In the landscape of municipal taxation, the City of Wilmington's WCWT-6 form plays a pivotal role for individuals, partnerships, estates or trusts, and businesses operating within the jurisdiction. This comprehensive tax document is designed to capture a wide array of financial information, critically impacting how net profits are reported and taxed. From its inception, the form demands detailed inputs about the taxpayer's status, encompassing options for individual owners, both resident and non-resident partnerships, among others. Its structure guides taxpayers through the process of declaring earnings, adjustments, and deductions in a manner aligned with federal tax obligations, reflecting any examinations or changes to prior year’s federal returns. Intricately, it canvasses the taxpayer's employment status, record-keeping methods, associated businesses, and various income sources, including rental, royalty, partnership, and capital asset transactions. This meticulous approach ensures a holistic declaration of taxable profits and other income, culminating in the calculation of the tax due, adjusted by payments made through extensions or estimates, and penalties or interest as applicable. The provision for documenting the termination or structural change of a business further adds to the form’s comprehensive nature. By requiring attachments like Federal Schedules C, D, E, and others, the WCWT-6 form leverages federal tax information to facilitate accurate local tax reporting and compliance, embedding the collaborative essence of federal and municipal tax systems. It stands as a critical tool for both taxpayers and the City of Wilmington, ensuring the precise assessment and collection of net profits tax in adherence to the Earned Income Tax Regulations.

| Question | Answer |

|---|---|

| Form Name | Wcwt 6 Form |

| Form Length | 4 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 1 min |

| Other names | wcwt 1, wilmington net return, wcwt 6 download, wilmington net profits |

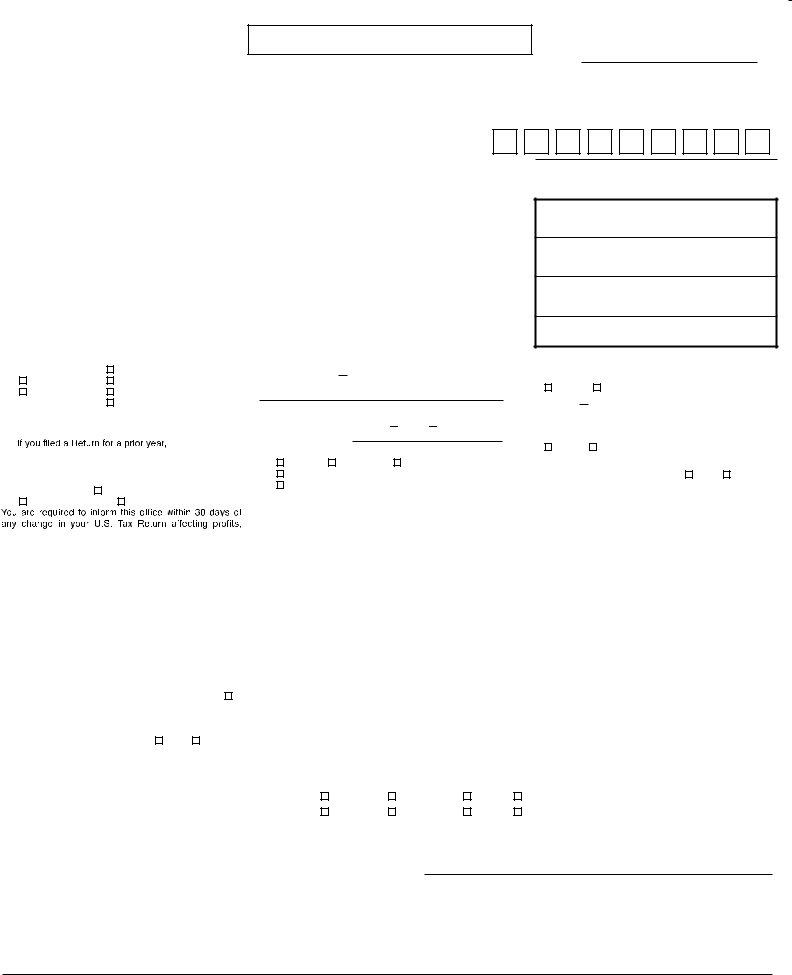

SEE PAGE 4 FOR INSTRUCTIONS

202018 CITY OF WILMINGTON 202018

NET PROFITS TAX RETURN

ACCOUNT NUMBER

. . . . . . . . . . . . . . . . . . . . . . and ending . . . . . . . . . . . . . . . . . . . . . .

