You'll be able to work with income withholding order for child support effortlessly by using our online editor for PDFs. Our tool is continually evolving to provide the best user experience attainable, and that is thanks to our dedication to continuous improvement and listening closely to user comments. This is what you would want to do to get started:

Step 1: Press the "Get Form" button above on this page to open our PDF tool.

Step 2: The tool grants the opportunity to change almost all PDF documents in various ways. Enhance it by writing personalized text, adjust what's already in the document, and add a signature - all close at hand!

Filling out this document requires thoroughness. Make sure each and every blank is done correctly.

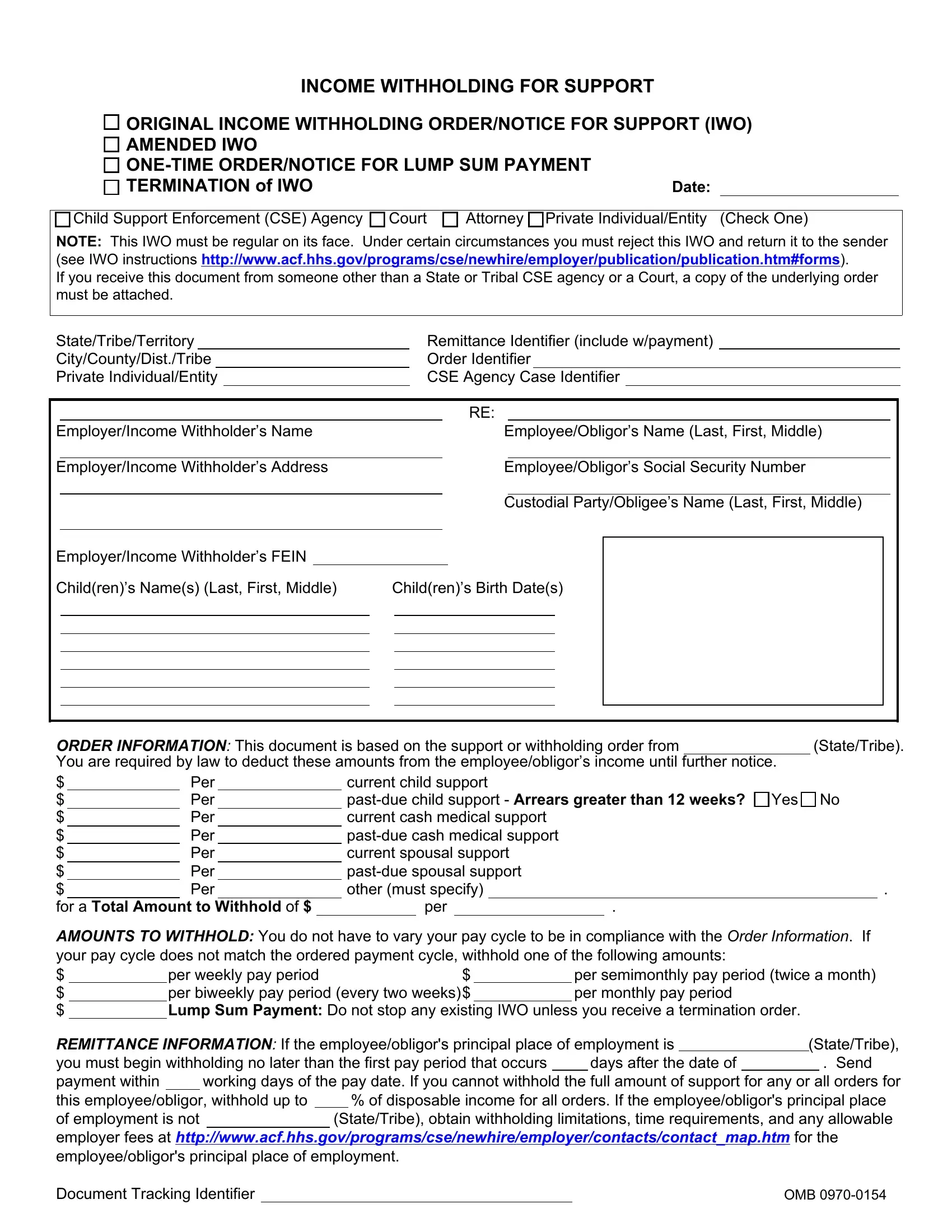

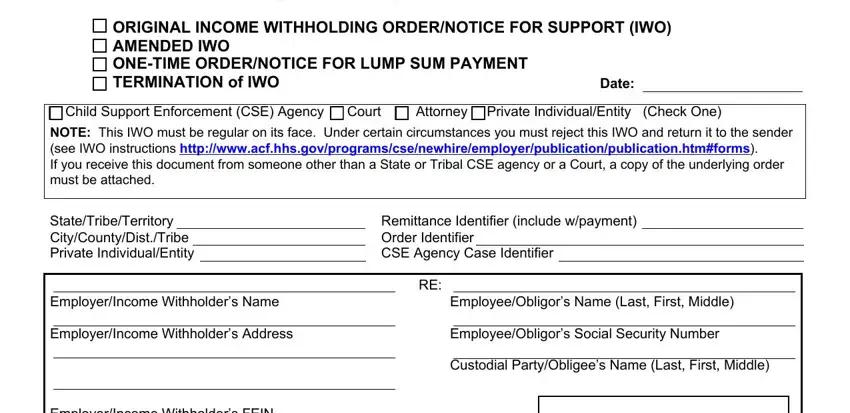

1. To start with, once filling in the income withholding order for child support, begin with the form section containing subsequent blank fields:

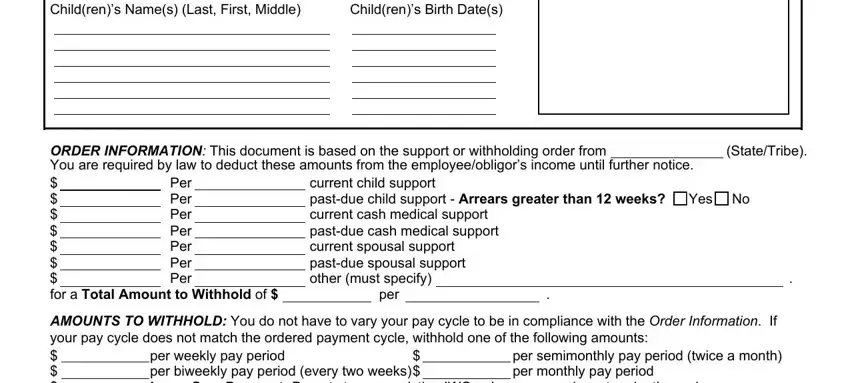

2. When this segment is finished, it's time to include the necessary details in Childrens Names Last First Middle, Childrens Birth Dates, ORDER INFORMATION This document is, current child support pastdue, Per Per Per Per Per Per Per, StateTribe, per, AMOUNTS TO WITHHOLD You do not, per weekly pay period per, and per semimonthly pay period twice a allowing you to progress to the next part.

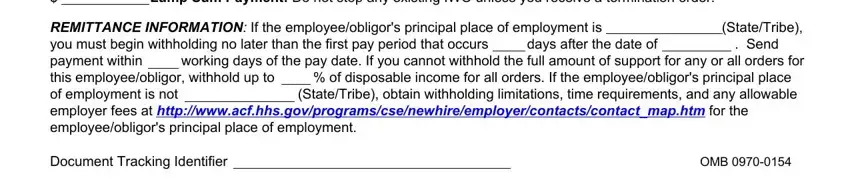

3. This subsequent segment should also be quite uncomplicated, AMOUNTS TO WITHHOLD You do not, per weekly pay period per, REMITTANCE INFORMATION If the, Document Tracking Identifier, and OMB - each one of these fields must be filled out here.

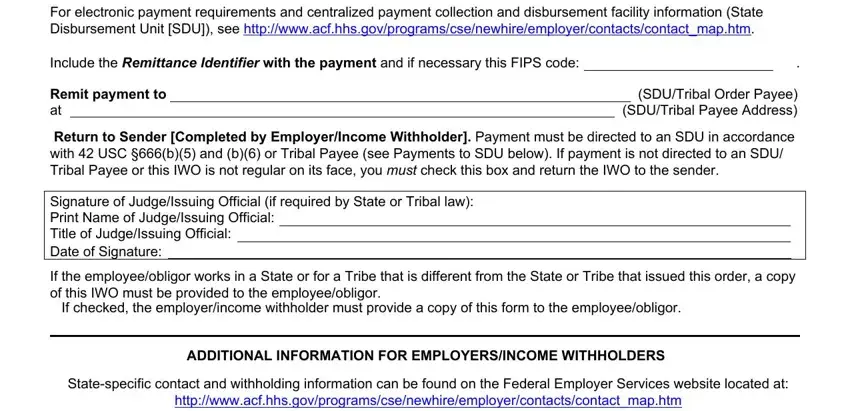

4. Completing For electronic payment, Include the Remittance Identifier, Remit payment to at, SDUTribal Order Payee SDUTribal, Return to Sender Completed by, Signature of JudgeIssuing Official, If the employeeobligor works in a, ADDITIONAL INFORMATION FOR, and Statespecific contact and is paramount in this form section - make certain that you devote some time and be attentive with every empty field!

Concerning Signature of JudgeIssuing Official and Return to Sender Completed by, ensure you do everything properly here. Both these are certainly the most significant fields in this document.

5. This document has to be finalized by filling in this section. Further there can be found a detailed list of blanks that need correct details in order for your form usage to be accomplished: Liability If you have any doubts, Antidiscrimination You are subject, and OMB Expiration Date The OMB.

Step 3: Confirm that your details are right and just click "Done" to proceed further. Make a 7-day free trial option with us and obtain instant access to income withholding order for child support - download or edit inside your personal cabinet. FormsPal is committed to the personal privacy of our users; we make certain that all personal data processed by our editor is kept secure.