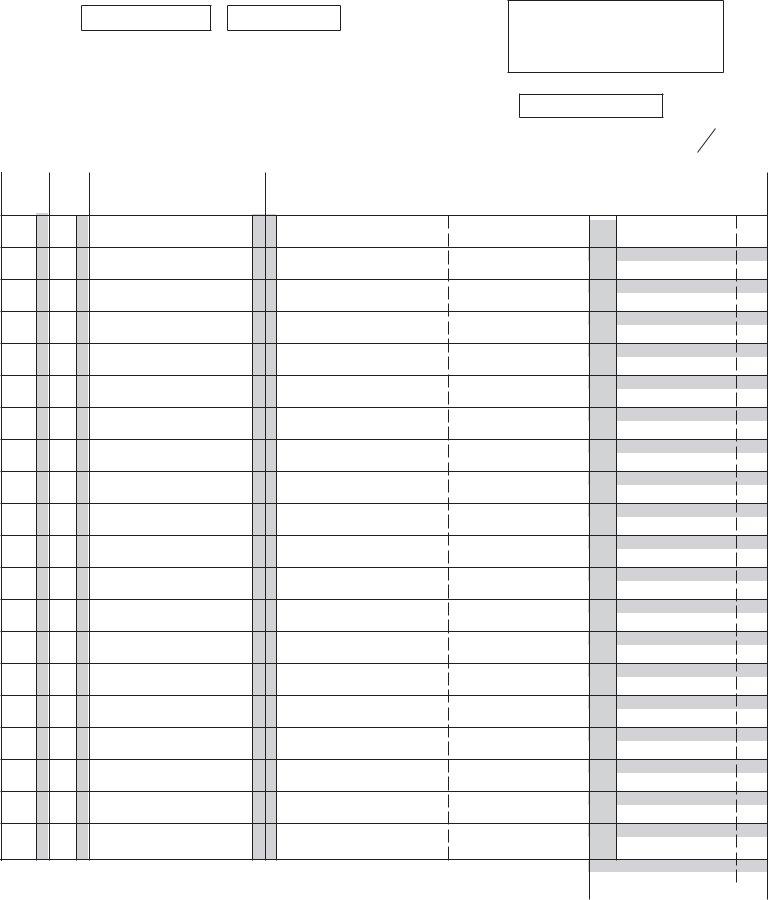

The Wage Detail Report form, identified as UC 1017 and issued by the State of Michigan's Department of Consumer & Industry Services, serves as a critical tool for employers in reporting quarterly wage information. This form is integral for the accurate calculation and reporting of wages paid to employees, ensuring compliance with state regulations regarding worker's compensation and unemployment benefits. Specifically designed for businesses to report individual employee wages, the form requires details such as Social Security numbers, names, and the gross wages paid within the quarter. It is imperative for employers to accurately enter all information, including making any necessary corrections or deletions to employee data, to avoid discrepancies and potential penalties. Since the third quarter of 1995, failing to submit this form as required can result in fines, underscoring the importance of timely and accurate submissions. Moreover, the form instructions advise against including certain types of payments such as profit-sharing and sickness benefits under employer plans, delineating what constitutes reportable wages. It also provides guidelines for specific cases, such as family businesses, on how to report wages. Should there be any changes in business location or contact information, or if previous reports need amendment, the form directs employers to the appropriate resources and forms to use, ensuring that the state's records remain up-to-date. This comprehensive approach highlights the form's significance in maintaining fair labor practices and supporting the unemployment compensation system within Michigan.

| Question | Answer |

|---|---|

| Form Name | Wage Detail Report Form |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | wage detail any, quarterly wage detail report mi, 1017 form uia, quarterly wage tax report michigan |

UC 1017 (REV. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wage Detail Report |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||

PICA ELITE |

|

|

|

|

|

|

|

|

|

|

|

|

|

STATE OF MICHIGAN, DEPARTMENT OF CONSUMER & INDUSTRY SERVICES |

|

|

|

|

|

|

|

|

|

|

|

|

|

PICA ELITE |

||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BUREAU OF WORKERS’ & UNEMPLOYMENT COMPENSATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

< |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See Reverse for Detailed Instructions and Penalty Provisions. |

|

|

|

|

|

|

|

|

|

|

|

|

> |

|

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BY USING “alignment BOXES” TYPED & LINE PRINTED DATA WILL FALL WITHIN ALL FIELDS |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||

Report Quarter Ending: |

Return by: |

Mail original form to:

(Do not mail a copy)

FEIN

UC Wage Record Unit P.O. Box 9052 Detroit, MI

|

|

UC Account |

|

|

|

|

|

|

|

Number |

|

|

|

|

|

|

Please Type Or Print All Information |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DELETE |

|

EMPLOYEE NAME |

|

GROSS WAGES |

|||

STATUS (X) SOCIAL SECURITY NUMBER |

LAST NAME |

FIRST NAME |

|

PAID THIS QUARTER |

|||

|

|

|

|

|

|

|

|

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

I declare that I have examined this report and to the best of my knowledge and belief, it is correct and complete.

