You'll be able to fill out form vat 7 without difficulty using our online tool for PDF editing. To make our tool better and less complicated to utilize, we constantly come up with new features, with our users' feedback in mind. If you're seeking to start, here is what it takes:

Step 1: Click the orange "Get Form" button above. It'll open our tool so you can begin completing your form.

Step 2: When you access the tool, you will see the document prepared to be filled in. Other than filling out different fields, you may as well do many other things with the form, such as putting on any text, changing the original text, adding images, affixing your signature to the document, and more.

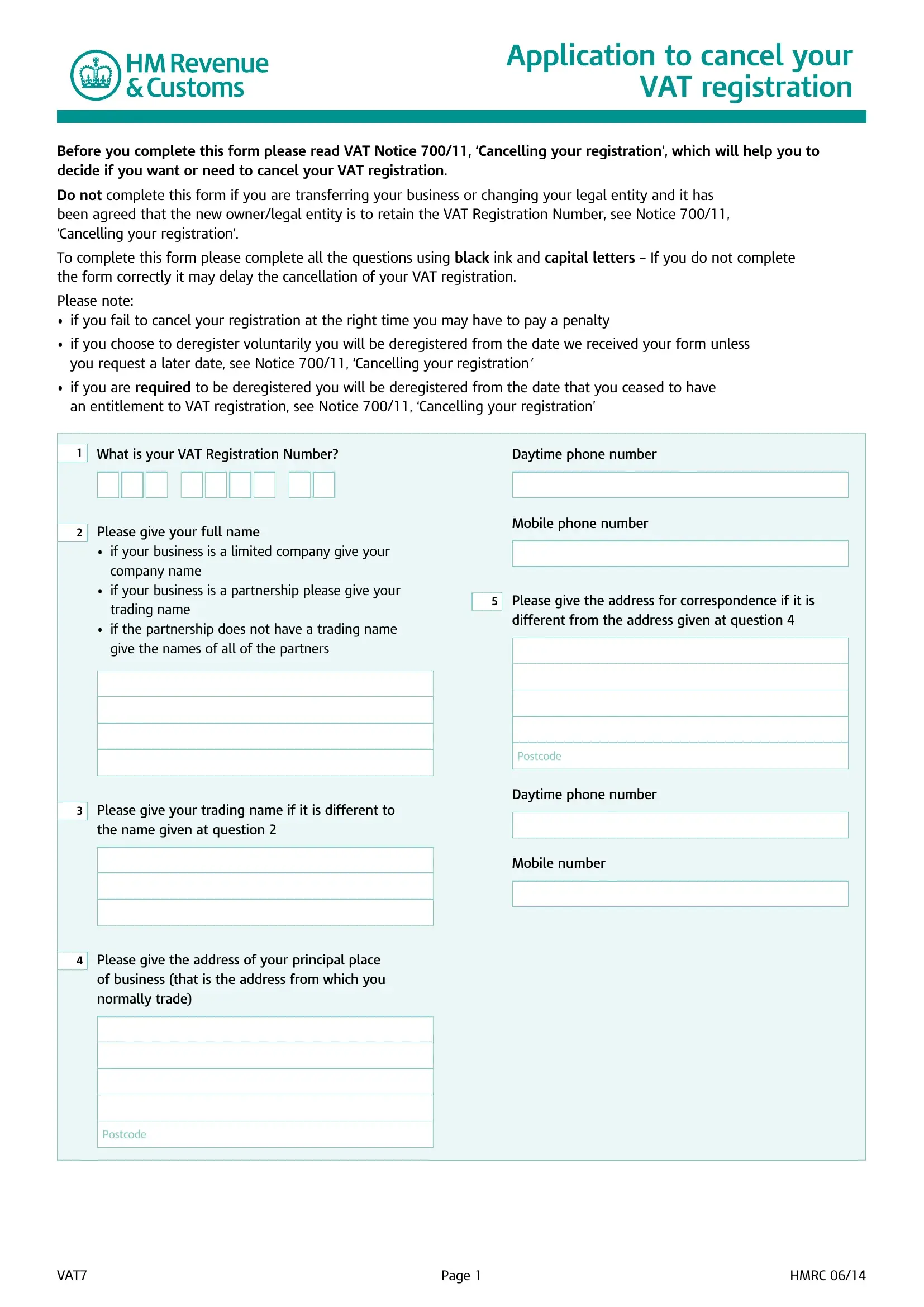

In order to finalize this PDF document, ensure you type in the necessary details in every blank:

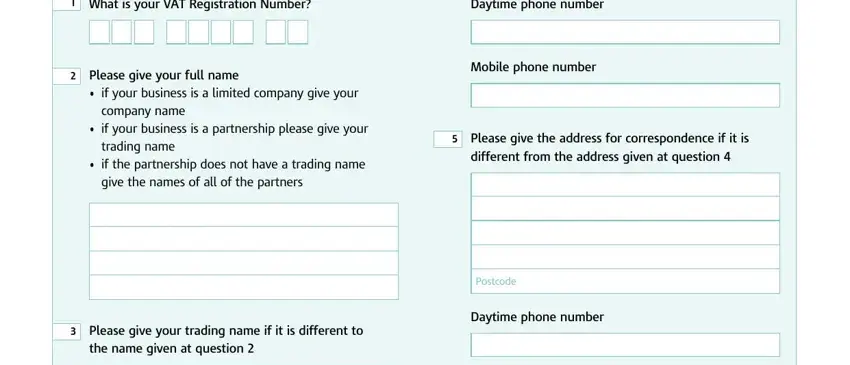

1. Start completing the form vat 7 with a number of necessary blank fields. Gather all the information you need and make certain there's nothing omitted!

