Completing files with our PDF editor is simpler when compared with anything. To change valic transfer the file, there isn't anything you need to do - only proceed with the actions below:

Step 1: Click the "Get Form Here" button.

Step 2: The form editing page is right now available. You can include information or edit existing data.

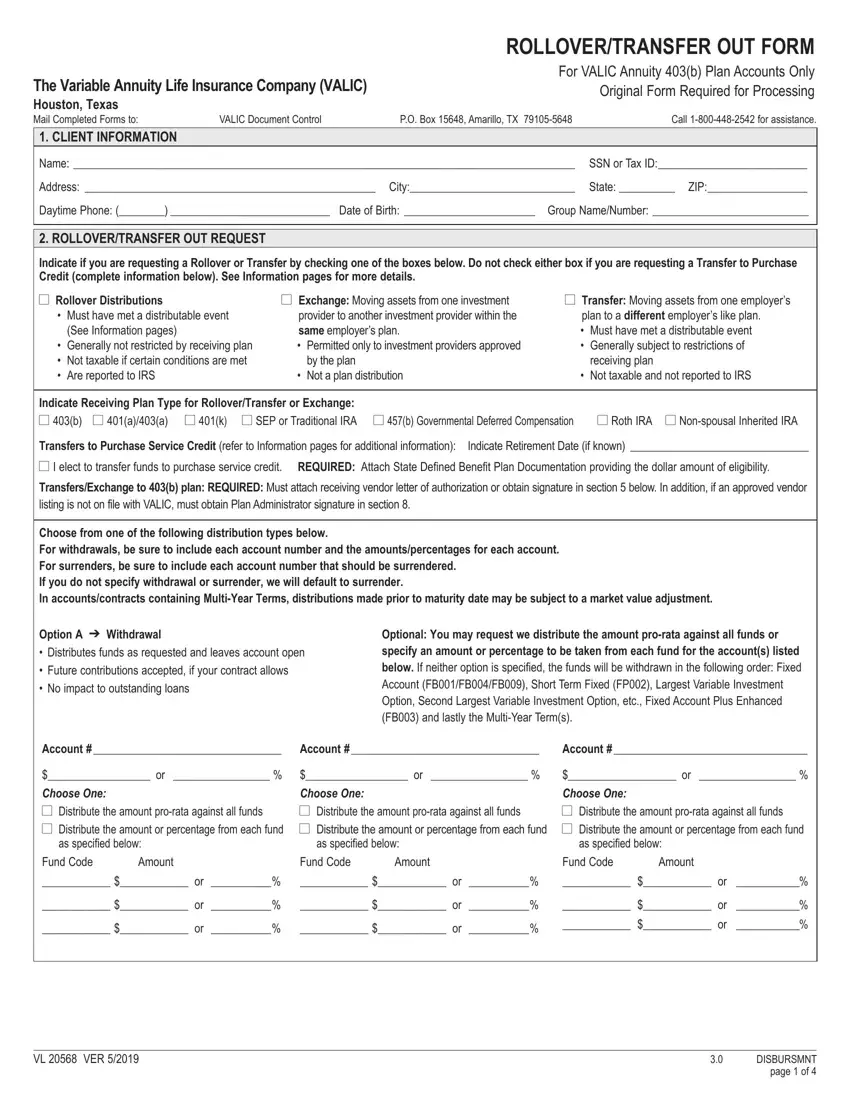

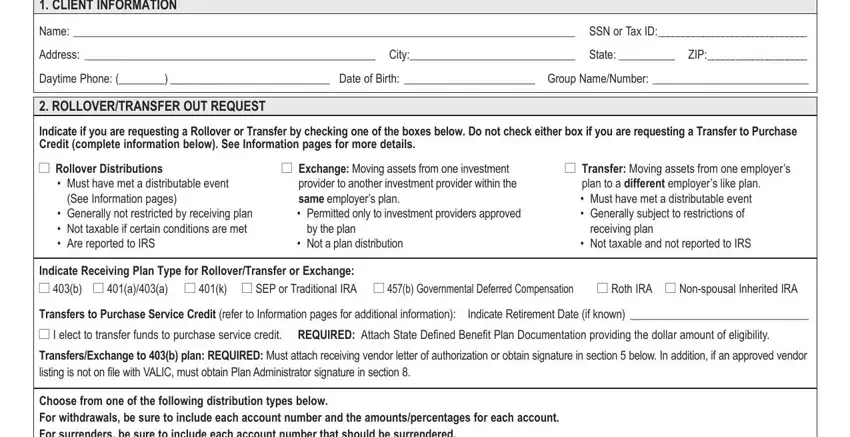

Type in the details demanded by the system to fill in the form.

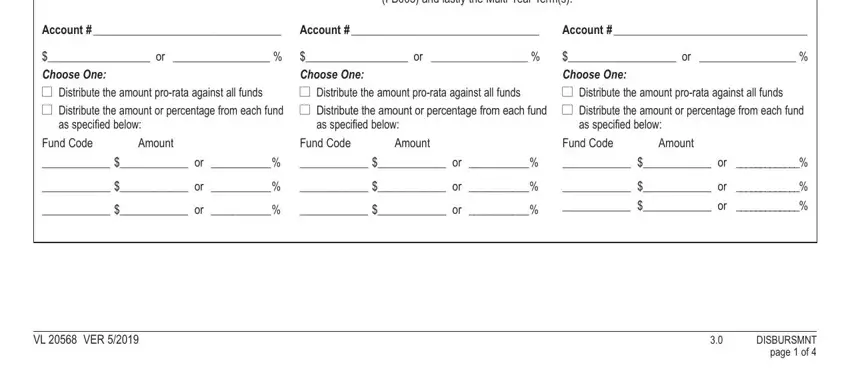

Type in the details in the Optional You may request we, Account, Account, Account, or Choose One l Distribute the, as specified below, or Choose One l Distribute the, as specified below, or Choose One l Distribute the, as specified below, Fund Code, Amount, Fund Code, Amount, and Fund Code field.

