Approved by Wisconsin Department of Regulation and Licensing |

|

For Sale By Owner Madison |

|

|

|

|

|

|

|

Madison, Wisconsin |

|

|

|

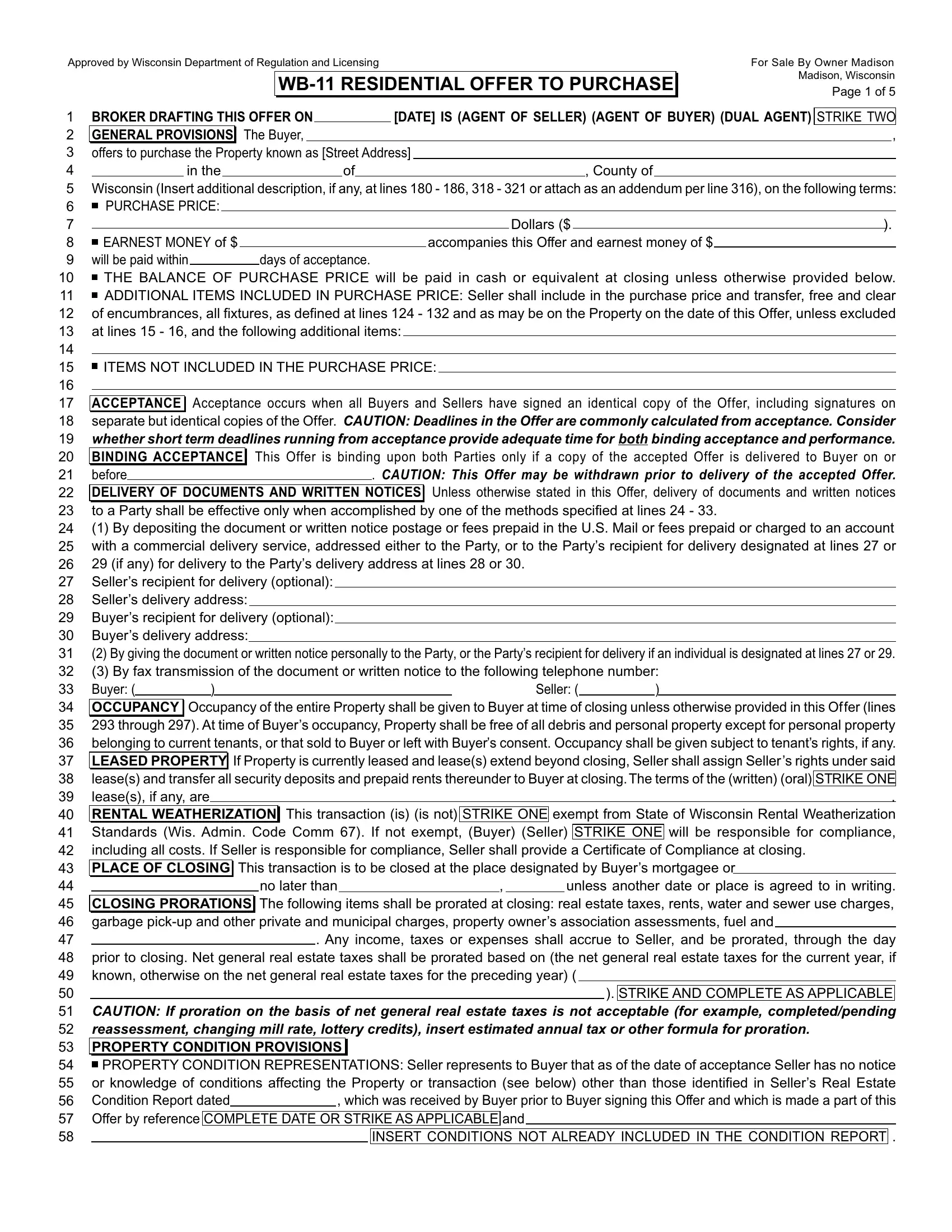

WB-11RESIDENTIALOFFERTOPURCHASE |

|

|

|

|

Page 1 of 5 |

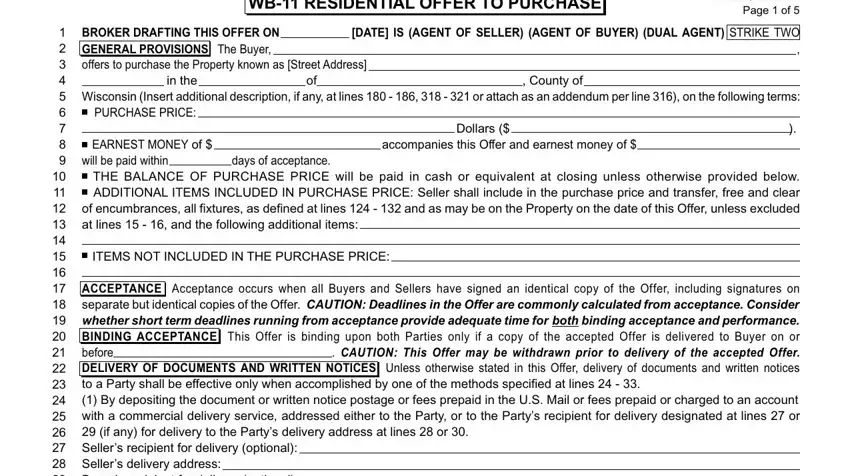

1 |

|

|

|

|

|

|

BROKERDRAFTINGTHISOFFERON |

|

[DATE] IS (AGENT OF SELLER) (AGENT OF BUYER) (DUAL AGENT) |

STRIKE TWO |

2 |

|

|

|

|

|

|

|

|

|

GENERALPROVISIONS |

TheBuyer, |

|

|

|

, |

3offerstopurchasethePropertyknownas[StreetAddress]

