Working with PDF files online is certainly very easy with our PDF editor. You can fill out Wh 1 Form here effortlessly. To have our editor on the forefront of convenience, we work to put into operation user-driven capabilities and improvements regularly. We are always looking for suggestions - play a pivotal part in reshaping PDF editing. It merely requires a couple of simple steps:

Step 1: Click the orange "Get Form" button above. It is going to open our pdf tool so you can begin filling in your form.

Step 2: With this advanced PDF file editor, you may do more than just fill out blanks. Express yourself and make your docs look professional with custom text added in, or optimize the file's original input to perfection - all comes with the capability to insert stunning graphics and sign the document off.

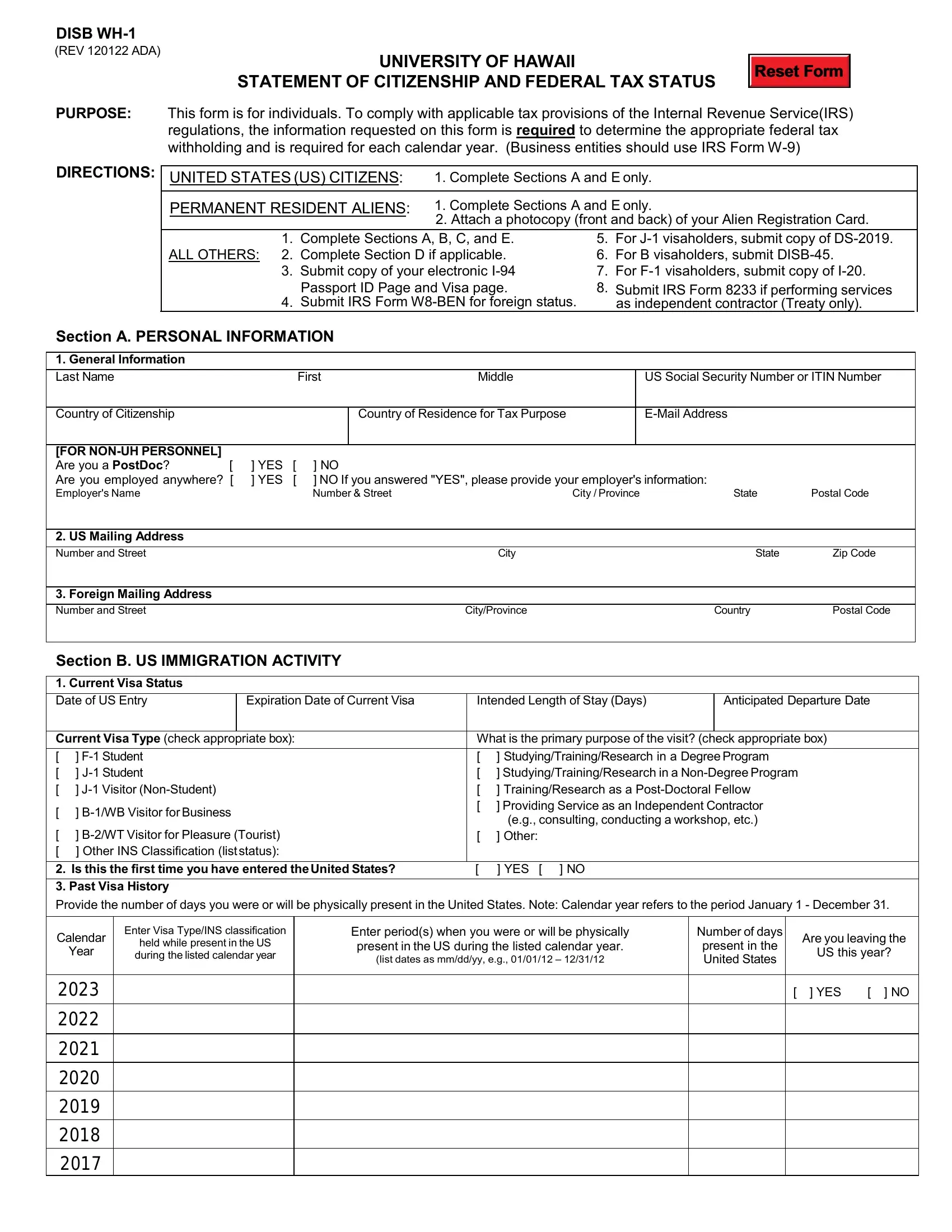

This PDF requires particular details to be filled in, thus you should definitely take the time to provide exactly what is asked:

