Handling PDF files online is actually surprisingly easy with our PDF tool. You can fill in when does paylocity release w2 here effortlessly. In order to make our editor better and more convenient to work with, we constantly work on new features, bearing in mind feedback coming from our users. Here is what you will need to do to begin:

Step 1: Hit the "Get Form" button above. It will open our tool so you can start completing your form.

Step 2: When you open the online editor, you will get the document ready to be filled out. Aside from filling in different blanks, you can also do other actions with the PDF, namely putting on custom textual content, editing the initial text, adding graphics, signing the document, and much more.

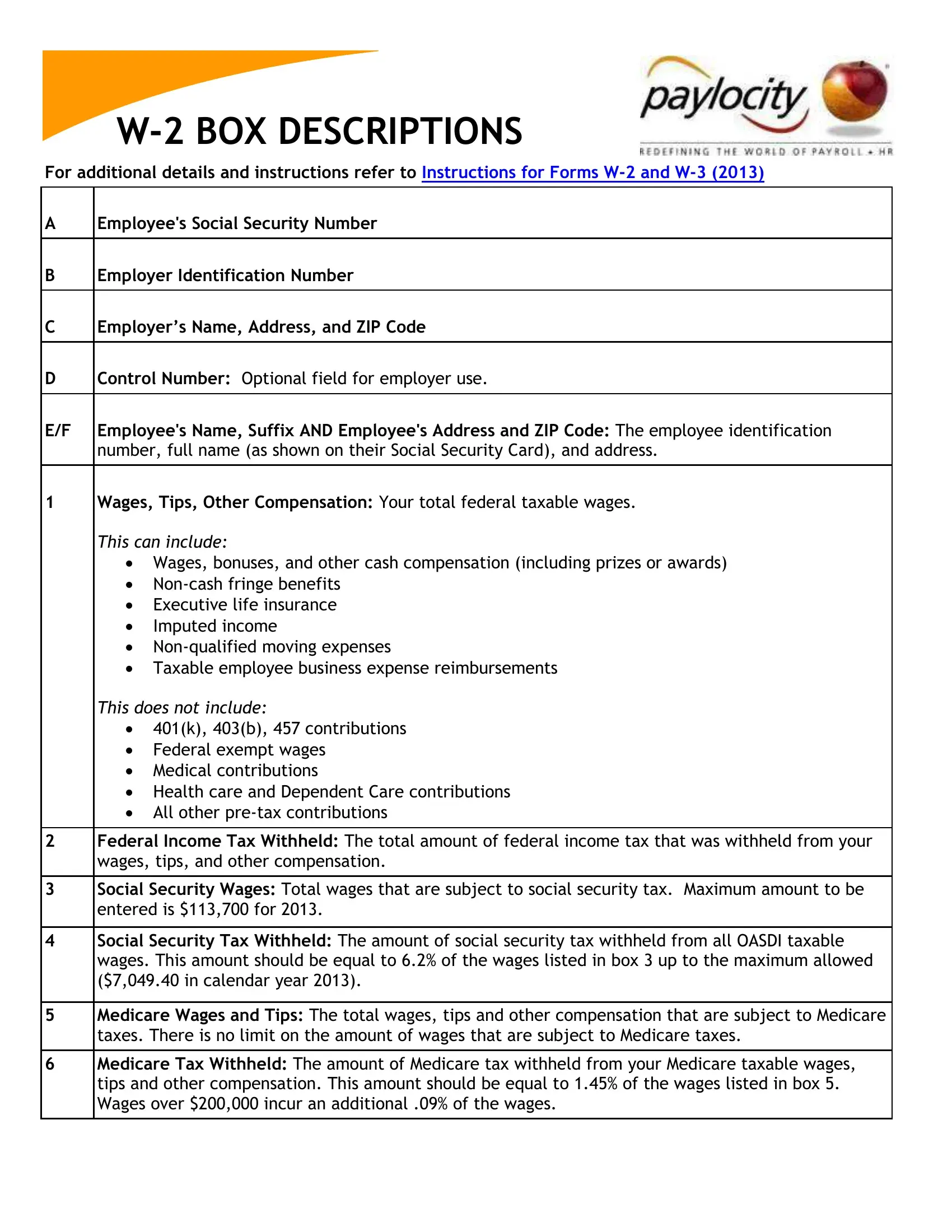

This PDF will require specific information to be typed in, therefore ensure that you take the time to provide what's expected:

