Dealing with PDF files online is certainly simple with this PDF tool. You can fill out authorizing here without trouble. To retain our editor on the cutting edge of convenience, we strive to put into practice user-driven features and improvements on a regular basis. We are always thankful for any suggestions - help us with revampimg how you work with PDF docs. To get the process started, go through these simple steps:

Step 1: Open the PDF file inside our editor by clicking on the "Get Form Button" at the top of this page.

Step 2: With our online PDF file editor, you'll be able to accomplish more than just fill out forms. Edit away and make your forms seem high-quality with custom textual content added in, or modify the file's original content to excellence - all that accompanied by an ability to incorporate your own graphics and sign the file off.

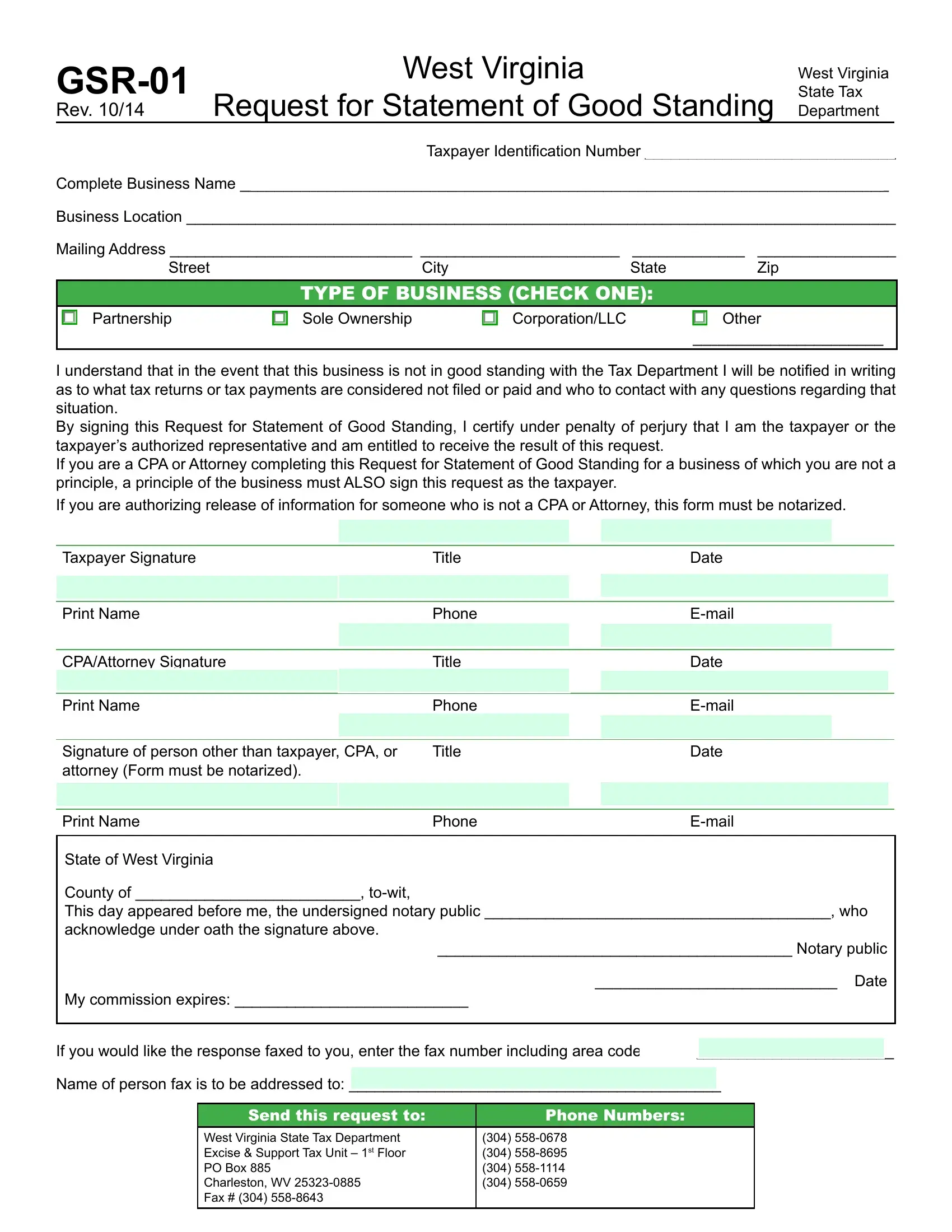

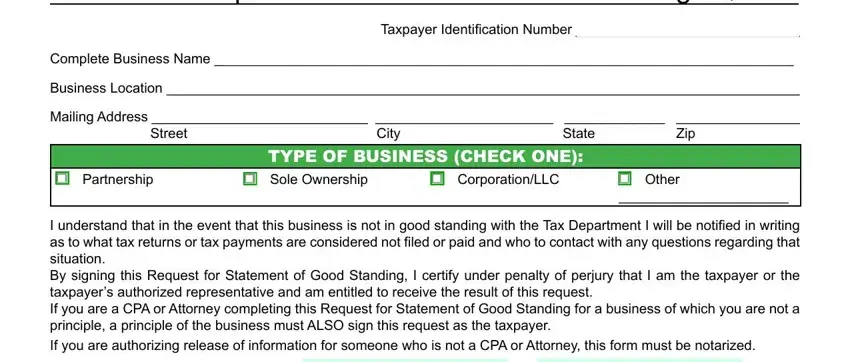

Filling out this document requires thoroughness. Make sure that each and every blank field is completed correctly.

1. Begin completing your authorizing with a selection of necessary blank fields. Gather all of the important information and be sure there is nothing forgotten!

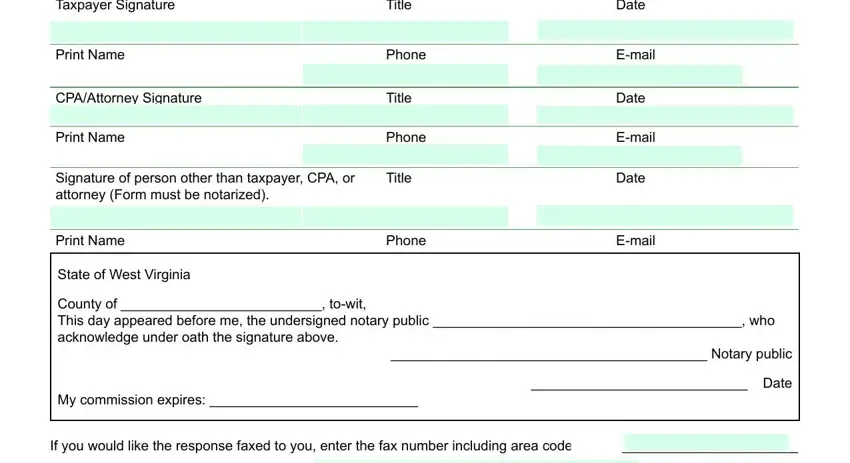

