Handling PDF files online is actually a piece of cake with our PDF editor. You can fill in Wisconsin Form W706 here painlessly. The editor is continually maintained by our staff, acquiring new functions and turning out to be greater. It merely requires a few basic steps:

Step 1: Simply click the "Get Form Button" above on this site to get into our form editing tool. There you'll find everything that is needed to fill out your file.

Step 2: With our state-of-the-art PDF editor, you can accomplish more than just complete blank form fields. Express yourself and make your forms appear great with customized textual content put in, or fine-tune the original content to excellence - all that comes with the capability to add your own graphics and sign the document off.

It's straightforward to complete the document using this helpful guide! This is what you need to do:

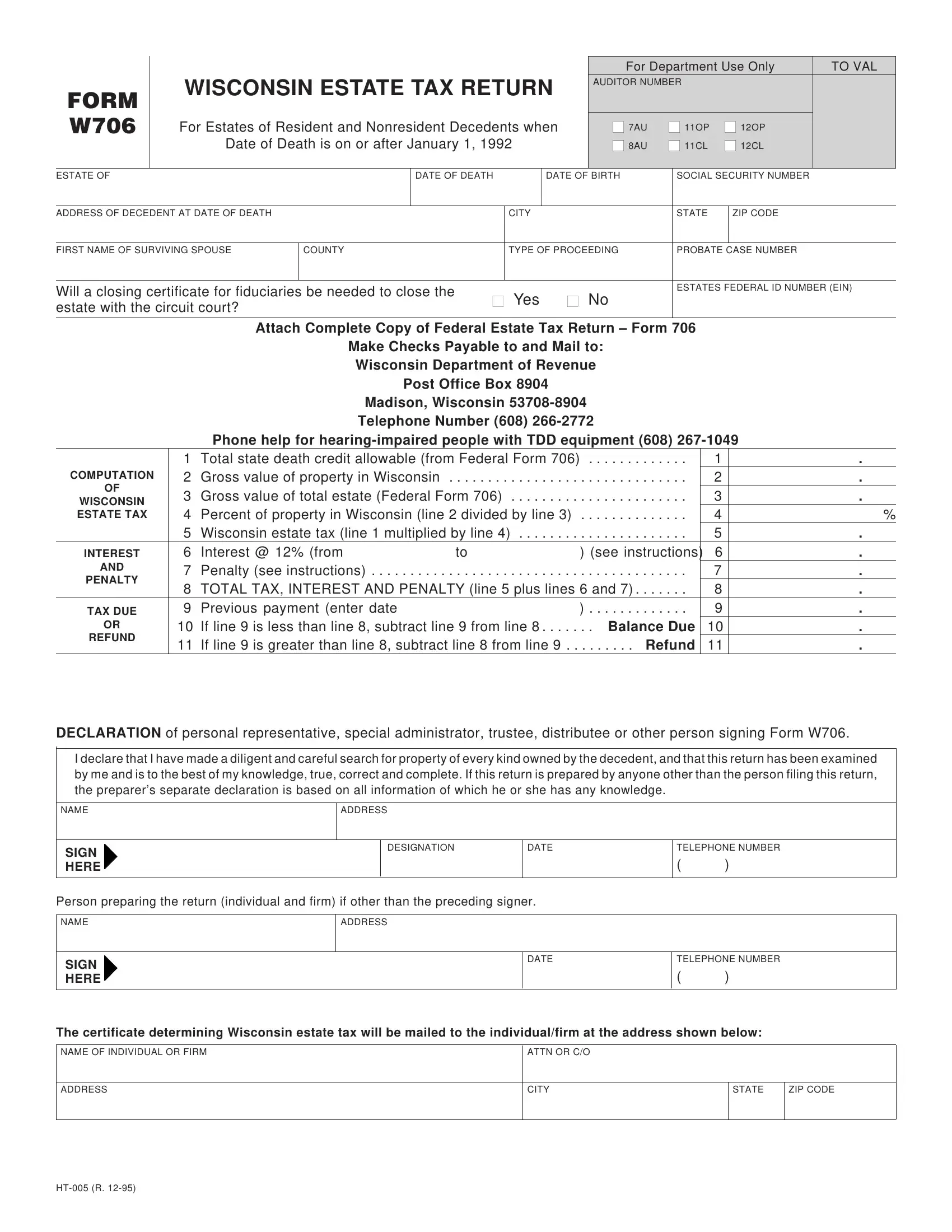

1. You should complete the Wisconsin Form W706 accurately, hence take care while filling in the parts containing these fields:

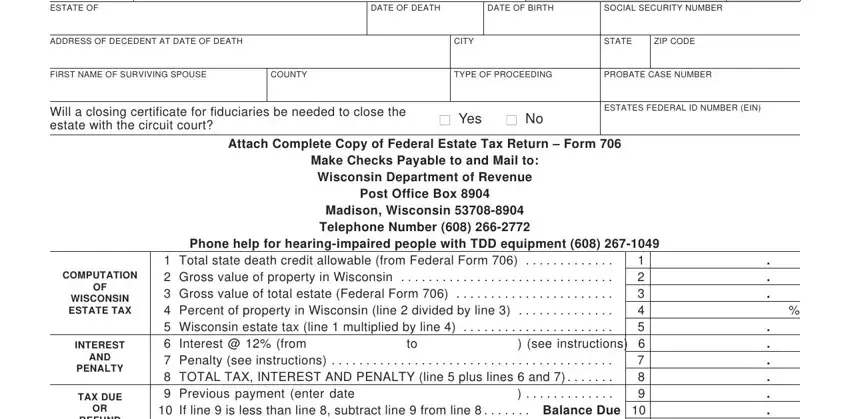

2. Right after the previous array of blanks is filled out, go on to enter the suitable information in these: REFUND, Total state death credit, DECLARATION of personal, I declare that I have made a, NAME, SIGN HERE, ADDRESS, DESIGNATION, DATE, TELEPHONE NUMBER, Person preparing the return, NAME, SIGN HERE, ADDRESS, and DATE.

Be extremely careful while filling out I declare that I have made a and NAME, as this is where most people make errors.

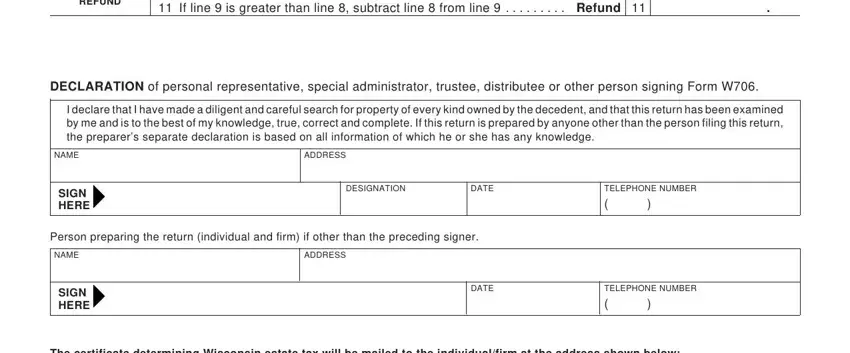

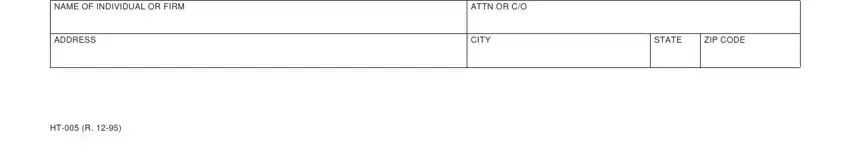

3. Throughout this part, have a look at NAME OF INDIVIDUAL OR FIRM, ATTN OR CO, ADDRESS, CITY, STATE, ZIP CODE, and HT R. These will need to be taken care of with greatest accuracy.

Step 3: As soon as you have reviewed the details in the fields, click "Done" to complete your FormsPal process. Right after getting afree trial account at FormsPal, you'll be able to download Wisconsin Form W706 or email it at once. The file will also be readily available in your personal cabinet with your every single change. FormsPal guarantees your information confidentiality by using a protected method that in no way records or shares any private information provided. You can relax knowing your paperwork are kept safe when you work with our tools!