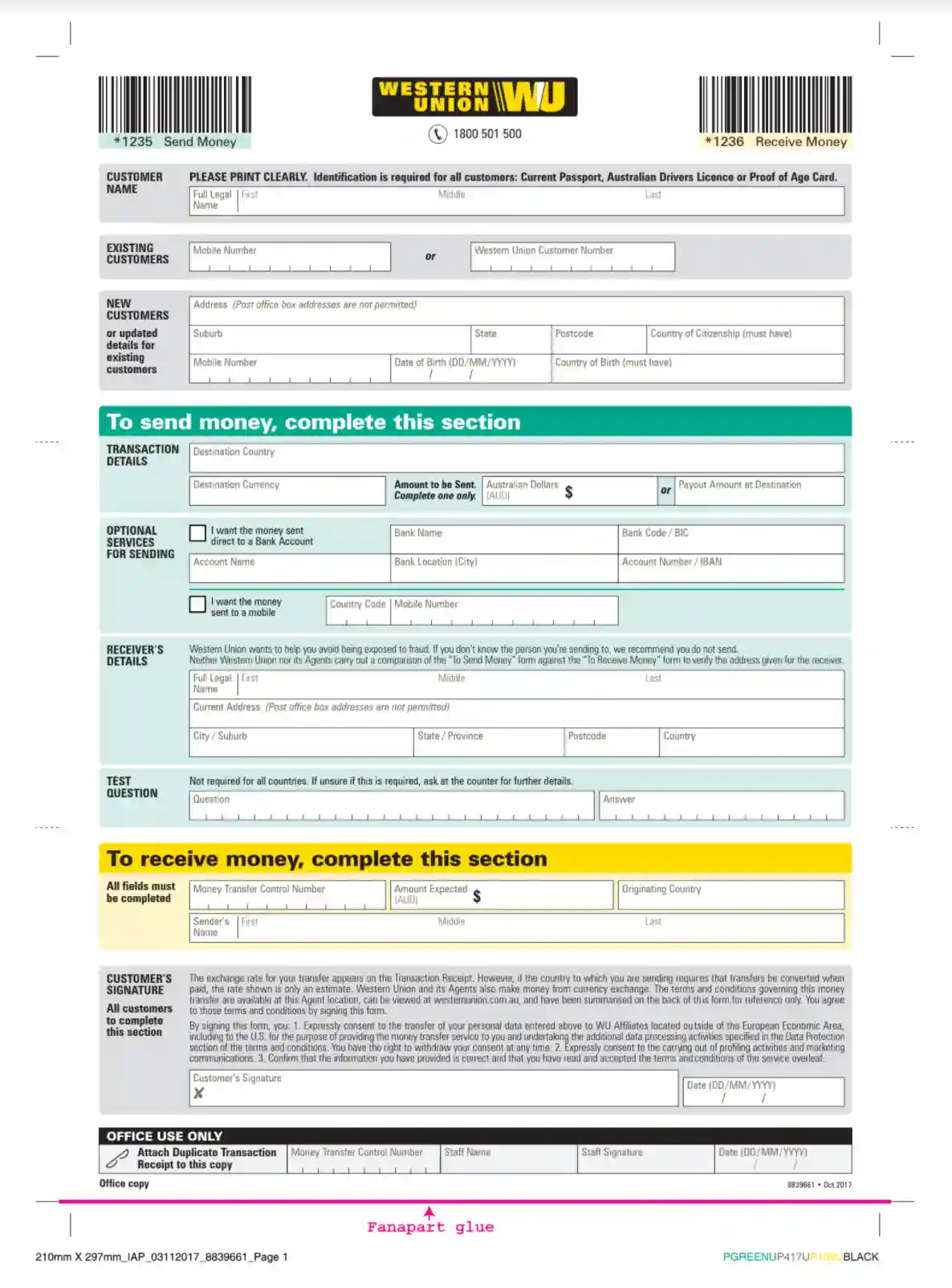

The Western Union Form is a comprehensive document for sending and receiving money internationally through Western Union services. This form requires detailed personal information from the customer, including full legal name, address (excluding P.O. boxes), mobile number, date and country of birth, and citizenship. It facilitates direct deposits to bank accounts and mobile transfers, with sections for entering specific banking details like the bank name, account number, and BIC.

Sending money with this form requires information about the destination country, currency, and the amount being sent. Additionally, the form includes a section for receiving money, where the money transfer control number and expected amount are specified. The Western Union Form ensures secure and efficient money transfers, allowing users to send or receive funds across borders while complying with legal and regulatory standards.

Other Financial Forms

Take a look at a few other financial PDFs accessible for editing in our software. Moreover, remember that you can easily upload, fill out, and edit any PDF at FormsPal.

How to Fill Out Western Union Form

Generate and download the needed Western Union PDF file template in high quality via our form-building software: complete, print out, and use it instantly. You are welcome to follow the tips of the guide below to avoid any troubleshooting while preparing the document.

The form consists of three main parts, including the client’s identification block and two transaction alternatives to choose from, relying on whether you plan to send or receive payments. Submit the parts, subsequently entering the valid data to avoid any unfavorable situations and money loss.