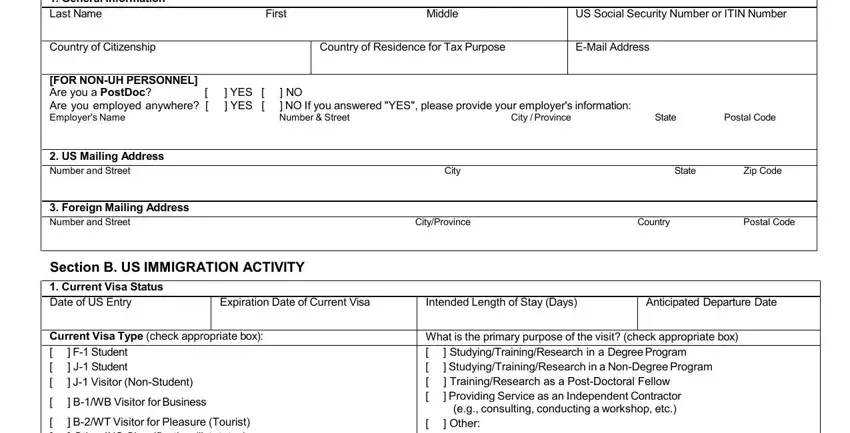

1. Start filling out your Wh 1 Form with a group of essential blanks. Collect all of the important information and ensure there's nothing neglected!

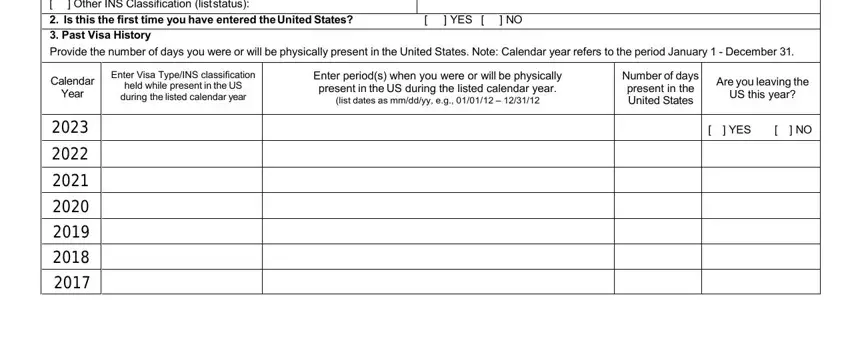

2. Soon after the last selection of fields is completed, go on to type in the relevant information in all these - BWT Visitor for Pleasure Tourist, Is this the first time you have, YES, Provide the number of days you, Calendar, Year, Enter Visa TypeINS classification, held while present in the US, Enter periods when you were or, list dates as mmddyy eg, Number of days present in the, Are you leaving the, US this year, and YES.

Always be very mindful while completing Are you leaving the and Enter Visa TypeINS classification, as this is where a lot of people make some mistakes.

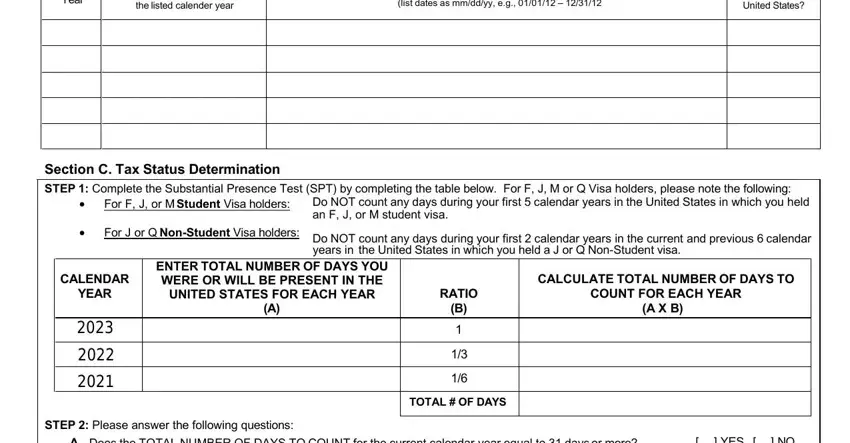

3. The following section should also be relatively straightforward, Year, Enter Visa TypeINS classification, the listed calender year, list dates as mmddyy eg, Number of days present in the, Section C Tax Status Determination, STEP Complete the Substantial, For F J or M Student Visa holders, Do NOT count any days during your, For J or Q NonStudent Visa holders, Do NOT count any days during your, CALENDAR, YEAR, ENTER TOTAL NUMBER OF DAYS YOU, and UNITED STATES FOR EACH YEAR - each one of these form fields will need to be completed here.

