You can work with Virginia Form St 13 effortlessly by using our PDF editor online. Our tool is continually evolving to provide the very best user experience attainable, and that's thanks to our dedication to continual improvement and listening closely to customer opinions. Starting is effortless! All you have to do is adhere to these easy steps down below:

Step 1: Firstly, access the editor by pressing the "Get Form Button" at the top of this page.

Step 2: With our advanced PDF editing tool, it is possible to do more than just fill in blanks. Try all the features and make your forms appear sublime with custom textual content added in, or modify the original input to perfection - all comes along with an ability to incorporate almost any photos and sign the document off.

It really is simple to finish the pdf following our helpful guide! Here's what you need to do:

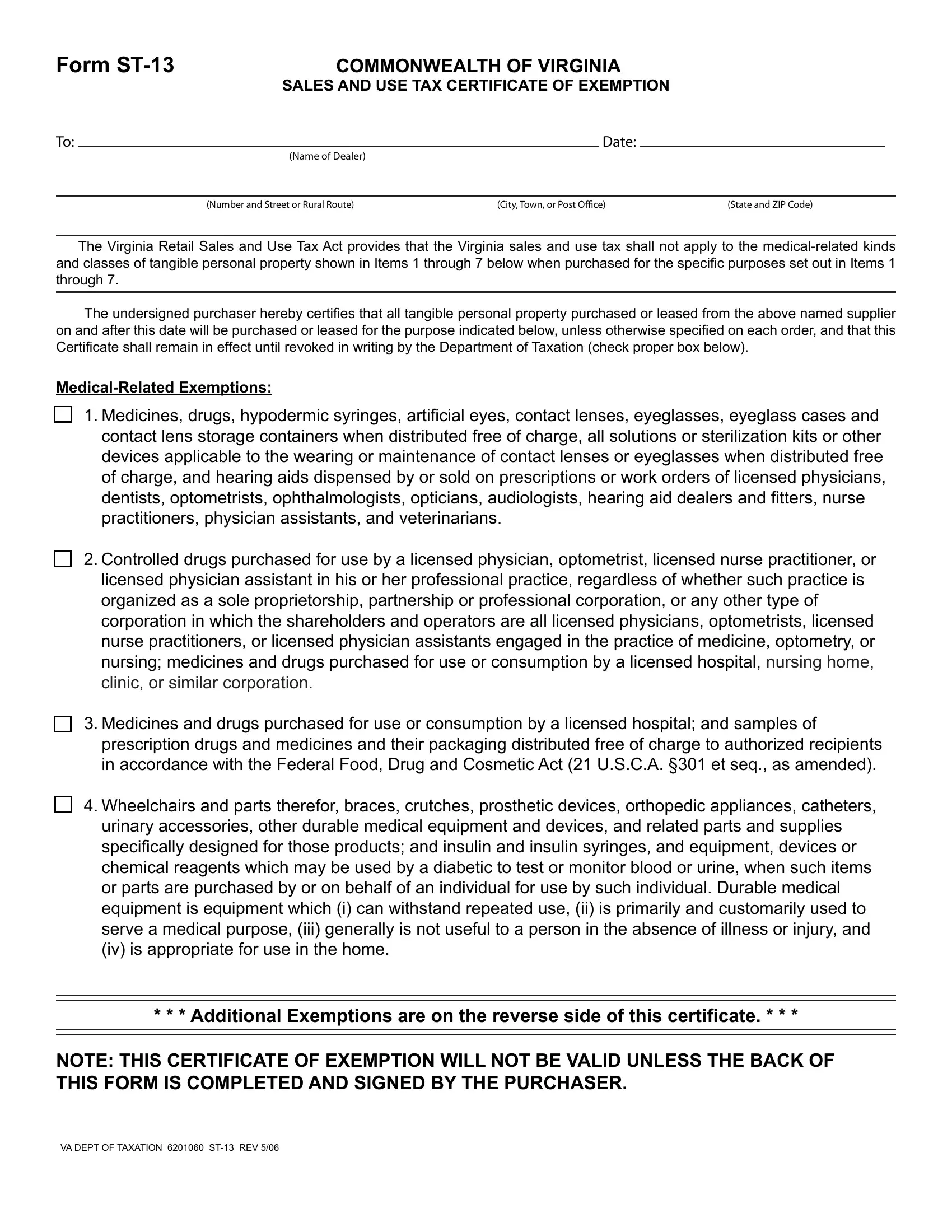

1. While filling in the Virginia Form St 13, be sure to incorporate all essential blank fields in its associated area. This will help to expedite the process, which allows your information to be processed swiftly and appropriately.

