When working in the online editor for PDFs by FormsPal, you're able to fill in or alter printable wr 1 form massachusetts right here and now. FormsPal professional team is always working to improve the editor and ensure it is much faster for clients with its many features. Make use of present-day revolutionary prospects, and find a myriad of unique experiences! With some simple steps, you'll be able to begin your PDF editing:

Step 1: Access the PDF doc in our editor by hitting the "Get Form Button" at the top of this webpage.

Step 2: With the help of our advanced PDF tool, you'll be able to accomplish more than merely complete blanks. Edit away and make your forms look faultless with custom text added, or tweak the original content to excellence - all comes along with the capability to add stunning images and sign the PDF off.

As a way to finalize this PDF form, make sure you enter the information you need in each field:

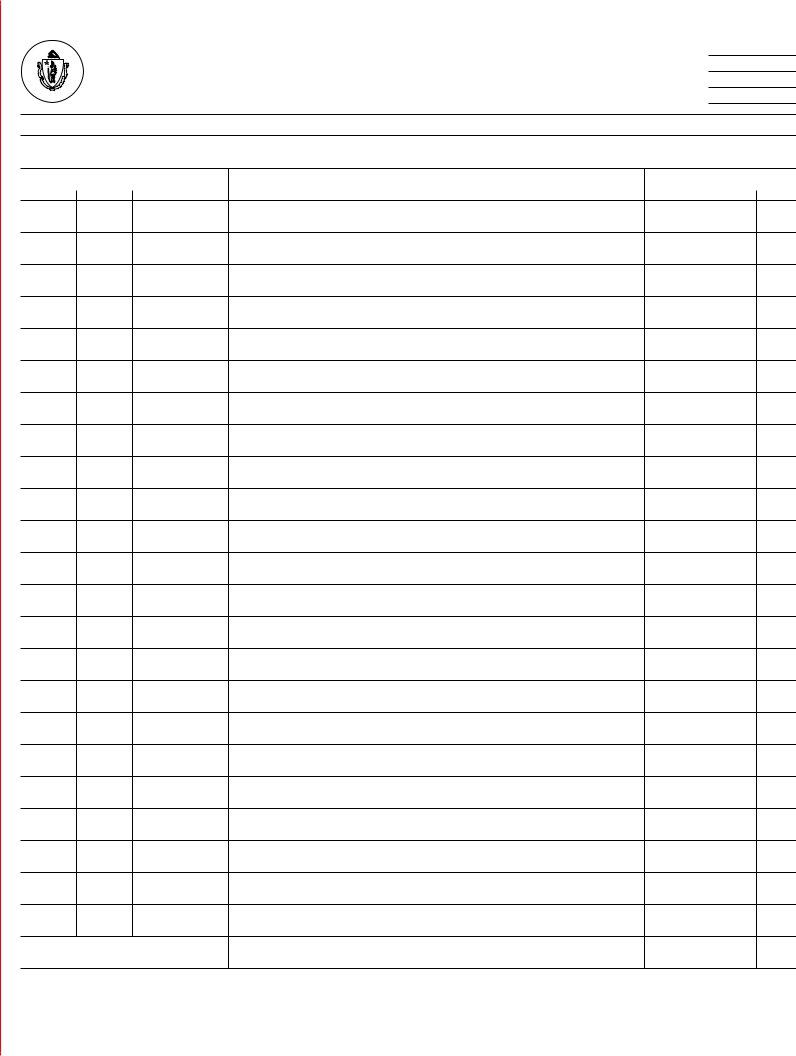

1. It's very important to fill out the printable wr 1 form massachusetts correctly, therefore take care when filling out the parts that contain all these blank fields:

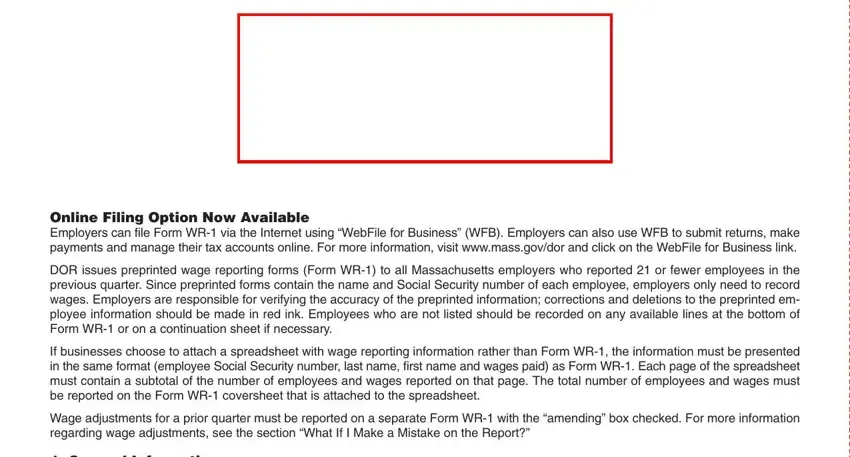

2. Now that the last array of fields is finished, you should include the required specifics in Online Filing Option Now Available, DOR issues preprinted wage, If businesses choose to attach a, Wage adjustments for a prior, and General Information The federal allowing you to progress to the 3rd stage.

