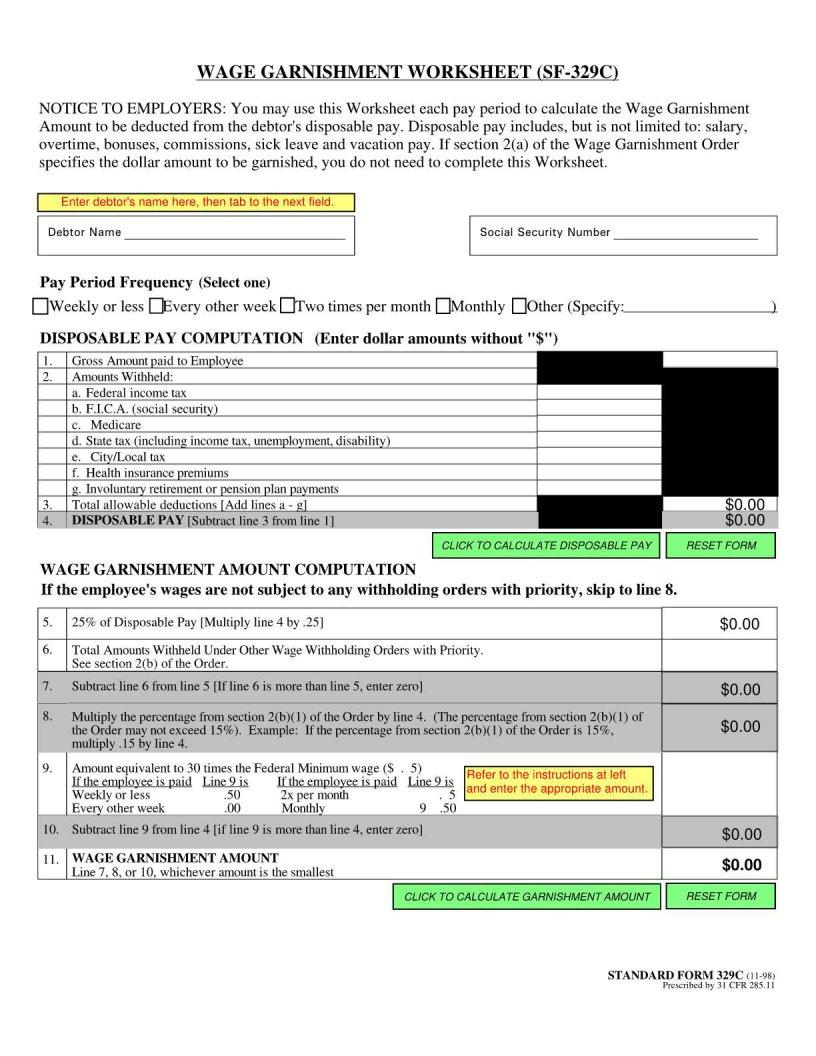

When individuals find themselves facing financial obligations they cannot meet, the specter of wage garnishment looms large. This legal process enables creditors to directly deduct payments from a debtor's earnings, putting a strain on personal finances and instilling a sense of urgency to resolve debts. Enter the Wage Garnishment Worksheet form, a crucial tool designed to ensure that the amount garnished from wages complies with federal and state limits, safeguarding a basic standard of living for the debtor. It meticulously navigates through the complexities of disposable income calculations, mandatory deductions, and exemption claims, offering a structured pathway for determining legally permissible garnishment amounts. By balancing the creditor's right to collect against the debtor's right to retain sufficient income for essentials, this form embodies the intricate dance between financial obligation and protection under the law. Understanding its provisions, calculations, and the protections it affords is essential for both creditors seeking to recover debts and employees striving to maintain their financial footing amidst challenging circumstances.

| Question | Answer |

|---|---|

| Form Name | Wage Garnishment Worksheet Form |

| Form Length | 1 pages |

| Fillable? | Yes |

| Fillable fields | 16 |

| Avg. time to fill out | 3 min 27 sec |

| Other names | sf 329c form, wage garnishment worksheet 2020, wage worksheet, form wage form |