The Form 2 Wisconsin 1997 Fiduciary Income Tax Return serves as a critical document for trusts and estates navigating post-decedent financial responsibilities within the state's tax framework. Broadly, this form encapsulates the process of reporting income, calculating taxable amounts, and determining the fiduciary's tax liability or refund eligibility for estates or trusts for the year 1997 or other taxable periods beginning in that year. Detailing the essential elements, such as the decedent's Social Security number, trust's federal ID number, personal representative or trustee details, and specific financial entries including federal taxable income, adjustments, exemptions, and credits, the form stands as a comprehensive tool for financial accountability. Moreover, it delves into specific schedules for modifications, adjustments due to differences in Wisconsin and federal tax bases, and other critical tax considerations like alternative minimum tax and recycling surcharge, which underscore the nuanced nature of fiduciary tax obligations. Significantly, the form also addresses procedural components for seeking a closing certificate, which marks the formal conclusion of fiscal duties for estates and trusts, outlining necessary documentation and procedural steps. Thus, Form 2 Wisconsin epitomizes a vital process in ensuring fiduciary compliance with state tax laws, illustrating the intersection of legal duty and financial transparency.

| Question | Answer |

|---|---|

| Form Name | Wisconsin Form 2 |

| Form Length | 2 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 30 sec |

| Other names | fillable wisconsin form 2, wisconsin form 2 2020, wi form 2 instructions, wisconsin dept of revenue |

or type

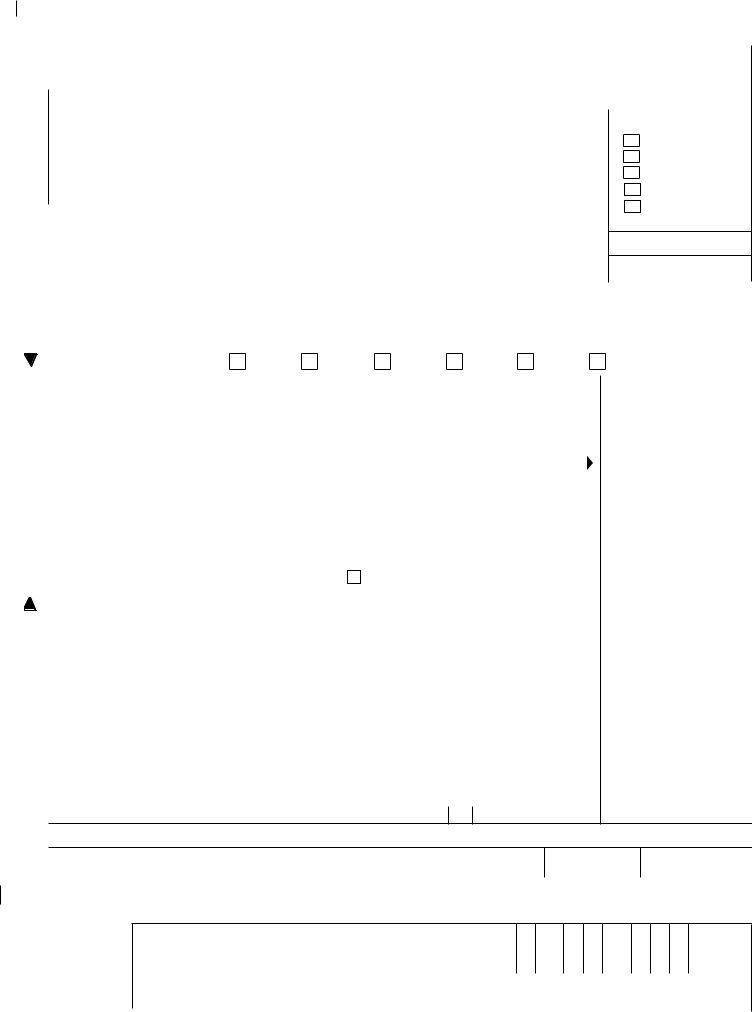

FORM |

2 |

|

WISCONSIN |

1997 |

||||

|

|

|

|

|

||||

|

|

|

|

FIDUCIARY INCOME TAX RETURN (For Estates or Trusts) |

|

|||

|

|

|

|

For 1997 or taxable year beginning __________________ , 1997, and ending ____________________ |

