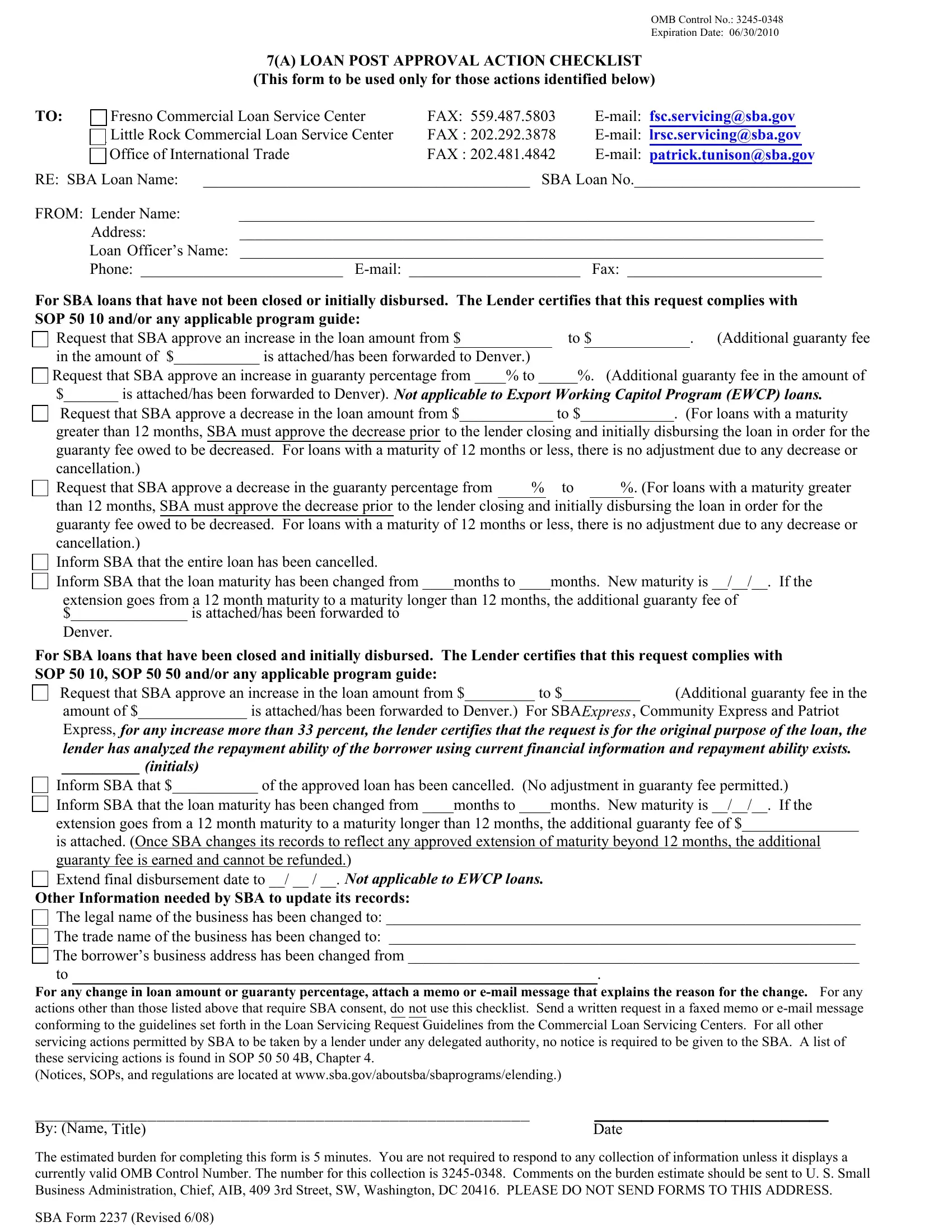

OMB Control No.: 3245-0348

Expiration Date: 06/30/2010

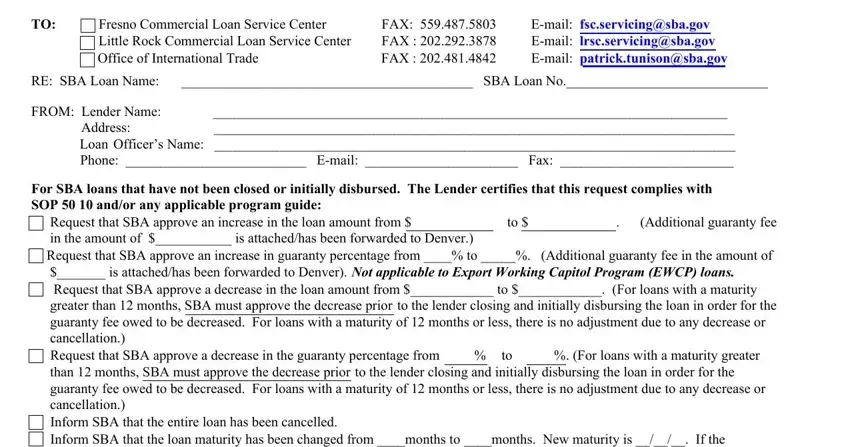

7(A) LOAN POST APPROVAL ACTION CHECKLIST (This form to be used only for those actions identified below)

TO: |

__ Fresno Commercial Loan Service Center |

FAX: 559.487.5803 |

E-mail: fsc.servicing@sba.gov |

|

__ Little Rock Commercial Loan Service Center |

FAX : 202.292.3878 |

E-mail: lrsc.servicing@sba.gov |

|

__ Office of International Trade |

FAX : 202.481.4842 |

E-mail: patrick.tunison@sba.gov |

RE: SBA Loan Name: |

__________________________________________ SBA Loan No._____________________________ |

FROM: Lender Name: |

__________________________________________________________________________ |

Address: |

___________________________________________________________________________ |

Loan Officer’s Name: ___________________________________________________________________________

Phone: __________________________ E-mail: ______________________ Fax: _________________________

For SBA loans that have not been closed or initially disbursed. The Lender certifies that this request complies with

SOP 50 10 and/or any applicable program guide: |

|

|

|

Request that SBA approve an increase in the loan amount from $ |

to $ |

. (Additional guaranty fee |

|

|

|

|

|

in the amount of $___________ is attached/has been forwarded to Denver.) |

|

|

|

Request that SBA approve an increase in guaranty percentage from ____% to _____%. (Additional guaranty fee in the amount of

$_______ is attached/has been forwarded to Denver). Not applicable to Export Working Capitol Program (EWCP) loans.

