You could complete SS-5 instantly using our PDFinity® online PDF tool. The editor is continually updated by our staff, getting powerful features and turning out to be more versatile. To get started on your journey, take these easy steps:

Step 1: Just click the "Get Form Button" at the top of this page to launch our pdf editor. This way, you will find everything that is necessary to work with your file.

Step 2: When you access the tool, you will get the document made ready to be filled out. Besides filling in different blank fields, you may also perform other actions with the Document, including putting on custom words, changing the original textual content, adding images, putting your signature on the PDF, and a lot more.

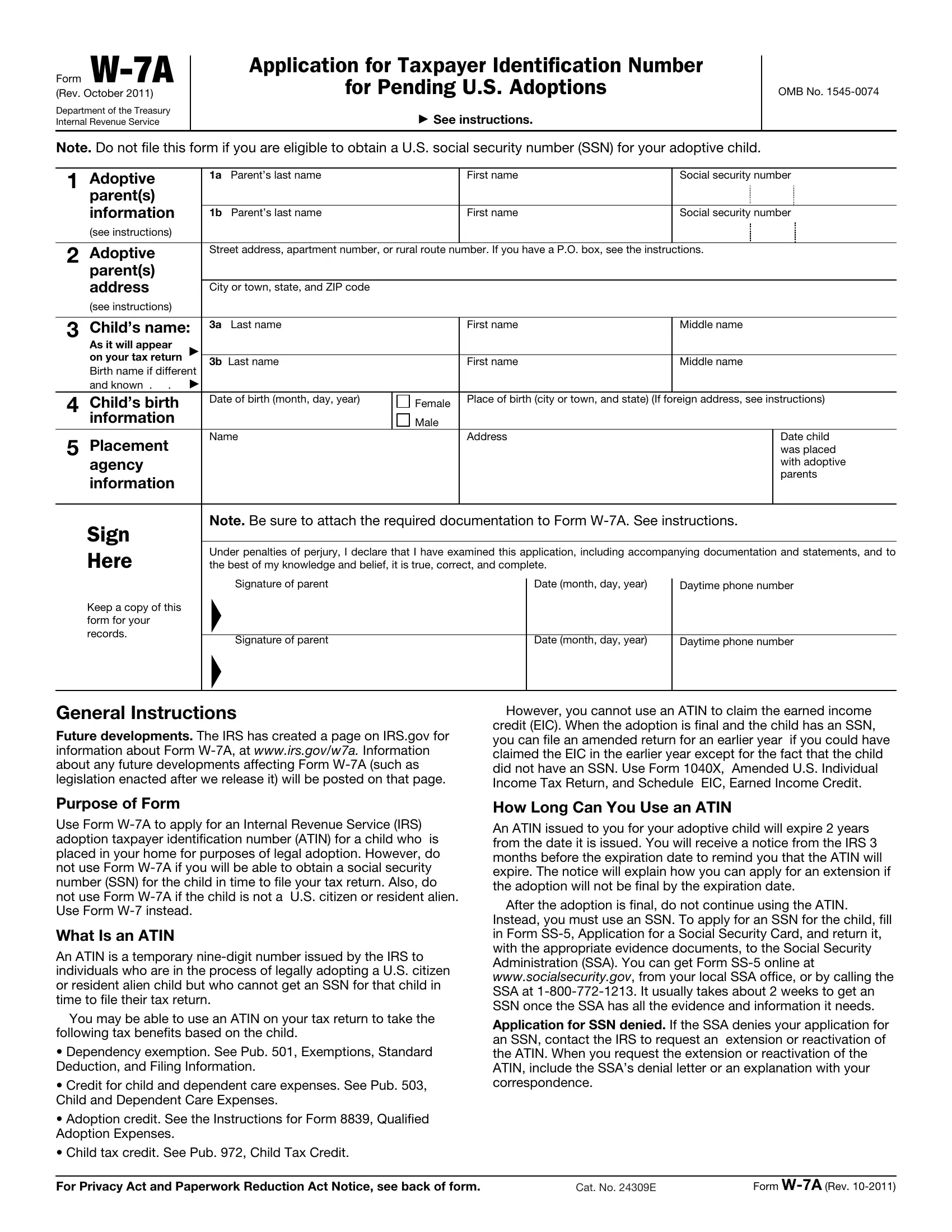

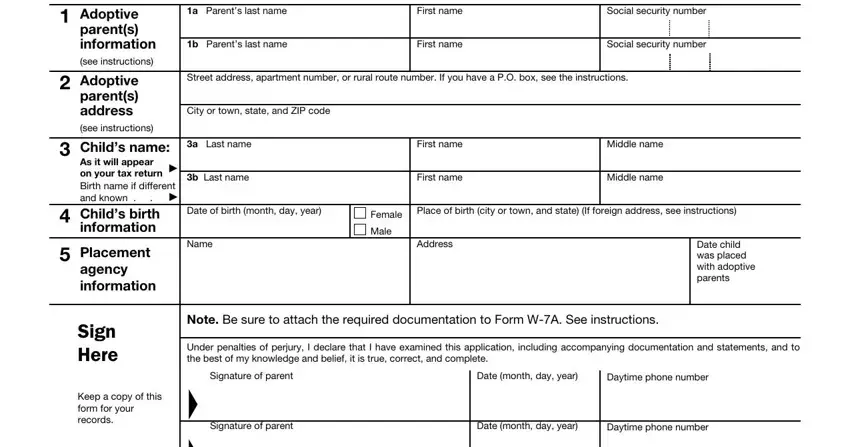

As for the blank fields of this specific document, here's what you should consider:

1. Whenever filling in the SS-5, ensure to complete all needed fields in their corresponding section. This will help to speed up the process, which allows your details to be processed efficiently and correctly.

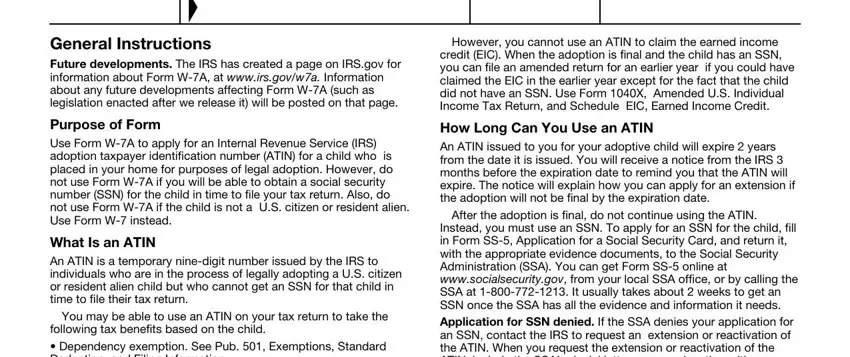

2. After the previous segment is finished, it's time to include the necessary specifics in General Instructions Future, However you cannot use an ATIN to, Purpose of Form, Use Form WA to apply for an, What Is an ATIN, An ATIN is a temporary ninedigit, You may be able to use an ATIN on, following tax benefits based on, Dependency exemption See Pub, How Long Can You Use an ATIN, An ATIN issued to you for your, After the adoption is final do not, Instead you must use an SSN To, and Application for SSN denied If the so that you can proceed further.

Always be very mindful while filling out However you cannot use an ATIN to and What Is an ATIN, because this is the part in which many people make errors.

Step 3: Look through the details you've typed into the blank fields and then press the "Done" button. After creating a7-day free trial account here, you'll be able to download SS-5 or email it directly. The document will also be accessible from your personal account with all your edits. We do not sell or share the information you use while filling out documents at our site.