2. Once your current task is complete, take the next step – fill out all of these fields - Taxpayer Signature, Print Name, CPAAttorney Signature, Print Name, Signature of person other than, Print Name, State of West Virginia, Title, Phone, Title, Phone, Title, Phone, Date, and Email with their corresponding information. Make sure to double check that everything has been entered correctly before continuing!

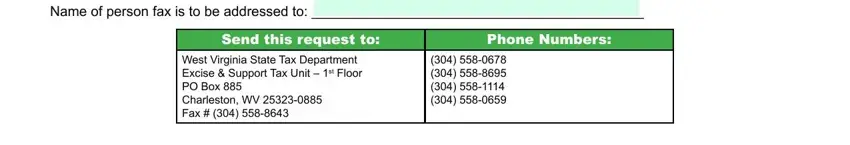

3. Completing Name of person fax is to be, send this request to, phone numbers, and West Virginia State Tax Department is essential for the next step, make sure to fill them out in their entirety. Don't miss any details!

Be really mindful while filling in phone numbers and Name of person fax is to be, since this is the part in which many people make mistakes.

Step 3: Ensure that your information is accurate and press "Done" to continue further. Join FormsPal today and easily gain access to authorizing, all set for downloading. Each and every edit you make is conveniently saved , meaning you can customize the pdf later on when required. When using FormsPal, you're able to fill out forms without having to be concerned about personal information breaches or entries being shared. Our secure software makes sure that your private information is stored safely.