Are you familiar with Wv Tax Form? If not, you should be! This form is necessary for filing your state taxes. Here we will go over some of the basics of the Wv Tax Form so that you can understand it better. We will also provide a link to download the form itself so that you can get started on filing your state taxes. Thank you for choosing our blog as your source of information!

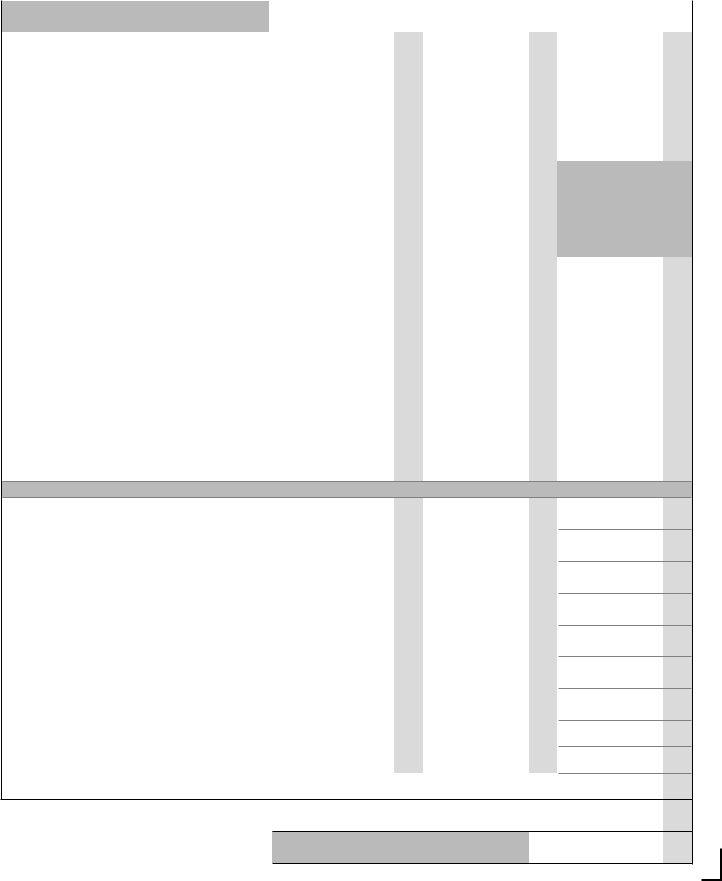

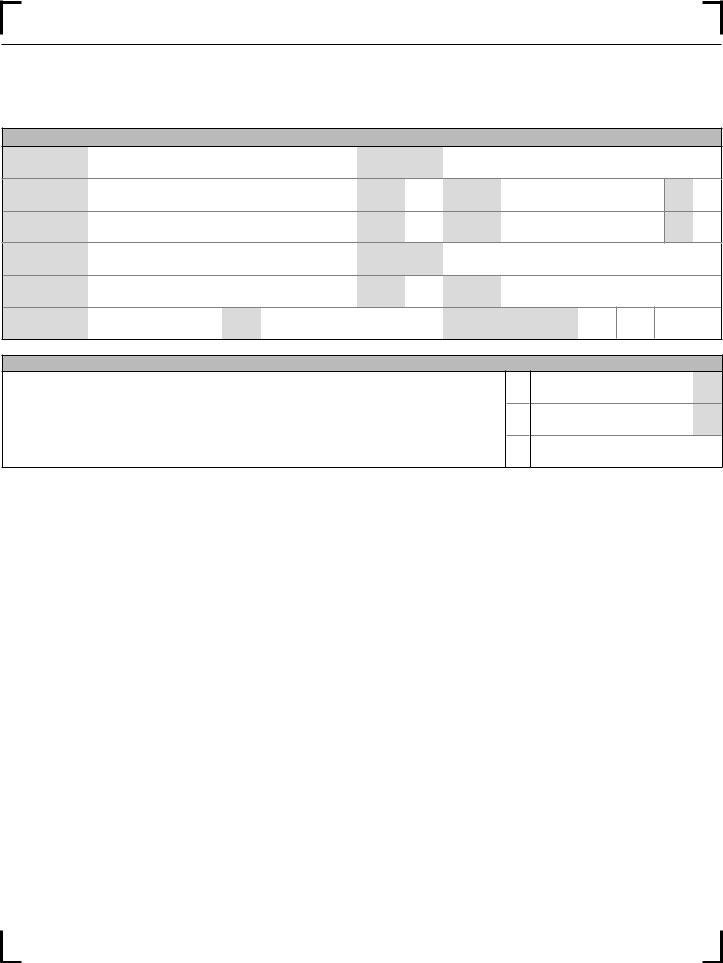

| Question | Answer |

|---|---|

| Form Name | Wv Tax Form |

| Form Length | 52 pages |

| Fillable? | No |

| Fillable fields | 0 |

| Avg. time to fill out | 13 min |

| Other names | wv state tax forms, wv tax, west virginia tax forms, west virginia |