1. |

Please check all applicable blocks. |

||||

|

|

|

Individual Owner |

||

|

Resident |

Partnership - In Wilm. |

|||

|

Partnership Outside Wilm. |

||||

|

|

|

Estate or Trust |

||

2. |

Date business started or trust |

||||

|

created |

/in Wilmington |

|||

3. |

|

|

|

|

|

|

what was the latest year? |

|

|||

4.Were any of your prior years’ Federal Income Tax Returns examined and/or changed during 201820

|

Not Examined |

Changed |

Examined but Unchanged |

earnings or expenses. |

|

Federal I.D. # or Soc. Sec. #

QUESTIONS

(Answer fully use extra sheet if necessary)

5.Did you have any employees between Jan. 1, 202018

and December 31, 202018 Yes No If Yes, How Many

6.On which basis are your records kept?

Cash |

Accrual |

Cash and Accrual |

|

Complete Contract |

Combination |

||

Other, (explain) |

|

|

|

7. Do you maintain any bona fide branches or other

businesses? Yes No

If “Yes” attach separate schedule of all locations including names under which operated.

WILM. ACCOUNT NUMBER

(COMPLETE IF LABEL NOT USED)

IF ANY CHANGES IN LABEL

MAKE CORRECTION HERE

8.Did you receive any wages, salary or commission as an employee of ANY business during 201820?

YES NO

If “YES” attach copy of your

9.If answer to question 8 is “Yes” was the City Wage Tax withheld from your pay?

Yes No

10. If answer to question 9 is “No” have you filed

quarterly returns and paid tax? |

Yes |

No |

If “Yes” give account number.

R1. |

TAXABLE PROFIT (loss) FROM BUSINESS OR PROFESSION (From Page 2, Schedule A – Line 6) |

|

R1. |

|

|

|

|

|

|

|

|||||||||||

R2. |

TAXABLE INCOME FROM ALL OTHER SOURCES (From Page 3, Schedule E – Line 15) |

|

R2. |

|

|

|

|

|

|

|

|||||||||||

R3. |

TOTAL AMOUNT ON WHICH TAX IS DUE (Line R1, plus Line R2.) |

|

|

|

|

R3. |

|

|

|

|

|

|

|

||||||||

R4. |

TAX AT 1 1/4% (.0125) |

|

|

|

|

|

|

|

|

|

|

|

|

R4. |

|

|

|

||||

R5. |

|

R5. |

|

|

|

||||||||||||||||

PENALTY: ONE TIME 5% ($5.00 MIN.) AND INTEREST: 1.5% PER MONTH AS OF |

4/15/1821 |

(PLEASE READ BACK PAGE ITEM (1)) |

|

|

|||||||||||||||||

R6. |

LESS: AMOUNTS PAID WITH EXTENSIONS OR ESTIMATES |

|

|

|

|

|

|

|

R6. |

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||||

R7. |

TOTAL DUE |

|

|

|

|

|

|

|

|

|

|

|

|

R7. |

|

|

|

|

|||

R8. |

FOR OVERPAYMENT, PLEASE INDICATE |

REFUND TO ME |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

IF BUSINESS HAS BEEN TERMINATED COMPLETE THIS BLOCK |

|

|

|

|

|

TAX OFFICE USE ONLY |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

Have you terminated your business? Yes |

No |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

If you terminated your business |

|

|

|

NAME |

|

|

|

|

|

|

|

|

|

ENTERED BY |

|

DATE |

|||||

give exact date |

|

|

|

|

ADDRESS |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

If you sold your business (or assets upon liquidation), insert |

|

|

|

|

|

|

|

|

|

|

CHECK NO./DATE |

|

AMOUNT |

||||||||

purchaser ’s name at right; if you effected a change of |

From: |

Individual |

Partnership |

Corp . |

Estate/Trust |

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

business entity during the past year, mark appropriate block. |

To: |

Individual |

Partnership |

Corp . |

Estate/Trust |

|

|

|

|

|

|

|

|||||||||

|

|

COMMENTS |

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

I hereby certify under the penalties provided by law that all statements made herein and/or in any supporting schedule or exhibit are true, correct and complete to the best of my knowledge and belief.

