irs form14310 form can be filled out very easily. Just open FormsPal PDF editor to complete the task quickly. Our editor is continually developing to deliver the very best user experience attainable, and that is due to our dedication to continuous improvement and listening closely to feedback from customers. With just a few easy steps, you can begin your PDF editing:

Step 1: Simply click on the "Get Form Button" in the top section of this webpage to launch our pdf form editing tool. There you'll find everything that is required to fill out your file.

Step 2: With this online PDF editor, you're able to accomplish more than just complete blanks. Try each of the functions and make your forms seem high-quality with customized text incorporated, or modify the original content to excellence - all that comes with the capability to incorporate any type of images and sign the file off.

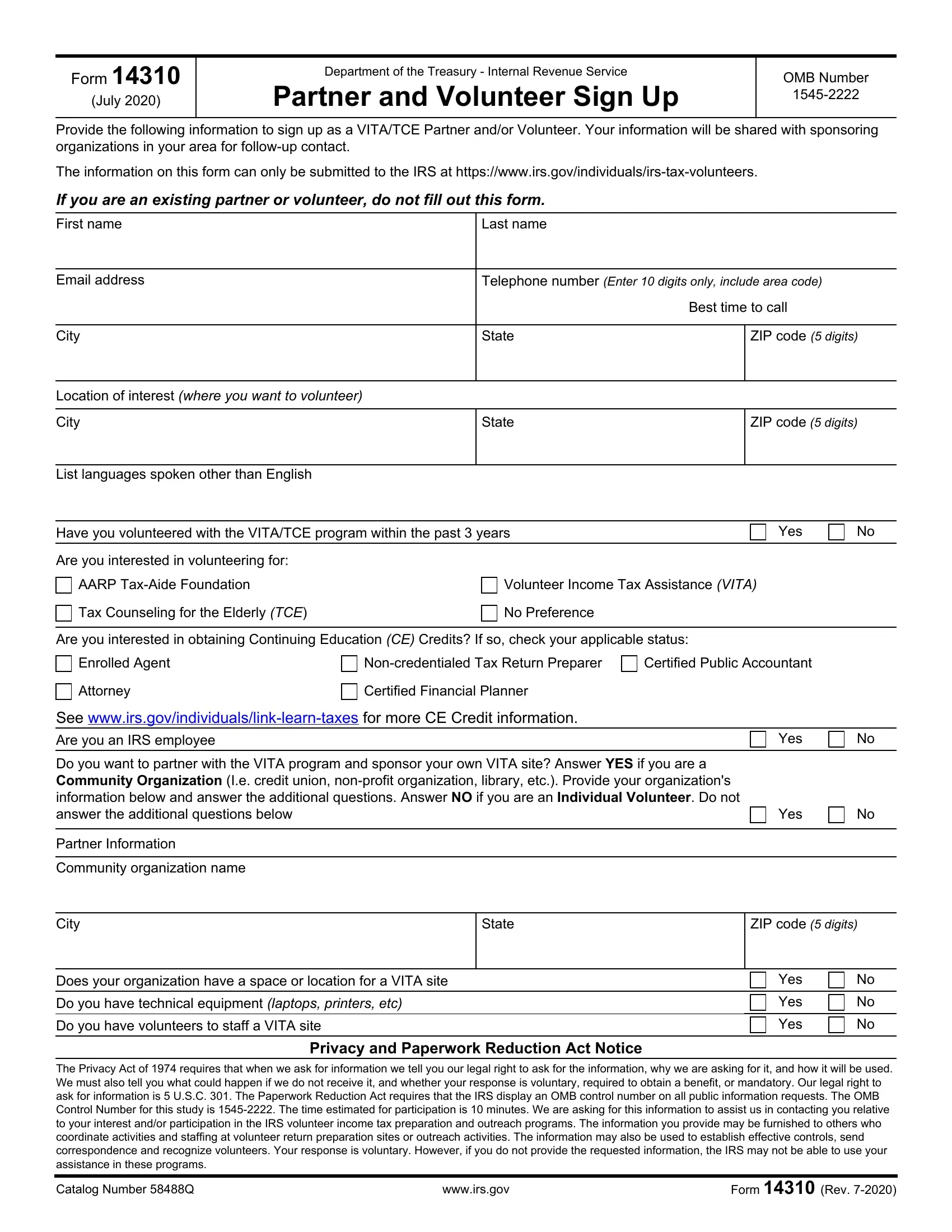

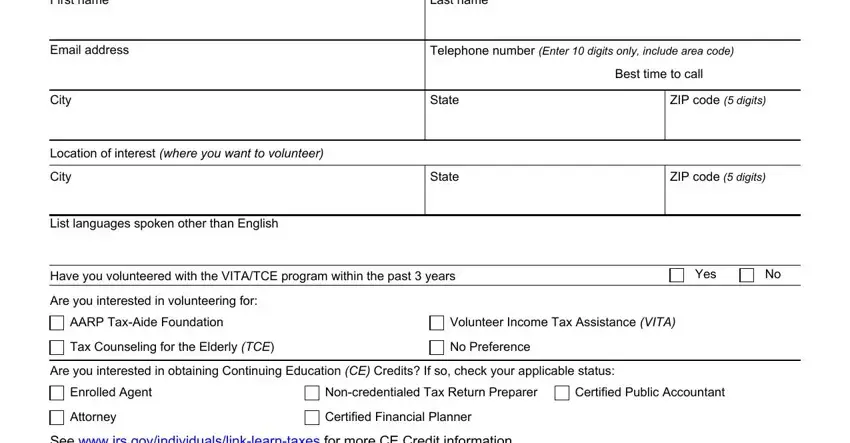

When it comes to fields of this precise PDF, this is what you should know:

1. While completing the irs form14310 form, ensure to include all of the needed blank fields within the relevant form section. It will help hasten the process, making it possible for your information to be handled without delay and accurately.

