Every year, residents of West Virginia navigate the process of filing their state tax returns, a task that involves understanding and correctly filling out the WV Tax Form for the reporting year. The 2020 WV Personal Income Tax Forms & Instructions, which includes the IT-140 form among others like Schedule M, A, E, and IT-210 instructions, serves as a comprehensive guide tailored for West Virginia taxpayers. This document not only lists the required forms but also provides detailed guidance on how to report income, claim exemptions, and calculate both owed taxes and potential refunds. Additionally, it outlines specific tax credits like the Family Tax Credit, Homestead Excess Property Tax Credit, and Senior Citizen Tax Credit, helping filers reduce their tax liability. Important dates are emphasized, with the personal income tax due on April 15, 2021, and instructions for those needing to file an amended return or request extensions are clearly mentioned. Special situations, such as filings for nonresidents or part-year residents, are also addressed to ensure that every taxpayer's unique circumstances are covered. Moreover, the documentation features payment options for those who owe taxes, including modern conveniences like electronic payments or traditional methods such as checks or money orders. With the ultimate goal of providing every taxpayer the information needed for compliance, the WV State Tax Department also offers insights on completing the form accurately to avoid common mistakes, ensuring a smooth tax filing experience.

| Question | Answer |

|---|---|

| Form Name | Wv Tax Form |

| Form Length | 52 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 13 min |

| Other names | wv state tax forms, wv tax, west virginia tax forms, west virginia |

2020

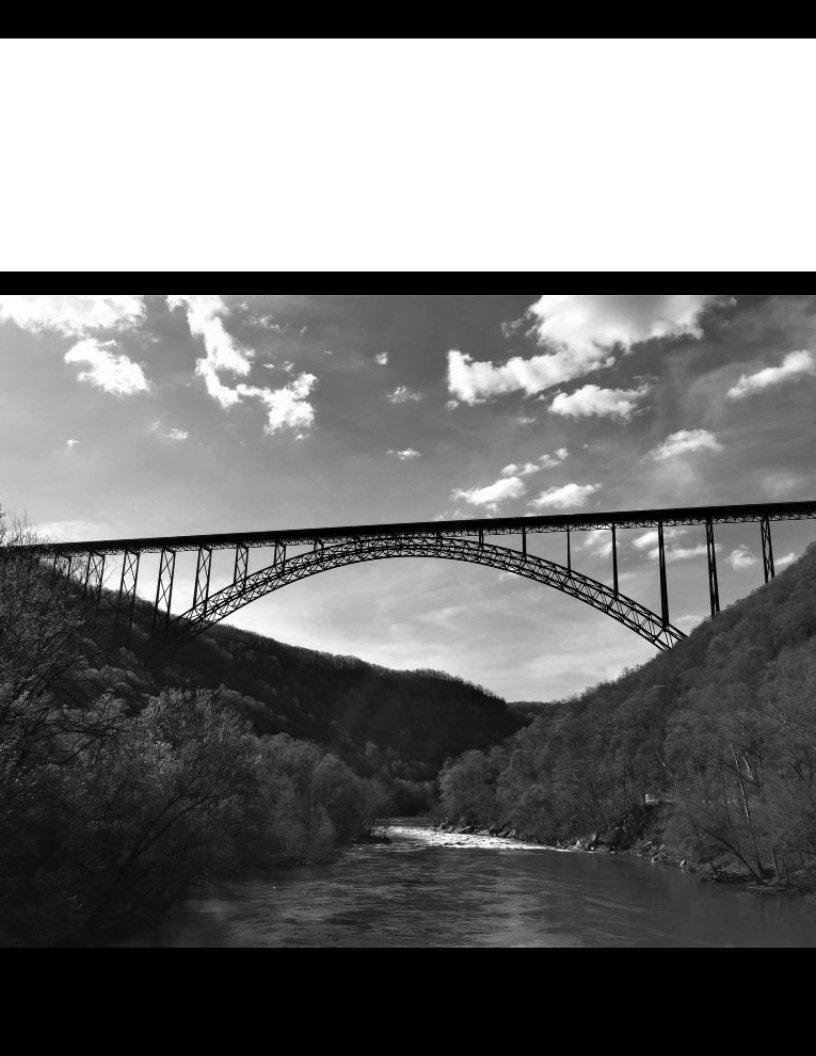

Wൾ ඌ ඍ V ං උ ං ඇ ං ൺ

Personal Income Tax Forms & Instructions

2020 PERSONAL INCOME TAX IS DUE APRIL 15, 2021

WE S T V I R G I N I A S TAT E TA X D E PA RT M E N T