Have you heard of Form 103? It's an important legal document that every business operating in the European Union (EU) must be aware of. The form, referred to as a VAT Return or Tax Return, is required by law for each member state and provides information about any Value Added Taxes (VATs) collected during each tax period. As such, it serves as a key tool when calculating and remitting your company's taxes to the proper authorities within the EU. In this blog post we'll discuss what exactly Form 103 entails - from its purpose to filing options - so that businesses can better understand and comply with their taxation obligations!

| Question | Answer |

|---|---|

| Form Name | Vat Form 103 |

| Form Length | 3 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 45 sec |

| Other names | 103 form icai, form 103 sample, form 103 icai online, form 103 icai filled sample pdf |

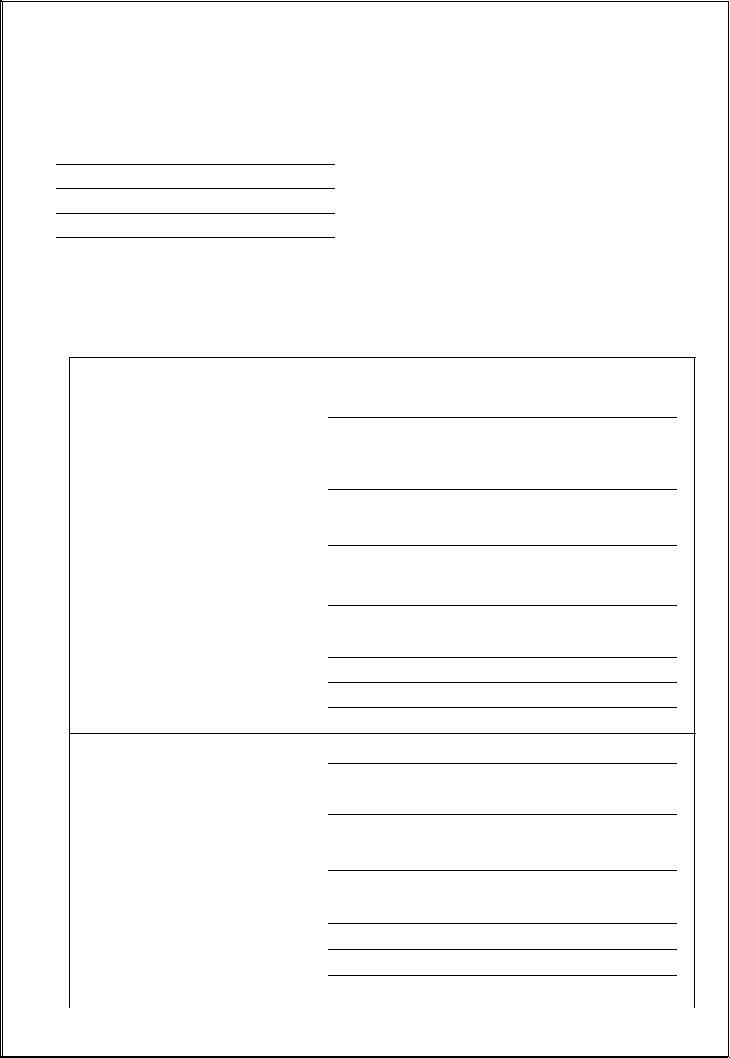

(See rule 11of The Maharashtra Value Added Tax Rules,2005)

Application for cancellation of Registration Certificate

under Section 16 of The Maharashtra Value Added Tax Act, 2002

To

Subject:- Application for cancellation of Registration Certificate under section 16 of The Maharashtra Value Added Tax Act, 2002

I, the undersigned hereby apply for the cancellation of Registration Certificate issued or deemed to have been issued under the Maharashtra Value Added Tax Act, 2002. The details are as follows :

1)Registration certificate number under MVAT Act, 2002

2)Registration certificate number under CST Act,1956

3)Name and style of the business

4)Name and the status of the applicant

5)Address of the principal place of business

Telephone No (with STD Code)

Fax No.(with STD code)

6)Address for correspondence, if it is different from the address given at Sr. No.5

1

Telephone No (with STD Code)

Fax No.(with STD code)

