With the online editor for PDFs by FormsPal, you're able to complete or modify Taxation right here. The tool is continually upgraded by our staff, getting useful features and turning out to be more convenient. If you're looking to get started, here is what it's going to take:

Step 1: Click the "Get Form" button at the top of this page to get into our PDF tool.

Step 2: With our state-of-the-art PDF editor, it is possible to accomplish more than merely fill out blanks. Try all of the features and make your documents appear sublime with customized textual content added in, or optimize the original content to excellence - all that comes along with the capability to incorporate just about any graphics and sign it off.

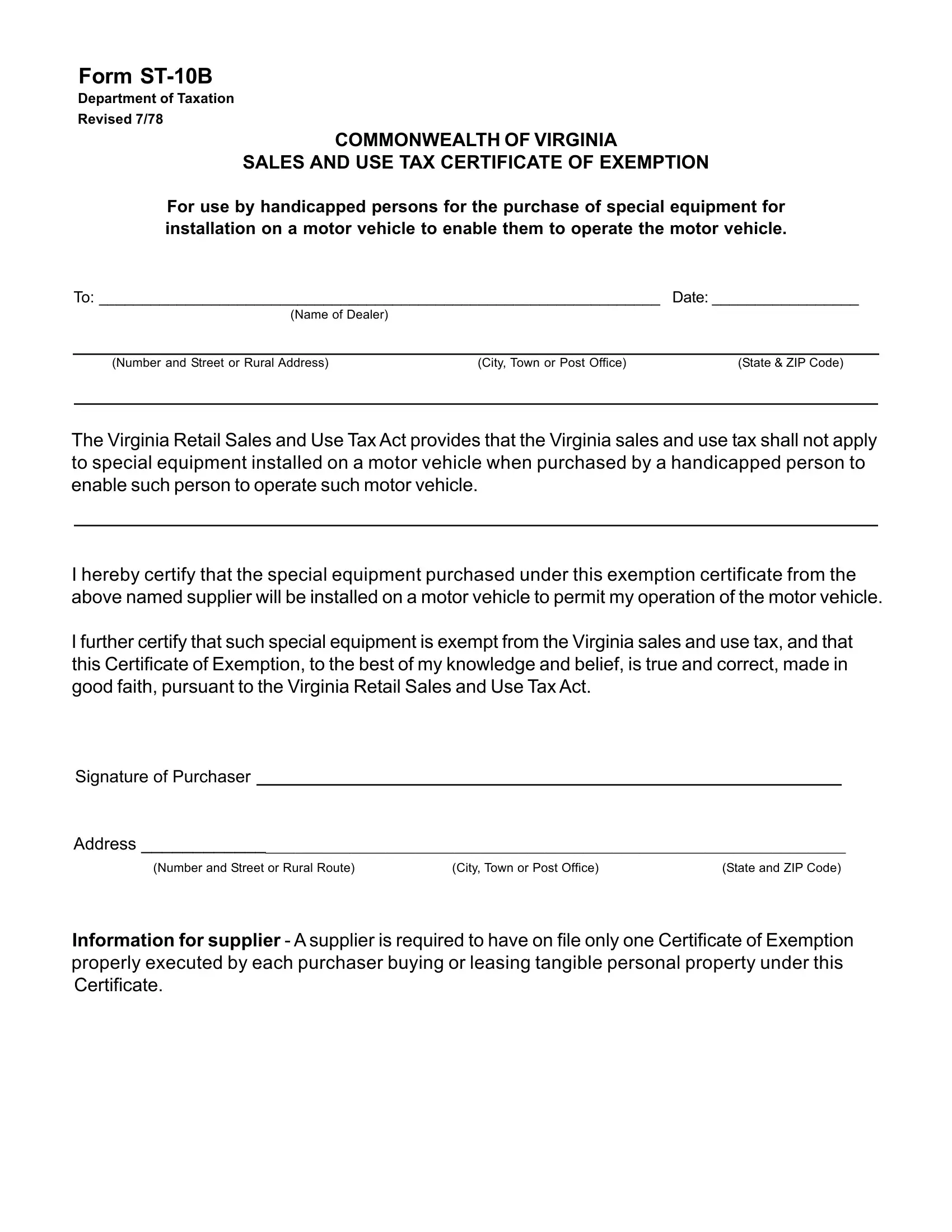

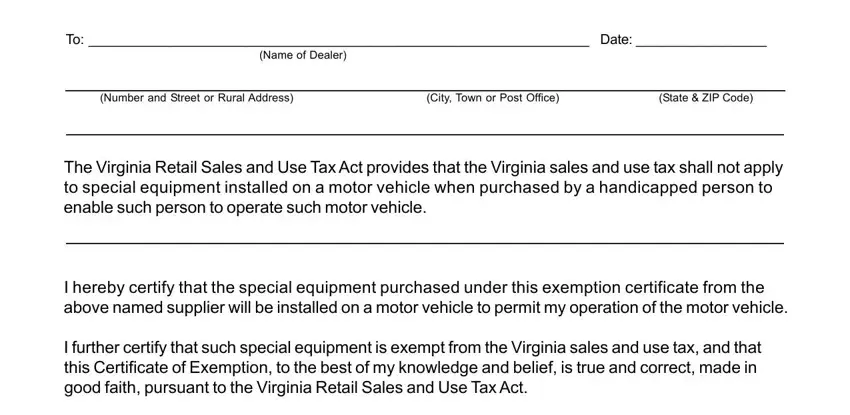

This PDF form will need specific information; to guarantee accuracy, please take heed of the suggestions further on:

1. Fill out your Taxation with a selection of necessary blanks. Gather all of the necessary information and make certain absolutely nothing is overlooked!

2. Just after this array of blank fields is done, proceed to type in the applicable information in these: Address, Number and Street or Rural Route, State and ZIP Code, and Information for supplier A.

A lot of people often make some errors when completing Number and Street or Rural Route in this part. Remember to reread whatever you type in right here.

Step 3: Before obtaining the next stage, make certain that blanks are filled in right. As soon as you believe it's all fine, click on “Done." Join FormsPal right now and easily access Taxation, prepared for download. Every edit made is handily saved , which enables you to customize the file at a later point when required. We don't share the details that you use when dealing with documents at our website.