Dealing with PDF forms online is definitely a piece of cake using our PDF editor. You can fill out w4p here effortlessly. We are focused on making sure you have the absolute best experience with our tool by regularly introducing new capabilities and enhancements. Our tool is now much more intuitive as the result of the latest updates! Currently, editing PDF documents is a lot easier and faster than ever. Getting underway is simple! All you have to do is adhere to these basic steps down below:

Step 1: Just press the "Get Form Button" above on this page to get into our pdf file editing tool. Here you'll find everything that is required to fill out your file.

Step 2: This tool provides the ability to customize PDF forms in a variety of ways. Modify it with any text, adjust what is already in the file, and put in a signature - all possible in no time!

As for the blanks of this precise document, here is what you should know:

1. While filling in the w4p, make sure to incorporate all essential blanks in the relevant form section. It will help facilitate the process, allowing your information to be handled without delay and correctly.

2. Your next stage is to fill in these blank fields: If you wish you can submit, instructions or publications on, page on IRSgov We cannot respond, volume we receive but we will, we may not be able to consider, and revision of the product.

3. The following part will be about DRAFT AS OF DRAFT AS OF July, You are married have only one, Personal Allowances Worksheet Keep, B Enter if You are single and, C Enter for your spouse But you, A Enter for yourself if no one, C D E, F G, D Enter number of dependents, If your total income will be less, G Add lines A through F and enter, For accuracy complete all, that apply If you plan to itemize, married and you and your spouse, and see the Deductions and Adjustments - fill out all of these blanks.

People often make some mistakes when filling out married and you and your spouse in this part. Be sure you re-examine whatever you type in here.

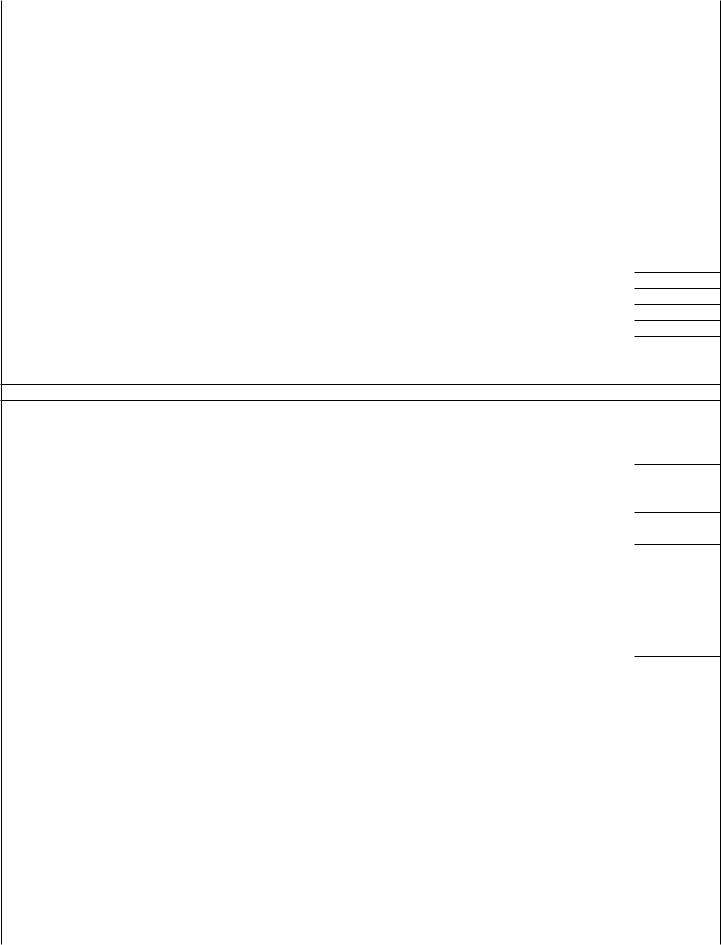

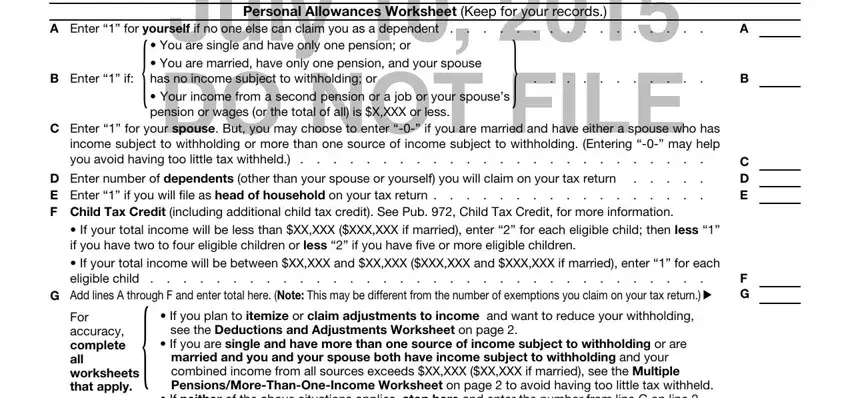

4. The subsequent paragraph comes with these blank fields to consider: Department of the Treasury, For Privacy Act and Paperwork, Last name, Home address number and street or, City or town state and ZIP code, Your social security number, Claim or identification number if, Complete the following applicable, annuity payment You also may, Married but withhold at higher, Married, Single, Additional amount if any you want, Enter number of allowances, and you cannot enter an amount here.

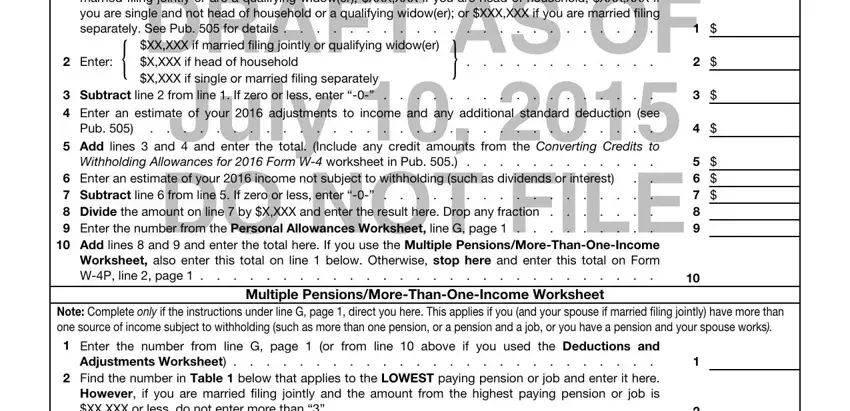

5. The last stage to finish this PDF form is integral. Be certain to fill in the displayed blank fields, which includes Enter XXXXX if married filing, XXXX if head of household XXXX if, Enter an estimate of your, DRAFT AS OF DRAFT AS OF July, Enter an estimate of your, Subtract line from line If zero, Add lines and and enter the, Withholding Allowances for Form W, Add lines and and enter the, Pub, Multiple, Note Complete only if the, Enter the number from line G page, Adjustments Worksheet, and Find the number in Table below, before submitting. Failing to do this might give you an unfinished and potentially unacceptable form!

Step 3: As soon as you've reread the details provided, press "Done" to complete your form. Sign up with us right now and easily gain access to w4p, all set for download. Each change you make is conveniently kept , letting you edit the file at a later time anytime. We do not share any information that you use when completing forms at FormsPal.