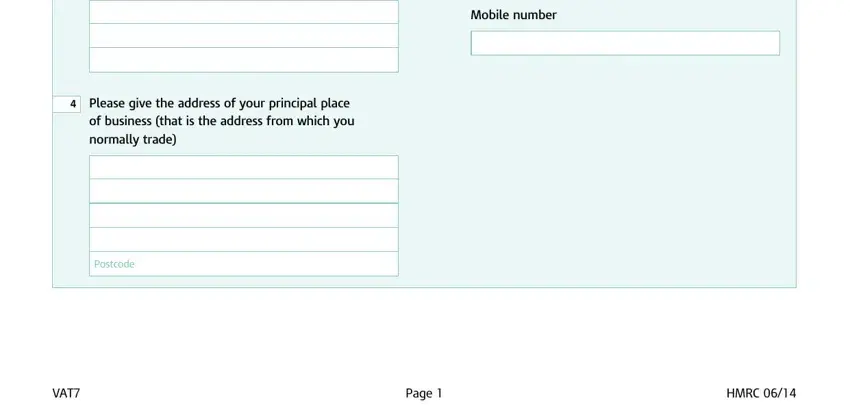

2. After this part is filled out, go on to type in the suitable information in these: Mobile number, Please give the address of your, of business that is the address, normally trade, Postcode, VAT, Page, and HMRC.

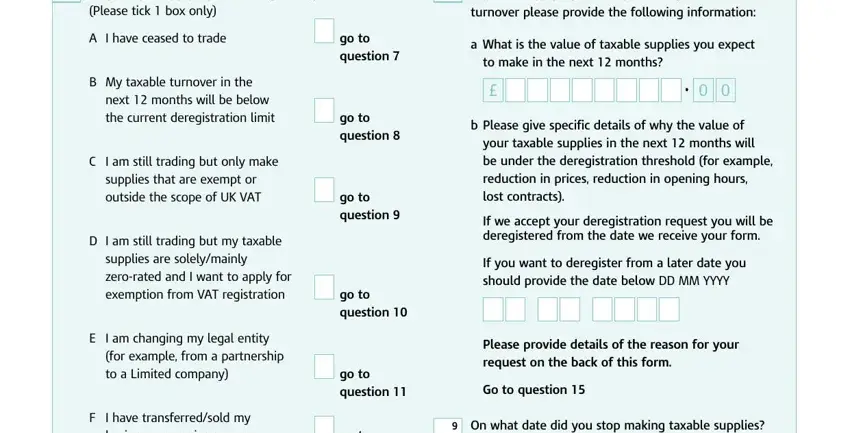

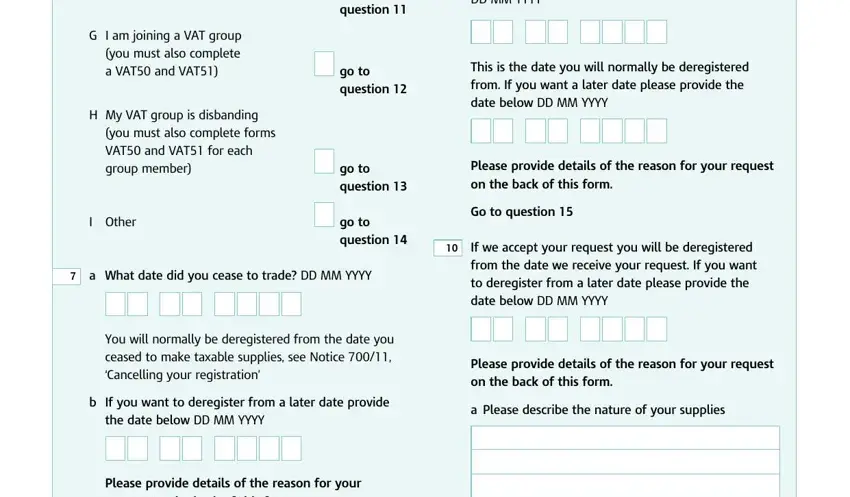

3. Your next step will be hassle-free - complete every one of the empty fields in Why are you applying to cancel, Please tick box only, A I have ceased to trade, B My taxable turnover in the, next months will be below the, C I am still trading but only make, supplies that are exempt or, supplies are solelymainly, D I am still trading but my taxable, exemption from VAT registration, E I am changing my legal entity, for example from a partnership to, F I have transferredsold my, business as a going concern, and go to question in order to complete this process.

People often make some errors when filling out go to question in this section. You need to read twice what you type in right here.

4. Completing F I have transferredsold my, business as a going concern, G I am joining a VAT group you, a VAT and VAT, you must also complete forms, H My VAT group is disbanding, VAT and VAT for each group member, I Other, go to question, go to question, go to question, go to question, DD MM YYYY, This is the date you will normally, and Please provide details of the is key in the fourth form section - be certain to invest some time and be mindful with each field!

5. The pdf must be completed by filling out this area. Here there is a detailed set of fields that need to be completed with accurate information in order for your form submission to be faultless: b If you remain registered for VAT, a repayment situation, Yes, You must continue to charge VAT on, Go to question, and Page.

Step 3: Check all the details you have inserted in the blanks and then press the "Done" button. Sign up with FormsPal today and instantly use form vat 7, available for downloading. Every last edit made is handily saved , allowing you to edit the file further when necessary. FormsPal offers safe document editor without personal data record-keeping or sharing. Rest assured that your details are secure with us!