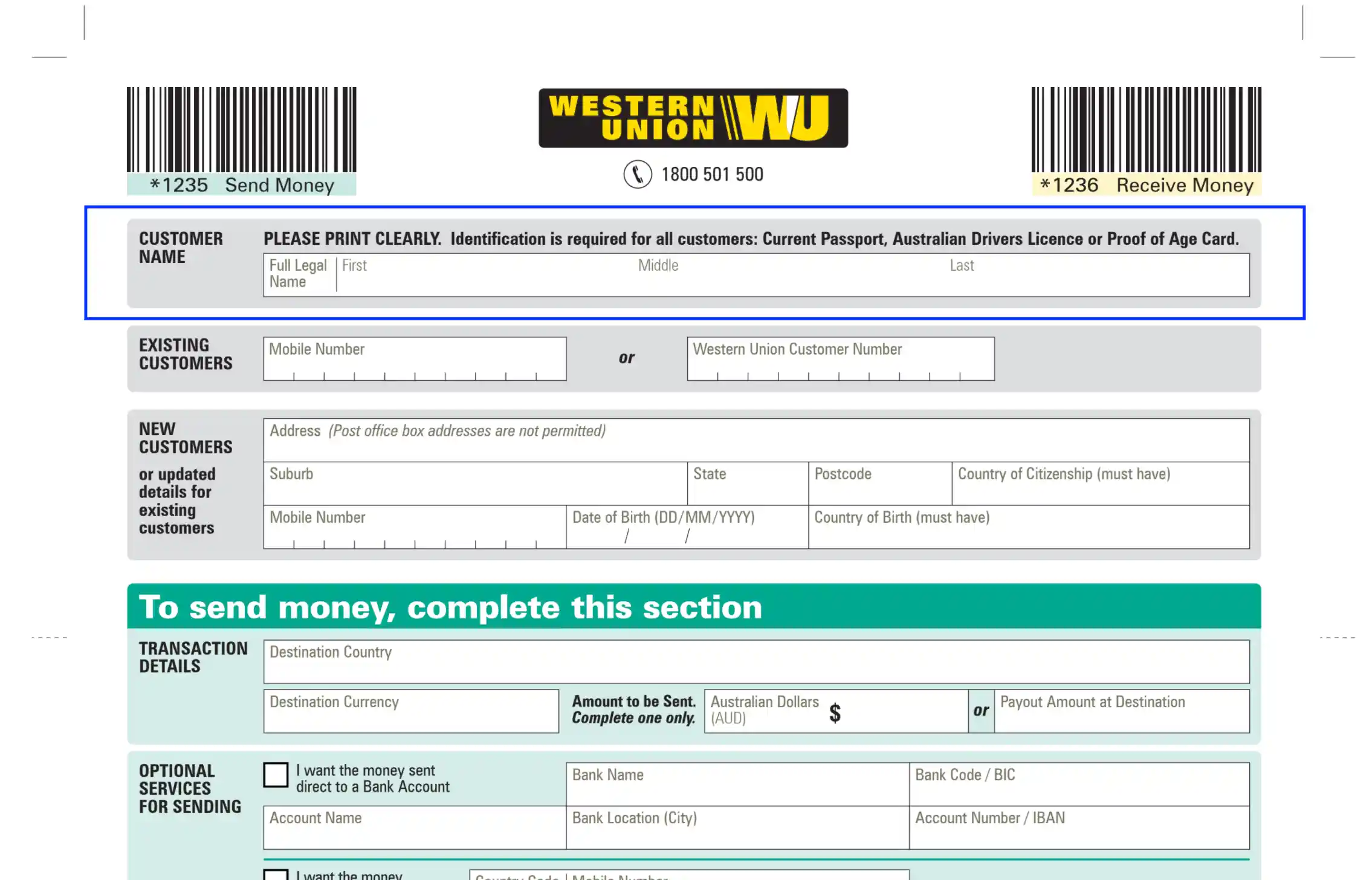

Identify the Western Union Customer

In the first spare field, the client should enter their full legal name in a printed manner, the exact way it is stated on their ID document (either passport, driver’s license, or proof of age card).

Provide the Customer’s Contact Details

Here, you need to select the right box to submit your contact data. If you are an existing customer and your name is included in the database, follow the instructions of the upper box and enter your mobile phone number and Western Union customer ID.

If you are new to Western Union service, make sure to fill out the lower box and disclose the info as follows:

- Apartment or suite number and street

- City or Suburb

- State and postal code details

- Country of citizenship

- Birthdate and country of birth

- Mobile phone number

Ensure to avoid P. O. Box address, as Western Union does not accept these data as a mailing location.

Once the heading part is completed, proceed to fill out the next appropriate section. Select the green-color part if you plan to send payments. If you expect to receive funds, choose the yellow-color section.