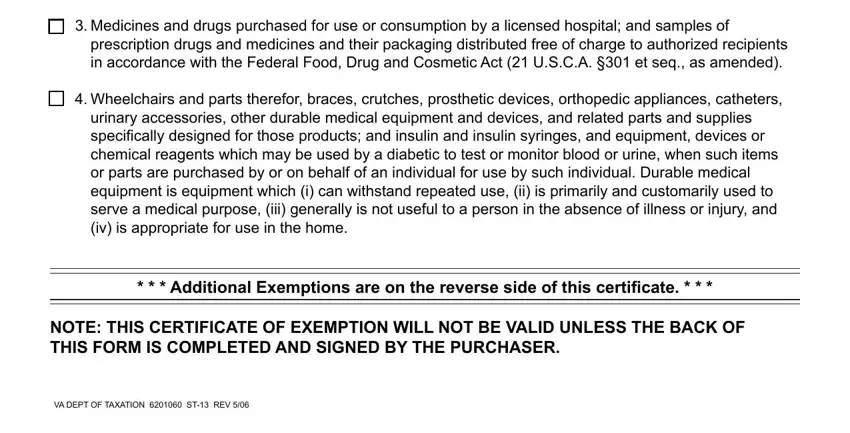

2. Once your current task is complete, take the next step – fill out all of these fields - Medicines and drugs purchased for, prescription drugs and medicines, in accordance with the Federal, Wheelchairs and parts therefor, urinary accessories other durable, iv is appropriate for use in the, Additional Exemptions are on, NOTE THIS CERTIFICATE OF EXEMPTION, and VA DEPT OF TAXATION ST REV with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

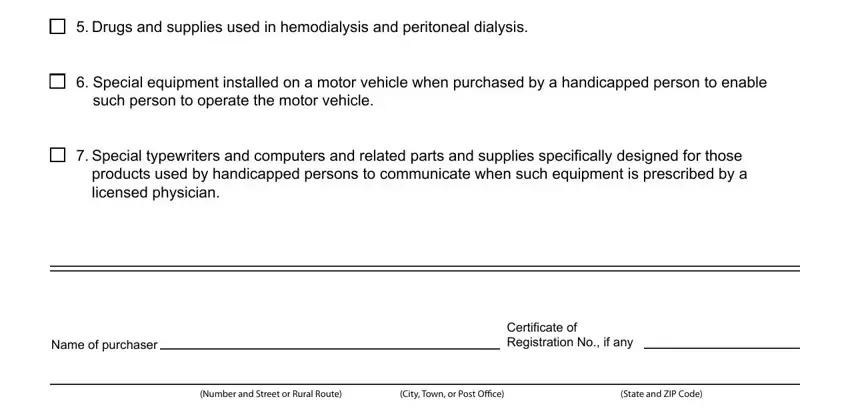

3. This next portion is mostly about Drugs and supplies used in, Special equipment installed on a, such person to operate the motor, Special typewriters and computers, licensed physician, Name of purchaser, Certiicate of Registration No if, Number and Street or Rural Route, City Town or Post Oice, and State and ZIP Code - fill in each one of these fields.

It's very easy to make errors while filling in the Certiicate of Registration No if, for that reason make sure you look again before you'll submit it.

4. This fourth paragraph comes next with all of the following blanks to complete: Signature, Title, and Information for dealer A dealer.

Step 3: After proofreading the fields you've filled out, click "Done" and you're all set! Sign up with us now and immediately gain access to Virginia Form St 13, set for download. All modifications you make are preserved , allowing you to modify the form at a later stage when required. Whenever you work with FormsPal, you can certainly complete documents without worrying about personal data breaches or entries getting distributed. Our secure software helps to ensure that your personal data is maintained safely.