With the help of the online tool for PDF editing by FormsPal, you are able to fill in or alter va form 26 6807 right here and now. Our editor is continually developing to provide the very best user experience attainable, and that is thanks to our commitment to continuous enhancement and listening closely to comments from customers. With some simple steps, you'll be able to start your PDF journey:

Step 1: Click on the "Get Form" button in the top part of this page to get into our tool.

Step 2: After you start the online editor, you will find the document prepared to be filled in. Other than filling out various blanks, it's also possible to perform some other actions with the form, that is adding any words, modifying the initial textual content, adding illustrations or photos, signing the document, and a lot more.

It will be an easy task to finish the document using this helpful guide! Here's what you need to do:

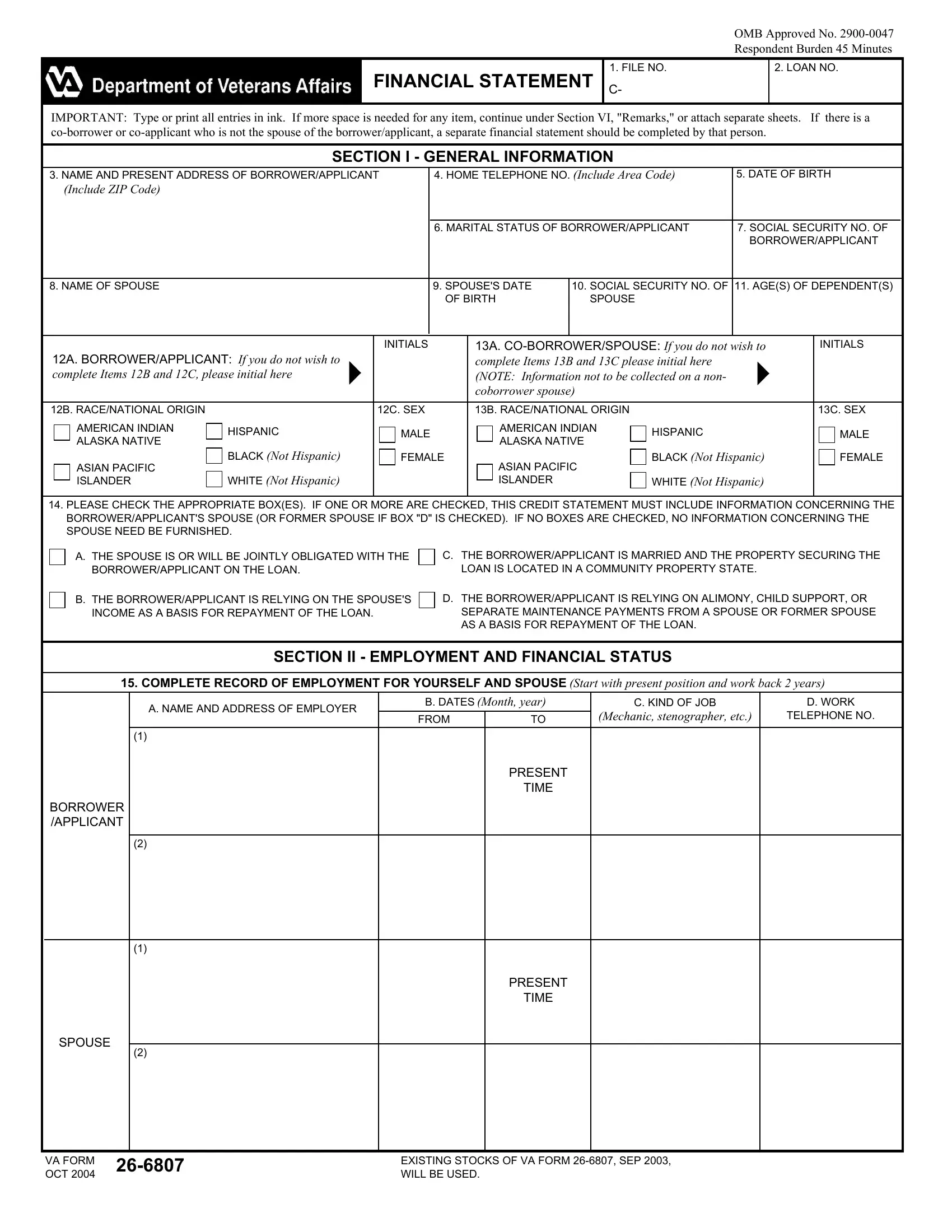

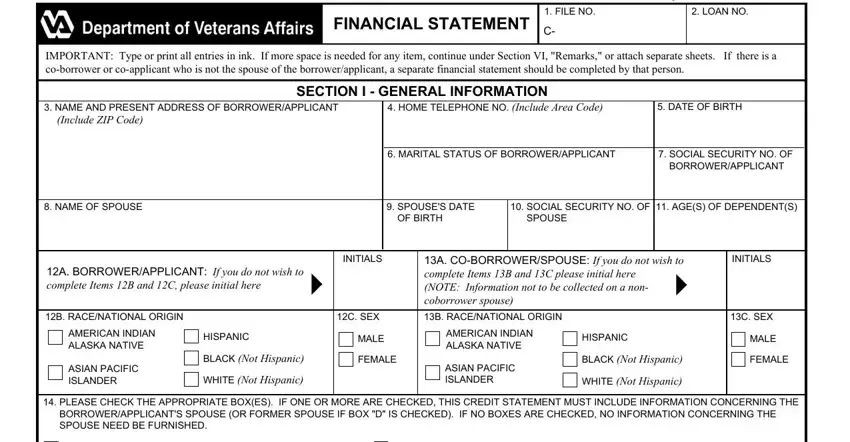

1. The va form 26 6807 necessitates particular details to be entered. Ensure that the subsequent blanks are filled out:

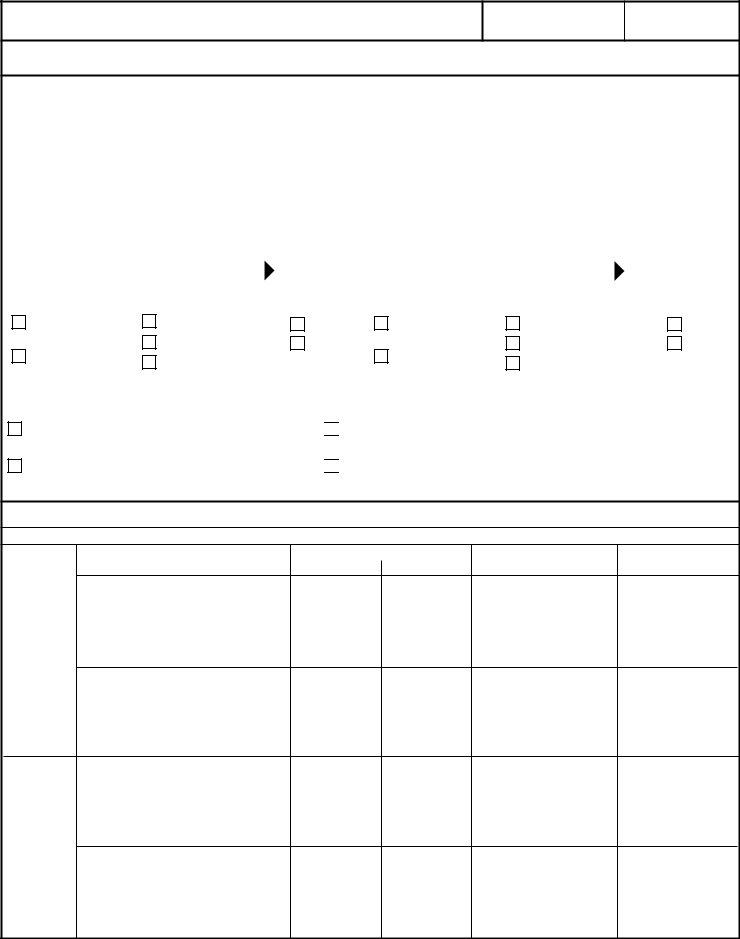

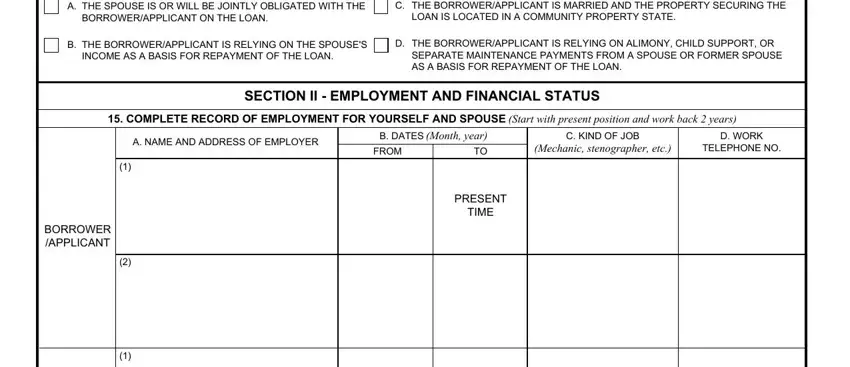

2. Once your current task is complete, take the next step – fill out all of these fields - THE SPOUSE IS OR WILL BE JOINTLY, THE BORROWERAPPLICANT IS MARRIED, THE BORROWERAPPLICANT IS RELYING, THE BORROWERAPPLICANT IS RELYING, SECTION II EMPLOYMENT AND, COMPLETE RECORD OF EMPLOYMENT FOR, A NAME AND ADDRESS OF EMPLOYER, B DATES Month year, FROM, C KIND OF JOB, Mechanic stenographer etc, D WORK, TELEPHONE NO, BORROWER APPLICANT, and PRESENT with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