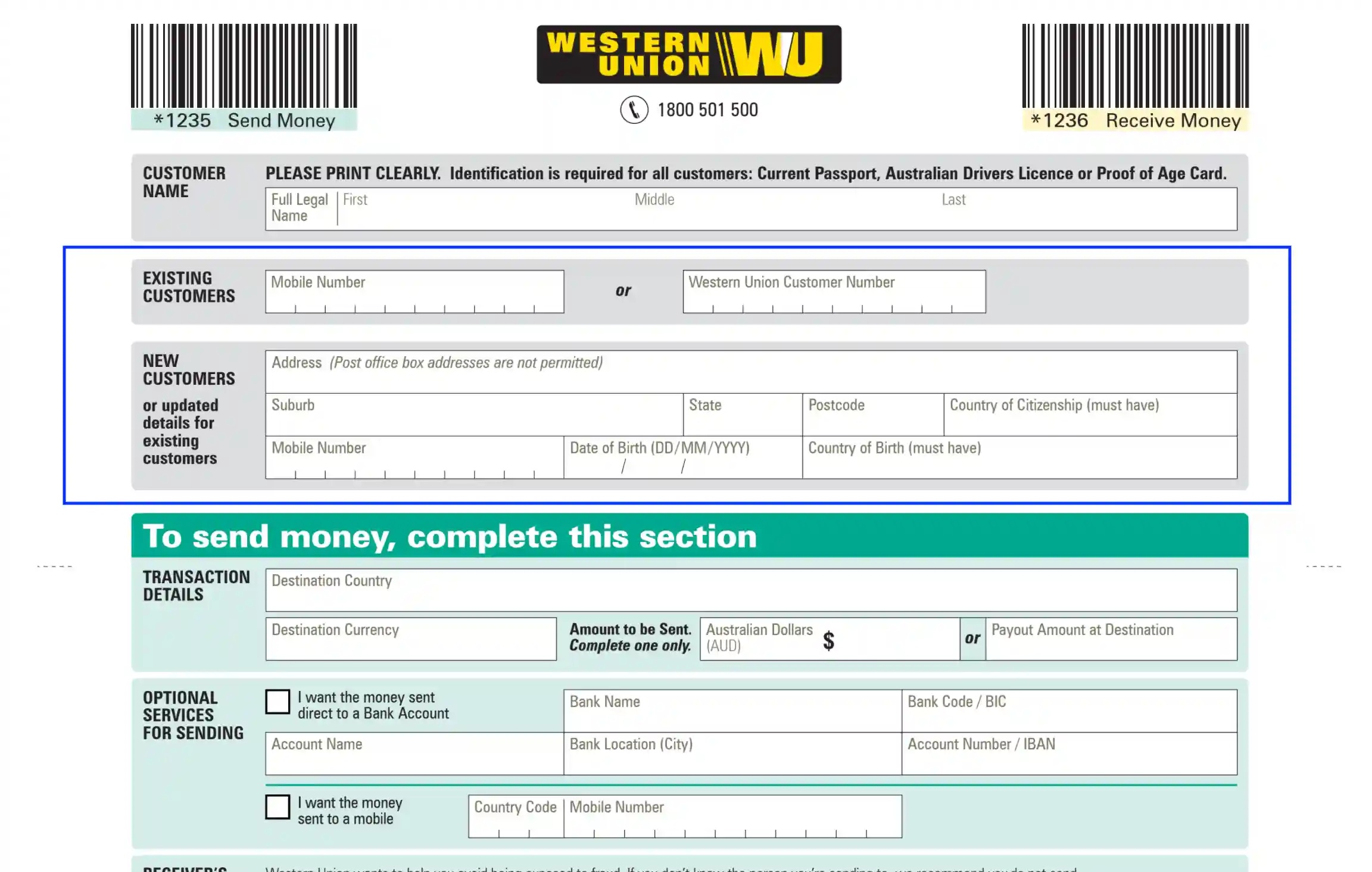

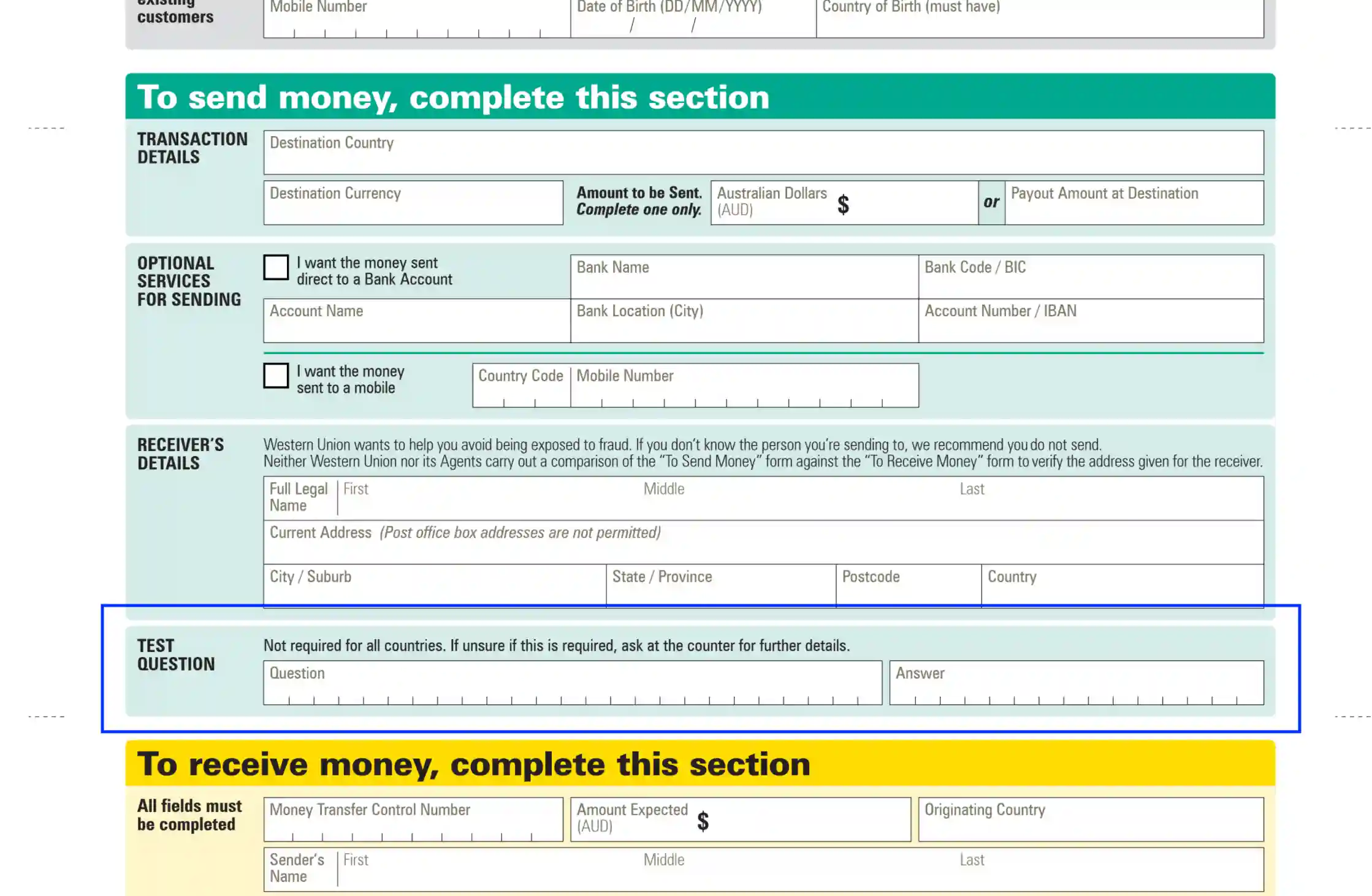

Prepare the “Send Money” Part

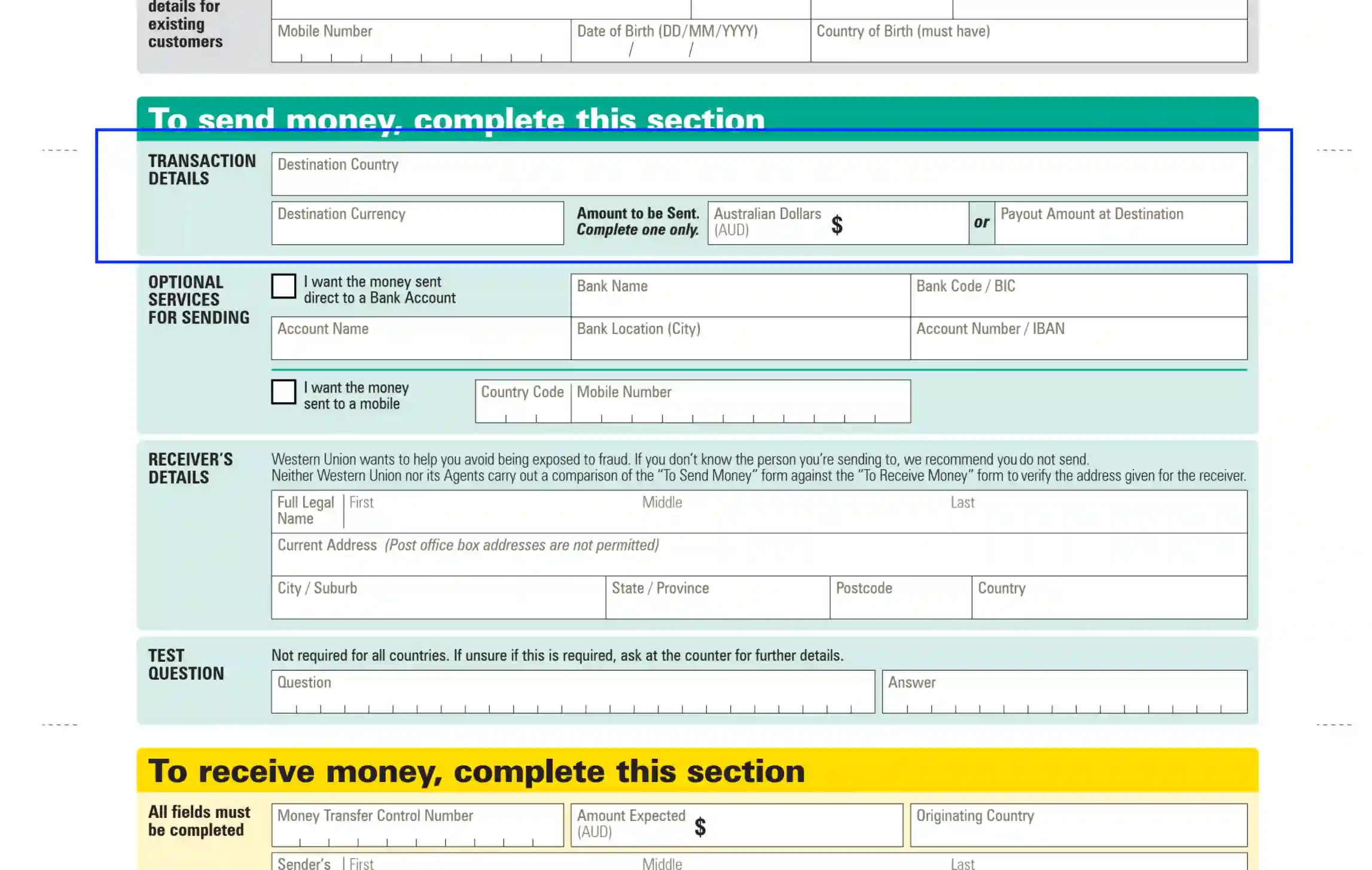

Here, the customer is expected to enter the following info regarding the procedure:

- To specify the transaction details, insert the