Making use of the online PDF editor by FormsPal, you'll be able to fill in or change va retail sales tax right here. The tool is continually updated by our team, receiving handy features and becoming a lot more convenient. All it takes is several easy steps:

Step 1: Click on the "Get Form" button above on this webpage to access our PDF tool.

Step 2: After you start the editor, you will see the form prepared to be completed. Other than filling out different fields, you may also perform other actions with the form, that is writing any text, changing the original textual content, adding images, placing your signature to the form, and a lot more.

This PDF doc will require you to enter some specific details; in order to ensure accuracy, please make sure to bear in mind the next steps:

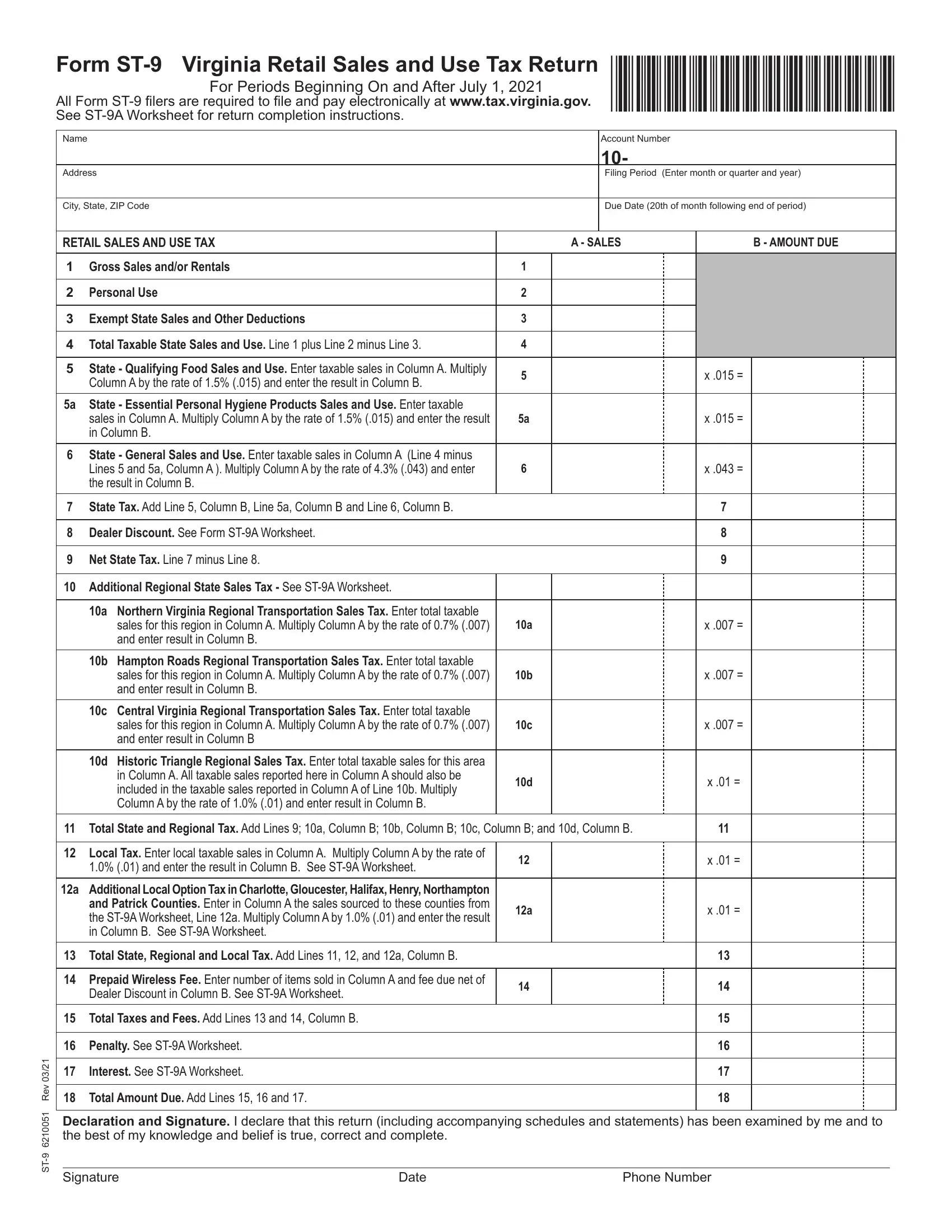

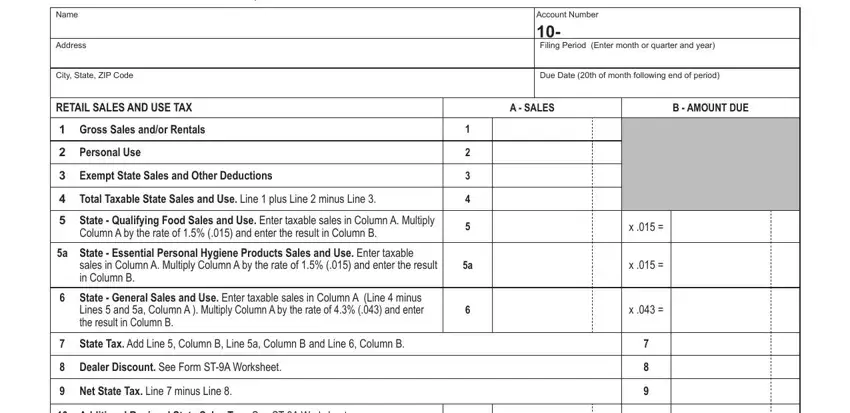

1. The va retail sales tax will require particular information to be entered. Ensure the subsequent blanks are complete:

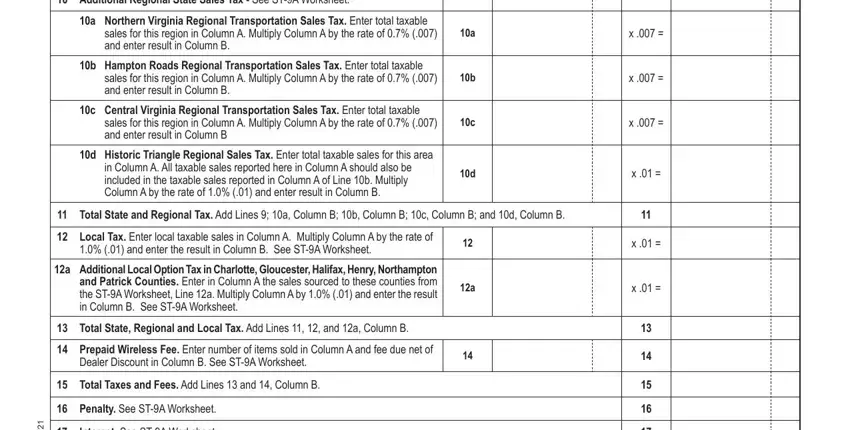

2. Just after filling out the last step, go to the subsequent step and enter the necessary particulars in these blanks - Additional Regional State Sales, a Northern Virginia Regional, sales for this region in Column A, b Hampton Roads Regional, sales for this region in Column A, c Central Virginia Regional, sales for this region in Column A, d Historic Triangle Regional Sales, in Column A All taxable sales, Local Tax Enter local taxable, a Additional Local Option Tax in, Total State Regional and Local Tax, Prepaid Wireless Fee Enter number, Dealer Discount in Column B See, and Total Taxes and Fees Add Lines.

