POA can be filled out online in no time. Just open FormsPal PDF editing tool to get the job done in a timely fashion. FormsPal is devoted to giving you the ideal experience with our editor by consistently introducing new features and improvements. Our tool has become even more useful as the result of the newest updates! Now, editing PDF files is a lot easier and faster than ever before. By taking several easy steps, you are able to begin your PDF journey:

Step 1: Access the PDF inside our tool by pressing the "Get Form Button" in the top section of this page.

Step 2: Using this handy PDF editing tool, you are able to do more than just fill in blank fields. Edit away and make your forms seem perfect with custom textual content put in, or optimize the original content to excellence - all that comes with an ability to insert stunning photos and sign it off.

When it comes to fields of this specific document, this is what you need to do:

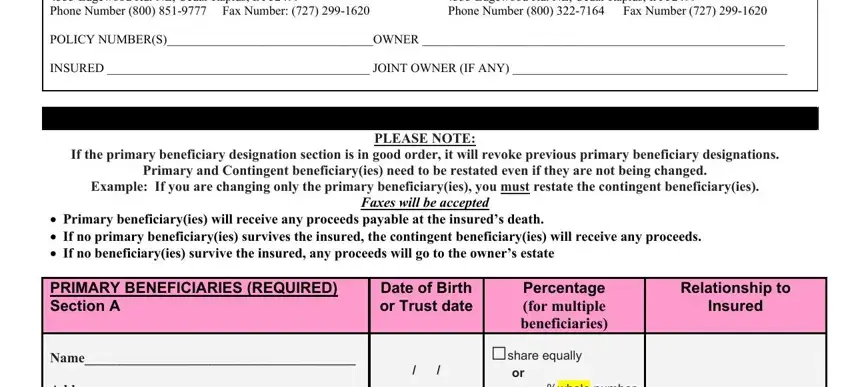

1. Fill out the POA with a selection of major fields. Note all of the information you need and ensure absolutely nothing is forgotten!

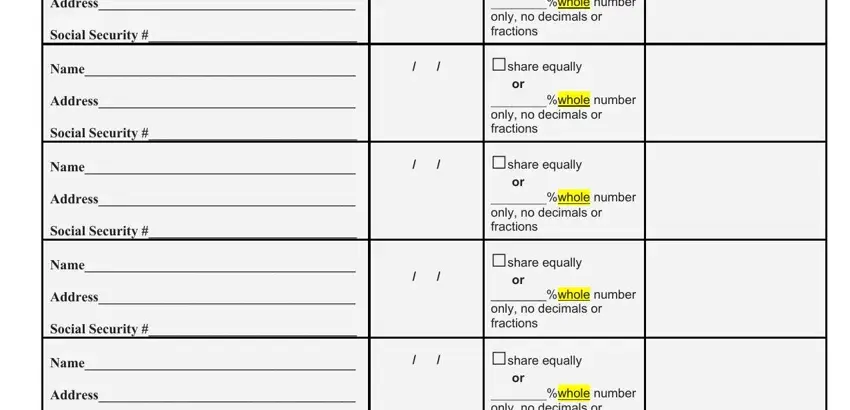

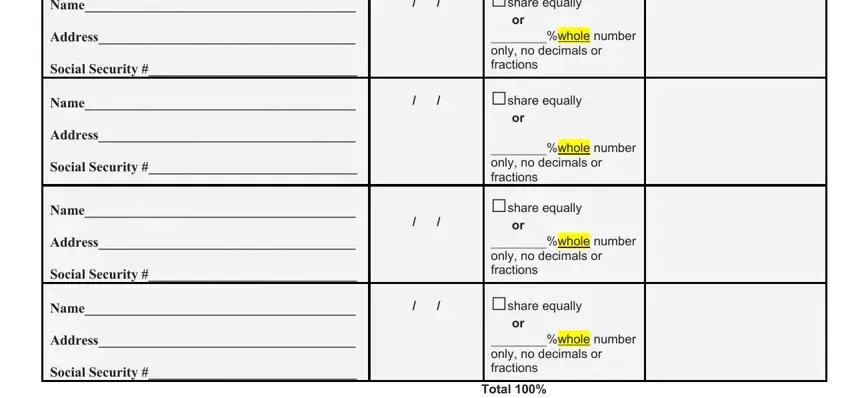

2. When this section is completed, go to type in the applicable details in all these: Name Address Social Security Name, or whole number only no decimals, share equally, or whole number only no decimals, share equally, or whole number only no decimals, share equally, or whole number only no decimals, share equally, and or whole number only no decimals.

