OMB Approved No. 2900-0060

Respondent Burden: 6 Minutes

|

|

|

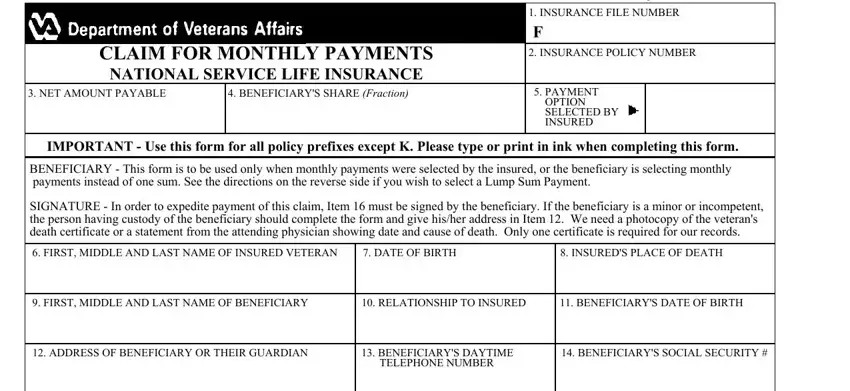

1. INSURANCE FILE NUMBER |

|

|

|

F |

CLAIM FOR MONTHLY PAYMENTS |

2. INSURANCE POLICY NUMBER |

|

|

|

NATIONAL SERVICE LIFE INSURANCE |

|

|

3. NET AMOUNT PAYABLE |

4. BENEFICIARY'S SHARE (Fraction) |

5. PAYMENT |

|

|

|

|

OPTION |

|

|

|

|

SELECTED BY |

|

|

|

|

INSURED |

|

|

|

|

|

|

IMPORTANT - Use this form for all policy prefixes except K. Please type or print in ink when completing this form.

BENEFICIARY - This form is to be used only when monthly payments were selected by the insured, or the beneficiary is selecting monthly payments instead of one sum. See the directions on the reverse side if you wish to select a Lump Sum Payment.

SIGNATURE - In order to expedite payment of this claim, Item 16 must be signed by the beneficiary. If the beneficiary is a minor or incompetent, the person having custody of the beneficiary should complete the form and give his/her address in Item 12. We need a photocopy of the veteran's death certificate or a statement from the attending physician showing date and cause of death. Only one certificate is required for our records.

6. FIRST, MIDDLE AND LAST NAME OF INSURED VETERAN |

7. DATE OF BIRTH |

8. INSURED'S PLACE OF DEATH |

|

|

|

9. FIRST, MIDDLE AND LAST NAME OF BENEFICIARY |

10. RELATIONSHIP TO INSURED |

11. BENEFICIARY'S DATE OF BIRTH |

|

|

|

12. ADDRESS OF BENEFICIARY OR THEIR GUARDIAN |

13. BENEFICIARY'S DAYTIME |

14. BENEFICIARY'S SOCIAL SECURITY # |

|

TELEPHONE NUMBER |

|

()

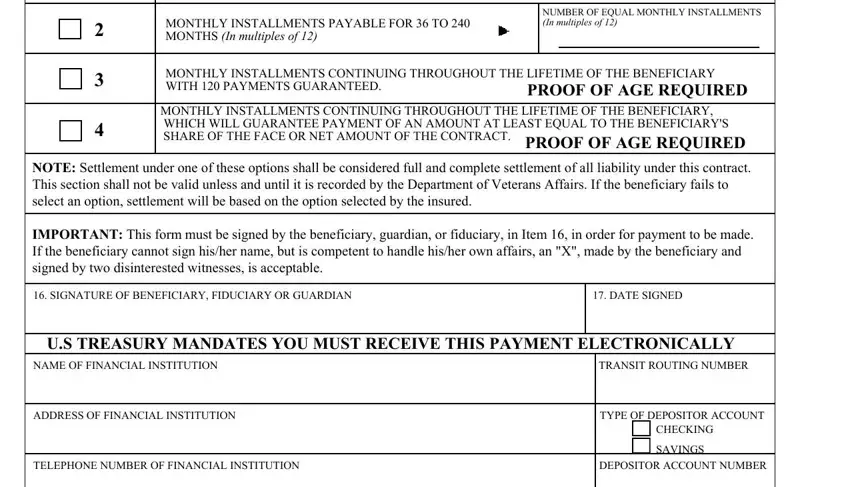

15.SELECTION OF OPTION

Read the instructions on the reverse side and consult the tables attached before making your selection in the space below.