5Wisconsin(Insertadditionaldescription,ifany,atlines180-186,318-321orattachasanaddendumperline316),onthefollowingterms:

6 PURCHASEPRICE:

7 |

|

|

|

|

|

|

Dollars ($ |

|

). |

|

|

|

|

|

|

|

|

|

8 |

|

EARNESTMONEY of $ |

|

|

accompanies this Offer and earnest money of $ |

|

|

|

|

|

|

|

|

9 |

willbepaidwithin |

|

|

daysofacceptance. |

|

|

|

|

|

|

10 THE BALANCE OF PURCHASE PRICE will be paid in cash or equivalent at closing unless otherwise provided below.

11 ADDITIONAL ITEMS INCLUDED IN PURCHASE PRICE: Seller shall include in the purchase price and transfer, free and clear

12ofencumbrances,allfixtures,asdefinedatlines124-132andasmaybeonthePropertyonthedateofthisOffer,unlessexcluded

13at lines 15 - 16, and the following additional items:

14

15 ITEMS NOT INCLUDED INTHE PURCHASE PRICE:

17 ACCEPTANCE Acceptance occurs when all Buyers and Sellers have signed an identical copy of the Offer, including signatures on

18separatebutidenticalcopiesoftheOffer. CAUTION:DeadlinesintheOfferarecommonlycalculatedfromacceptance.Consider

19whethershorttermdeadlinesrunningfromacceptanceprovideadequatetimefor bothbindingacceptanceandperformance.

20 |

BINDING ACCEPTANCE |

This Offer is binding upon both Parties only if a copy of the accepted Offer is delivered to Buyer on or |

21 |

before |

|

|

. CAUTION: This Offer may be withdrawn prior to delivery of the accepted Offer. |

22DELIVERY OF DOCUMENTS AND WRITTEN NOTICES Unless otherwise stated in this Offer, delivery of documents and written notices

23to a Party shall be effective only when accomplished by one of the methods specified at lines 24 - 33.

24(1) By depositing the document or written notice postage or fees prepaid in the U.S. Mail or fees prepaid or charged to an account

25with a commercial delivery service, addressed either to the Party, or to the Party’s recipient for delivery designated at lines 27 or

2629 (if any) for delivery to the Party’s delivery address at lines 28 or 30.

27Seller’s recipient for delivery (optional):

28Seller’s delivery address:

29Buyer’s recipient for delivery (optional):

30Buyer’s delivery address:

31(2)BygivingthedocumentorwrittennoticepersonallytotheParty,ortheParty’srecipientfordeliveryifanindividualisdesignatedatlines27or29.

32(3) By fax transmission of the document or written notice to the following telephone number:

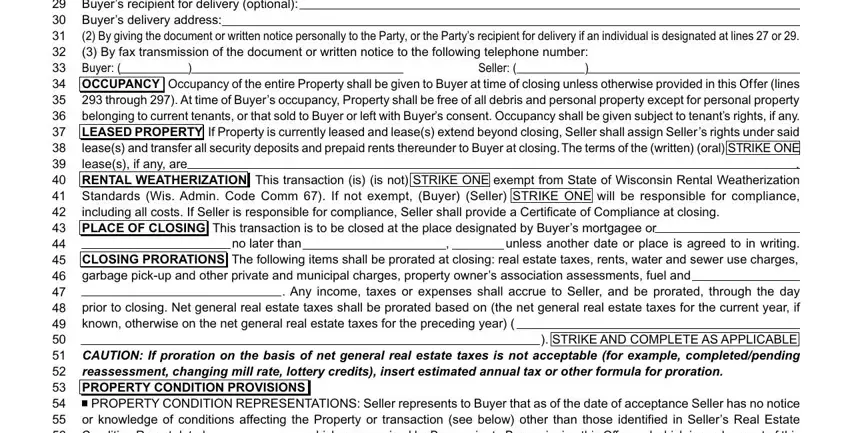

34OCCUPANCY OccupancyoftheentirePropertyshallbegiventoBuyerattimeofclosingunlessotherwiseprovidedinthisOffer(lines

35293through297).AttimeofBuyer’soccupancy,Propertyshallbefreeofalldebrisandpersonalpropertyexceptforpersonalproperty

36belongingtocurrenttenants,orthatsoldtoBuyerorleftwithBuyer’sconsent.Occupancyshallbegivensubjecttotenant’srights,ifany.

37LEASEDPROPERTY IfPropertyiscurrentlyleasedandlease(s)extendbeyondclosing,SellershallassignSeller’srightsundersaid

38lease(s)andtransferallsecuritydepositsandprepaidrentsthereundertoBuyeratclosing.Thetermsofthe(written)(oral)STRIKEONE

39 lease(s), if any, are |

. |

40RENTAL WEATHERIZATION This transaction (is) (is not) STRIKE ONE exempt from State of Wisconsin Rental Weatherization

41Standards (Wis. Admin. Code Comm 67). If not exempt, (Buyer) (Seller) STRIKE ONE will be responsible for compliance,

42including all costs. If Seller is responsible for compliance, Seller shall provide a Certificate of Compliance at closing.