As for If businesses choose to attach a and DOR issues preprinted wage, ensure that you review things in this current part. These are the key ones in this document.

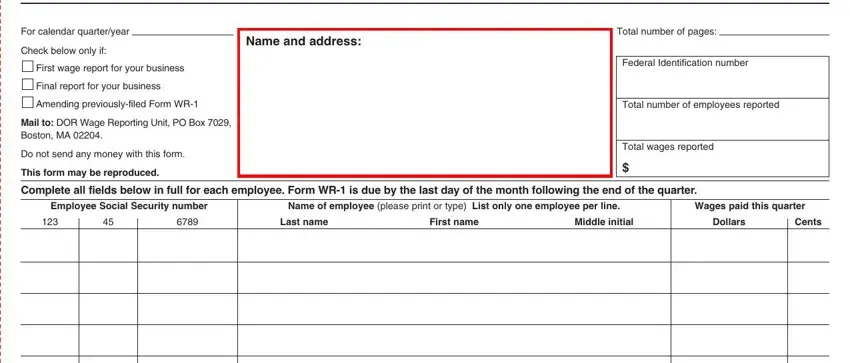

3. The next step should be fairly uncomplicated, Name and address, For calendar quarteryear, Check below only if, First wage report for your business, Final report for your business, Amending previouslyfiled Form WR, Mail to DOR Wage Reporting Unit PO, Do not send any money with this, This form may be reproduced, Total number of pages, Federal Identification number, Total number of employees reported, Total wages reported, Complete all fields below in full, and Employee Social Security number - all these form fields has to be completed here.

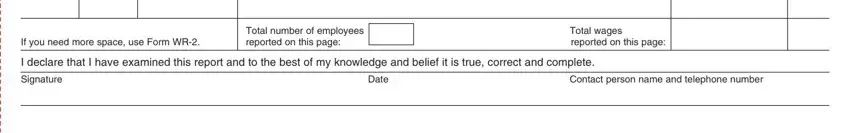

4. This particular paragraph comes with these blank fields to enter your details in: If you need more space use Form WR, Total number of employees reported, Total wages reported on this page, I declare that I have examined, Signature, Date, and Contact person name and telephone.

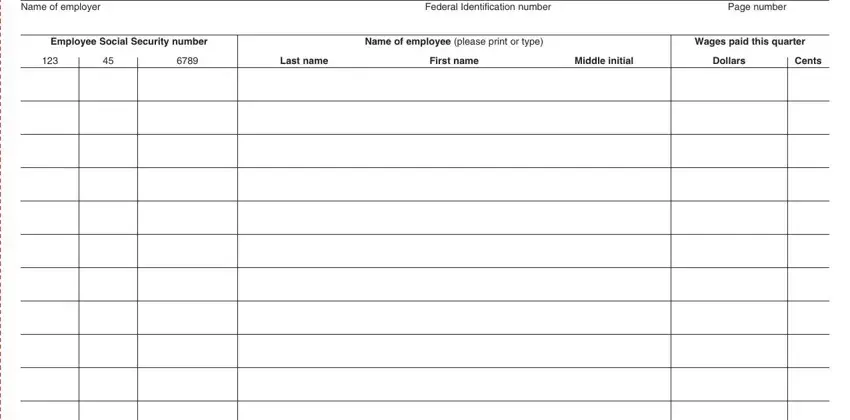

5. This document should be completed within this section. Here you will notice a detailed list of form fields that need accurate details for your form submission to be accomplished: Name of employer, Federal Identification number, Page number, Employee Social Security number, Name of employee please print or, Wages paid this quarter, Last name, First name, Middle initial, Dollars, and Cents.

Step 3: Immediately after looking through your form fields, press "Done" and you are good to go! After getting afree trial account at FormsPal, it will be possible to download printable wr 1 form massachusetts or email it promptly. The PDF form will also be readily accessible via your personal account with your each modification. FormsPal guarantees your information privacy by having a secure method that in no way saves or distributes any private data involved in the process. Be assured knowing your documents are kept safe every time you work with our service!