You can prepare Virginia Form 502 instantly by using our online PDF tool. The editor is consistently maintained by our team, receiving new functions and growing to be better. With some easy steps, it is possible to begin your PDF journey:

Step 1: Firstly, access the pdf editor by clicking the "Get Form Button" above on this page.

Step 2: The editor will allow you to customize PDF files in many different ways. Enhance it by writing customized text, adjust original content, and add a signature - all within the reach of several mouse clicks!

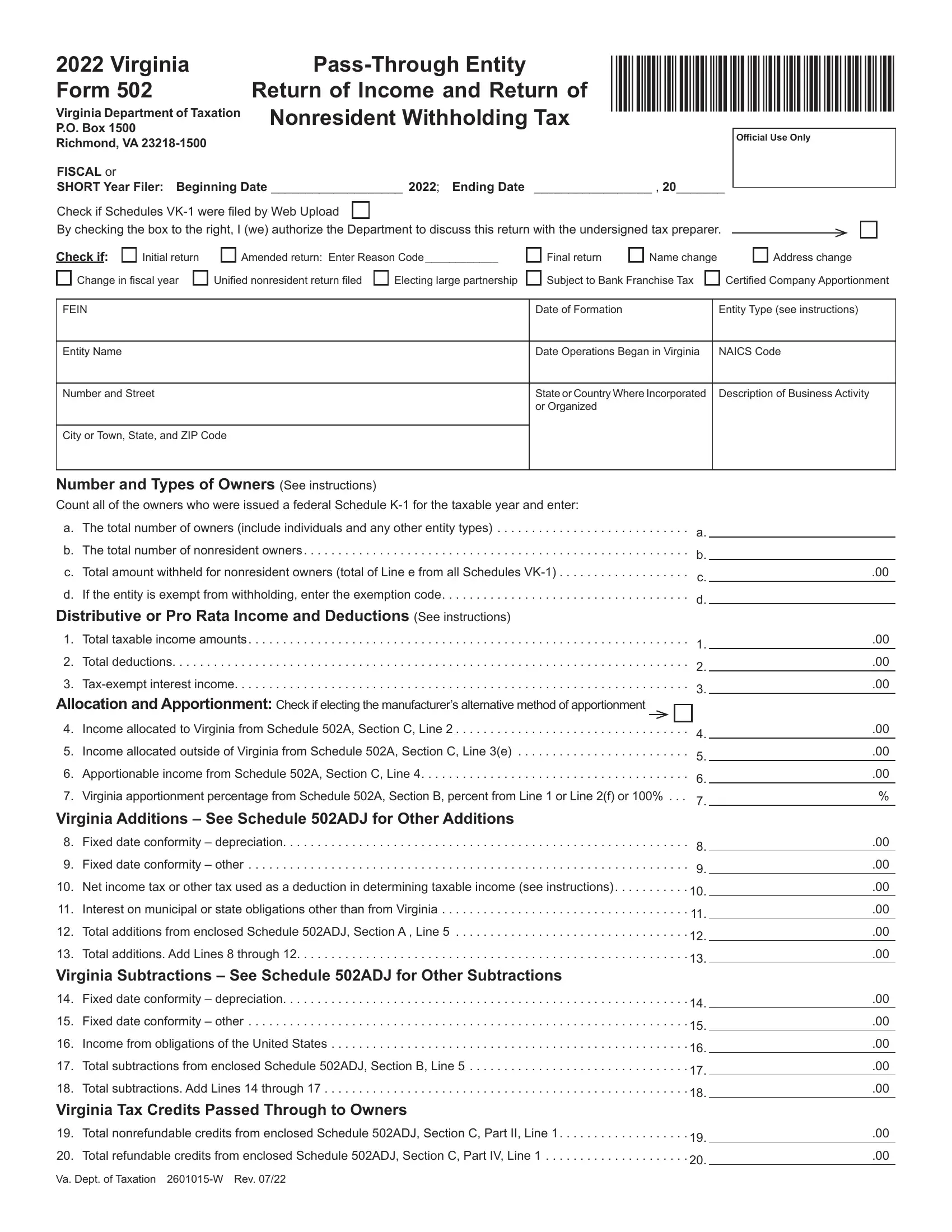

This PDF will need specific data to be filled in, therefore ensure you take whatever time to fill in precisely what is requested:

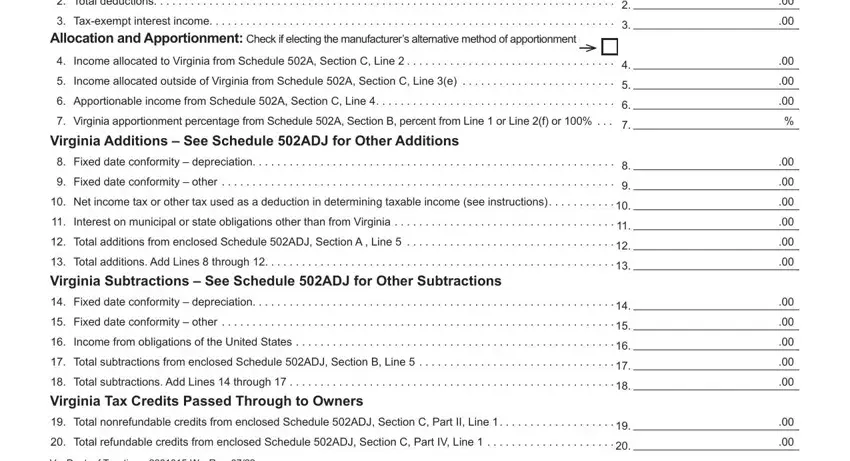

1. To start off, when filling in the Virginia Form 502, begin with the page with the following blank fields:

2. Once the last array of fields is completed, it is time to include the essential details in Number and Types of Owners See so you can proceed to the third stage.