43PLACEOFCLOSING This transaction is to be closed at the place designated by Buyer’s mortgagee or

44 |

|

no later than |

, |

|

unless another date or place is agreed to in writing. |

|

|

|

|

|

|

|

45CLOSINGPRORATIONS The following items shall be prorated at closing: real estate taxes, rents, water and sewer use charges,

46garbage pick-up and other private and municipal charges, property owner’s association assessments, fuel and

47. Any income, taxes or expenses shall accrue to Seller, and be prorated, through the day

48prior to closing. Net general real estate taxes shall be prorated based on (the net general real estate taxes for the current year, if

49known, otherwise on the net general real estate taxes for the preceding year) (

50 |

|

). |

STRIKEAND COMPLETEASAPPLICABLE |

|

|

|

|

51CAUTION: If proration on the basis of net general real estate taxes is not acceptable (for example, completed/pending

52reassessment, changing mill rate, lottery credits), insert estimated annual tax or other formula for proration.

53PROPERTYCONDITIONPROVISIONS

54 PROPERTYCONDITIONREPRESENTATIONS:SellerrepresentstoBuyerthatasofthedateofacceptanceSellerhasnonotice

55or knowledge of conditions affecting the Property or transaction (see below) other than those identified in Seller’s Real Estate

56 |

Condition Report dated |

|

, which wasreceived by Buyer prior to Buyer signing this Offer and which is made a part of this |

|

|

|

|

|

|

57 |

Offer by reference |

COMPLETE DATE OR STRIKEASAPPLICABLE |

and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

58 |

|

|

|

|

|

INSERT CONDITIONS NOT ALREADY INCLUDED IN THE CONDITION REPORT |

. |

|

|

|

|

|

|

|

|

|

|

FSBO Madison

59 |

|

A“condition affecting the Property or transaction” is defined as follows: |

[Page 2 of 5, WB-11] |

|

|

60(a) planned or commenced public improvements which may result in special assessments or otherwise materially affect the

61Property or the present use of the Property;

62(b) completed or pending reassessment of the Property for property tax purposes;

63(c) government agency or court order requiring repair, alteration or correction of any existing condition;

64(d) construction or remodeling on Property for which required state or local permits had not been obtained;

65(e) any land division involving the subject Property, for which required state or local approvals had not been obtained;

66(f) violation of applicable state or local smoke detector laws; NOTE: State law requires operating smoke detectors on all levels

67of all residential properties.

68(g) any portion of the Property being in a 100 year floodplain, a wetland or a shoreland zoning area under local, state or federal laws;

69(h) that a structure on the Property is designated as an historic building or that any part of Property is in an historic district;

70(i) structural inadequacies which if not repaired will significantly shorten the expected normal life of the Property;

71(j) mechanical systems inadequate for the present use of the Property;

72(k) insect or animal infestation of the Property;

73(l) conditions constituting a significant health or safety hazard for occupants of Property; Note: Specific federal lead paint

74disclosure requirements must be complied with in the sale of most residential properties built before 1978.

75(m) underground or aboveground storage tanks on the Property for storage of flammable or combustible liquids including but not

76limited to gasoline and heating oil which are currently or which were previously located on the Property; NOTE: Wis.Adm. Code,

77Chapter Comm 10 contains registration and operation rules for such underground and aboveground storage tanks.

78(n) material violations of environmental laws or other laws or agreements regulating the use of the Property;

79(o) high voltage electric (100 KV or greater) or steel natural gas transmission lines located on but not directly serving the Property;

80(p) other conditions or occurrences which would significantly reduce the value of the Property to a reasonable person with

81knowledge of the nature and scope of the condition or occurrence.

82 REAL ESTATE CONDITION REPORT: Wisconsin law requires owners of property which includes 1-4 dwelling units to provide

83buyers with a Real Estate Condition Report. Excluded from this requirement are sales of property that has never been inhabited,

84 sales exempt from the real estate transfer fee, and sales by certain court-appointed fiduciaries, (for example, personal

85representatives who have never occupied the Property). The form of the Report is found in Wis. Stat. § 709.03. The law provides:

86“709.02 Disclosure . . . the owner of the property shall furnish, not later than 10 days after acceptance of the contract of sale . . . ,

87to the prospective buyer of the property a completed copy of the report . . . A prospective buyer who does not receive a report within

88the 10 days may, within 2 business days after the end of that 10 day period, rescind the contract of sale . . . by delivering a written

89notice of rescission to the owner or the owner’s agent.” Buyer may also have certain rescission rights if a Real Estate Condition

90Report disclosing defects is furnished before expiration of the 10 days, but after the Offer is submitted to Seller. Buyer should

91review the report form or consult with an attorney for additional information regarding these rescission rights.

92 PROPERTY DIMENSIONS AND SURVEYS: Buyer acknowledges that any land, building or room dimensions, or total acreage

93or building square footage figures, provided to Buyer by Seller or by a broker, may be approximate because of rounding or other

94reasons, unless verified by survey or other means. Buyer also acknowledges that there are various formulas used to calculate

95total square footage of buildings and that total square footage figures will vary dependent upon the formula used. CAUTION: Buyer

96should verify total square footage formula, total square footage/acreage figures, land, building or room dimensions, if material.

97 INSPECTIONS: Seller agrees to allow Buyer’s inspectors reasonable access to the Property upon reasonable notice if the

98inspections are reasonably necessary to satisfy the contingencies in this Offer. Buyer agrees to promptly provide copies of all such

99inspection reports to Seller, and to listing broker if Property is listed. Furthermore, Buyer agrees to promptly restore the Property

100to its original condition after Buyer’s inspections are completed, unless otherwise agreed with Seller. An “inspection” is defined as

101an observation of the Property which does not include testing of the Property, other than testing for leaking carbon monoxide, or

102testing for leaking LP gas or natural gas used as a fuel source, which are hereby authorized.