country and currency of destination and either the amount to be sent in dollars or payout value.

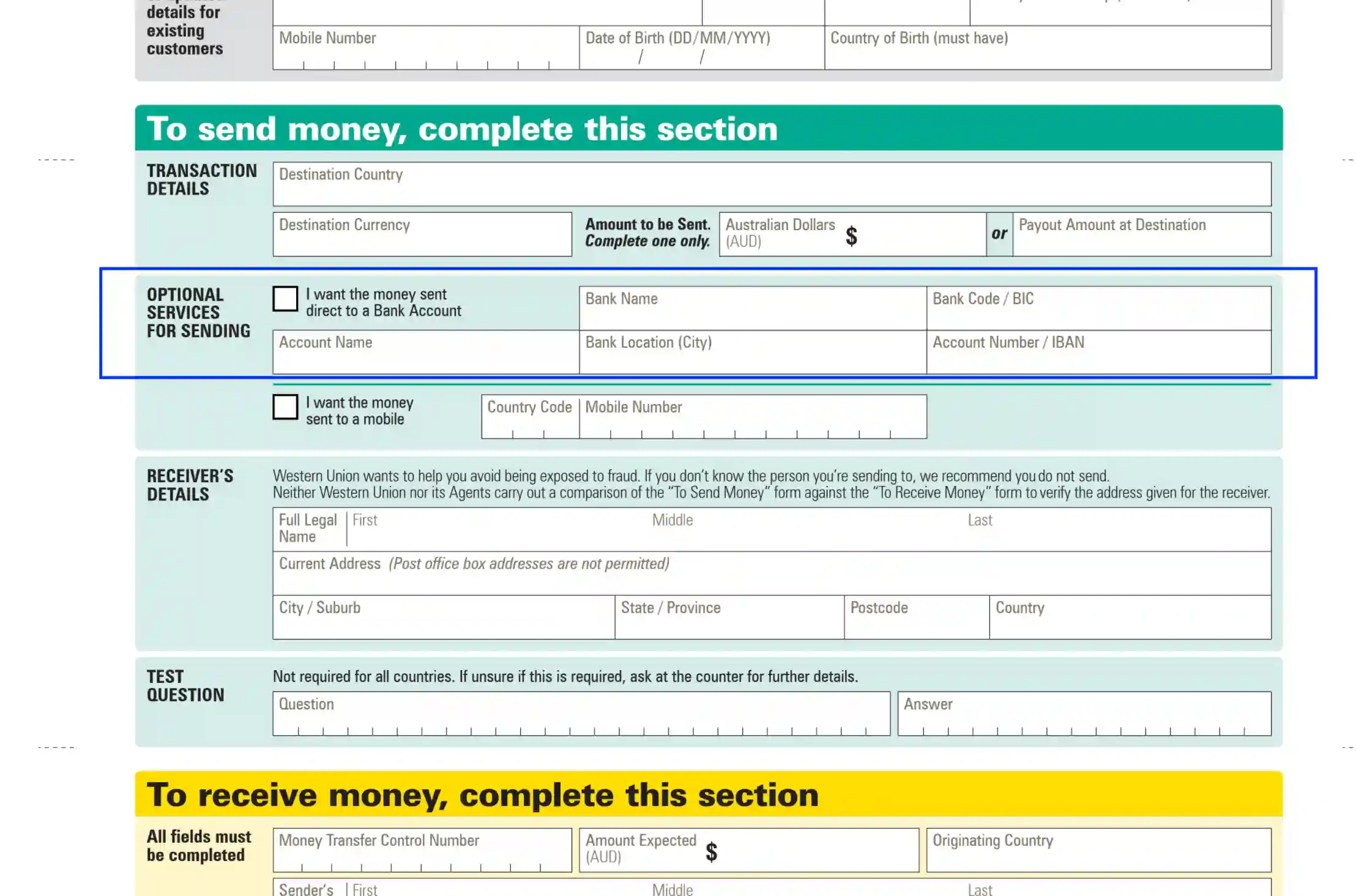

- Select optional services (if applicable). Here you need to clarify if you want the payment to be transacted to the bank account or a mobile number.

