INSTRUCTIONS FOR SECTION C: SETTLEMENT OPTIONS

The following is an explanation of the settlement options. You may select only one. Once you make an election, it cannot be changed. Restricted beneficiary status can be designated by the contract owner and limits payout options for his or her beneficiary(s). If the enclosed letter indicates that this contract has a restricted beneficiary, please mail or fax a death certificate and an IRS Form W-9 completed by the beneficiary. After receiving these documents, we will be able to release information regarding this restriction to the beneficiary.

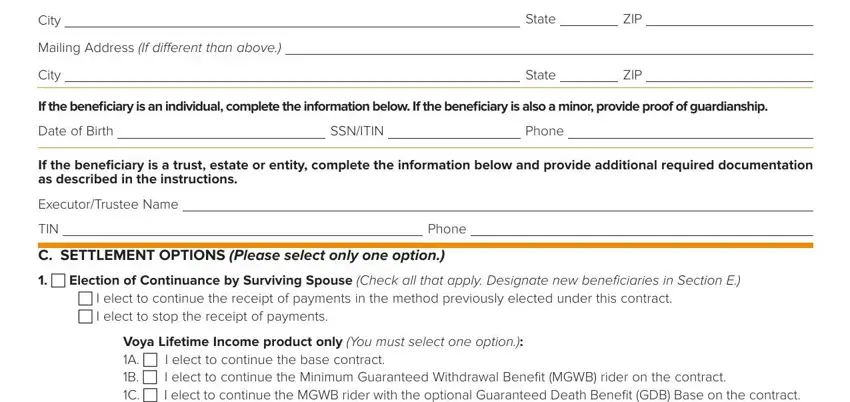

1.) ELECTION OF CONTINUANCE BY SURVIVING SPOUSE

This option is available only to a surviving spouse who is the sole beneficiary. This option may also be elected for custodial beneficiaries if the surviving spouse is the sole beneficiary of the custodial account.

By electing this option, the beneficiary chooses to become the owner and/or annuitant (same as the decedent). All provisions of the original contract and applicable riders apply, including the Surrender Charge Schedule.

If when the owner dies this contract is a 403(b)/TSA account, then as such the spouse cannot elect this option. However, the spouse may roll over claim proceeds to any qualified plan but must do so within 60 days from the date of distribution. To continue this contract as an IRA, the spouse must do two things:

1.Select the Election of Continuance by Surviving Spouse option on the Claimant Statement. There may be tax consequences associated with a rollover; please consult with an independent tax advisor. We will report to the IRS and provide the spouse with the appropriate tax form after the close of the calendar year. As a result of the rollover, we will also provide the spouse with an IRA endorsement to replace the 403(b) endorsement issued with the original contract.

2.Select the option in Section C to convert the contract to an IRA.

Note: You must check the box to continue previously elected payments. If this contract is on a systematic payment schedule, you must check one of the two options to either continue or stop the systematic payments.

If the original contract was the Voya Lifetime Income product, there are restrictions to spousal continuation of the Minimum Guaranteed Withdrawal Benefit (MGWB) rider under this contract, as follows:

For contracts with the Single Life MGWB rider in the Deferral Phase at time of death: The continuing spouse must be at least 50 years old in order to continue the MGWB rider. The continuing spouse becomes the annuitant and sole owner. The rider continues in the Deferral Phase and the Income Withdrawal Percentage (IWP) will be based on the age of the continuing spouse as of the date of death of the deceased spouse.

For contracts with the Single Life MGWB rider in the Income Phase at time of death: The MGWB rider can be continued only if the continuing spouse had been the annuitant prior to the date of death. If the continuing spouse had not been the annuitant prior to the date of death, the MGWB rider terminates. If the MGWB rider is in Automatic Periodic Benefit (APB) status and the annuitant dies, the contract and this rider terminate and will have no further value.

For contracts with the Joint Life MGWB rider: Upon the death of the owner (single ownership), or upon the first death of two joint owners (joint ownership), the surviving spouse may elect to continue the MGWB rider, provided that the surviving spouse is an active spouse and becomes the annuitant and sole owner.

You must elect to continue the MGWB rider by choosing this option in section C. If you do not make an election, the rider will terminate and have no further value.

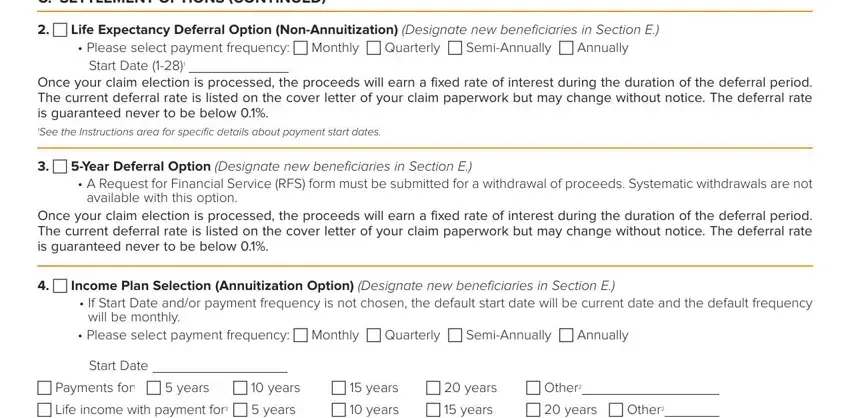

2.) LIFE EXPECTANCY DEFERRAL OPTION (NON-ANNUITIZATION)

This option is NOT available if the beneficiary is an estate, custodian or organization.

By electing this option, the beneficiary will receive payments based on his or her life expectancy. Payments must be taken at least annually until the account assets are exhausted. Please select a payment frequency and start date on the Claimant Statement. Once your claim election is processed, the proceeds will earn a fixed rate of interest during the duration of the deferral period. The current deferral rate is listed on the cover letter of your claim paperwork but may change without notice. The deferral rate is guaranteed never to be below 0.1%.

If paperwork is received within the calendar year of the contract owner/annuitant's date of death, payments will not begin before January of the following calendar year. If paperwork is received in the calendar year following the contract owner/annuitant's date of death, payments will begin once completed paperwork has been received.

If the original contract was the Voya Lifetime Income product and paperwork is received within the calendar year of the contract owner/annuitant's date of death, payments will begin January of the following calendar year, unless a later date is specified. If paperwork is received in the calendar year following the contract owner/annuitant's date of death, payments will begin on the date you specify after completed paperwork has been received. Payments cannot begin later than the election deadline.

If the original contract was the Voya Journey product: Upon election of the LED option during the initial term (currently 7 years), the contract will continue to be invested in the same manner as prior to the death of the owner until the end of the initial term. Upon election of this option after the initial term, interest will follow the then current death benefit process. Contract values must be distributed over the life expectancy of the beneficiary with payments beginning within one year of the deceased owner's death.

If you are interested in electing this option, please call Customer Service at 800-369-5303 for assistance in determining whether there are any remaining years in the initial term, and to receive any other information regarding the original contract's investment selections that you may need to make your decision.

Exercise certain contract owner rights: You may name or change beneficiaries, but you cannot add additional premiums to the contract.

ELECTION DEADLINE (YOU MUST RECEIVE YOUR FIRST PAYMENT):

Tax Qualified: December 31 of the year following the owner’s date of death.

Tax Nonqualified: First anniversary of the owner’s date of death.