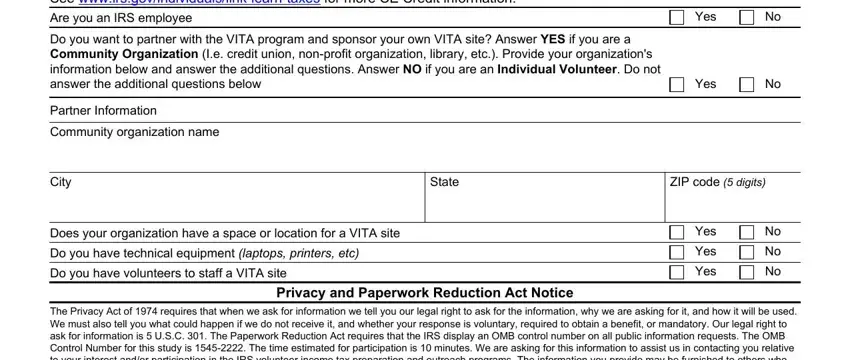

2. Soon after filling in the previous section, go on to the next step and fill in the essential details in all these fields - See, Are you an IRS employee, Do you want to partner with the, Yes, Yes, Partner Information, Community organization name, City, State, ZIP code digits, Does your organization have a, Do you have technical equipment, Do you have volunteers to staff a, Yes, and Yes.

As to Does your organization have a and Yes, make sure that you get them right in this section. Those two are the most important ones in this file.

Step 3: Before submitting this file, ensure that all blanks were filled out right. Once you verify that it is fine, click on “Done." Go for a 7-day free trial subscription at FormsPal and gain instant access to irs form14310 form - available from your FormsPal cabinet. When you use FormsPal, you can fill out forms without having to get worried about information incidents or entries getting shared. Our protected platform ensures that your personal data is maintained safe.