Check the box for the option selected, or more than one box if more than one option is selected in accordance with Instruction 2 on the reverse side. If selecting Option 2, please complete all items on the line checked.

OPTION NUMBER |

OPTION DESCRIPTION |

|

|

|

|

|

|

|

|

NUMBER OF EQUAL MONTHLY INSTALLMENTS |

|

|

|

2 |

MONTHLY INSTALLMENTS PAYABLE FOR 36 TO 240 |

(In multiples of 12) |

|

|

|

MONTHS (In multiples of 12) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3MONTHLY INSTALLMENTS CONTINUING THROUGHOUT THE LIFETIME OF THE BENEFICIARY

WITH 120 PAYMENTS GUARANTEED.PROOF OF AGE REQUIRED

MONTHLY INSTALLMENTS CONTINUING THROUGHOUT THE LIFETIME OF THE BENEFICIARY,

4WHICH WILL GUARANTEE PAYMENT OF AN AMOUNT AT LEAST EQUAL TO THE BENEFICIARY'S SHARE OF THE FACE OR NET AMOUNT OF THE CONTRACT. PROOF OF AGE REQUIRED

NOTE: Settlement under one of these options shall be considered full and complete settlement of all liability under this contract. This section shall not be valid unless and until it is recorded by the Department of Veterans Affairs. If the beneficiary fails to select an option, settlement will be based on the option selected by the insured.

IMPORTANT: This form must be signed by the beneficiary, guardian, or fiduciary, in Item 16, in order for payment to be made. If the beneficiary cannot sign his/her name, but is competent to handle his/her own affairs, an "X", made by the beneficiary and signed by two disinterested witnesses, is acceptable.

16. SIGNATURE OF BENEFICIARY, FIDUCIARY OR GUARDIAN

U.S TREASURY MANDATES YOU MUST RECEIVE THIS PAYMENT ELECTRONICALLY

NAME OF FINANCIAL INSTITUTION |

|

TRANSIT ROUTING NUMBER |

|

|

|

|

|

|

|

ADDRESS OF FINANCIAL INSTITUTION |

|

TYPE OF DEPOSITOR ACCOUNT |

|

|

|

|

|

|

CHECKING |

|

|

|

|

|

|

SAVINGS |

|

|

|

|

|

|

TELEPHONE NUMBER OF FINANCIAL INSTITUTION |

DEPOSITOR ACCOUNT NUMBER |

|

|

|

|

|

|

IF YOU HAVE ANY QUESTIONS ABOUT THIS FORM, PLEASE CALL OUR TOLL FREE NUMBER 1-800-669-8477 |

|

|

|

|

|

|

|

VA FORM 29-4125a |

EXISTING STOCKS OF VA FORM 29-4125a, AUG 2002, |

|

|

|

|

|

WILL NOT BE USED. |

|

|

|

|

|

MAR 2013 |

|

|

|

|

|

|

INSTRUCTIONS FOR SELECTION OF OPTIONAL SETTLEMENT

1.OPTION 1 - LUMP SUM SETTLEMENT is not available when the insured selected a monthly installment option. HOWEVER, if the insured left a will or there is other evidence, in writing, that the insured desired that the beneficiary receive a lump sum, the beneficiary may submit a copy of such consideration. When submitting also sign Item 16 of this form and return it along with the additional evidence. It is not necessary to complete the entire form.

2.If insured selected an option, the beneficiary may abide by the insured's selection or may request settlement in installments.

A. If insured selected Option 1 (Lump Sum Settlement) beneficiary may select Option 1, 2, 3 or 4 or may request part payment under Option 1 and remainder under any of the other options.