|

|||

|

|

|

|

|

|

|

|

|

Estate only - Last name |

|

|

First name and middle initial |

Decedent’s social security number |

Trust’s federal ID number (EIN) |

|||

|

|

|

|

|

|

|

|

|

Trusts only - Name |

|

|

|

|

If name change, state previous name |

|

||

|

|

|

|

|

|

|

|

|

Please print

Name and address of personal representative, petitioner, or trustee

Address where decedent lived at time of death |

Spouse’s first name |

|

|

Date trust or bankruptcy estate was created or date of decedent’s death ___________________

Is this the first return of the estate or trust? |

|

Yes |

|

No |

Age of decedent |

|

|

|

|

||||

|

|

|

|

|

|

|

Is this the final return of the estate or trust? |

|

Yes |

|

No |

|

|

|

|

|

|

|

|

|

Are you requesting a closing certificate at this time? |

|

Yes |

|

No |

If yes, see instructions. |

|

The closing certificate will be mailed to the address below. |

|

|

|

|

|

|

Check whether: Decedent's estate

Bankruptcy estate

Testamentary trust

Inter vivos trust

Electing small business trust

County of Jurisdiction

Probate Case Number

Name of individual/firm |

Attention or c/o |

|

|

|

|

|

|

Address |

City |

State |

Zip code |

|

|

|

|

Attach check or money order here

FOR DEPT USE ONLY |

2OP |

2CL |

7AU |

8AU |

|

|

9OP |

9CL |

|

HOLD FOR |

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

1. |

Federal taxable income of fiduciary (from attached federal Form 1041, line 23) |

. . . . . |

. . . . . . . . . |

. |

|

1 |

|

. |

|||||||||

2. |

Additions (from Schedule A, column 2, line 6) . . . . |

. . . . . . |

. . . . |

. . . . . |

. . . . |

. . . . . . . . |

. . . . . . . . . |

. |

|

2 |

|

. |

|||||

3. |

Add lines 1 and 2 . . . . |

. . . . . . . . . . . . . . . . . . . . . . |

. . . . . . |

. . . . |

. . . . . |

. . . . |

. . . . . . . . |

. . . . . . . . . |

. |

|

3 |

|

. |

||||

4. |

Subtractions (from Schedule A, column 2, line 12) |

. . . . . . |

. . . . |

. . . . . |

. . . . |

. . . . . . . . |

. . . . . . . . . |

. |

|

4 |

|

. |

|||||

5. |

Wisconsin taxable income of fiduciary (subtract line 4 from line 3) |

. . . . . . . . |

. . . . . . . . . |

. |

|

5 |

|

. |

|||||||||

6. |

. . . . . . . . . . . . . . .Gross tax (see instructions on page 4) |

. . . . |

. . . . . |

. . . . |

. . . . . . . . |

. . . . . . . . . |

. |

|

6 |

|

. |

||||||

7. |

Exemption/Historic credits (see instructions) |

. . . . . . |

. . . . |

. . . . . |

. . . . |

. . . . . . . . |

. . . . . . . . . |

. |

|

7 |

|

. |

|||||

8. |

Subtract line 7 from line 6. If line 7 is larger than line 6, fill in zero (0) . |

. . . . |

. . . . . . . . |

. . . . . . . . . |

. |

|

8 |

|

. |

||||||||

9. |

Alternative minimum tax. Fill in alternative minimum tax from line 18 Schedule MT . . |

