Using PDF files online is surprisingly easy with this PDF tool. You can fill out wi 1952 here with no trouble. Our editor is continually evolving to provide the very best user experience possible, and that's thanks to our resolve for continuous enhancement and listening closely to customer comments. With some simple steps, it is possible to begin your PDF editing:

Step 1: Open the PDF doc inside our editor by pressing the "Get Form Button" in the top area of this page.

Step 2: This editor offers the capability to customize your PDF document in various ways. Change it by writing your own text, correct original content, and put in a signature - all at your disposal!

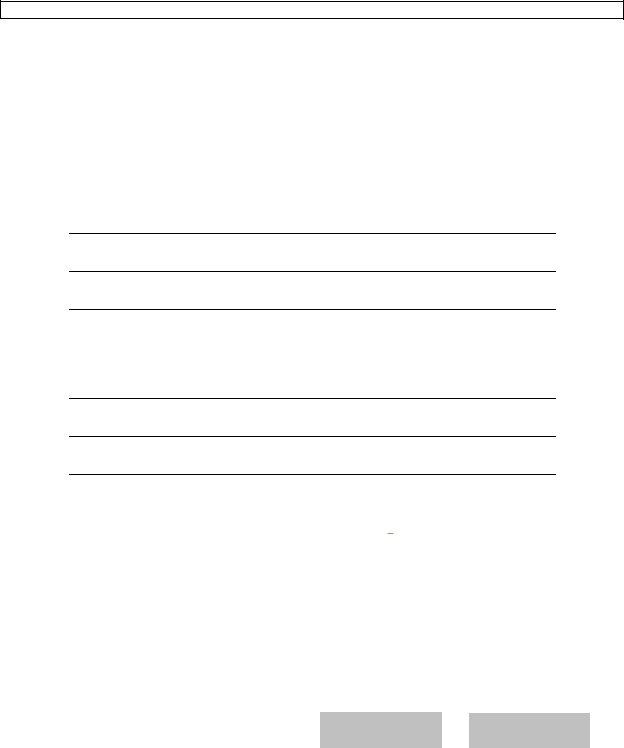

This form will need particular information to be typed in, thus you must take whatever time to enter precisely what is requested:

1. Start completing the wi 1952 with a selection of necessary blanks. Note all the required information and make certain absolutely nothing is omitted!

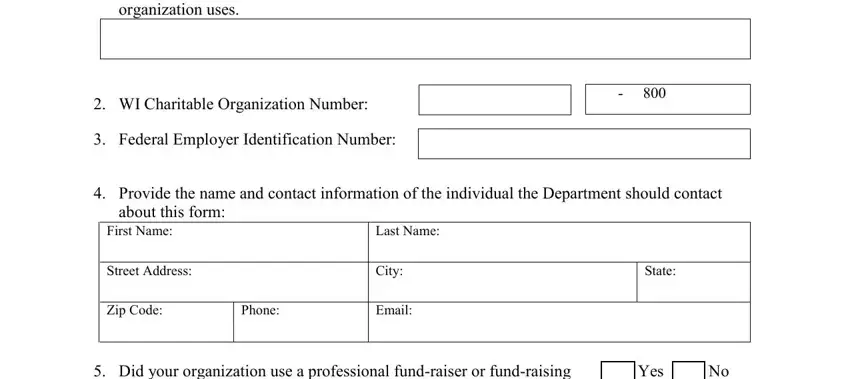

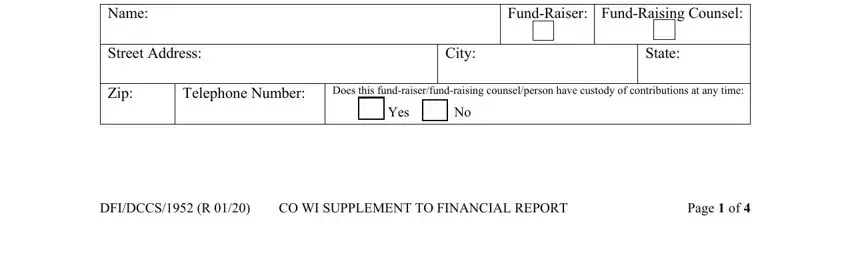

2. Immediately after the first array of blanks is done, go to enter the suitable information in all these: counsel during the fiscal year in, Name, Street Address, FundRaiser FundRaising Counsel, City, State, Zip, Telephone Number, Does this fundraiserfundraising, DFIDCCS R CO WI SUPPLEMENT TO, and Page of.

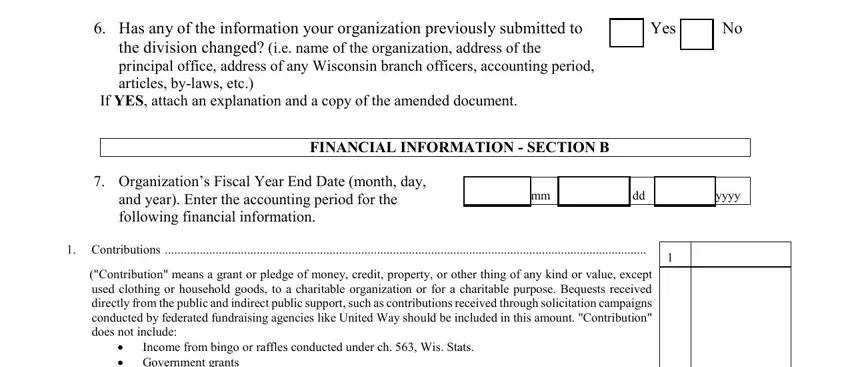

3. Throughout this step, check out Has any of the information your, Yes No, the division changed ie name of, If YES attach an explanation and a, FINANCIAL INFORMATION SECTION B, Organizations Fiscal Year End, and year Enter the accounting, yyyy, Contributions, Contribution means a grant or, Income from bingo or raffles, and Government grants Bona fide. Every one of these are required to be filled in with greatest precision.