|

|

|

|

Signature and Identification Number of Return Preparer |

|

|

|

DUE |

|

|

|

|

APRIL 15 |

|

|

|

|

20219 |

|

Signature of Taxpayer |

|

Date |

Address of Return Preparer |

|

|

|

20219

year). MAKE CHECK OR MONEY ORDER PAYABLE TO: City of Wilmington, MAIL TO: City of Wilmington, Division of Revenue, 800 French St., Wilmington, DE

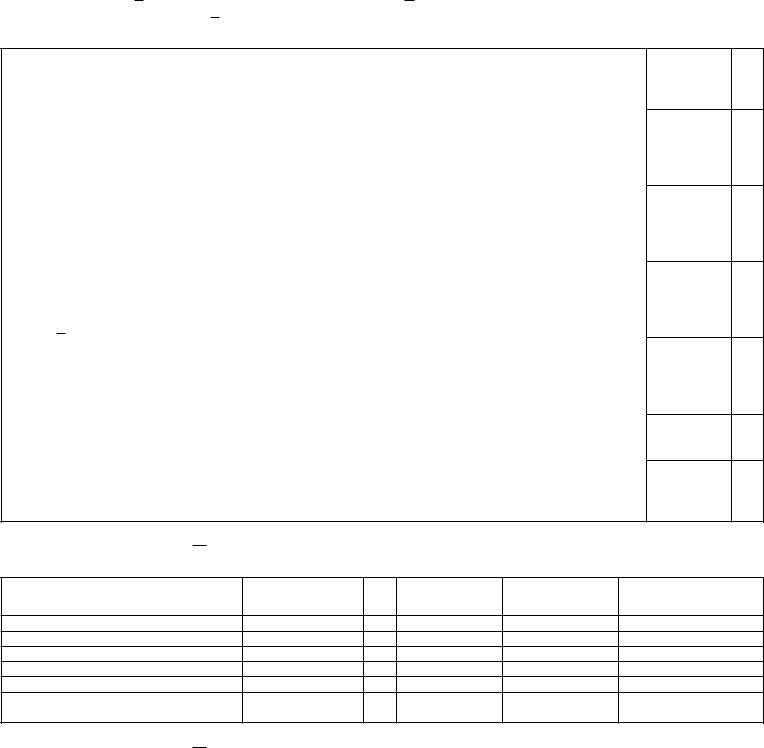

SCHEDULE A

SOLE PROPRIETORSHIP ATTACH COPY OF FEDERAL SCHEDULE C, LLC’S ATTACH APPROPRIATE FEDERAL FORMS & RELATED SCHEDULES

PARTNERSHIPS, JOINT VENTURES, ETC. ATTACH COMPLETE COPY OF FEDERAL FORM 1065 INCLUDING ALL

IMPORTANT If you had more than one business, a separate Schedule A must be completed for each business.

1. PROFIT (or loss) FROM BUSINESS OR PROFESSION . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2. ALLOCATION OF PROFIT OR LOSS ATTRIBUTABLE TO THE CONDUCT OF

BUSINESS INSIDE OF THE CITY BY

3. PROFIT OR LOSS ATTRIBUTED TO WILMINGTON (Line 1 x Line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. ADD DEDUCTION TAKEN FOR DEFERRED INCOME PLANS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. |

ADD |

|

DEDUCTION TAKEN FOR NET PROFITS TAX |

||

|

|

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

||

5A. ADD |

|

GUARANTEED PAYMENTS TO PARTNERS (Partnerships Only) |

|||

|

|

|

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . |

||

6. |

TAXABLE PROFIT (loss) |

|

(Total of Line 3, 4, 5 and 5A.) |

||

|

|||||

|

|

|

ENTER HERE AND ON PAGE 1, LINE |

||

$

$

%

SCHEDULE B RENTAL AND ROYALTY INCOME

ATTACH COPY OF FEDERAL SCHEDULE E

Location of Property

Type of

Property

No.

of

Units

Amount of

Rents

Amount of Expenses

Taxable Profit

Line 7.