. . . . . . . . . |

. |

|

9 |

|

. |

||||||||||

10. |

Add lines 8 and 9 . . . . |

. . . . . . . . . . . . . . . . . . . . . . |

. . . . . . |

. . . . |

. . . . . |

. . . . |

. . . . . . . . |

. . . . . . . . . |

. |

|

10 |

|

. |

||||

11. |

Development zone credits (attach Schedule DC) . . |

. . . . . . |

. . . . |

. . . . . |

. . . . |

. . . . . . . . |

. . . . . . . . . |

. |

|

11 |

|

. |

|||||

12. |

Subtract line 11 from line 10. If Line 11 is larger than Line 10, fill in zero (0) |

. . . . . . . . |

. . . . . . . . . |

. |

|

12 |

|

. |

|||||||||

13. |

Temporary recycling surcharge (see instructions) |

Check if surcharge computed on worksheet. |

|

|

|

||||||||||||

|

If worksheet not used, fill in nonfarm net business income . . . . |

. . |

|

|

|

. |

x .004345 = |

13 |

|

. |

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

14. |

Add lines 12 and 13. . . |

. . . . . . . . . . . |

. . . . |

. . . . . . . . . . . . . . . . . . . . |

. . |

. . . . |

. . |

. . . . . . . . . . . . . . . |

. |

14 |

|

. |

|||||

15. |

Wisconsin income tax withheld (attach withholding statement) |

15 |

|

|

. |

|

|

|

|

|

|||||||

16. |

1997 estimated payments and amount applied from 1996 return . . . |

16 |

|

|

. |

|

|

|

|

|

|||||||

17. |

Farmland preservation credit (attach Schedule FC) |

. . . . . . |

. . . . |

. . . . |

17 |

|

|

. |

|

|

|

|

|

||||

18. |

Net income tax paid to other states (see instructions) |

. . . . |

18 |

|

|

. |

|

|

|

|

|

||||||

19. |

Farmland tax relief credit: Farmland taxes |

|

|

X |

.10 = |

19 |

|

|

. |

|

|

|

|

|

|||

20. |

AMENDED RETURN ONLY — amount paid with original return |

. . . . 1 |

20 |

|

|

. |

|

|

|

|

|

||||||

21. |

. . . . . . . . . . . . . . . . . . . .Total lines 15 through 20 |

. . . . . . |

. . . . |

. . . . |

21 |

|

|

. |

|

|

|

|

|

||||

22. |

AMENDED RETURN ONLY — refund from original return less |

|

|

|

|

|

|

|

|

|

|

|

|||||

|

amount applied to 1998 estimated tax |

. . . . . . . . . . |

. . . . . . |

. . . . |

. . . .2 |

22 |

( |

|

. |

|

) |

|

|

|

|||

23. |

Subtract line 22 from line 21 |

. . . . . . |

. . . . |

. . . . . |

. . . . |

. . . . . . . . |

. . . . . . . . . |

. |

|

23 |

|

. |

|||||

24. |

If line 23 is larger than line 14, enter |

. . . . . . |

. . . . |

. . . . . |

. . . . |

. . . . . . . . |

. REFUND |

|

24 |

|

. |

||||||

25. |

If line 23 is less than line 14, enter |

. . . . . . |

. . . . |

. . . . . |

. . . . |

. . . |

. BALANCE DUE |

|

25 |

|

. |

||||||

26. |

Amount of line 24 to be applied to your 1998 ESTIMATED TAX |

. . . . |

26 |

|

|

. |

|

|

|

|

|

||||||

I, as fiduciary, declare under penalties of law that I have examined this return (including accompanying schedules, statements, and copy of federal income tax return) and to the best of my knowledge and belief it is true, correct and complete.