3. Completing Interest See STA Worksheet, v e R, T S, Total Amount Due Add Lines and, Declaration and Signature I, Signature, Date, and Phone Number is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

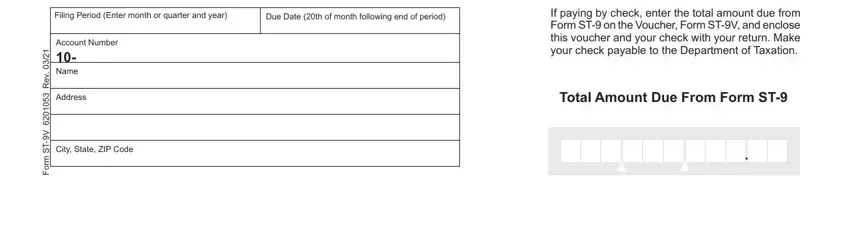

4. This next section requires some additional information. Ensure you complete all the necessary fields - Filing Period Enter month or, Due Date th of month following end, Account Number Name, Address, City State ZIP Code, v e R, V T S m r o F, If paying by check enter the total, and Total Amount Due From Form ST - to proceed further in your process!

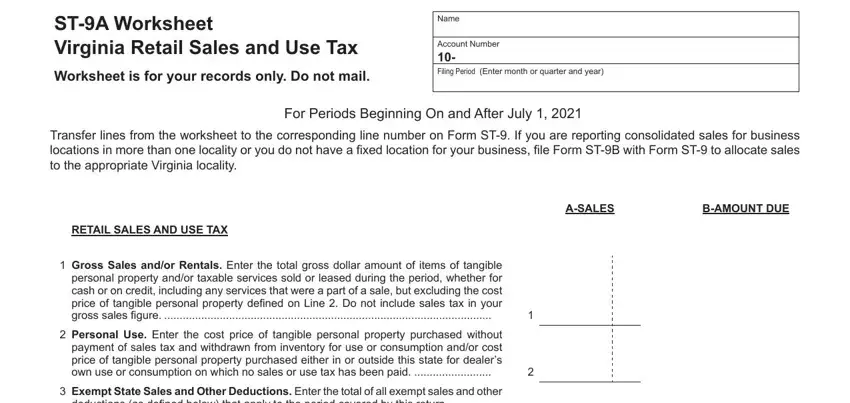

5. To conclude your document, the last area includes a couple of additional blank fields. Typing in STA Worksheet Virginia Retail, Worksheet is for your records only, Name, Account Number Filing Period, Transfer lines from the worksheet, For Periods Beginning On and After, ASALES, BAMOUNT DUE, RETAIL SALES AND USE TAX, Gross Sales andor Rentals Enter, Personal Use Enter the cost price, Exempt State Sales and Other, and deductions as defined below that is going to conclude everything and you'll definitely be done very fast!

People who use this form frequently make some errors while filling out Gross Sales andor Rentals Enter in this section. Ensure that you double-check what you enter here.

Step 3: Once you have reread the details in the fields, click "Done" to finalize your form at FormsPal. Create a free trial subscription at FormsPal and gain instant access to va retail sales tax - which you may then begin using as you would like in your FormsPal cabinet. FormsPal ensures your data confidentiality by using a secure method that never saves or shares any type of personal data used. You can relax knowing your docs are kept confidential whenever you use our tools!