Enter here and on Line 10, Scheulde E

$

$

$

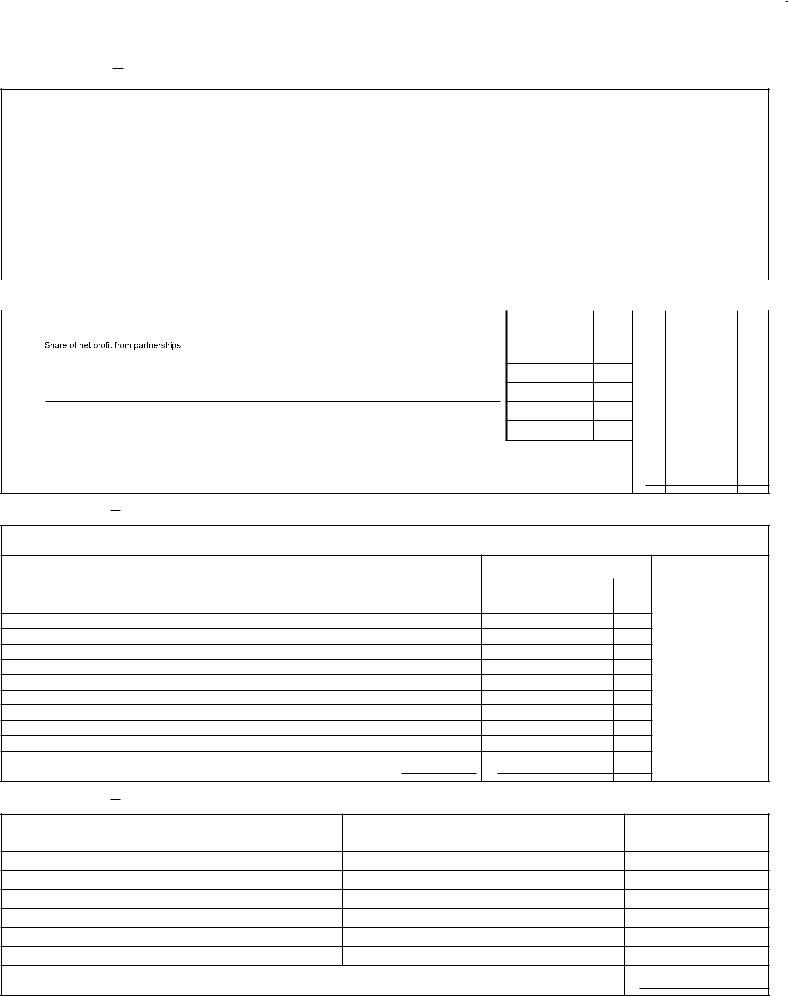

SCHEDULE C INCOME FROM PARTNERSHIPS, ASSOCIATIONS, LLC’S, ETC.

ATTACH COPY OF FEDERAL FORM 1065 OR APPLICABLE SCHEDULE

|

Column 1 |

Column 2 |

|

|

||

|

Your Share of |

Amount on which |

|

|

||

Name and Address of Partnership, Associations, etc. |

Partnership, etc. |

City Tax |

|

|

||

|

profits |

was paid |

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Line 8. Total on which City Tax is Due (Column 1 less Column 2) |

