w6 forms can be filled in online without any problem. Simply try FormsPal PDF tool to finish the job right away. Our professional team is ceaselessly endeavoring to improve the editor and enable it to be much better for clients with its multiple features. Bring your experience one stage further with continuously developing and fantastic possibilities we offer! Starting is simple! All you need to do is follow the following basic steps below:

Step 1: Click on the "Get Form" button at the top of this webpage to get into our editor.

Step 2: Using our handy PDF editing tool, you may accomplish more than simply fill out blank form fields. Try all the features and make your documents seem great with customized text added in, or modify the original input to excellence - all accompanied by the capability to incorporate stunning images and sign the PDF off.

For you to finalize this document, be sure to provide the required information in every field:

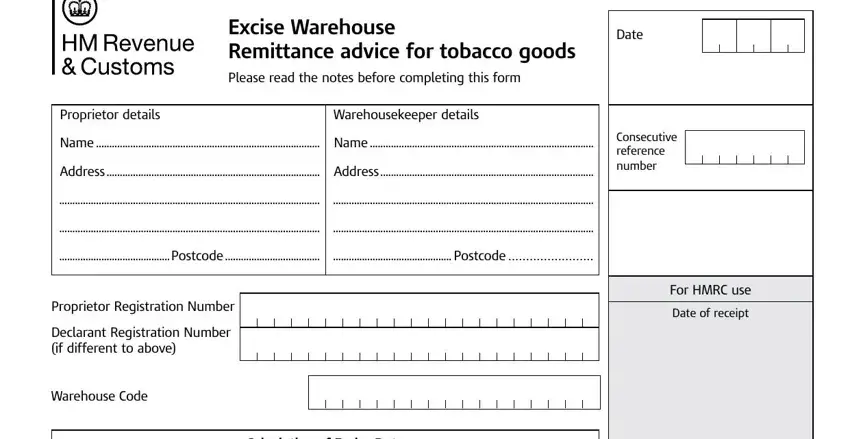

1. The w6 forms involves certain details to be inserted. Ensure that the subsequent fields are finalized:

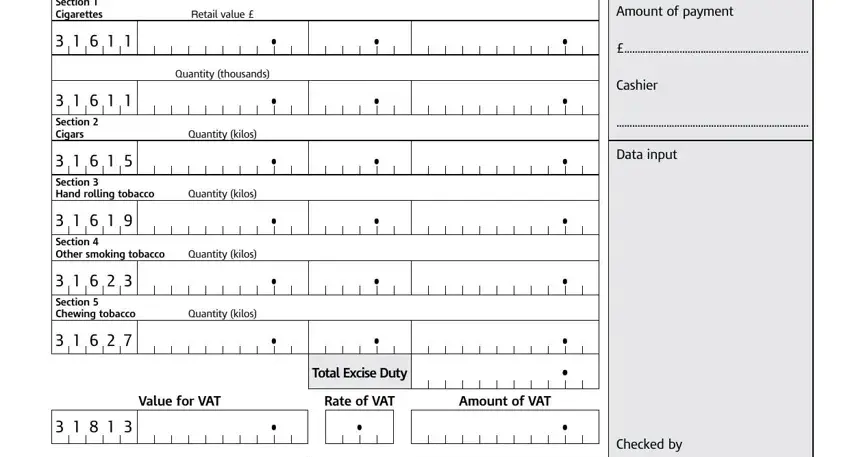

2. The subsequent stage is usually to fill out the following fields: Section Cigarettes, Retail value, Quantity thousands, Quantity kilos, Quantity kilos, Quantity kilos, Quantity kilos, Value for VAT, Section Cigars, Section Hand rolling tobacco, Section Other smoking tobacco, Section Chewing tobacco, Total Excise Duty, Rate of VAT, and Amount of VAT.