Always be really careful when filling out FINANCIAL INFORMATION SECTION B and Government grants Bona fide, as this is where many people make errors.

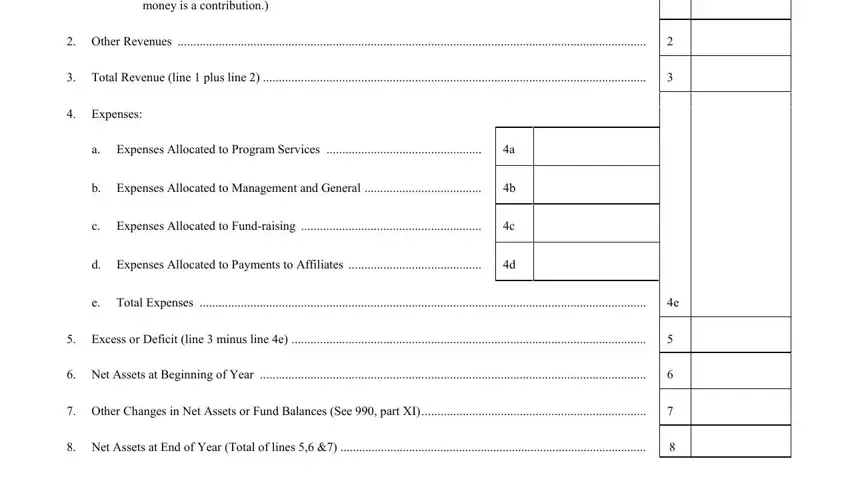

4. This next section requires some additional information. Ensure you complete all the necessary fields - Government grants Bona fide, Other Revenues, Total Revenue line plus line, Expenses, a Expenses Allocated to Program, b Expenses Allocated to Management, c Expenses Allocated to, d Expenses Allocated to Payments, e Total Expenses, Excess or Deficit line minus, Net Assets at Beginning of Year, Other Changes in Net Assets or, and Net Assets at End of Year Total - to proceed further in your process!

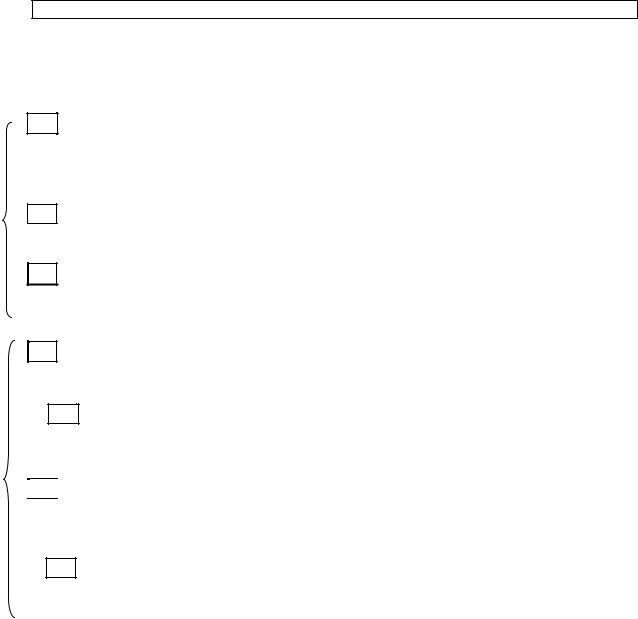

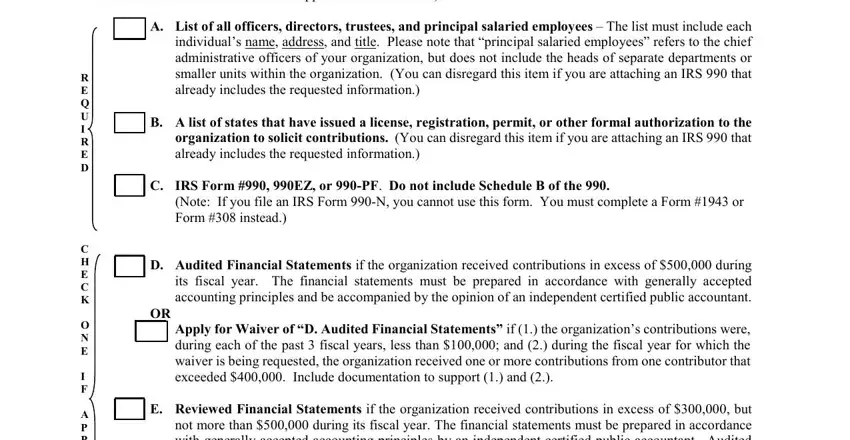

5. The document must be completed by going through this area. Below there can be found a comprehensive list of blanks that require specific details in order for your document usage to be accomplished: Check the box next to the items, R E Q U I R E D, C H E C K O N E I F A P P L I C A, A List of all officers directors, B A list of states that have, C IRS Form EZ or PF Do not, Note If you file an IRS Form N you, D Audited Financial Statements if, Apply for Waiver of D Audited, and E Reviewed Financial Statements if.

Step 3: Right after you have reviewed the details you given, simply click "Done" to conclude your FormsPal process. Right after creating afree trial account here, it will be possible to download wi 1952 or email it right off. The PDF document will also be accessible from your personal account menu with your each change. We don't share the information that you enter whenever completing forms at our website.