|

|

|

|

$ |

|

Enter here and on Line 11, Schedule E |

|

|

|

|

|

|

. . . . . . . . . . . . . . . . . . |

. . . . . . . |

. . . . . . . . . . . . . . |

. . . . . |

|

|

|

|

|

|

|

|

|

|

SCHEDULE D INCOME FROM SALE OF BUSINESS CAPITAL ASSETS

ATTACH COPY OF FEDERAL SCHEDULE D OR FORM 4797

1. Kind of property (If |

|

|

2. Date |

|

3. Date |

|

|

|

|

6. Expense of sale |

7. Depreciation |

8. Gain or loss |

|||||||

|

acquired |

|

sold |

|

4. Gross Sales |

|

|

|

and cost of |

(column 4 plus |

|||||||||

necessary attach statement |

|

|

5. Cost or |

|

allowed (or |

||||||||||||||

|

|

|

|

|

|

Price (contract |

improvements |

column 7 less the |

|||||||||||

of descriptive details |

|

|

|

|

|

|

|

other basis |

allowable) since |

||||||||||

|

|

|

|

|

|

|

price) |

subsequent to |

sum of columns |

||||||||||

not shown below) |

|

|

|

|

|

|

|

|

|

acquisition |

|||||||||

|

Mo |

Day |

Year |

Mo |

Day |

Year |

|

|

|

|

acquisition |

5 and 6) |

|||||||

|

|

|

|

|

|

|

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Line 9. Net Gain (or loss) from Sale of Business Capital Assets (Reportable at 100%) Enter here and on line 13, Schedule E |

. . . . . . . . . . |

. . . |

. . . |

$ |

|

||||||||||||||

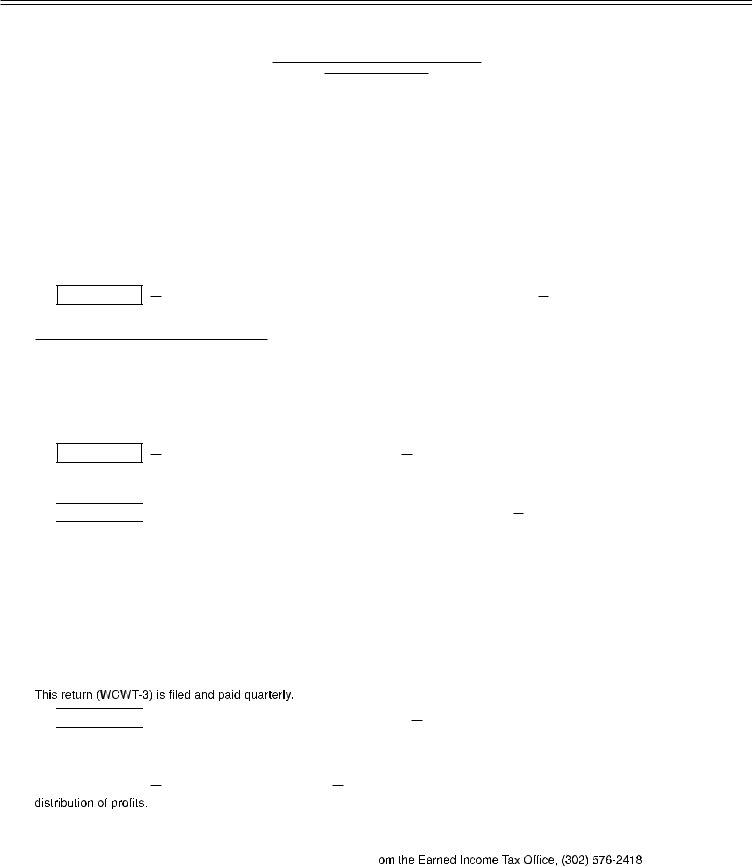

SCHEDULE E |

|

TAXABLE INCOME FROM ALL OTHER SOURCES |

|

|

|

|

|

||||||||||||

|

|

|

|

|

|

||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Line 10. |

|

|

|

|

|

dule B) |

. . . . . . . . . |

. . . . . |

. . . . . |

|

|

|

|

|

|

|

|||

11.

associations, etc. (from line 8, Schedule C) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12. Income from estate or trust (State name and address of trust, etc.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13. Net Gain (or loss) from Sale of Business Capital Assets (Reportable at 100%) (from line 9, Schedule D) . . . . . . . . . . . . . . .