103 TESTING: Except as otherwise provided, Seller’s authorization for inspections does not authorize Buyer to conduct testing of

104the Property. A “test” is defined as the taking of samples of materials such as soils, water, air or building materials from the

105Property and the laboratory or other analysis of these materials. If Buyer requires testing, testing contingencies must be specifically

106provided for at lines 180 - 186, 318 - 321 or in an addendum per line 316. Note: Any contingency authorizing such tests should

107specify the areas of the Property to be tested, the purpose of the test, (e.g., to determine if environmental contamination is present),

108any limitations on Buyer’s testing and any other material terms of the contingency (e.g., Buyer’s obligation to return the Property

109to its original condition). Seller acknowledges that certain inspections or tests may detect environmental pollution which may be

110required to be reported to the Wisconsin Department of Natural Resources.

111 PRE-CLOSING INSPECTION: At a reasonable time, pre-approved by Seller or Seller’s agent, within 3 days before closing,

112Buyer shall have the right to inspect the Property to determine that there has been no significant change in the condition of the

113Property, except for ordinary wear and tear and changes approved by Buyer, and that any defects Seller has elected to cure have

114been repaired in a good and workmanlike manner.

115 PROPERTY DAMAGE BETWEEN ACCEPTANCE AND CLOSING: Seller shall maintain the Property until the earlier of closing

116or occupancy of Buyer in materially the same condition as of the date of acceptance of this Offer, except for ordinary wear and tear.

117If, prior to closing, the Property is damaged in an amount of not more than five per cent (5%) of the selling price, Seller shall be

118obligated to repair the Property and restore it to the same condition that it was on the day of this Offer. If the damage shall exceed

119such sum, Seller shall promptly notify Buyer in writing of the damage and this Offer may be canceled at option of Buyer. Should

120Buyer elect to carry out this Offer despite such damage, Buyer shall be entitled to the insurance proceeds relating to the damage

121to the Property, plus a credit towards the purchase price equal to the amount of Seller’s deductible on such policy. However, if this

122sale is financed by a land contract or a mortgage to Seller, the insurance proceeds shall be held in trust for the sole purpose of

123restoring the Property.

124 FIXTURES A “Fixture” is defined as an item of property which is physically attached to or so closely associated with land or

125improvements so as to be treated as part of the real estate, including, without limitation, physically attached items not easily

126removable without damage to the Property, items specifically adapted to the Property, and items customarily treated as fixtures,

127including, but not limited to, all: garden bulbs; plants; shrubs and trees; screen and storm doors and windows; electric lighting

128fixtures; window shades; curtain and traverse rods; blinds and shutters; central heating and cooling units and attached equipment;

129water heaters and softeners; sump pumps; attached or fitted floor coverings; awnings; attached antennas, satellite dishes and

130component parts; garage door openers and remote controls; installed security systems; central vacuum systems and accessories;

131in-ground sprinkler systems and component parts; built-in appliances; ceiling fans; fences; storage buildings on permanent

132foundations and docks/piers on permanent foundations. NOTE: The terms of the Offer will determine what items are

133 included/excluded.Address rented fixtures (e.g., water softeners), if any.

|

|

|

|

|

|

|

|

|

|

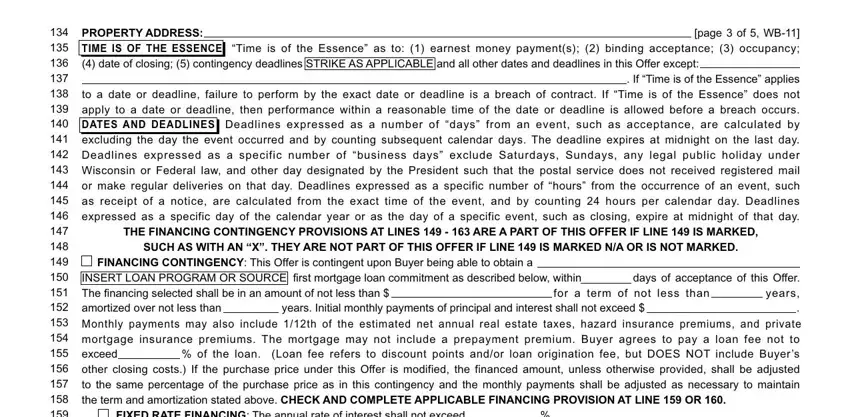

134 |

PROPERTYADDRESS: |

|

|

|

|

|

[page 3 of 5, WB-11] |

135 |

|

|

|

“Time is of the Essence” as to: (1) earnest money payment(s); (2) binding acceptance; (3) occupancy; |

TIME IS OF THE ESSENCE |

136 |

(4) date of closing; (5) contingency deadlines |

STRIKEASAPPLICABLE |

and all other dates and deadlines in this Offer except: |

|

137 |

|

|

|

|

|

|

. If “Time is of the Essence” applies |

|

|

|

|

|

|

138to a date or deadline, failure to perform by the exact date or deadline is a breach of contract. If “Time is of the Essence” does not

139apply to a date or deadline, then performance within a reasonable time of the date or deadline is allowed before a breach occurs.

140 DATES AND DEADLINES Deadlines expressed as a number of “days” from an event, such as acceptance, are calculated by

141excluding the day the event occurred and by counting subsequent calendar days. The deadline expires at midnight on the last day.

142Deadlines expressed as a specific number of “business days” exclude Saturdays, Sundays, any legal public holiday under

143Wisconsin or Federal law, and other day designated by the President such that the postal service does not received registered mail

144or make regular deliveries on that day. Deadlines expressed as a specific number of “hours” from the occurrence of an event, such

145as receipt of a notice, are calculated from the exact time of the event, and by counting 24 hours per calendar day. Deadlines

146expressed as a specific day of the calendar year or as the day of a specific event, such as closing, expire at midnight of that day.