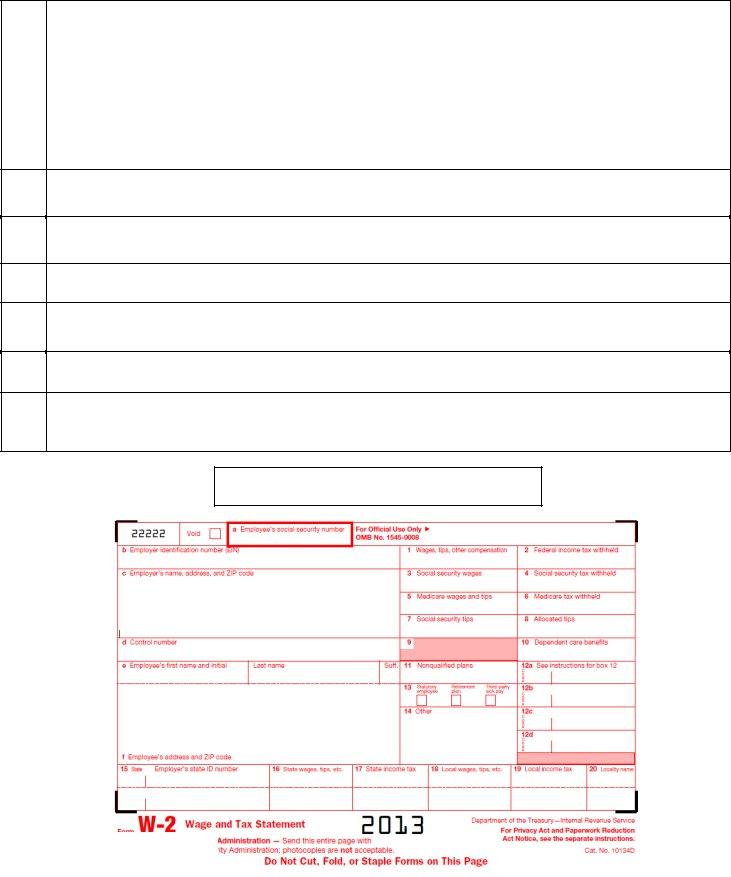

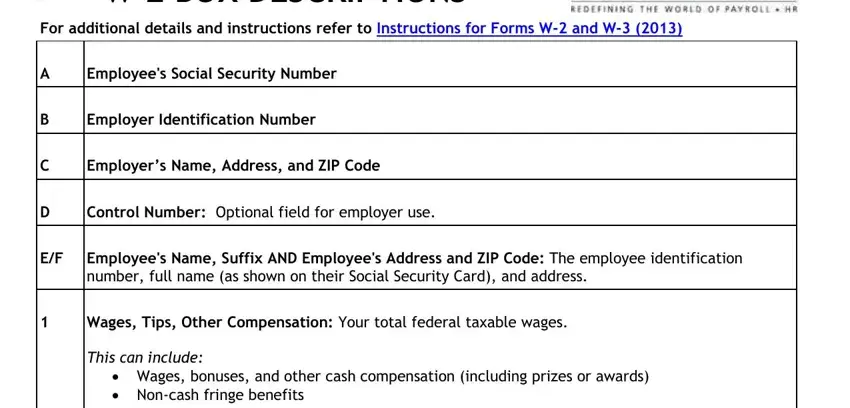

1. It's vital to fill out the when does paylocity release w2 correctly, therefore be mindful when filling in the sections including these particular fields:

2. After the last segment is done, you're ready put in the essential details in httpwwwirsgovpubirspdffwpdf in order to go to the 3rd part.

Always be very mindful while filling in httpwwwirsgovpubirspdffwpdf and httpwwwirsgovpubirspdffwpdf, as this is the part where many people make errors.

Step 3: Proofread all the details you have typed into the blanks and click the "Done" button. Join us right now and easily access when does paylocity release w2, prepared for downloading. Every edit made is handily saved , which enables you to modify the document further as required. FormsPal ensures your data privacy by having a protected system that in no way saves or distributes any kind of private data involved. Rest assured knowing your files are kept protected whenever you use our editor!