Request that SBA approve a decrease in the loan amount from $____________ to $____________. (For loans with a maturity

greater than 12 months, SBA must approve the decrease prior to the lender closing and initially disbursing the loan in order for the guaranty fee owed to be decreased. For loans with a maturity of 12 months or less, there is no adjustment due to any decrease or cancellation.)

Request that SBA approve a decrease in the guaranty percentage from % to %. (For loans with a maturity greater

than 12 months, SBA must approve the decrease prior to the lender closing and initially disbursing the loan in order for the guaranty fee owed to be decreased. For loans with a maturity of 12 months or less, there is no adjustment due to any decrease or cancellation.)

Inform SBA that the entire loan has been cancelled.

Inform SBA that the loan maturity has been changed from ____months to ____months. New maturity is __/__/__. If the

extension goes from a 12 month maturity to a maturity longer than 12 months, the additional guaranty fee of $_______________ is attached/has been forwarded to

Denver.

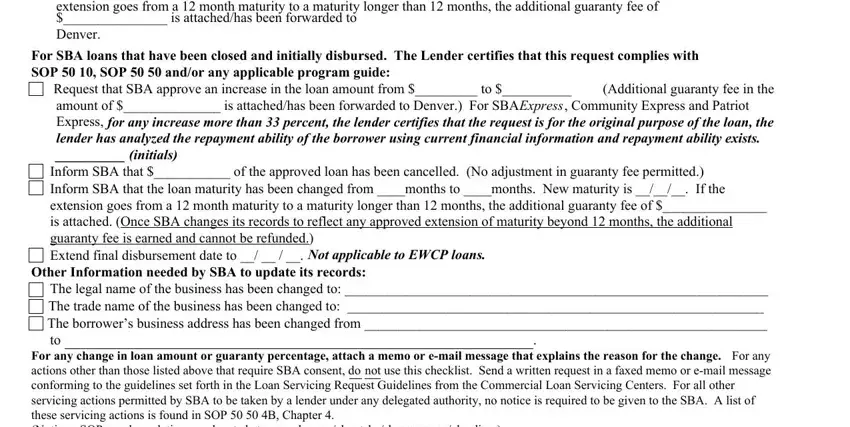

For SBA loans that have been closed and initially disbursed. The Lender certifies that this request complies with SOP 50 10, SOP 50 50 and/or any applicable program guide:

Request that SBA approve an increase in the loan amount from $_________ to $__________ (Additional guaranty fee in the

amount of $______________ is attached/has been forwarded to Denver.) For SBAEXPRESS, Community Express and Patriot

Express, for any increase more than 33 percent, the lender certifies that the request is for the original purpose of the loan, the lender has analyzed the repayment ability of the borrower using current financial information and repayment ability exists.

__________ (initials)

Inform SBA that $___________ of the approved loan has been cancelled. (No adjustment in guaranty fee permitted.)

Inform SBA that the loan maturity has been changed from ____months to ____months. New maturity is __/__/__. If the

extension goes from a 12 month maturity to a maturity longer than 12 months, the additional guaranty fee of $_______________

is attached. (Once SBA changes its records to reflect any approved extension of maturity beyond 12 months, the additional guaranty fee is earned and cannot be refunded.)

Extend final disbursement date to __/ __ / __. Not applicable to EWCP loans.

Other Information needed by SBA to update its records:

The legal name of the business has been changed to: _____________________________________________________________

The trade name of the business has been changed to: ____________________________________________________________

The borrower’s business address has been changed from __________________________________________________________

For any change in loan amount or guaranty percentage, attach a memo or e-mail message that explains the reason for the change. For any actions other than those listed above that require SBA consent, do not use this checklist. Send a written request in a faxed memo or e-mail message conforming to the guidelines set forth in the Loan Servicing Request Guidelines from the Commercial Loan Servicing Centers. For all other servicing actions permitted by SBA to be taken by a lender under any delegated authority, no notice is required to be given to the SBA. A list of these servicing actions is found in SOP 50 50 4B, Chapter 4.

(Notices, SOPs, and regulations are located at www.sba.gov/aboutsba/sbaprograms/elending.)

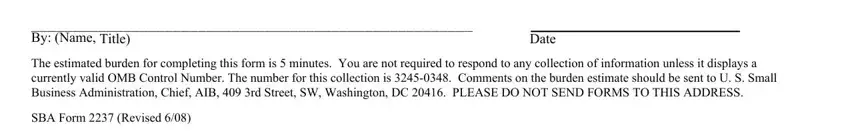

_____________________________________________________ |

_________________________ |

By: (Name, Title) |

Date |

The estimated burden for completing this form is 5 minutes. You are not required to respond to any collection of information unless it displays a currently valid OMB Control Number. The number for this collection is 3245-0348. Comments on the burden estimate should be sent to U. S. Small Business Administration, Chief, AIB, 409 3rd Street, SW, Washington, DC 20416. PLEASE DO NOT SEND FORMS TO THIS ADDRESS.

SBA Form 2237 (Revised 6/08)