147THE FINANCING CONTINGENCY PROVISIONSAT LINES 149 - 163AREAPART OF THIS OFFER IF LINE 149 IS MARKED,

148SUCHAS WITHAN “X”. THEYARE NOT PART OF THIS OFFER IF LINE 149 IS MARKED N/AOR IS NOT MARKED.

149 FINANCING CONTINGENCY:This Offer is contingent upon Buyer being able to obtain a

|

|

|

|

|

|

|

|

|

|

|

|

|

|

150 |

INSERT LOAN PROGRAM OR SOURCE |

first mortgage loan commitment as described below, within |

|

days of acceptance of this Offer. |

151 |

|

|

|

|

|

|

|

The financing selected shall be in an amount of not less than $ |

|

for a term |

of not less than |

|

years, |

152 |

amortized over not less than |

|

years. Initial monthly payments of principal and interest shall not exceed $ |

|

|

. |

153Monthly payments may also include 1/12th of the estimated net annual real estate taxes, hazard insurance premiums, and private

154mortgage insurance premiums. The mortgage may not include a prepayment premium. Buyer agrees to pay a loan fee not to

155 exceed |

|

% of the loan. (Loan fee refers to discount points and/or loan origination fee, but DOES NOT include Buyer’s |

156other closing costs.) If the purchase price under this Offer is modified, the financed amount, unless otherwise provided, shall be adjusted

157to the same percentage of the purchase price as in this contingency and the monthly payments shall be adjusted as necessary to maintain

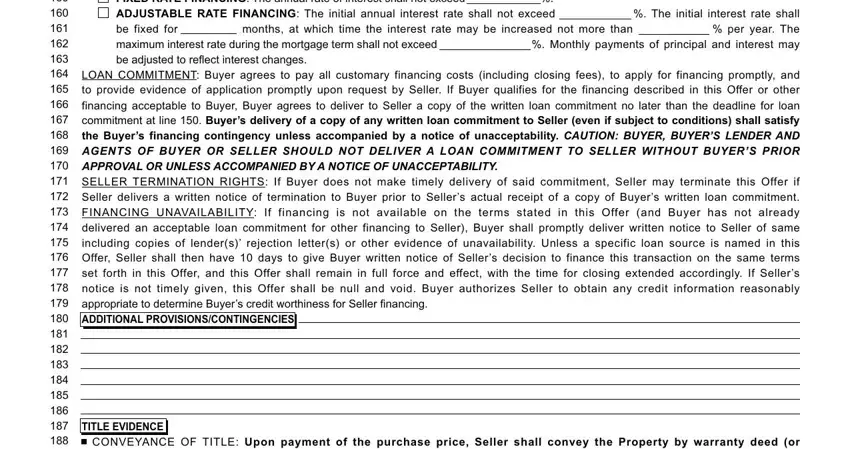

158the term and amortization stated above. CHECKAND COMPLETEAPPLICABLE FINANCING PROVISIONAT LINE 159 OR 160.

|

|

|

|

|

|

|

|

|

|

|

|

|

159 |

FIXED RATE FINANCING:The annual rate of interest shall not exceed |

|

%. |

|

|

|

|

|

160 |

ADJUSTABLE RATE FINANCING: The initial annual interest rate shall not exceed |

|

|

%. The initial interest rate shall |

161 |

be fixed for |

|

months, at which time the interest rate may be increased not more than |

|

|

% per year. The |

162 |

maximum interest rate during the mortgage term shall not exceed |

|

|

%. Monthly payments of principal and interest may |

163be adjusted to reflect interest changes.

164LOAN COMMITMENT: Buyer agrees to pay all customary financing costs (including closing fees), to apply for financing promptly, and

165to provide evidence of application promptly upon request by Seller. If Buyer qualifies for the financing described in this Offer or other

166financing acceptable to Buyer, Buyer agrees to deliver to Seller a copy of the written loan commitment no later than the deadline for loan

167commitment at line 150. Buyer’s delivery of a copy of any written loan commitment to Seller (even if subject to conditions) shall satisfy

168the Buyer’s financing contingency unless accompanied by a notice of unacceptability. CAUTION: BUYER, BUYER’S LENDER AND

169AGENTS OF BUYER OR SELLER SHOULD NOT DELIVER A LOAN COMMITMENT TO SELLER WITHOUT BUYER’S PRIOR

170APPROVALOR UNLESSACCOMPANIED BYANOTICE OF UNACCEPTABILITY.

171SELLER TERMINATION RIGHTS: If Buyer does not make timely delivery of said commitment, Seller may terminate this Offer if

172Seller delivers a written notice of termination to Buyer prior to Seller’s actual receipt of a copy of Buyer’s written loan commitment.

173FINANCING UNAVAILABILITY: If financing is not available on the terms stated in this Offer (and Buyer has not already

174delivered an acceptable loan commitment for other financing to Seller), Buyer shall promptly deliver written notice to Seller of same

175including copies of lender(s)’ rejection letter(s) or other evidence of unavailability. Unless a specific loan source is named in this

176Offer, Seller shall then have 10 days to give Buyer written notice of Seller’s decision to finance this transaction on the same terms

177set forth in this Offer, and this Offer shall remain in full force and effect, with the time for closing extended accordingly. If Seller’s

178notice is not timely given, this Offer shall be null and void. Buyer authorizes Seller to obtain any credit information reasonably

179appropriate to determine Buyer’s credit worthiness for Seller financing.