Signature of fiduciary or trust officer |

Date |

Telephone number |

|

|

( |

) |

|

|

|

|

PERSON PREPARING THE RETURN (individual and firm) if other than the preceding signer |

|

|

|

Name of preparer other than fiduciary |

Signature of preparer |

Date |

|

|

|

|

|

Mail this return to: Wisconsin Dept. of Revenue

P.O. Box 8904 Madison, WI

R M O N Y R T

M A N D

A

P C

Form 2 (1997)Page 2

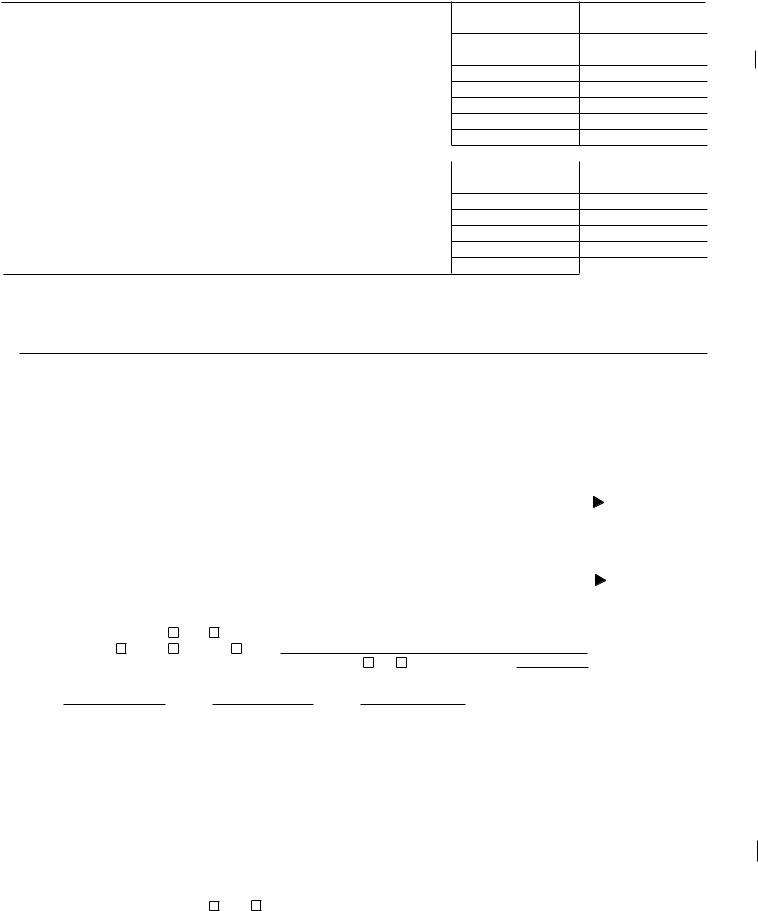

SCHEDULE A — MODIFICATIONS AND ADJUSTMENTS |

COL. 1 |

COL. 2 |

|

ADDITIONS: |

Distributable Income |

||

1. |

Adjustment to convert 1997 federal taxable income to the level allowable under |

|

|

|

the Internal Revenue Code in effect on August 5, 1997 (Schedule B) |

|

. |

2. |

Interest (less related expenses) on state and municipal obligations |

. |

. |

3. |

State and local taxes (see instructions) |

. |

. |

4. |

Capital gain/loss adjustment (see instructions) |

. |

. |

5. |

Other (specify) |

. |

. |

6. |

Total additions (add lines 1 through 5) |

. |

. |

SUBTRACTIONS: |

|

|

|

7. |

Adjustment to convert 1997 federal taxable income to the level allowable under |

|

|

|

|

||

|

the Internal Revenue Code in effect on August 5, 1997 (Schedule B) |

|

. |

8. |

Interest (less related expenses) on obligations of the United States |

. |

. |

9. |

Capital gain/loss adjustment (see instructions) |

|

. |

. . . . . . . . . . . . . . . . . . .10. State and local income tax refunds (see instructions) |