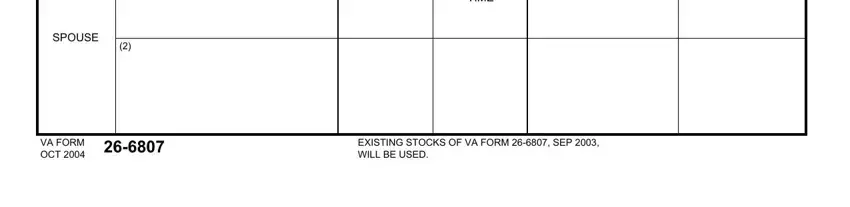

3. The following section focuses on SPOUSE, TIME, VA FORM, OCT, and EXISTING STOCKS OF VA FORM SEP - complete all these fields.

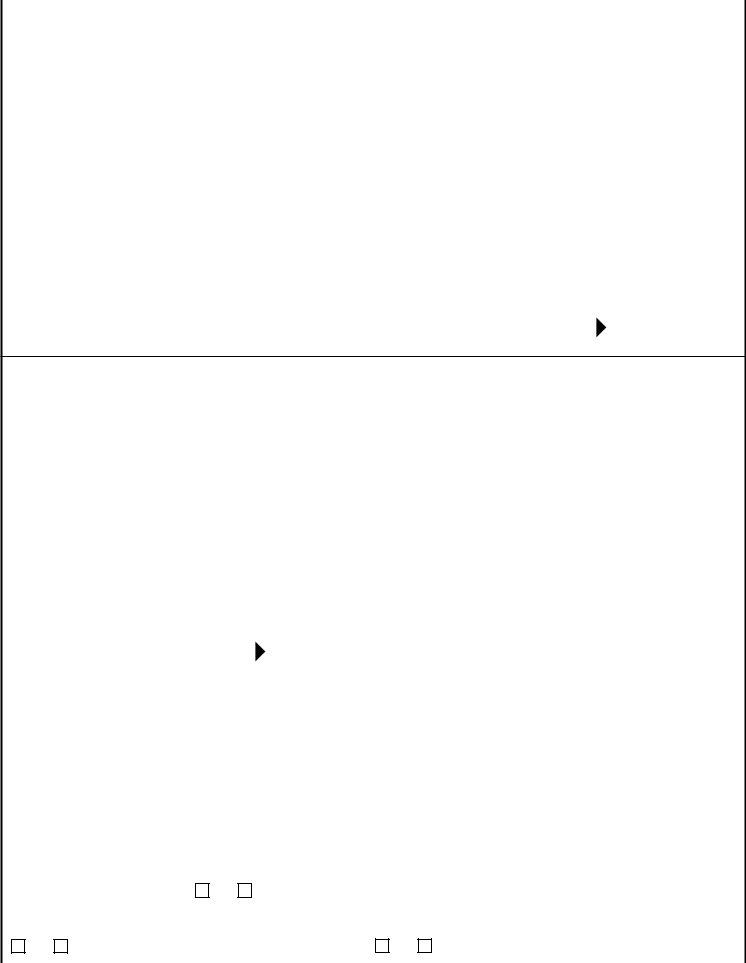

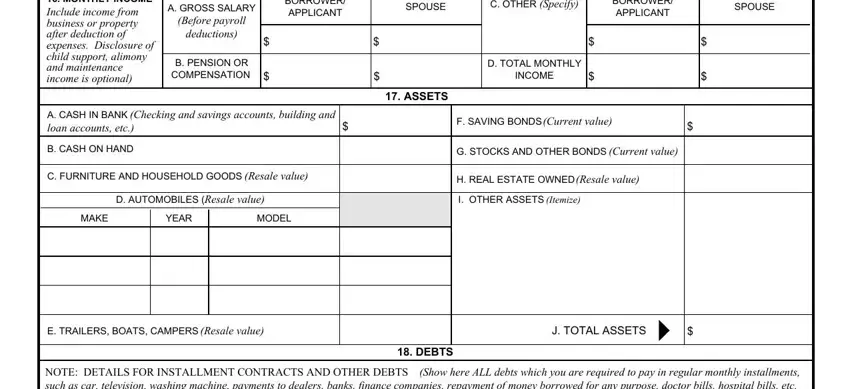

4. This next section requires some additional information. Ensure you complete all the necessary fields - MONTHLY INCOME Include income, A GROSS SALARY, Before payroll, deductions, B PENSION OR COMPENSATION, BORROWER APPLICANT, SPOUSE, C OTHER Specify, BORROWER APPLICANT, SPOUSE, ASSETS, D TOTAL MONTHLY, INCOME, A CASH IN BANK Checking and, and F SAVING BONDS Current value - to proceed further in your process!