180ADDITIONALPROVISIONS/CONTINGENCIES

187TITLEEVIDENCE

188 CONVEYANCE OF TITLE: Upon payment of the purchase price, Seller shall convey the Property by warranty deed (or

189other conveyance as provided herein) free and clear of all liens and encumbrances, except: municipal and zoning ordinances

190and agreements entered under them, recorded easements for the distribution of utility and municipal services, recorded building

191and use restrictions and covenants, general taxes levied in the year of closing and

193of the foregoing prohibit present use of the Property), which constitutes merchantable title for purposes of this transaction. Seller

194further agrees to complete and execute the documents necessary to record the conveyance. WARNING: Municipal and zoning

195ordinances, recorded building and use restrictions, covenants and easements may prohibit certain improvements or uses and therefore

196should be reviewed, particularly if Buyer contemplates making improvements to Property or a use other than the current use.

197 FORM OF TITLE EVIDENCE: Seller shall give evidence of title in the form of an owner’s policy of title insurance in the amount

198of the purchase price on a current ALTA form issued by an insurer licensed to write title insurance in Wisconsin. CAUTION: IF TITLE

199EVIDENCE WILLBE GIVEN BYABSTRACT, STRIKE TITLE INSURANCE PROVISIONSAND INSERTABSTRACT PROVISIONS.

200 PROVISION OF MERCHANTABLE TITLE: Seller shall pay all costs of providing title evidence. For purposes of closing, title

201evidence shall be acceptable if the commitment for the required title insurance is delivered to Buyer’s attorney or Buyer not less

202than 3 business days before closing, showing title to the Property as of a date no more than 15 days before delivery of such title

203evidence to be merchantable, subject only to liens which will be paid out of the proceeds of closing and standard title insurance

204requirements and exceptions, as appropriate. CAUTION: BUYER SHOULD CONSIDER UPDATING THE EFFECTIVE DATE OF

205THE TITLE COMMITMENT PRIOR TO CLOSING OR A “GAP ENDORSEMENT” WHICH WOULD INSURE OVER LIENS FILED

206BETWEEN THE EFFECTIVE DATE OF THE COMMITMENTAND THE DATE THE DEED IS RECORDED.

207 TITLE ACCEPTABLE FOR CLOSING: If title is not acceptable for closing, Buyer shall notify Seller in writing of objections to title

208by the time set for closing. In such event, Seller shall have a reasonable time, but not exceeding 15 days, to remove the objections,

209and the time for closing shall be extended as necessary for this purpose. In the event that Seller is unable to remove said

210objections, Buyer shall have 5 days from receipt of notice thereof, to deliver written notice waiving the objections, and the time for

211closing shall be extended accordingly. if Buyer does not waive the objections, this Offer shall be null and void. Providing title

212evidence acceptable for closing does not extinguish Seller’s obligations to give merchantable title to Buyer.

213 SPECIAL ASSESSMENTS: Special assessments, if any, for work actually commenced or levied prior to date of this Offer shall

214be paid by Seller no later than closing. All other special assessments shall be paid by Buyer. CAUTION: Consider a special agreement

215ifareaassessments,propertyowner’sassociationassessmentsorotherexpensesarecontemplated.“Otherexpenses”areone-timecharges

216or ongoing use fees for public improvements (other than those resulting in special assessments) relating to curb, gutter, street,

217sidewalk, sanitary and stormwater and storm sewer (including all sewer mains and hook-up and interceptor charges), parks, street

218lighting and street trees, and impact fees for other public facilities, as defined in Wis. Stat. §66.55(1)(c) & (f).

219DELIVERY/RECEIPT Unless otherwise stated in this Offer, any signed document transmitted by facsimile machine (fax) shall be treated

220in all manner and respects as an original document and the signature of any Party upon a document transmitted by fax shall be

221considered an original signature. Personal delivery to, or actual receipt by, any named Buyer or Seller constitutes personal delivery to,

222or actual receipt by Buyer or Seller. Once received, a notice cannot be withdrawn by the Party delivering the notice without the consent

223of the party receiving the notice. A Party may not unilaterally reinstate a contingency after a notice of a contingency waiver has been

224receivedbytheotherParty.Thedelivery/receiptprovisionsinthisOffermaybemodifiedwhenappropriate(e.g.,whenmaildeliveryisnotdesirable

225(see lines 24 - 30) or when a party will not be personally available to receive a notice (see line 286)). Buyer and Seller authorize the agents of

226Buyer and Seller to distribute copies of the Offer to Buyer’s lender, appraisers, title insurance companies and any other settlement

227service providers for the transaction as defined by the Real Estate Settlement ProceduresAct (RESPA).

228DEFAULT Seller and Buyer each have the legal duty to use good faith and due diligence in completing the terms and conditions

229of this Offer. A material failure to perform any obligation under this Offer is a default which may subject the defaulting party to liability

230for damages or other legal remedies.

231If Buyer defaults, Seller may:

232(1) sue for specific performance and request the earnest money as partial payment of the purchase price; or

233(2) terminate the Offer and have the option to: (a) request the earnest money as liquidated damages; or (b) direct Broker to

234return the earnest money and have the option to sue for actual damages.

235If Seller defaults, Buyer may:

236(1) sue for specific performance; or

237(2) terminate the Offer and request the return of the earnest money, sue for actual damages, or both.

238In addition, the Parties may seek any other remedies availble in law or equity.

239The Parties understand that the availability of any judicial remedy will depend upon the circumstances of the situation and the

240discretion of the courts. If either Party defaults, the Parties may renegotiate the Offer or seek nonjudicial dispute resolution instead

241of the remedies outlined above. By agreeing to binding arbitration, the Parties may lose the right to litigate in a court of law those

242disputes covered by the arbitration agreement.