B. If insured selected Option 2, beneficiary may request settlement split between two variations of Option 2.

C. If insured selected Option 2, with monthly installments in excess of 120, beneficiary may select to receive payment in a greater number of installments under Option 2, or may elect to receive payment under Option 3 or 4 or may request settlement split between Option 2, as herein limited, and Option 3 and 4.

D. If insured selected Option 2, with monthly installments not in excess of 120, beneficiary may select a greater number of installments under Option 2 or may select Option 4, provided number of installments guaranteed under Option 4 is greater than number of installments selected by insured under Option 2 or may request settlement split between Option 2 and 4, as herein limited.

E. If insured has selected Option 3, beneficiary may select Option 4.

F. If insured has selected Option 4, and named no contingent beneficiary, beneficiary may select Option 3.

G. If beneficiary selects two methods of payment the amount payable under at least one of them must be in multiples of $1,000 and all monthly installments under such selection must be at least $10. (See Instruction 5)

3.Settlement under Option 4 is not authorized when payments would be made in a shorter period than 120 months.

4.Option 3 and 4 shall not be available if the beneficiary is a firm, corporation, legal entity or trustee. Settlement to an estate is authorized only in one sum.

5.If option selected requires payment of installments of less than $10, the amount payable shall be paid under Option 2 in such maximum number of installments as are a multiple of 12 as will provide a monthly installment of not less than $10. If present value at time any person initially becomes entitled to payment thereof is not sufficient to pay at least twelve monthly installments of not less than $10 each, such amount shall be payable in one sum.

6.If the insured selected Option 1 and the beneficiary has elected payment under Option 2, 3 or 4 and dies before receiving all installments due, the commuted (cash) value of the remaining unpaid installments guaranteed will be paid to the ESTATE OF THE BENEFICIARY. If the insured designated Option 2, 3 or 4 and all beneficiaries die before receiving all installments due, the commuted value of the remaining installments guaranteed will be paid to the

ESTATE OF THE INSURED.

SUBMIT THE COMPLETED FORM TO THIS ADDRESS :

DEPARTMENT OF VETERANS AFFAIRS

REGIONAL OFFICE AND INSURANCE CENTER

P.O. BOX 7208

PHILADELPHIA, PA 19101

PRIVACY ACT NOTICE: No proceeds may be paid unless a completed claim form has been received (38 USC 1917). The information provided on a voluntary basis will be used by VA employees and your authorized representatives in the maintenance of Government Insurance programs. Responses may be disclosed outside the VA only if the disclosure is authorized under the Privacy Act, including the routine uses identified in the VA system of records, 36VA00, Veterans and Armed Forces Personnel U.S. Government Life Insurance Records - VA, published in the Federal Register.

RESPONDENT BURDEN: VA may not conduct or sponsor, and respondent is not required to respond to this collection of information unless it displays a valid OMB Control Number. Public reporting burden for this collection of information is estimated to average 6 minutes per response, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. If you have comments regarding this burden estimate or any other aspect of this collection of information, call 1-800-827-1000 for mailing information on where to send your comments.

VA FORM 29-4125a

MAR 2013

IMPORTANT NOTIFICATION

Effective Immediately, There Will Be No More Paper Government Checks. Payments Must Now Be Deposited Electronically Into Your Bank Account.

This is to inform you that, based on new U.S. Treasury regulations, we will no longer be permitted to send out paper checks for your Insurance payments. The Treasury will only send payments by Direct Deposit (which your bank may refer to as Electronic Funds Transfer or EFT).

This means that if you send us an Insurance application that requires us to send you money (For example: loans, cash surrenders, dividend withdrawals or claims for death benefits), you will have to provide us with your banking information. This is a mandatory requirement of the Treasury Department.

In order to set up Direct Deposit you must send us the following information:

If you will be using your checking account, send us:

A copy of a voided check (Your name must be on the account)

If you will be using a savings account, send us:

Your bank's name and address

Your bank's routing and transit number

Your bank account number

We know this may be an inconvenience but this information is mandatory based on U.S. Treasury Regulations and all government agencies must comply. Thank you for your cooperation.