Using PDF documents online is always easy with this PDF tool. Anyone can fill in vat correction form 652 here and use many other functions available. Our editor is consistently evolving to deliver the very best user experience possible, and that is thanks to our commitment to continual enhancement and listening closely to feedback from users. Here's what you would want to do to get started:

Step 1: Press the "Get Form" button above. It'll open up our tool so you can begin filling out your form.

Step 2: With the help of this advanced PDF tool, you'll be able to accomplish more than merely fill in forms. Express yourself and make your docs seem sublime with customized text incorporated, or optimize the original input to perfection - all that comes with an ability to add any kind of graphics and sign the document off.

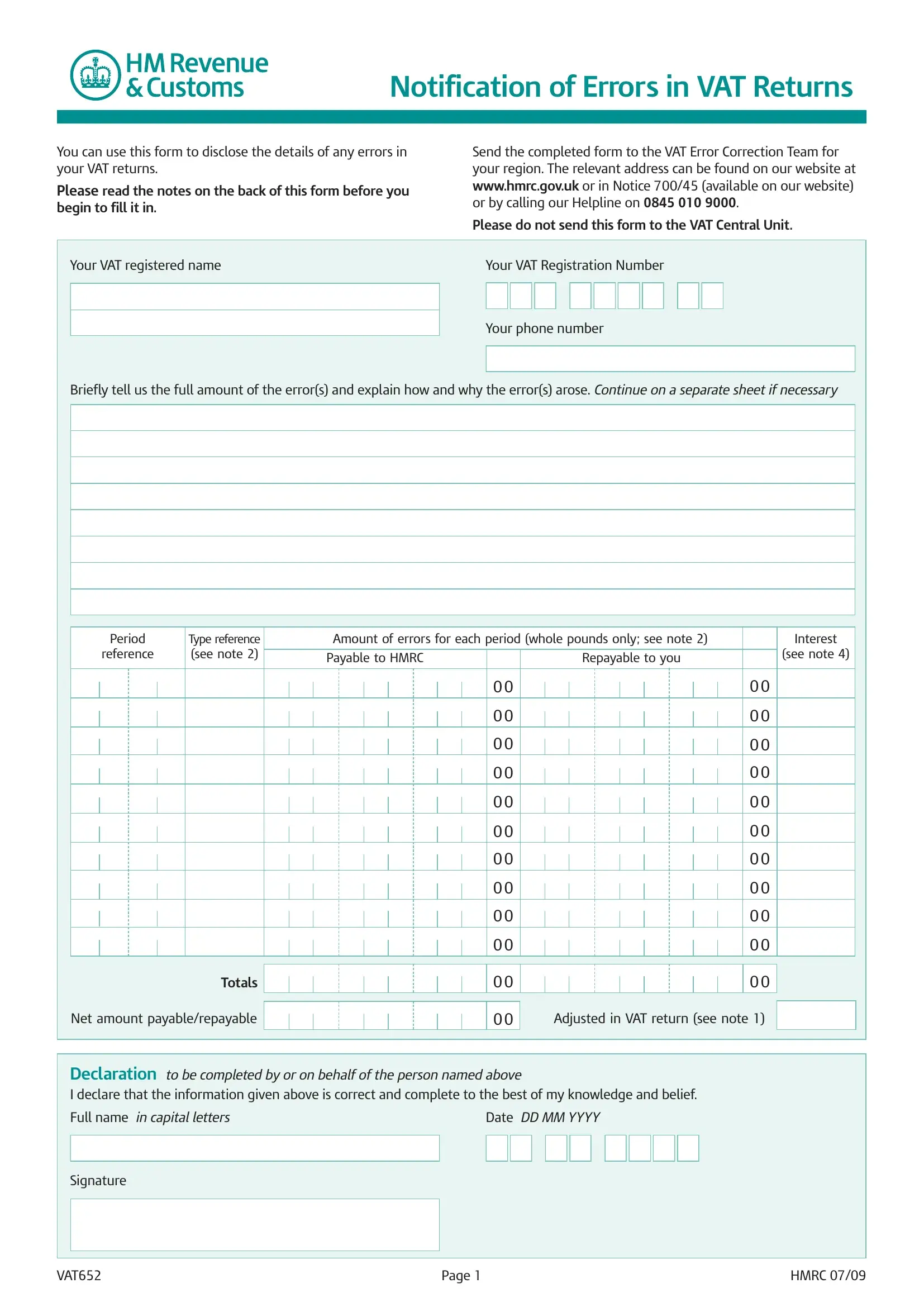

For you to fill out this PDF document, ensure that you type in the required information in each and every field:

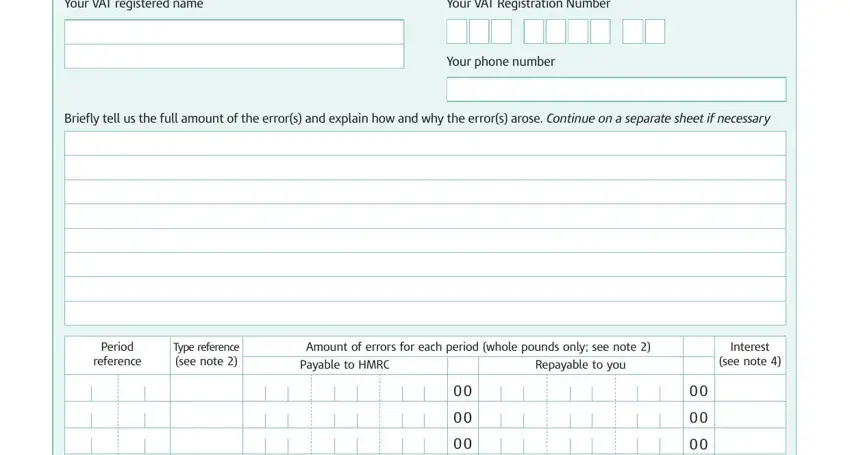