243NOTE: IF ACCEPTED, THIS OFFER CAN CREATE A LEGALLY ENFORCEABLE CONTRACT. BOTH PARTIES SHOULD READ THIS DOCUMENT

244CAREFULLY.BROKERSMAYPROVIDEAGENERALEXPLANATIONOFTHEPROVISIONSOFTHEOFFERBUTAREPROHIBITEDBYLAWFROM

245GIVINGADVICEOROPINIONSCONCERNINGYOURLEGALRIGHTSUNDERTHISOFFERORHOWTITLESHOULDBETAKENATCLOSING.AN

246ATTORNEY SHOULD BE CONSULTED IF LEGALADVICE IS NEEDED.

247EARNESTMONEY

248 HELD BY: Unless otherwise agreed, earnest money shall be paid to and held in the trust account of the listing broker (buyer’s

249agent if Property is not listed or Seller’s account if no broker is involved), until applied to purchase price or otherwise disbursed as

250providedintheOffer.CAUTION:Shouldpersonsotherthanabrokerholdearnestmoney,anescrowagreementshouldbedraftedbytheParties

251or an attorney. If someone other than Buyer makes payment of earnest money, consider a special disbursement agreement.

252 DISBURSEMENT: If negotiations do not result in an accepted offer, the earnest money shall be promptly disbursed (after

253clearance from payor’s depository institution if earnest money is paid by check) to the person(s) who paid the earnest money. At

254closing, earnest money shall be disbursed according to the closing statement. If this Offer does not close, the earnest money shall

255be disbursed according to a written disbursement agreement signed by all Parties to this Offer (Note: Wis. Adm. Code s. RL

25618.09(1)(b) provides that an offer to purchase is not a written disbursement agreement pursuant to which the broker may disburse).

257If said disbursement agreement has not been delivered to broker within 60 days after the date set for closing, broker may disburse

258the earnest money: (1) as directed by an attorney who has reviewed the transaction and does not represent Buyer or Seller; (2)

259into a court hearing a lawsuit involving the earnest money and all Parties to this Offer; (3) as directed by court order; or (4) any

260other disbursement required or allowed by law. Broker may retain legal services to direct disbursement per (1) or to file an

261interpleader action per (2) and broker may deduct from the earnest money any costs and reasonable attorneys fees, not to exceed

262$250, prior to disbursement.

263 LEGAL RIGHTS/ACTION: Broker’s disbursement of earnest money does not determine the legal rights of the Parties in

264relation to this Offer. Buyer’s or Seller’s legal right to earnest money cannot be determined by broker. At least 30 days prior to

265disbursement per (1) or (4) above, broker shall send Buyer and Seller notice of the disbursement by certified mail. If Buyer or

266Seller disagree with broker’s proposed disbursement, a lawsuit may be filed to obtain a court order regarding disbursement.

267Small Claims Court has jurisdiction over all earnest money disputes arising out of the sale of residential property with 1-4

268dwelling units and certain other earnest money disputes. Buyer and Seller should consider consulting attorneys regarding their

269legal rights under this Offer in case of a dispute. Both Parties agree to hold the broker harmless from any liability for good faith

270disbursement of earnest money in accordance with this Offer or applicable Deparment of Regulation and Licensing regulations

271concerning earnest money. See Wis.Adm. Code Ch. RL18.

272 |

ENTIRE CONTRACT |

This Offer, including any amendments to it, contains the entire agreement of the Buyer and Seller regarding |

273 |

the transaction. All prior negotiations and discussions have been merged into this Offer. This agreement binds and inures to |

274 |

the benefit of the Parties to this Offer and their successors in interest. |

FSBO Madison |

|

|

|

FSBO Madison

[INSERT OTHER

275 PROPERTYADDRESS: |

|

[page5of5,WB-11] |

276OPTIONALPROVISIONS:THEPROVISIONSONLINES278THROUGH317AREAPARTOFTHISOFFERIFMARKED,SUCHASWITHAN“X”.

277THEYARENOTPARTOFTHISOFFERIFMARKEDN/AORARELEFTBLANK(EXCEPTASPROVIDEDATLINES280-281).

278 SALE OF BUYER’S PROPERTY CONTINGENCY: This offer is contingent upon the sale and closing of Buyer’s property

279 located at |

|

, no later than |

280. Seller may keep Seller’s Property on the market for sale and accept secondary offers. If this contingency is

281made a part of this Offer, lines 282 - 286 are also a part of this offer unless marked N/Aat line 282 or otherwise deleted.

282 CONTINUED MARKETING: If Seller accepts a bona fide secondary offer, Seller may give written notice to Buyer of

283acceptance. If Buyer does not deliver to Seller a written waiver of sale of Buyer’s property contingency and

284

285REQUIREMENTS, IF ANY (e.g., PAYMENT OF ADDITIONAL EARNEST MONEY, WAIVER OF ALL CONTINGENCIES, OR PROVIDING

286 EVIDENCE OF SALE OR BRIDGE LOAN, etc.)] within |

|

hoursofBuyer’sactualreceiptofsaidnotice,thisOffershallbenullandvoid. |

|

287 SECONDARY OFFER: This Offer is secondary to a prior accepted offer. This Offer shall become primary upon delivery of

288written notice to Buyer that this Offer is primary. Unless otherwise provided, Seller is not obligated to give Buyer notice prior to any

289deadline, nor is any particular secondary buyer given the right to be made primary ahead of other secondary buyers. Buyer may