If the customer chooses a bank account, let them specify the bank name, code (BIC), and location. Also, disclose the account name and account number (IBAN).

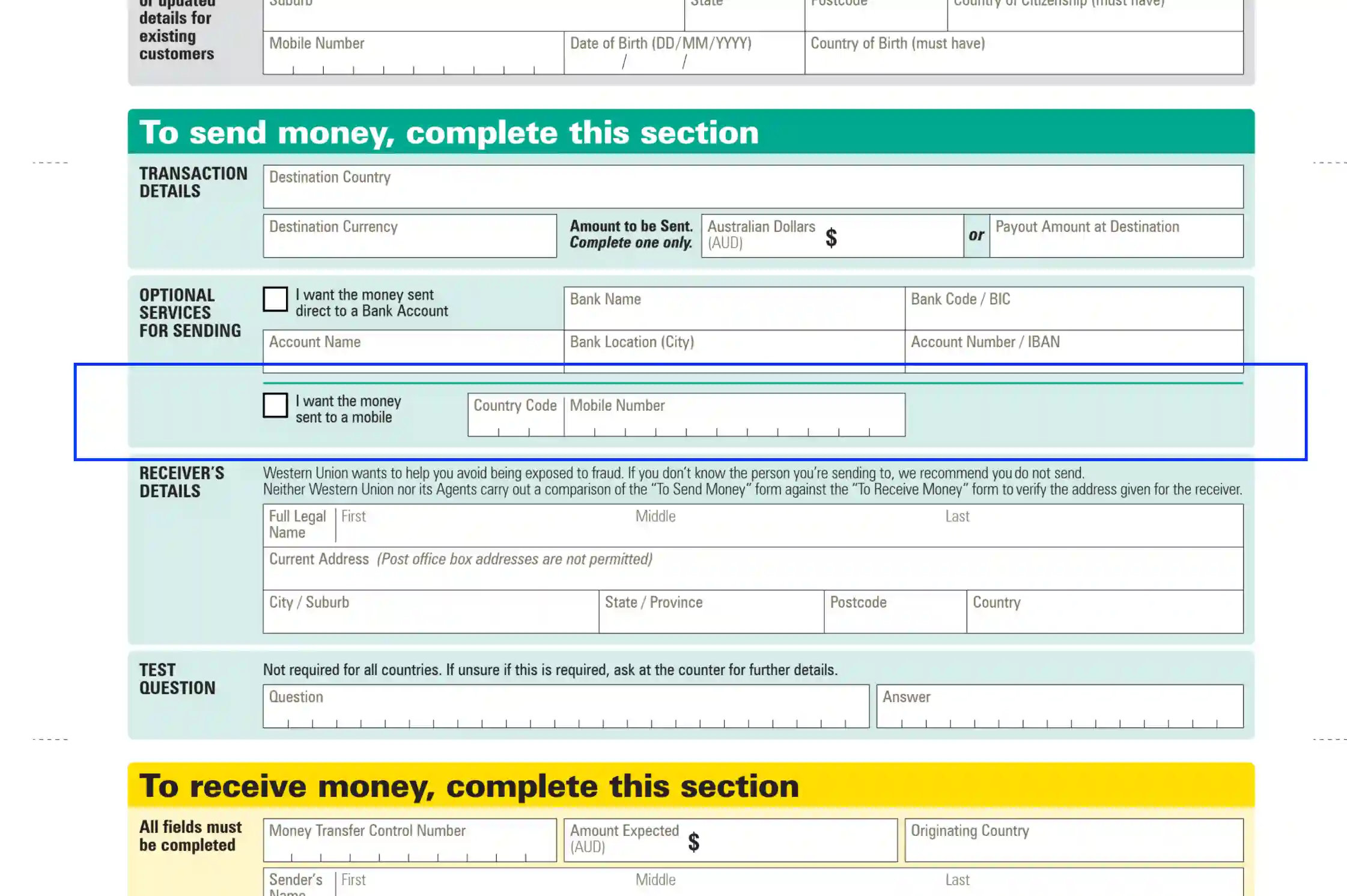

If you wish to proceed with the transaction to a mobile, specify the country code and a phone number.