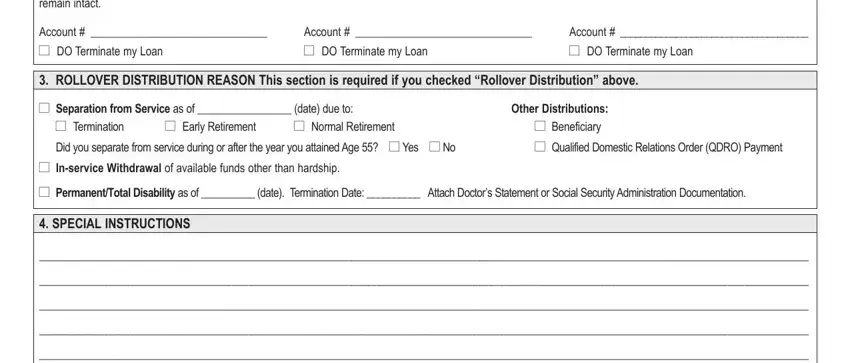

Write the significant details in If you have an outstanding loans, Account l DO Terminate my Loan, Account l DO Terminate my Loan, Account l DO Terminate my Loan, ROLLOVER DISTRIBUTION REASON This, l Separation from Service as of, l Termination l Early Retirement l, Other Distributions l Beneficiary, l Inservice Withdrawal of, and SPECIAL INSTRUCTIONS area.

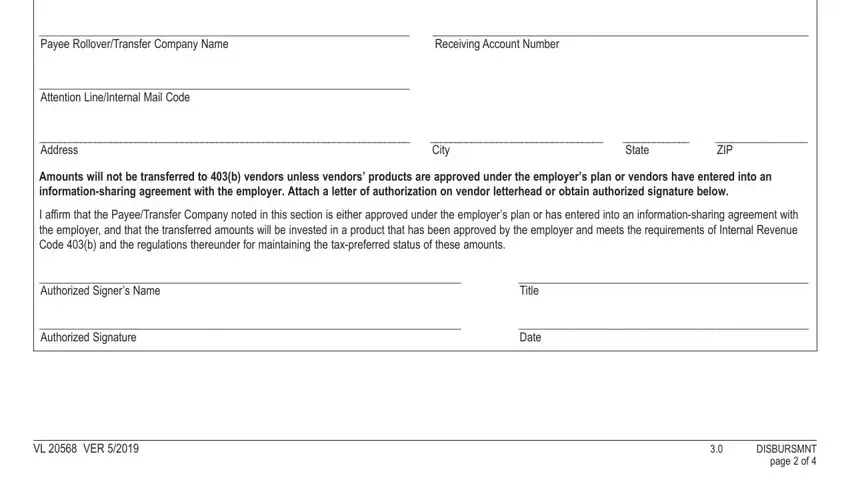

The Payee RolloverTransfer Company, Receiving Account Number, Attention LineInternal Mail Code, Address, City, State, ZIP, Amounts will not be transferred to, I affirm that the PayeeTransfer, Authorized Signers Name, Title, Authorized Signature, Date, VL VER, and DISBURSMNT page of area could be used to identify the rights and obligations of each side.

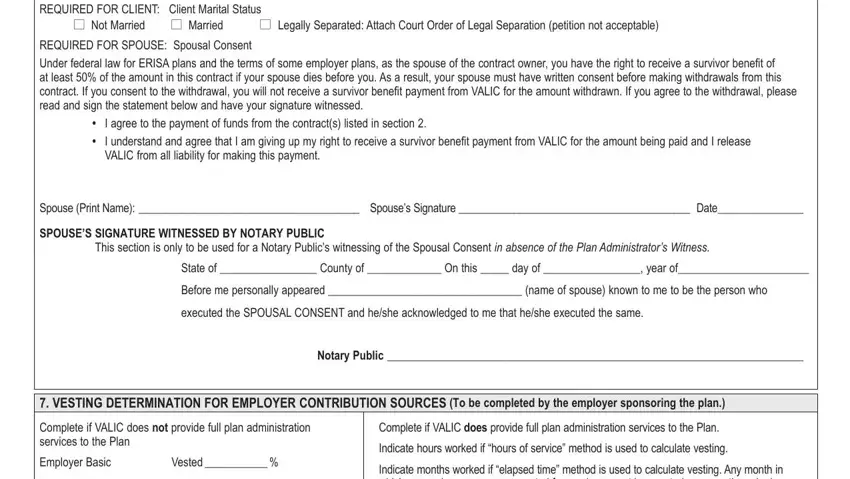

End by reading all of these fields and typing in the relevant details: REQUIRED FOR CLIENT Client Marital, l Not Married, l Married, l Legally Separated Attach Court, REQUIRED FOR SPOUSE Spousal, I agree to the payment of funds, Spouse Print Name Spouses, SPOUSES SIGNATURE WITNESSED BY, This section is only to be used, State of County of On this day, Before me personally appeared, executed the SPOUSAL CONSENT and, Notary Public, VESTING DETERMINATION FOR, and Complete if VALIC does not provide.

Step 3: Choose the "Done" button. Now it's possible to upload the PDF form to your gadget. Besides, you can easily deliver it by means of email.

Step 4: You should get as many duplicates of the file as possible to keep away from potential complications.