We were designing this PDF editor having the prospect of allowing it to be as quick to use as it can be. That's the reason the actual procedure of completing the Va Form 10 10Ec will likely to be effortless carry out all of these steps:

Step 1: To start out, choose the orange button "Get Form Now".

Step 2: You're now on the file editing page. You may edit, add text, highlight certain words or phrases, put crosses or checks, and insert images.

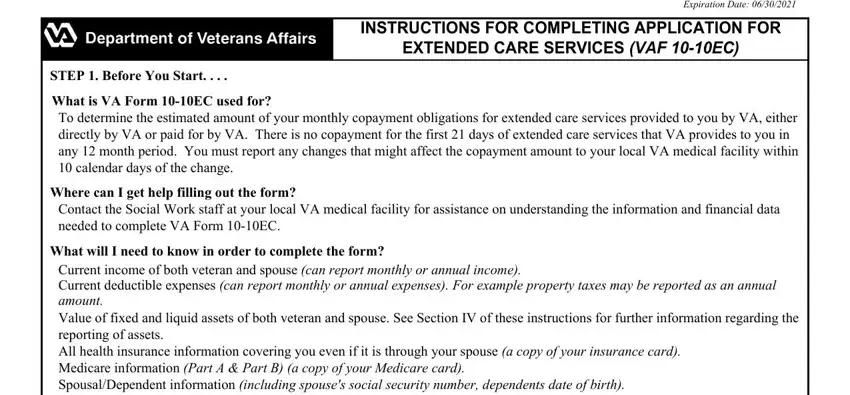

To fill out the Va Form 10 10Ec PDF, enter the content for each of the segments:

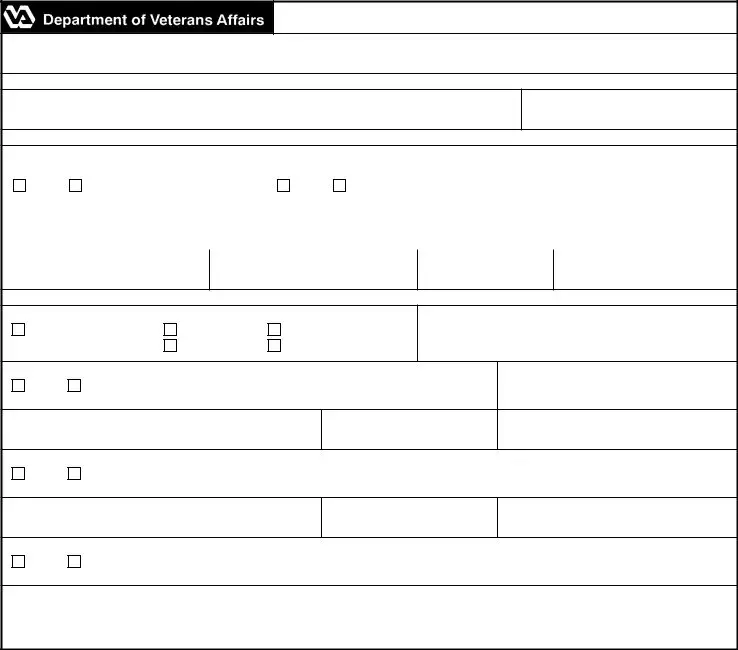

Remember to submit the data within the section APPLICATION FOR EXTENDED CARE, OMB Number Estimated Burden min, Federal law provides criminal, VETERANS NAME Last First MI, SOCIAL SECURITY NUMBER, SECTION I GENERAL INFORMATION, SECTION II INSURANCE INFORMATION, ARE YOU ELIGIBLE FOR MEDICAID, A ARE YOU ENROLLED IN MEDICARE, B EFFECTIVE DATE If Yes, YES, YES, NAME OF INSURANCE COMPANY, A ADDRESS OF INSURANCE COMPANY, and B PHONE NUMBER OF INSURANCE COMPANY.