Signature: |

Date: |

|

TOTAL |

$ |

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||

|

|

|

|

(Last page only) |

||||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

Title: |

Telephone: ( |

) |

|

PAGE |

|

OF |

|

|

|

|

UC 1017 (REV. |

INSTRUCTIONS FOR COMPLETING WAGE DETAIL DEPORT |

|

|

|

|

|||||

REVERSE SIDE |

|

|

|

|

||||||

|

|

|

(THIS FORM MUST BE TYPED OR PRINTED) |

|

|

|

|

|||

(NOTE: Employers reporting quarterly wage detail information using magnetic tape or computer printouts should not complete this form.) |

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

|

|

DELETE |

|

|

EMPLOYEE NAME |

|

GROSS WAGES |

|

|

||

STATUS |

(X) |

SOCIAL SECURITY NUMBER |

LAST NAME |

|

FIRST NAME |

|

PAID THIS QUARTER |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

X |

PUBLIC |

|

JOHN |

|

$ |

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

ANTHONY |

|

WAYNE |

|

$ |

13620 |

|

00 |

|

|

|

|

|

|

||||||

|

|

|

|

|

||||||

|

|

|

|

|

|

|||||

F |

|

GREEN |

|

RALPH |

|

$ |

12345 |

|

00 |

|

|

|

|

|

|||||||

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

PUBLIC |

|

QUINCY |

|

$ |

12987 |

|

00 |

|

|

|

|

|

|

||||||

|

|

|

|

|

||||||

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

PREPRINTED FORM

1.Review each Social Security number and employee name for correct- ness.

2.Enter the Social Security number and name of any unlisted employee to whom you paid wages during the quarter. Wages cannot be pro- cessed without a Social Security number.

3.If the Social Security number or name is incorrect, or you wish to de- lete a name, place an “X” in the Delete column. Do not enter the wages. (See the sample at the top of this page.) IF WAGES ARE REPORTED

FOR THE QUARTER, THE EMPLOYEE NAME CANNOT BE DELETED.

BLANK FORM

1.At the top of each page, in the space provided, enter the employer name, address, the

2.Enter the Social Security number, name, and gross quarterly wages paid for all employees.

WAGES TO BE REPORTED

Wage detail information must be provided for every covered employee to whom wages were paid during the calendar quarter. Do not report wages that were earned but not actually paid during the calendar quarter. Also, do not report wages of a worker whose services are excluded from coverage under Section 43 of the Michigan Employment Security (MES) Act. When reporting gross wages, enter the total amount of wages paid to each em- ployee during the calendar quarter.

Include wages paid either in cash or in a medium other than cash such as the cash equivalent of meals furnished on the employer’s premises and the cash equivalent of lodging provided by the employer as a condition of employment. Also included as wages are commissions and bonuses, awards and prizes, severance pay, vacation and holiday pay, sick pay when paid to liquidate a worker’s balance of sick pay at the time of separation from employment, tips actually reported by the worker to the employer, and the cash value of a cafeteria plan if the employee has the option under the plan to choose cash. Do not include as wages such payments as

Refer to Section 44 of the MES Act for more information.

STATUS

Leave blank unless you are a family owned business in which the major- ity interest is owned by the claimant alone, or by the claimant’s son, daughter, or spouse, or by any combination of these individuals; or by the claimant’s mother and/or father if the claimant is under the age of 18. If so, place an “F” in this column as shown in the above sample. Otherwise, this field is reserved for other future uses. Refer to Section 46(g) of the MES Act.

GROSS WAGES

Enter a zero (0) for each employee who was not paid any wages during the quarter. This ensures that the employee will be included on future reports.

Enter the total on the bottom of the LAST PAGE ONLY. The total shown on the last page of this report MUST equal the Gross Quarterly Wages reported on your Employer’s Quarterly Tax Report (Form UC 1020) for the same quarter.

PENALTY INFORMATION

Effective with the third quarter of 1995, any employer (or agent) failing to submit, when due, any Wage Detail Report, required by Section 54(2) of the MES Act, is subject to a penalty of $25.00 for each untimely report.

TO CORRECT PRIOR REPORTS

Please submit an Amended Wage Detail Report (Form UC 1019). To ob- tain Form UC 1019, contact the Wage Record Unit at (313)

CHANGE OF BUSINESS LOCATION

OR MAILING ADDRESS

Please submit an Employer Request for Address/Name Change (Form UC 1025). To obtain this form contact the UC Tax Office at (313)