14. Other Sources, (state nature) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(Note: Do not include in this Schedule income from salaries, wages, commissions, etc., but enter on Schedule F.

15. TAXABLE INCOME FROM ALL OTHER SOURCES (total of lines 10 through 14) Enter here & on page 1, line

$

SCHEDULE EF EXPLANATION OF UNREPORTED INCOME

ITEMIZE BELOW ALL ITEMS OF INCOME WHICH YOU REPORTED AS TAXABLE ON YOUR FEDERAL

INCOME TAX RETURN BUT WHICH YOU DID NOT REPORT AS TAXABLE ON THIS RETURN

DESCRIPTION AND EXPLANATION |

AMOUNT |

CITY TAX WITHHELD |

|

|

|

Compensation on which City Tax was paid or withheld (Attach |

$ |

|

Other (specify) |

|

|

TOTAL

$

SCHEDULE G DISTRIBUTION OF PROFITS FROM PARTNERSHIPS, ASSOCIATIONS, LLC’S, ETC.

NAMES OF PARTNERS OR STOCKHOLDERS

ADDRESSES

DISTRIBUTIVE

SHARES OF

PROFITS

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

202018 CITY OF WILMINGTON 202018 NET PROFITS TAX RETURN FORM:

PLEASE NOTE THE FOLLOWING:

(1) |

2021,9 |

The

prescribed in Section 601a of the Earned Income Tax Regulations.

(2)

220 EARNED INCOME REGULATIONS (REV. 3/05) FOR ADDITIONAL INFORMATION.

(3)

(4)The Tax Rate is 1 1/4% (.0125).

(6)SPECIFIC INSTRUCTIONS:

TAXABLE PROFIT (or loss) FROM BUSINESS OR PROFESSION all returns must have a copy of the

FEDERAL SCHEDULE C, OR FEDERAL PARTNERSHIP RETURN (1065) ATTACHED, OR APPROPRIATE FEDERAL RETURNS OR APPLICABLE SCHEDULES FOR LLC’S.

deductions taken for deferred income such as Keogh Plans, enter on Line 4, Partnerships must add back all guaranteed payments to parters on line 5A.

222 EARNED INCOME TAX REGULATIONS (REV. 3/05) FOR ALLOCATION INFORMATION.

INCOME FROM RENTS OR ROYALTIES attach a copy of the FEDERAL SCHEDULE E and enter on

SCHEDULE B, Line 7. All income from rental property and the number of rental units must be reported by all resident individuals and/or resident businesses.

INCOME FROM PARTNERSHIPS, LLC’S, ASSOCIATIONS, ETC. all entries must be accompanied by a copy of the FEDERAL PARTNERSHIP RETURN (1065) or an applicable schedule and for LLC’s attach appropriate federal return or

applicable schedules. |

|

|

|

|

|

|

|||

|

|

|

|

INCOME FROM SALE OF BUSINESS CAPITAL ASSETS |

|

|

all gains or losses from the sales of business assets |

||

|

SCHEDULE D |

|

|

|

|

||||

|

|

|

|

||||||

must be accompanied by a copy of the Federal SCHEDULE D or FEDERAL FORM 4797. |

|||||||||

|

All income or losses must be reported at 100% in the year transaction occurs. |

||||||||

|

|

|

TAXABLE INCOME FROM ALL OTHER SOURCES |

|

|

all taxable income from OTHER SOURCES must be |

|||

|

SCHEDULE E |

|

|

|

|

||||

|

|

|

|

||||||

listed. All wages, salaries and commissions must be reported on SCHEDULE F.

EMPLOYEE’S TAX RETURN

EXPLANATION OF UNREPORTED INCOME report any items of income which you reported as taxable on your Federal Income Tax Return but which you did not report as taxable on this return.

All compensation on which city tax was paid or withheld should be entered and a copy of the

DISTRIBUTION OF PROFITS all partnerships, LLC’S, associations and/or joint ventures must show the

the funds of the partnerships and LLC’S is taxable.

Web address: www.wilmingtonde.gov