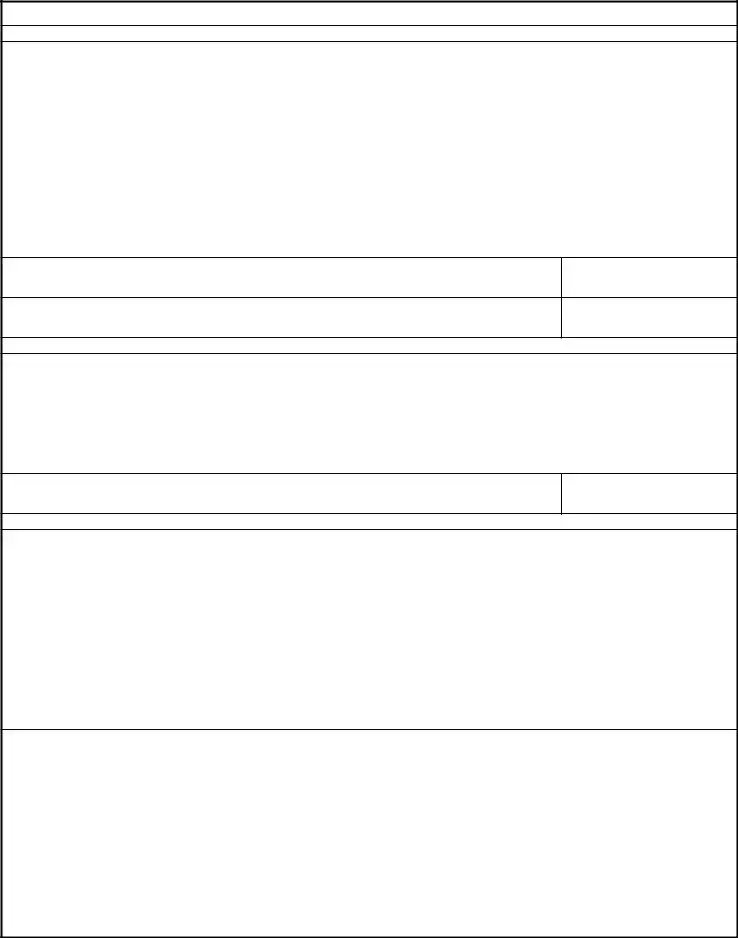

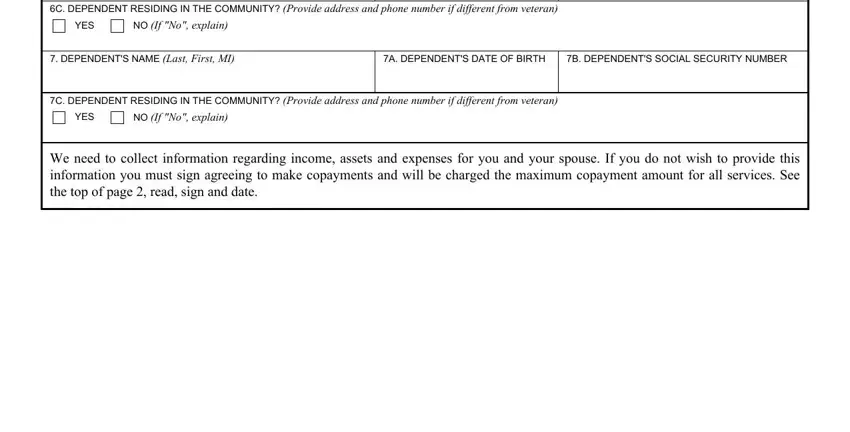

Describe the important data in the C DEPENDENT RESIDING IN THE, YES, NO If No explain, DEPENDENTS NAME Last First MI, A DEPENDENTS DATE OF BIRTH, B DEPENDENTS SOCIAL SECURITY NUMBER, C DEPENDENT RESIDING IN THE, YES, NO If No explain, and We need to collect information segment.