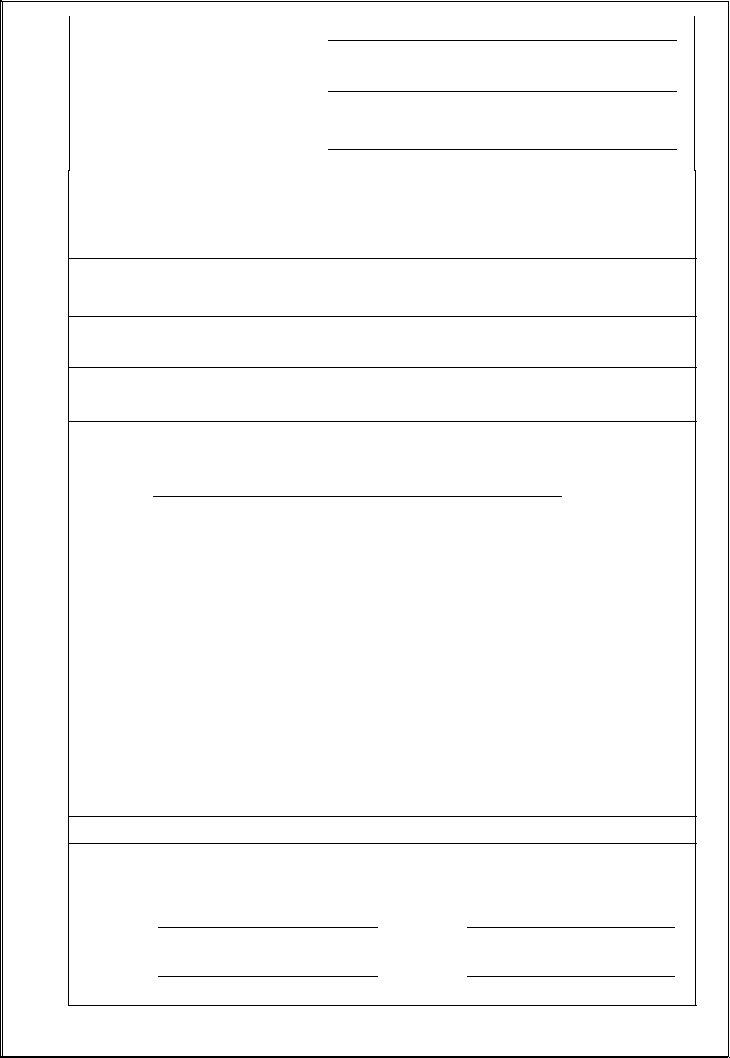

7)Application for cancellation of the certificate of registration under the Maharashtra Value Added Tax Act 2002, is on account of __

(a)* the said business having been discontinued with effect from ____________________

(b)* the said business having been transferred to M/s ______________________________________

in accordance with the section 44 with effect from __________________

(c)*Change in the ownership of the said business as follows: -

(d)*the additional place of business having been discontinued with effect from ________________

(e)*the place of business has been shifted to the following address :

_____________________________________________________________

_____________________________________________________________

(f) *the turnover of sales and the turnover of purchases of the said business during the year

______________ having failed to exceed the threshold limit specified in section 3 (4), the details

of which are as |

follows:- |

|

|

|

|

|

|

|

|

|

|

|

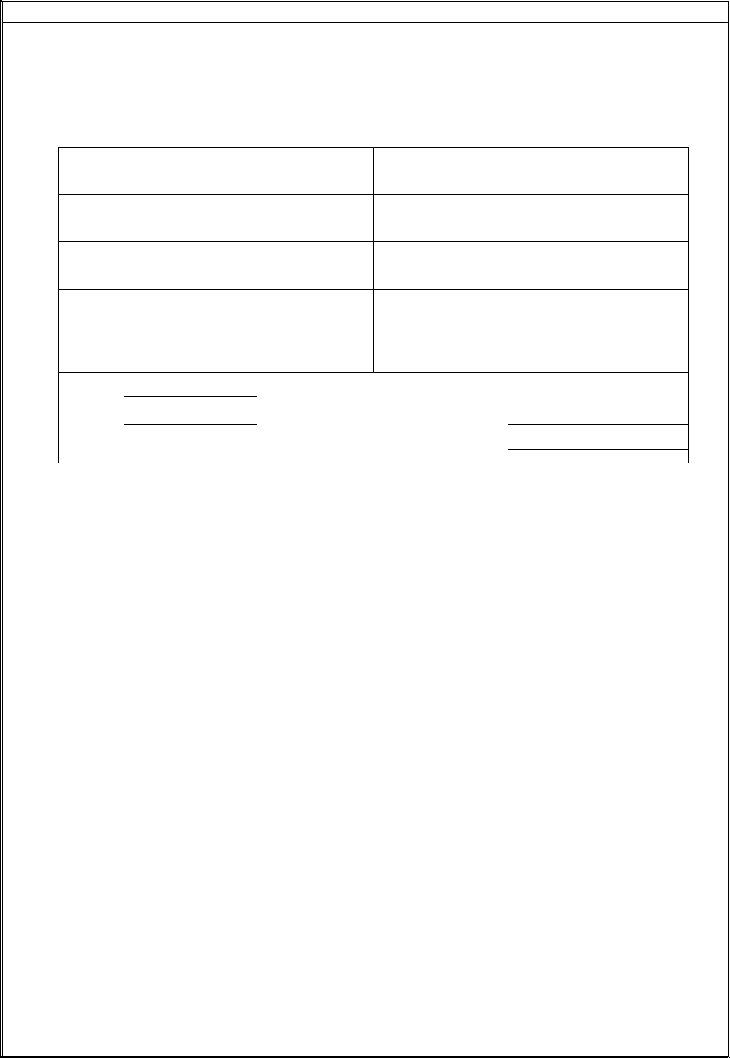

The turnover of all sales of all places of |

The turnover of all purchases of all places |

|||

Period |

|

business In Maharashtra |

of business in Maharashtra |

||

|

|

|

|

|

|

|

Taxable goods (Rs.) |

Tax free goods(Rs.) |

Taxable goods(Rs.) |

Tax free goods( Rs.) |

|

|

|

|

|

|

|

(1) |

|

(2) |

(3) |

(4) |

(5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(h) *Other reasons ( Please Specify) |

|

Declaration : |

|

I, ____________________________________ hereby solemnly declare that what is stated herein above is |

|

true to the best of my knowledge and belief. |

|

Date |

Signature |

Place |

Status |

*Strike out whichever phrase/clause is not applicable

2

ACKOWLEDGEMENT

Name of the Applicant

Name and Style of Business

Registration Certificate No. under MVAT Act, 2002

Received application in

Date

Place

Signature of the Receiving Officer

Designation

3