In terms of A CASH IN BANK Checking and and deductions, be certain you review things in this current part. These two are the most important ones in the PDF.

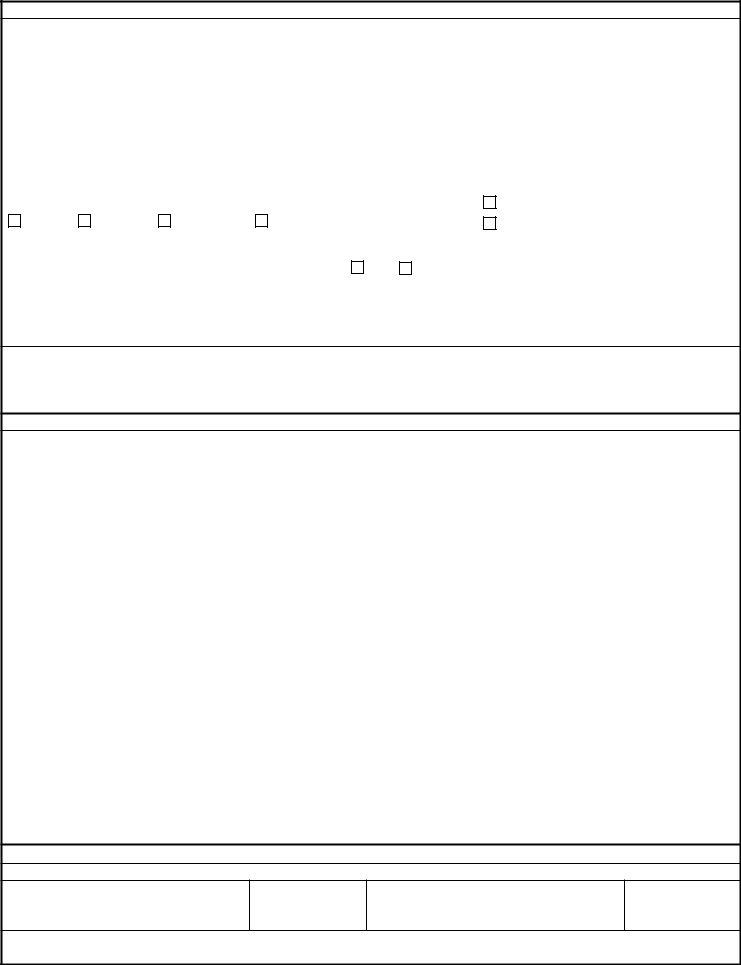

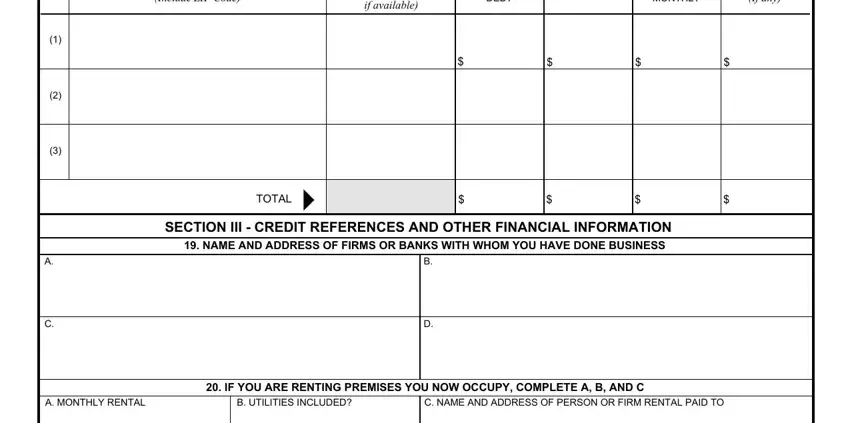

5. The final section to complete this form is integral. Ensure you fill in the displayed fields, such as Include ZIP Code, if available, DEBT, MONTHLY, If any, TOTAL, SECTION III CREDIT REFERENCES AND, NAME AND ADDRESS OF FIRMS OR, A MONTHLY RENTAL, B UTILITIES INCLUDED, C NAME AND ADDRESS OF PERSON OR, and IF YOU ARE RENTING PREMISES YOU, before submitting. In any other case, it might end up in a flawed and potentially unacceptable document!

Step 3: Right after double-checking the form fields, press "Done" and you're all set! Right after registering afree trial account at FormsPal, it will be possible to download va form 26 6807 or email it immediately. The PDF file will also be easily accessible via your personal account with your every edit. FormsPal ensures your information privacy by having a secure system that never records or distributes any type of personal data involved in the process. Rest assured knowing your files are kept confidential every time you use our tools!