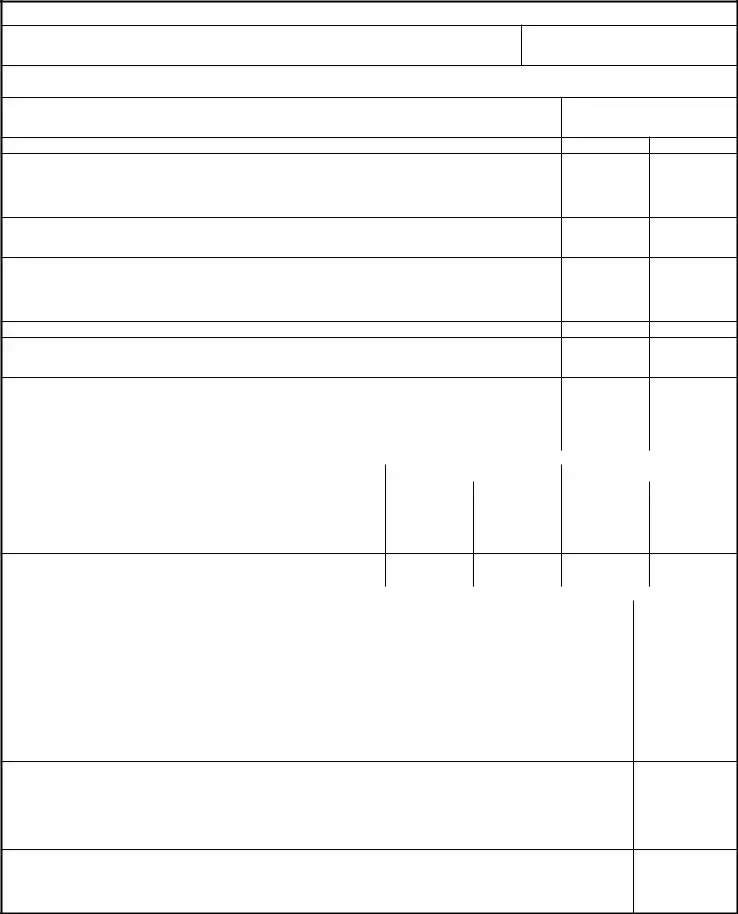

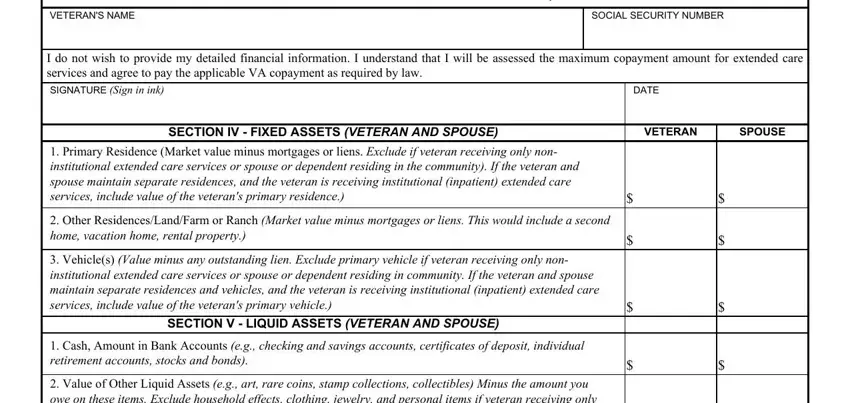

You will have to spell out the rights and responsibilities of all parties in field VETERANS NAME, SOCIAL SECURITY NUMBER, APPLICATION FOR EXTENDED CARE, I do not wish to provide my, DATE, SECTION IV FIXED ASSETS VETERAN, VETERAN, SPOUSE, Primary Residence Market value, Other ResidencesLandFarm or Ranch, Vehicles Value minus any, SECTION V LIQUID ASSETS VETERAN, Cash Amount in Bank Accounts eg, and Value of Other Liquid Assets eg.

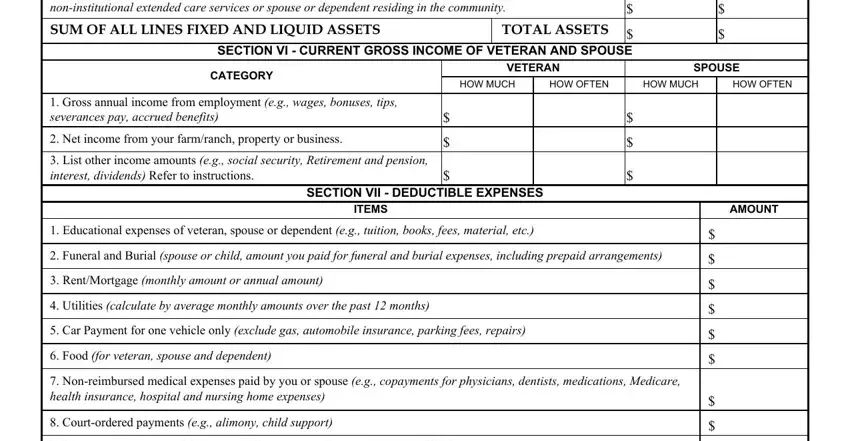

Review the areas Value of Other Liquid Assets eg, SUM OF ALL LINES FIXED AND LIQUID, SECTION VI CURRENT GROSS INCOME, TOTAL ASSETS, CATEGORY, VETERAN, SPOUSE, HOW MUCH, HOW OFTEN, HOW MUCH, HOW OFTEN, Gross annual income from, Net income from your farmranch, List other income amounts eg, and SECTION VII DEDUCTIBLE EXPENSES and next fill them out.

Step 3: Click the Done button to save the file. At this point it is offered for export to your electronic device.

Step 4: It's possible to make copies of the file torefrain from any kind of future challenges. Don't get worried, we don't reveal or track your data.