290declare this Offer null and void by delivering written notice of withdrawal to Seller prior to delivery of Seller’s notice that this Offer

291 |

is primary. Buyer may not deliver notice of withdrawal earlier than |

|

days after acceptance of this Offer. All other Offer |

292 |

deadlines which are run from acceptance shall run from the time this Offer becomes primary. |

293 |

PRE/POST CLOSING OCCUPANCY: Occupancy of |

|

|

|

|

|

|

shall be |

|

|

|

|

|

|

294 |

|

|

|

|

|

|

|

|

|

|

|

|

given to Buyer on |

|

|

|

|

at |

|

|

|

am/pm.(Seller)(Buyer) |

STRIKEONE |

shallpayan |

295 |

|

|

|

|

|

occupancy charge of $ |

|

per day or partial day of pre/post-closing occupancy. Payment shall be due at the beginning of the |

296occupancy period. Any unearned post closing occupancy fee (shall)(shall not) STRIKE ONE be refunded based on actual occupancy.

297CAUTION:Consideraspecialagreementregardingoccupancy,escrow,insurance,utilities,maintenance,keys,etc.

298 INSPECTION CONTINGENCY: This Offer is contingent upon a Wisconsin registered home inspector performing a home

299inspection of the Property, and an inspection, by a qualified independent inspector, of

300 |

|

|

|

|

which discloses no defects as defined below. This contingency |

|

|

|

|

301 |

shall be deemed satisfied unless Buyer, within |

|

days of acceptance, delivers to Seller, and to listing broker if Property is |

302listed, a copy of the inspector’s written inspection report(s) and a written notice listing the defect(s) identified in the inspection

303report(s)towhichBuyerobjects. CAUTION:Aproposedamendmentwillnotsatisfythisnoticerequirement.Buyershallorder

304theinspectionandberesponsibleforallcostsofinspection,includinganyinspectionsrequiredbylenderorasfollow-upinspectionsto

305the home inspection. Note: This contingency only authorizes inspections, not testing. (See lines 97 - 110.)

306 RIGHTTOCURE:Seller(shall)(shallnot)STRIKEONE havearighttocurethedefects.(Sellershallhavearighttocureifnochoiceisindicated.)

307IfSellerhasrighttocure,Sellermaysatisfythiscontingencyby:(1)deliveringawrittennoticewithin10daysofreceiptofBuyer’snoticeofSeller’selection

308tocuredefects,(2)curingthedefectsinagoodandworkmanlikemannerand(3)deliveringtoBuyerawrittenreportdetailingtheworkdonenolaterthan

3093dayspriortoclosing.ThisOffershallbenullandvoidifBuyermakestimelydeliveryoftheabovenoticeandreportand:(1)Sellerdoesnothavearight

310tocureor(2)Sellerhasarighttocurebut:a)SellerdeliversnoticethatSellerwillnotcureorb)Sellerdoesnottimelydeliverthenoticeofelectiontocure.

311 “DEFECT” DEFINED: For the purposes of this contingency, a defect is defined as a structural, mechanical or other condition

312that would have a significant adverse effect on the value of the Property; that would significantly impair the health or safety of future

313occupants of the Poperty; or that if not repaired, removed or replaced would significantly shorten or have a significant adverse

314effect on the expected normal life of the Property. Defects do not include structural, mechanical or other conditions the nature and

315extent of which Buyer had actual knowledge or written notice before signing this Offer.

316 |

ADDENDA: The attached |

|

is/are made part of this Offer. |

317ADDITIONALPROVISIONS/CONTINGENCIES

321 |

This Offer was drafted on |

[date] by [Licensee and firm] |

. |

322 |

(x) |

|

|

|

|

|

|

|

|

|

|

323 |

|

|

Buyer’s Signature |

Print Name Here: |

|

|

|

|

|

Social Security No. or FEIN |

|

Date |

324 |

(x) |

|

|

|

|

|

|

|

|

|

|

325 |

|

|

Buyer’s Signature |

Print Name Here: |

|

|

|

|

|

Social Security No. or FEIN |

|

Date |

326 |

EARNESTMONEYRECEIPTBrokeracknowledgesreceiptofearnestmoneyasperline8oftheaboveOffer.(Seelines247-271.) |

327 |

|

|

|

|

|

|

Broker (By) |

|

|

|

|

|

|

|

|

|

|

|

|

328SELLER ACCEPTS THIS OFFER. THE WARRANTIES, REPRESENTATIONS AND COVENANTS MADE IN THIS OFFER

329SURVIVE CLOSING AND THE CONVEYANCE OF THE PROPERTY. SELLER AGREES TO CONVEY THE PROPERTY ON

330THE TERMSAND CONDITIONSAS SET FORTH HEREINANDACKNOWLEDGES RECEIPT OFACOPY OF THIS OFFER.

331(x)

332 |

|

Seller’s Signature |

Print Name Here: |

|

|

|

|

|

|

Social Security No. or FEIN |

|

|

|

|

|

Date |

333 |

(x) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

334 |

|

Seller’s Signature |

Print Name Here: |

|

|

|

|

|

|

Social Security No. or FEIN |

|

|

|

|

|

Date |

335 |

This Offer was presented to the Seller by |

|

|

|

|

|

on |

|

, |

|

, at |

|

|

a.m./p.m. |

336 |

THIS OFFER IS REJECTED |

|

|

|

|

THIS OFFER IS COUNTERED [See attached counter] |

|

|

|

|

|

|

|

|

|

|

|

337 |

|

|

|

Seller Initials |

|

Date |

|

|

|

|

|

|

|

|

Seller Initials |

|

|

Date |