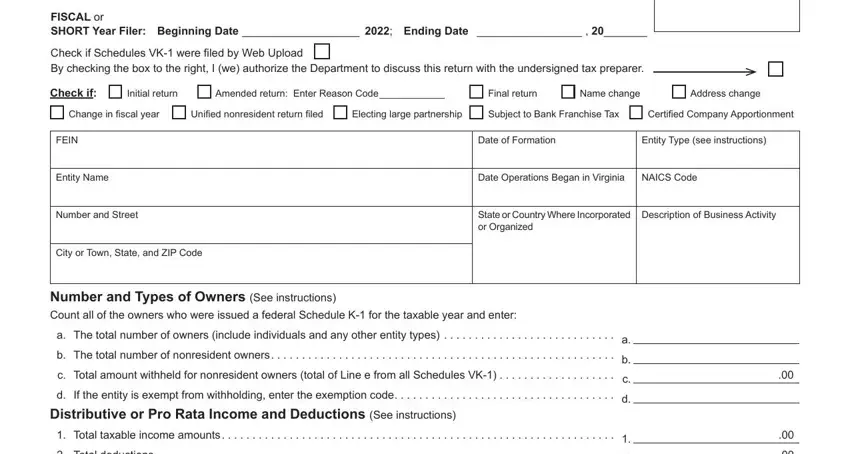

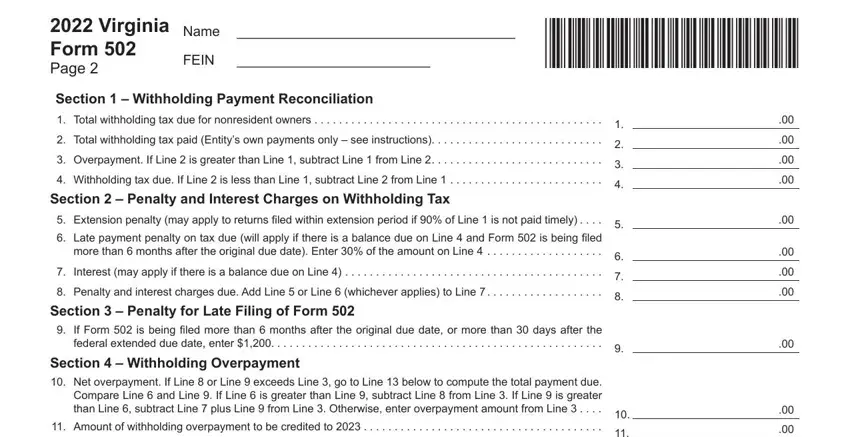

3. Completing Virginia Form Page, Name, FEIN, VAPTE, Section Withholding Payment, If Form is being filed more than, and Section Withholding Overpayment is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

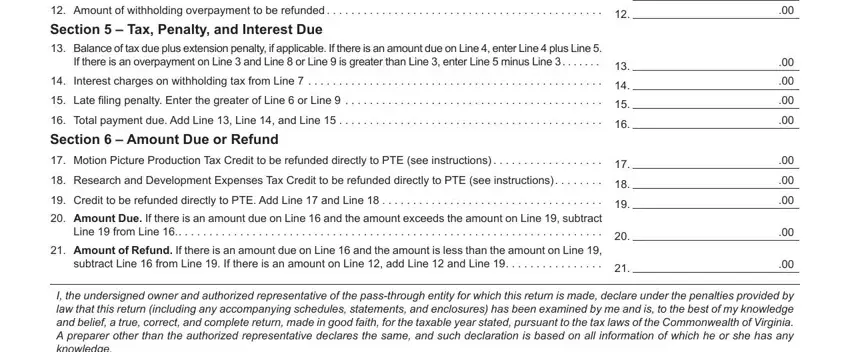

4. To move onward, this step requires filling out several form blanks. These include Section Withholding Overpayment, and I the undersigned owner and, which you'll find key to going forward with this process.

Those who work with this PDF generally make some errors while completing I the undersigned owner and in this part. Be sure to read twice everything you type in here.

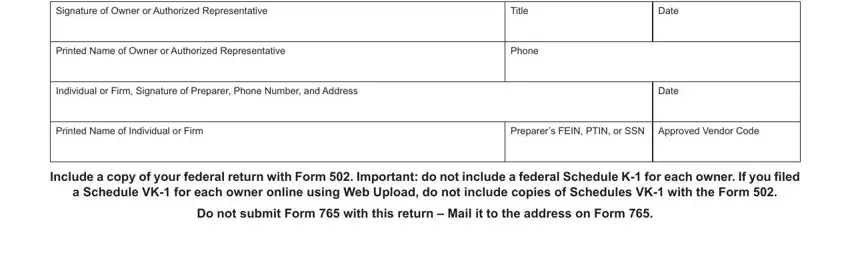

5. Finally, this final segment is what you have to wrap up before submitting the PDF. The blanks in question are the next: Signature of Owner or Authorized, Printed Name of Owner or, Individual or Firm Signature of, Title, Phone, Date, Date, Printed Name of Individual or Firm, Preparers FEIN PTIN or SSN, Include a copy of your federal, a Schedule VK for each owner, and Do not submit Form with this.

Step 3: After proofreading the filled out blanks, press "Done" and you are good to go! Make a free trial account with us and acquire instant access to Virginia Form 502 - download or modify in your FormsPal account page. FormsPal is devoted to the personal privacy of our users; we make certain that all personal data processed by our editor stays secure.