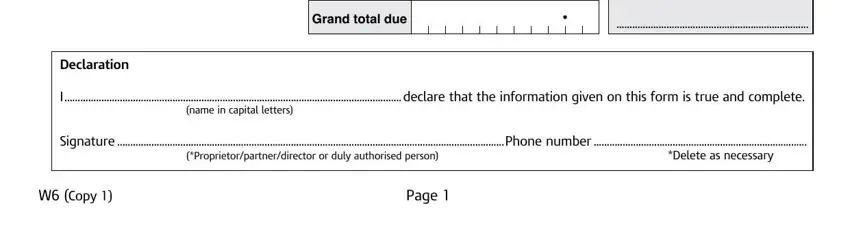

3. This next portion is related to Declaration, Grand total due, I declare that the information, name in capital letters, Signature Phone number, Proprietorpartnerdirector or duly, Delete as necessary, W Copy, and Page - fill out each one of these empty form fields.

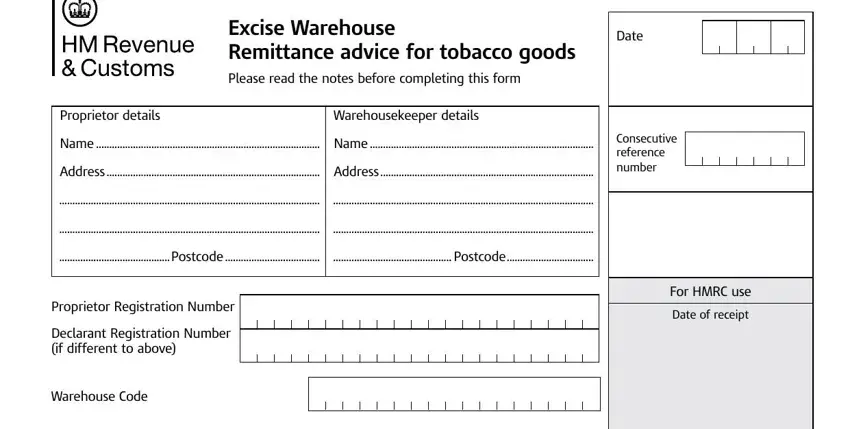

4. This next section requires some additional information. Ensure you complete all the necessary fields - Excise Warehouse Remittance advice, Date, Proprietor details, Warehousekeeper details, Name Name, Address Address, Consecutive reference number, Postcode Postcode, Proprietor Registration Number, Declarant Registration Number if, Warehouse Code, For HMRC use, and Date of receipt - to proceed further in your process!

As for Consecutive reference number and Address Address, be certain you review things in this current part. Both these are considered the key ones in the document.

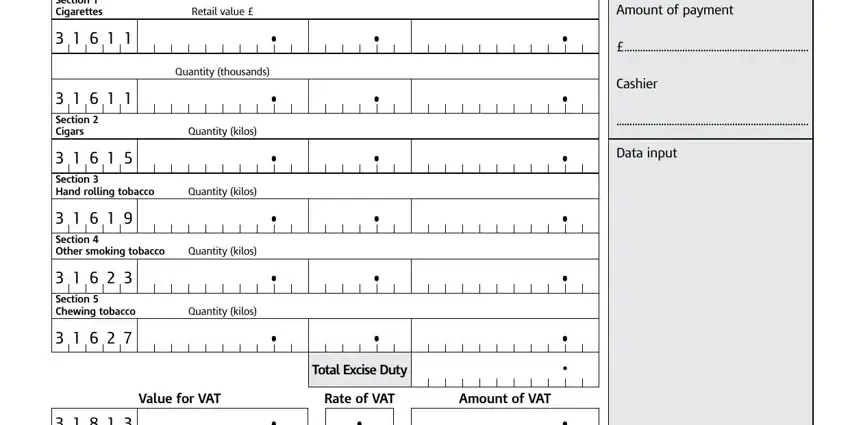

5. To wrap up your form, this final section features a couple of extra blank fields. Typing in Retail value, Quantity thousands, Quantity kilos, Quantity kilos, Quantity kilos, Quantity kilos, Value for VAT, Section Cigarettes, Section Cigars, Section Hand rolling tobacco, Section Other smoking tobacco, Section Chewing tobacco, Total Excise Duty, Rate of VAT, and Amount of VAT should conclude everything and you'll definitely be done before you know it!

Step 3: Immediately after looking through your entries, press "Done" and you are good to go! Join FormsPal now and easily access w6 forms, ready for downloading. Every modification you make is handily kept , which enables you to modify the file at a later point if required. At FormsPal, we endeavor to be sure that all your information is kept secure.