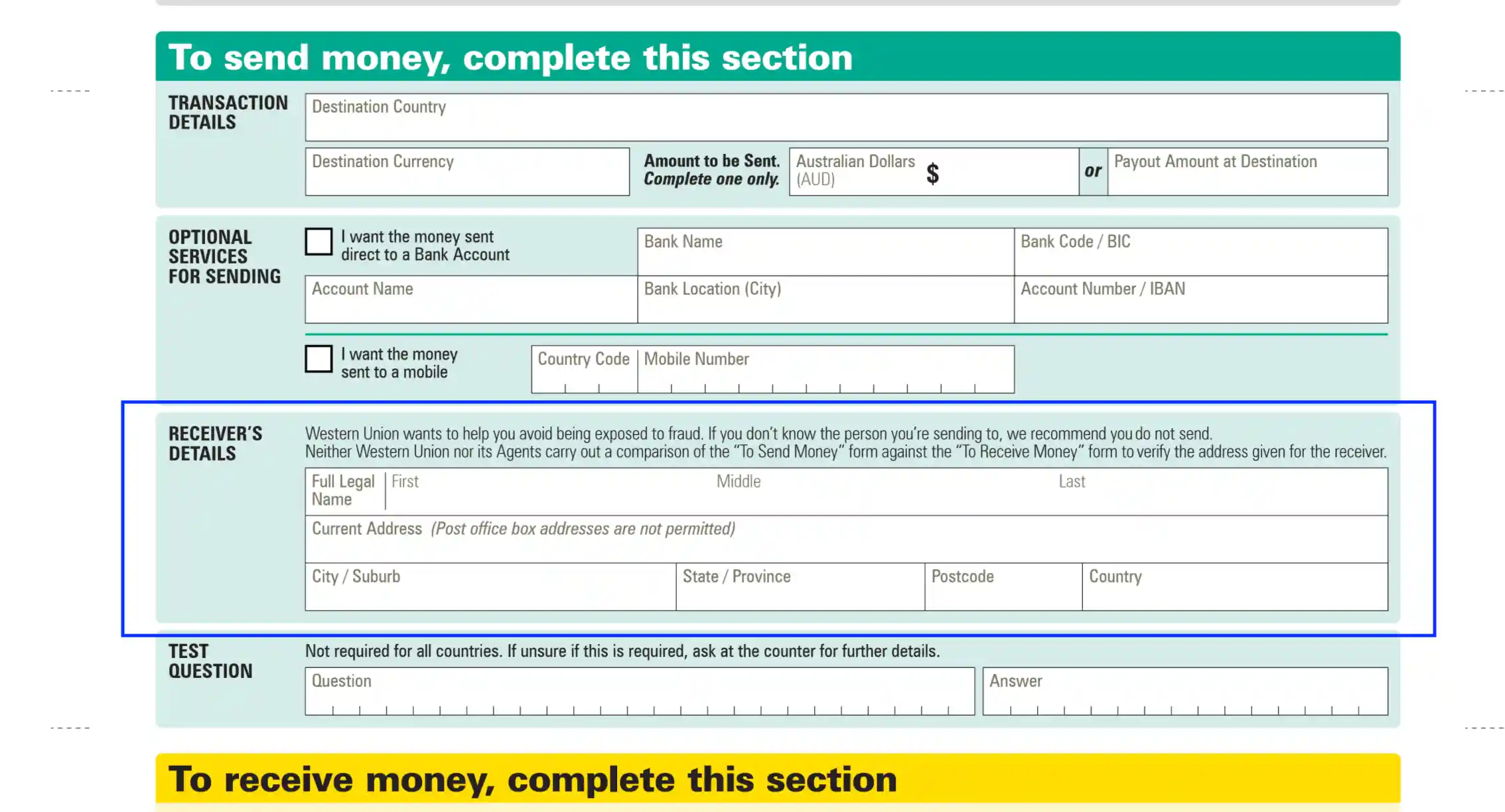

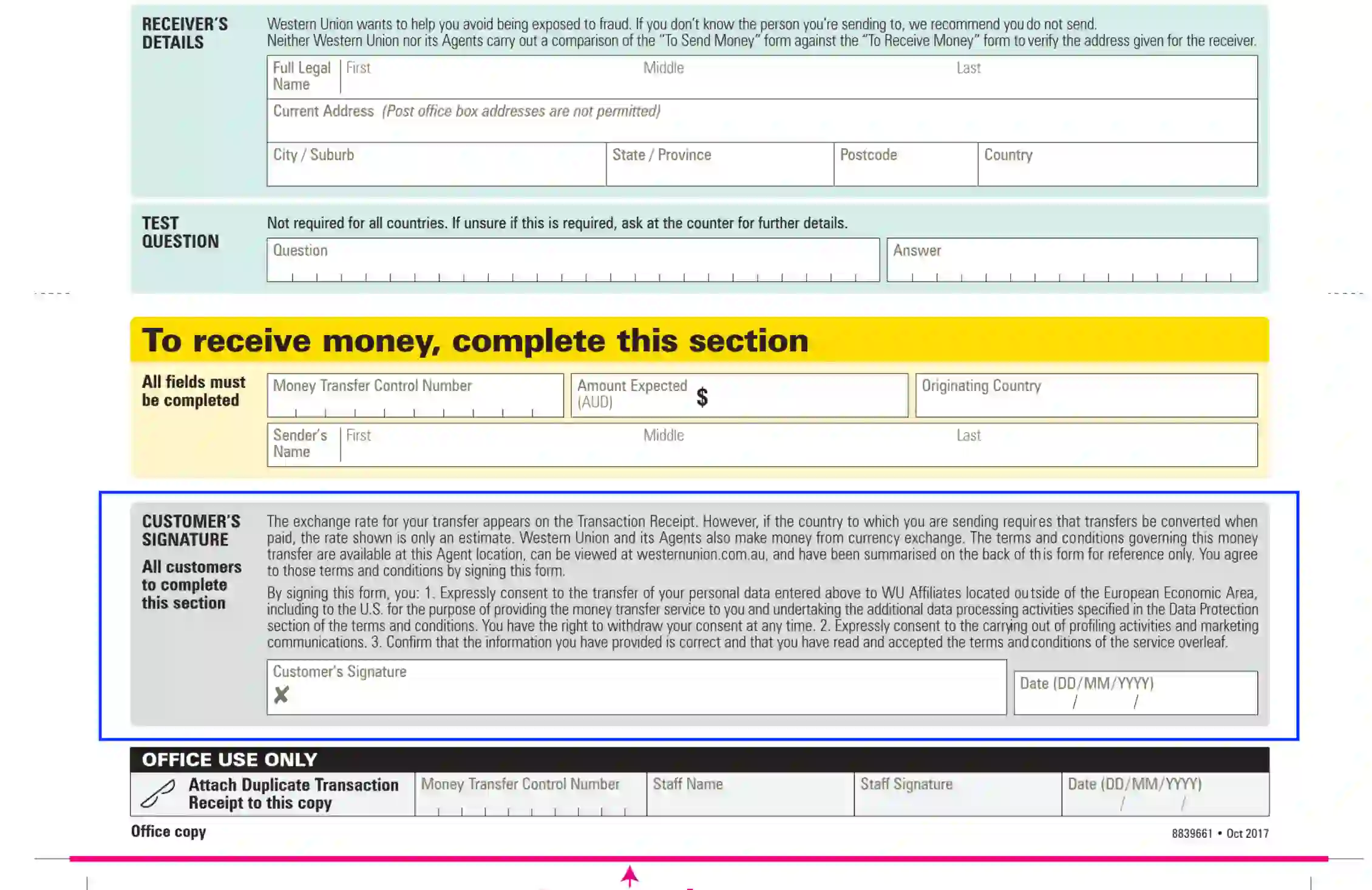

- To identify the receiver, submit the person’s full legal name as indicated in ID documents and living address, including the street, suite number, city, state (province), country, and postal data. Do not use the P. O. Box as a contact address because it is not accepted by the service.