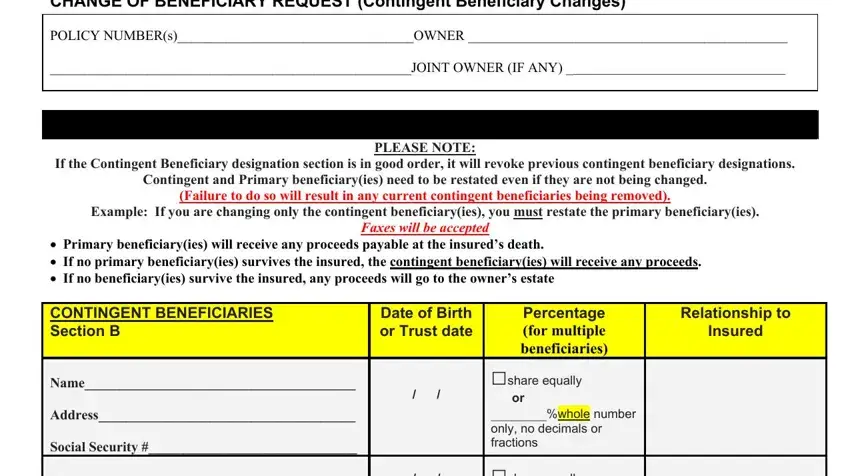

3. This next stage is straightforward - fill in all the fields in CHANGE OF BENEFICIARY REQUEST, PLEASE NOTE, If the Contingent Beneficiary, Contingent and Primary, Failure to do so will result in, Example If you are changing only, Primary beneficiaryies will, Faxes will be accepted, CONTINGENT BENEFICIARIES Section B, Date of Birth or Trust date, Relationship to, Insured, Percentage for multiple, share equally, and or whole number only no decimals to finish the current step.

4. Completing share equally, or whole number only no decimals, share equally, or whole number only no decimals, share equally, or whole number only no decimals, share equally, or whole number only no decimals, Name Address Social Security Name, Name Address Social Security Name, and Total is crucial in this part - ensure that you don't hurry and fill out every single blank!

As for Name Address Social Security Name and share equally, ensure you review things in this current part. Both of these could be the most significant ones in this PDF.

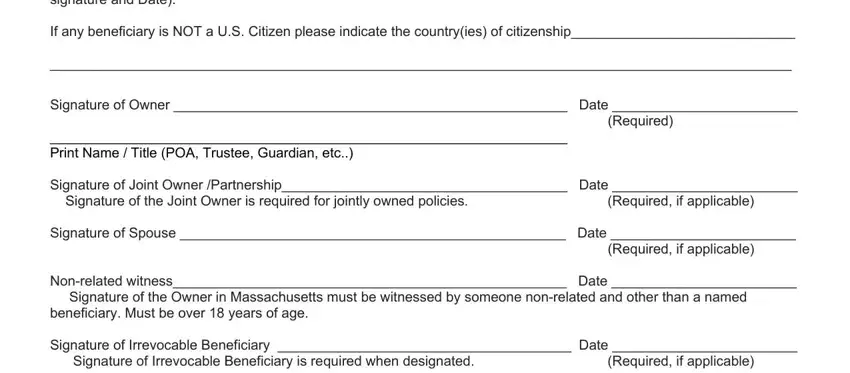

5. The last step to complete this PDF form is crucial. You need to fill in the required blanks, such as Revocable Beneficiary The owner, Required if applicable, Required if applicable, Required if applicable, and Required, before finalizing. Otherwise, it may give you an unfinished and potentially nonvalid paper!

Step 3: When you've reviewed the details in the blanks, just click "Done" to finalize your FormsPal process. Download the POA once you sign up for a free trial. Readily use the pdf file in your personal account, with any modifications and adjustments conveniently preserved! When you use FormsPal, you can certainly fill out documents without having to get worried about data incidents or data entries getting shared. Our secure software helps to ensure that your personal details are maintained safe.