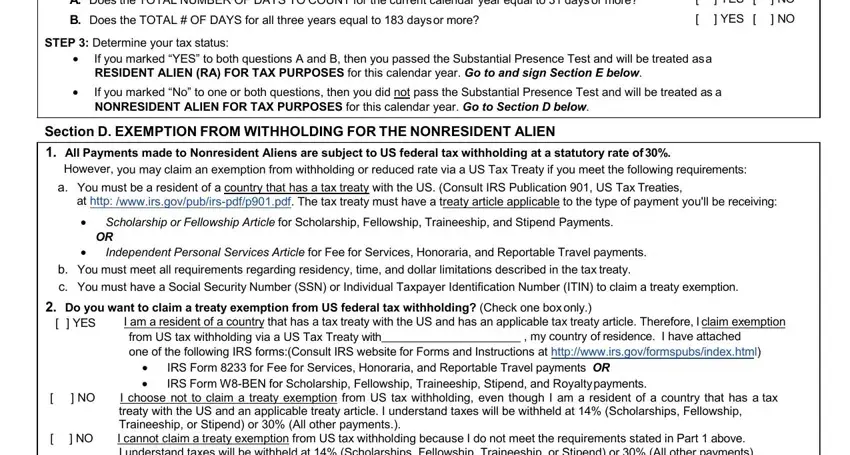

4. This next section requires some additional information. Ensure you complete all the necessary fields - A Does the TOTAL NUMBER OF DAYS TO, B Does the TOTAL OF DAYS for all, YES, YES, STEP Determine your tax status, If you marked YES to both, If you marked No to one or both, Section D EXEMPTION FROM, All Payments made to Nonresident, However you may claim an exemption, a You must be a resident of a, at http wwwirsgovpubirspdfppdf The, Scholarship or Fellowship Article, Independent Personal Services, and b You must meet all requirements - to proceed further in your process!

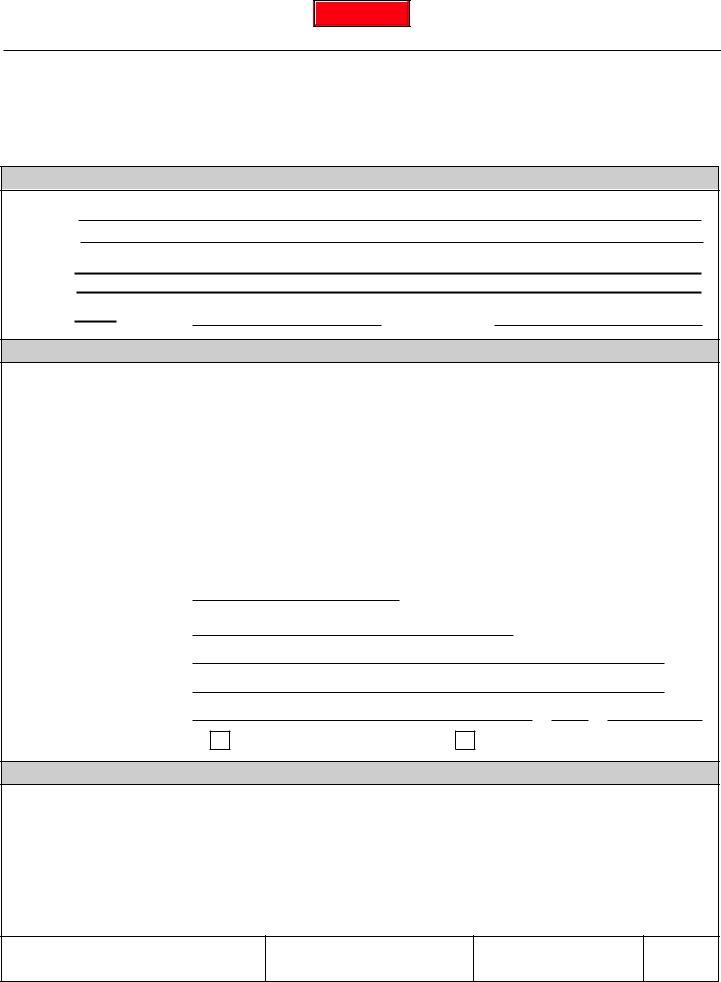

5. Because you come near to the end of your document, there are actually a few more things to do. Notably, Under penalties of perjury I, Signature, and Date must all be filled out.

Step 3: Before finalizing your document, you should make sure that form fields are filled out as intended. The moment you establish that it's good, press “Done." Acquire your Wh 1 Form when you sign up at FormsPal for a free trial. Quickly get access to the form from your FormsPal account, together with any edits and adjustments all preserved! When using FormsPal, you can certainly fill out documents without having to get worried about database incidents or entries being shared. Our protected system ensures that your personal data is stored safely.