment fraction enter or, Utah apportioned business, Total Utah incomeloss allocated, cid, cid, cid, cid, cid, and cid will conclude the process and you will be done in an instant!

Step 3: As soon as you've reviewed the information in the document, click on "Done" to finalize your FormsPal process. After registering afree trial account at FormsPal, it will be possible to download utah tc limited company or email it without delay. The PDF form will also be at your disposal via your personal cabinet with your each and every modification. If you use FormsPal, you can complete documents without stressing about data breaches or records getting distributed. Our secure system ensures that your personal details are kept safely.