- Provide the test question and answer to protect the funds from inappropriate withdrawals. Make sure to inform the recipient about the test details, so they can claim the payout without encumbrance.

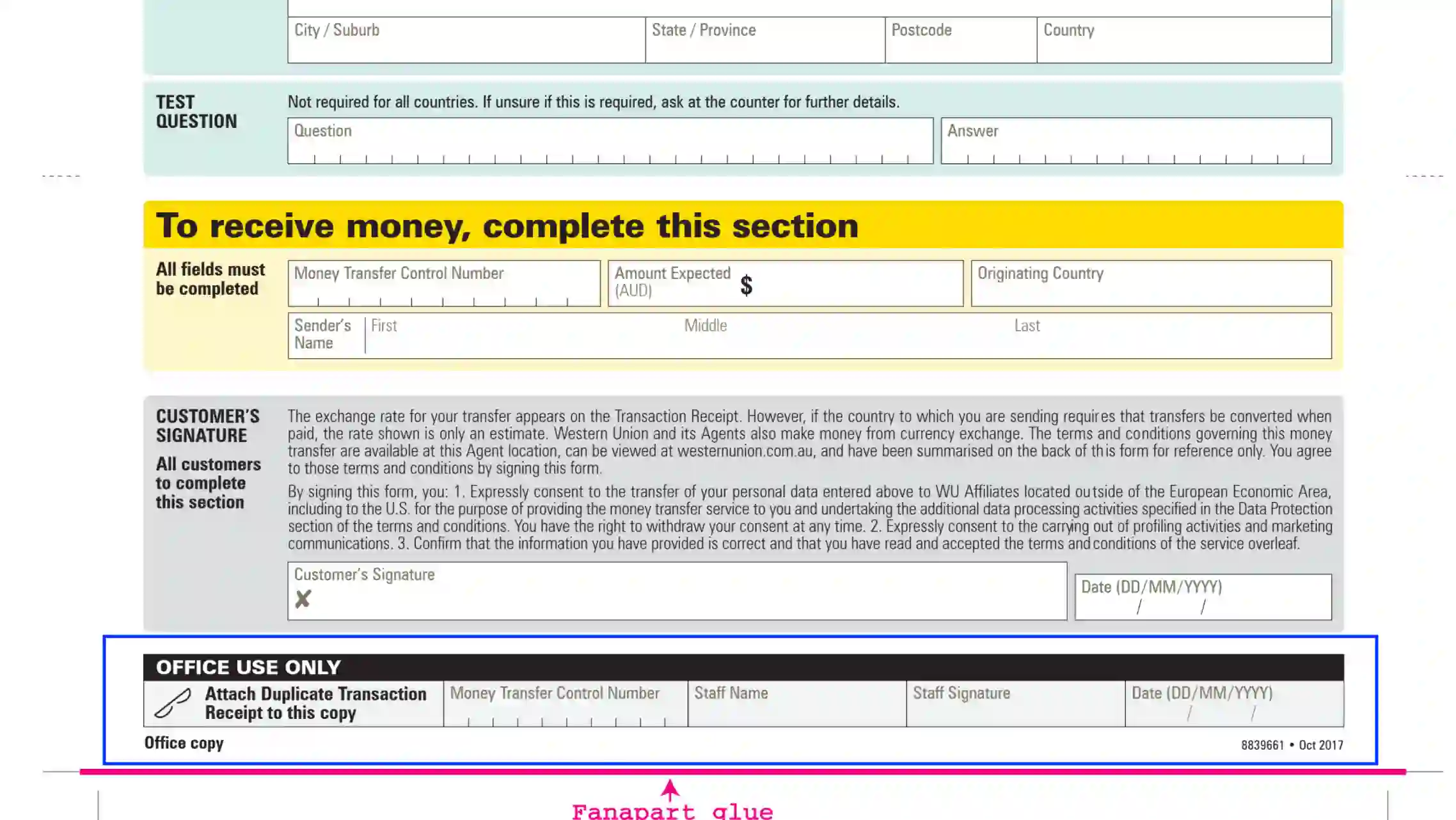

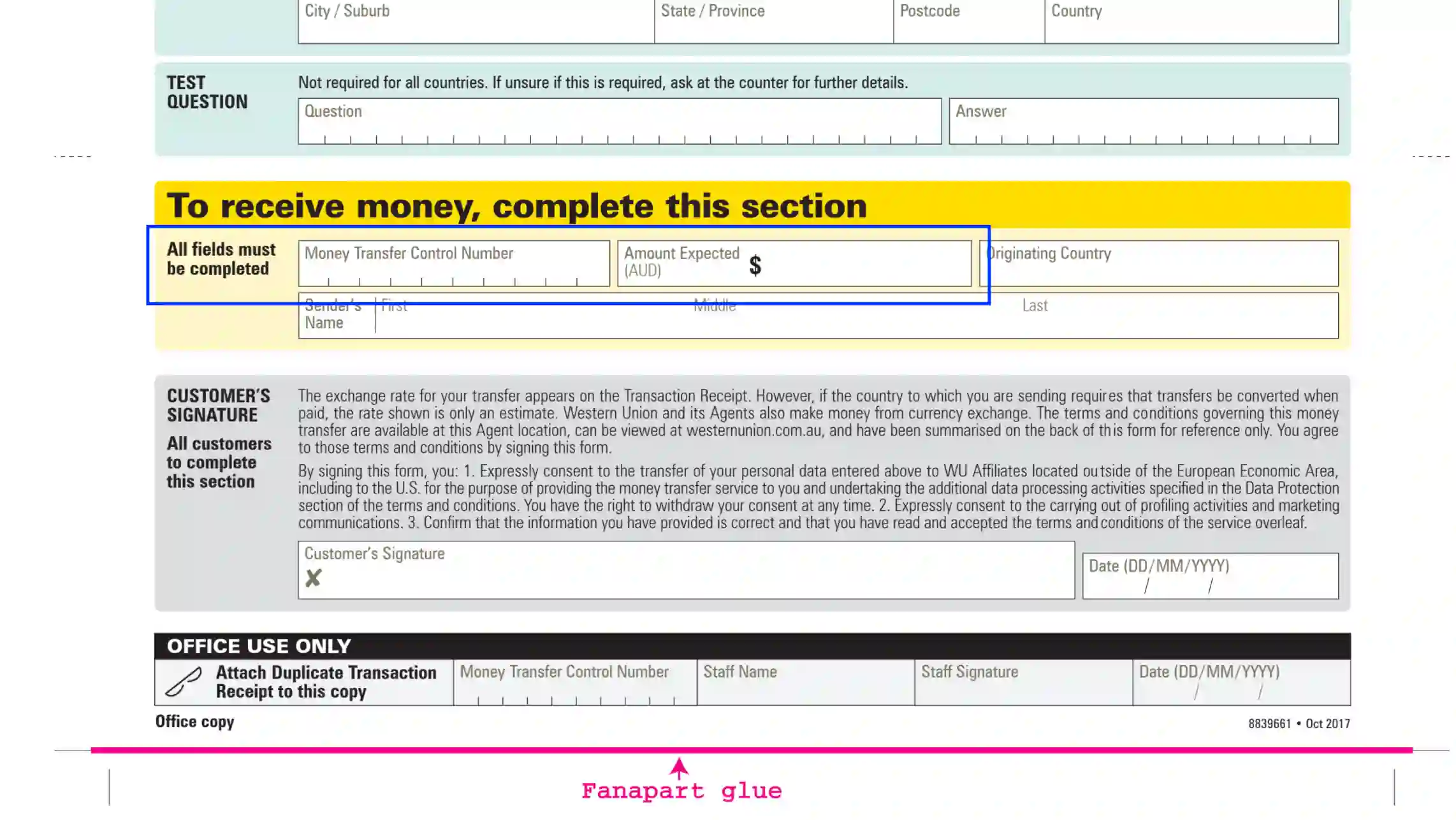

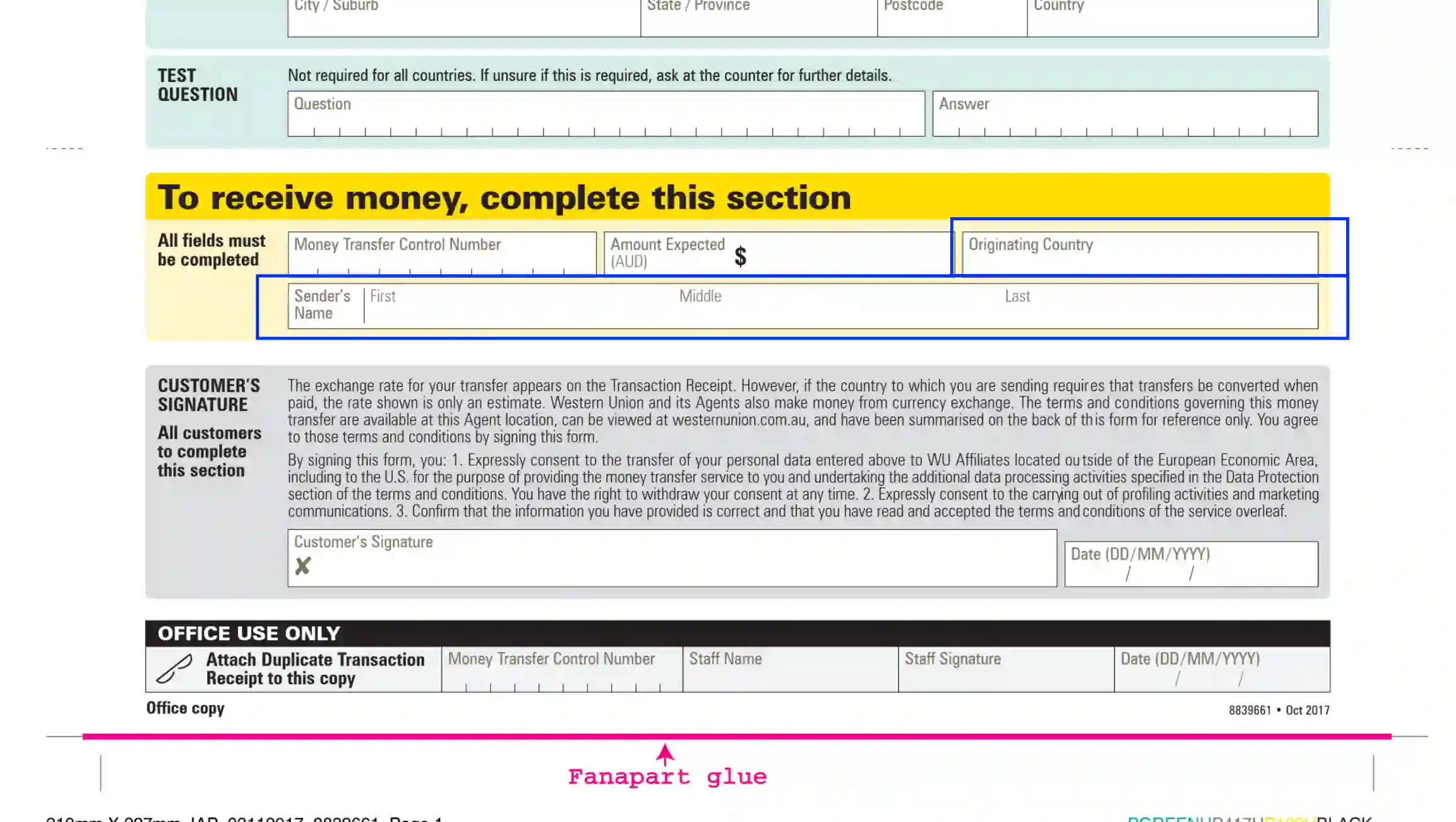

Complete the “Receive Money” Section

If you are the person to claim the payout, skip the green part and complete the following data in the corresponding section:

- Define the transaction details by entering the money transfer control number and amount to be withdrawn

- Country of the payment originator

- Sender’s full legal name

- Recipient’s signature and calendar date of withdrawal

Leave the Black Section Blank

The final part of the document should be completed by the Western Union service representative. Leave the section blank before you submit the form.