. |

. |

|

11. |

Other (specify) |

. |

. |

12. Total subtractions (add lines 7 through 11) |

. |

. |

|

SCHEDULE B — ADJUSTMENTS TO CONVERT 1997 FEDERAL TAXABLE INCOME TO THE LEVEL ALLOWABLE UNDER THE INTERNAL REVENUE CODE IN EFFECT ON AUGUST 5, 1997 (see instructions on page 11)

|

|

|

|

|

|

|

Adjustments for 1997 |

|||||

1 NATURE OF |

|

|

|

|

|

|

|

|

||||

|

Distributable |

|

|

|||||||||

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

TOTAL |

(If total increases federal taxable income, enter on Schedule A, line 1) |

|

|

|

|

|

|

|

|

||

(If total decreases federal taxable income, enter on Schedule A, line 7) |

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

TOTAL (enter, as appropriate, on Wisconsin Schedule |

|

|

|

|

|

|

|

|

|||

SCHEDULE C — ADJUSTMENTS TO CAPITAL GAINS/LOSSES BECAUSE CAPITAL ASSETS DISPOSED OF |

|

|

|

|||||||||

|

|

|

|

HAD DIFFERENT BASIS FOR WISCONSIN AND FEDERAL INCOME TAX PURPOSES |

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|||

1a |

|

DESCRIPTION OF CAPITAL ASSETS HELD ONE YEAR OR LESS |

A. FEDERAL |

B. WISCONSIN |

|

|

C. DIFFERENCE |

|||||

|

|

|

|

AND REASON FOR DIFFERENCE IN BASIS |

ADJUSTED BASIS |

ADJUSTED BASIS |

|

|||||

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

||

1b TOTAL – Combine amounts in column C. Fill in here and on line 4 of Wisconsin Schedule WD (Form 2) |

......................... |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

2a |

|

DESCRIPTION OF CAPITAL ASSETS HELD MORE THAN ONE YEAR |

A. FEDERAL |

B. WISCONSIN |

|

|

C. DIFFERENCE |

|||||

|

|

|

|

AND REASON FOR DIFFERENCE IN BASIS |

ADJUSTED BASIS |

ADJUSTED BASIS |

|

|||||

|

|

|

|

|

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

||||

2b TOTAL – Combine amounts in column C. Fill in here and on line 12 of Wisconsin Schedule WD (Form 2) |

....................... |

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INFORMATION REQUIRED WHEN REQUESTING A CLOSING CERTIFICATE FOR AN ESTATE |

|

|

|

|||||

1 |

Did the decedent have a will? |

yes |

no |

|

2 |

Type of Probate |

formal |

informal |

other |

3 |

Is there a requirement to file a federal estate tax return (Form 706)? Yes |

|||

No If Yes, date filed

4 If the decedent did not file tax returns prior to death, state the decedent’s approximate income for: 1997 - $ |

, |

||||

1996 - $ |

, 1995 - $ |

, 1994- $ |

. |

|

|

|

|

||||

5Attach a copy of the inventory and will. Attach a copy of the final account to the final fiduciary return.

6If an estate does not have enough income to require filing and needs a Closing Certificate for Fiduciaries, or if the estate will be filing only one fiduciary return when the estate is closed and needs the closing certificate before filing that return, see page 2 of the instructions for procedures to be followed.

INFORMATION REQUIRED WHEN REQUESTING A CLOSING CERTIFICATE FOR A TRUST

1Attach a copy of the trust instrument with amendments and copies of annual court accountings for past three years.

2a. Name(s) of grantor(s) ______________________________________________________________________________________________

Social Security Number(s) _____________________________________ __________________________________________

b. Name(s) of grantee(s) _____________________________________________________________________________________________

Social Security Number(s) _____________________________________ |

__________________________________________ |

3State reason for closing the trust ________________________________________________________________________________________

__________________________________________________________________________________________________________________

4 Is a certificate required by the court? |

Yes |

No See page 2 of instructions (requests for closing certificates). |

|

|

|

ATTACH A COPY OF FEDERAL FORM 1041 AND SCHEDULES TO THIS RETURN.

ALSO ATTACH COPIES OF WISCONSIN SCHEDULES