1. The vat correction form 652 will require specific information to be entered. Be sure that the next fields are finalized:

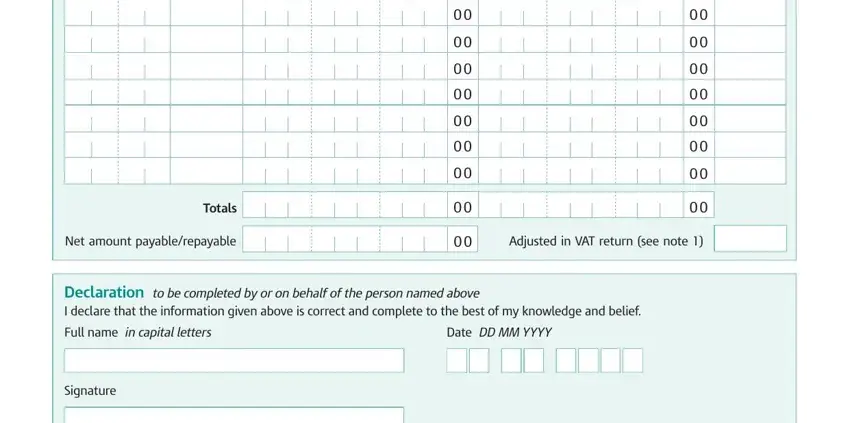

2. After performing the previous step, head on to the subsequent part and complete the essential particulars in these blank fields - Adjusted in VAT return see note, Totals, Net amount payablerepayable, Declaration to be completed by or, Full name in capital letters, Date DD MM YYYY, and Signature.

It is easy to make an error while filling out your Declaration to be completed by or, and so be sure to reread it before you decide to send it in.

Step 3: After proofreading the fields you have filled out, press "Done" and you're good to go! Make a free trial account with us and acquire instant access to vat correction form 652 - which you'll be able to then use as you wish from your personal account page. FormsPal ensures your information confidentiality via a protected method that never saves or shares any type of private data typed in. You can relax knowing your files are kept safe when you work with our service!