Our finest developers have worked together to develop the PDF editor that you'll take advantage of. The following software enables you to complete BA-402 documentation quickly and conveniently. This is all you should carry out.

Step 1: At first, select the orange "Get form now" button.

Step 2: Now, it is possible to edit the BA-402. Our multifunctional toolbar will let you add, delete, transform, highlight, as well as perform similar commands to the content material and fields inside the document.

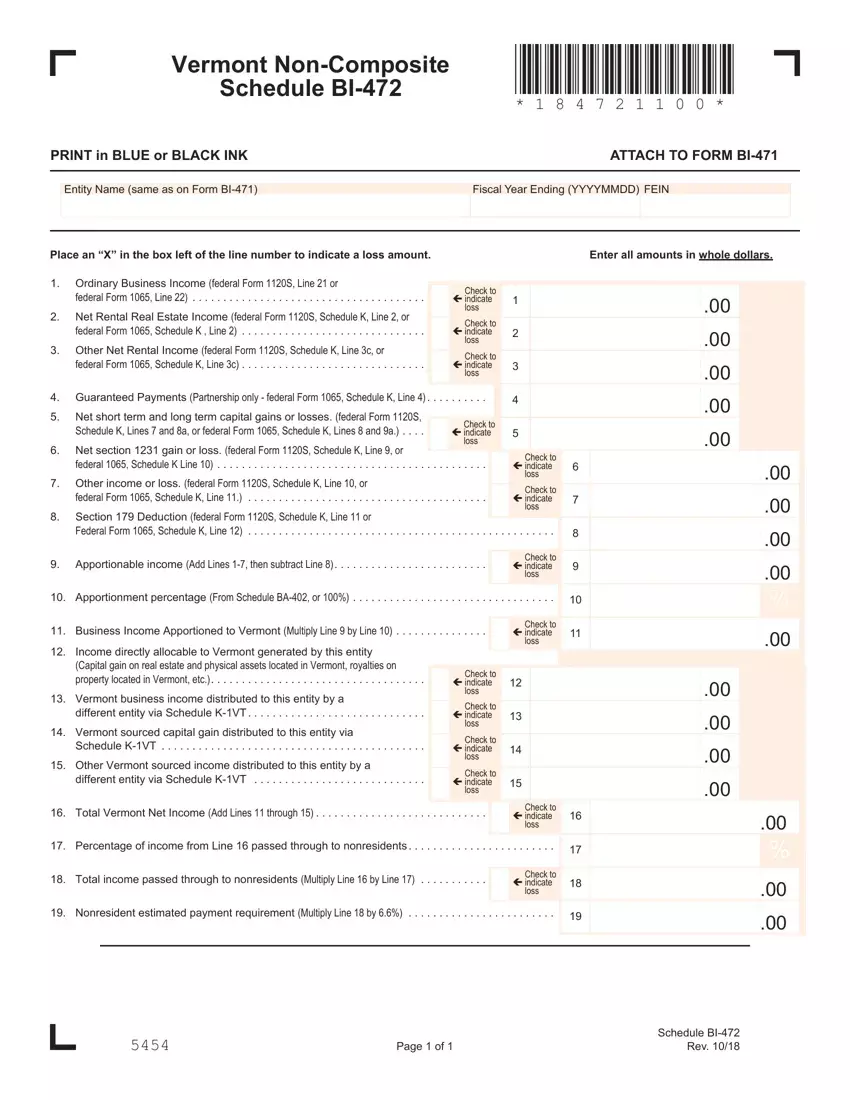

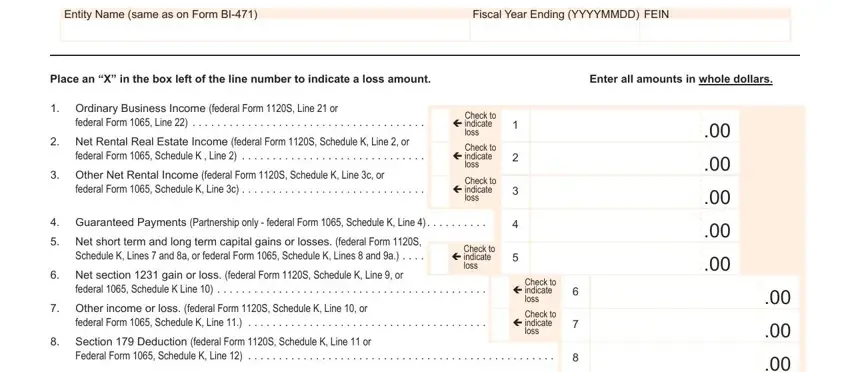

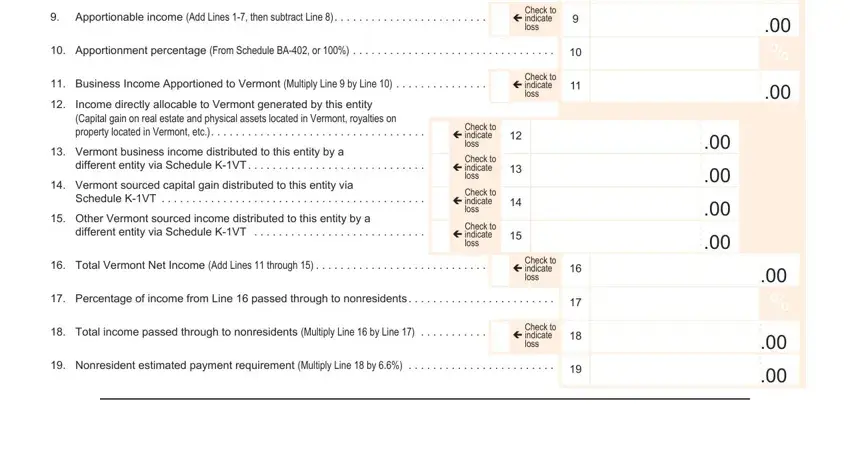

Enter the information demanded by the program to get the form.

Fill in the Apportionable income Add Lines, Check to ç indicate loss, Apportionment percentage From, Business Income Apportioned to, Check to ç indicate loss, Income directly allocable to, Vermont business income, different entity via Schedule KVT, Vermont sourced capital gain, Schedule KVT, Other Vermont sourced income, different entity via Schedule KVT, Check to ç indicate loss, Check to ç indicate loss, and Check to ç indicate loss areas with any content that are demanded by the software.

Step 3: Click "Done". You can now upload your PDF form.

Step 4: It can be more convenient to save duplicates of the file. You can be sure that we will not reveal or see your details.