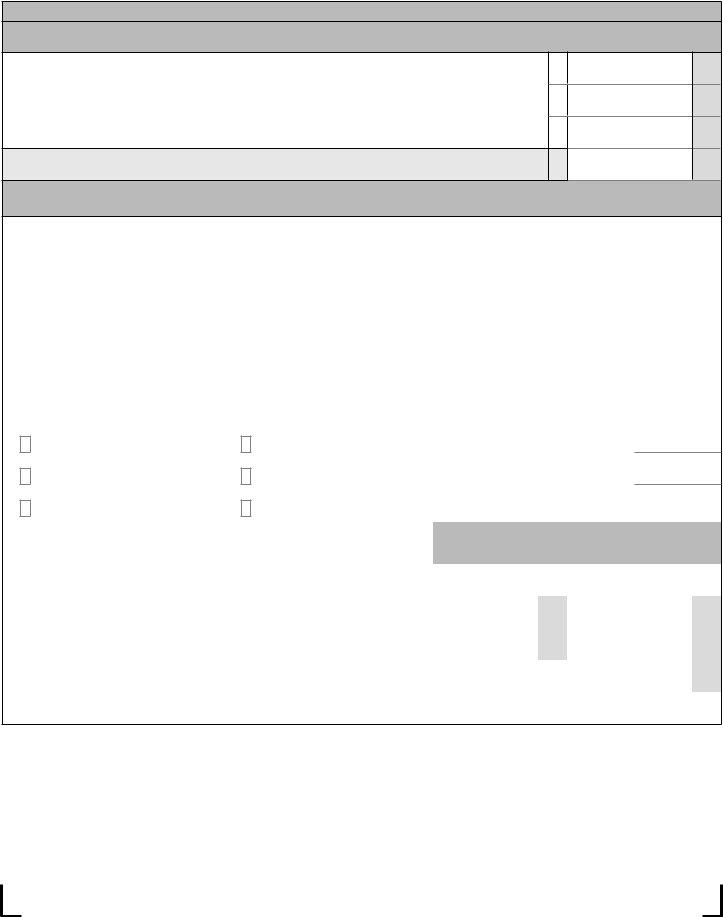

2020

Wൾ ඌ ඍ V ං උ ං ඇ ං ൺ

Personal Income Tax Forms & Instructions

2020 PERSONAL INCOME TAX IS DUE APRIL 15, 2021

WE S T V I R G I N I A S TAT E TA X D E PA RT M E N T

TABLE OF CONTENTS

Schedule UT Instructions |

10 |

|

Important Information for 2020 |

13 |

|

Tips on Filing a Paper Return |

14 |

|

General Information |

15 |

|

Form |

19 |

|

Schedule M Instructions |

21 |

|

Schedule A Instructions |

24 |

|

Schedule E Instructions |

26 |

|

Form |

27 |

|

2020 |

Family Tax Credit Tables |

31 |

2020 |

West Virginia Tax Table |

32 |

2020 |

Tax Rate Schedules |

37 |

Index |

49 |

|

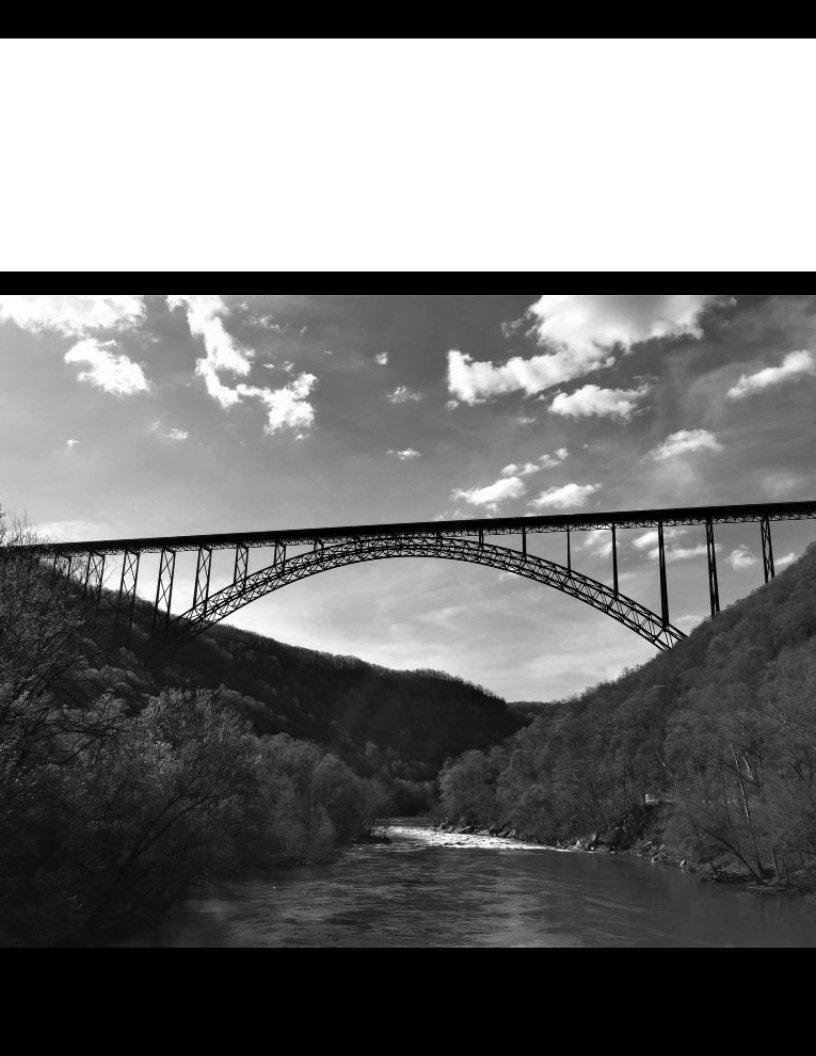

COVER PHOTO: NEW RIVER GORGE BRIDGE, WV. PHOTOGRAPH BY KENNY BERRY

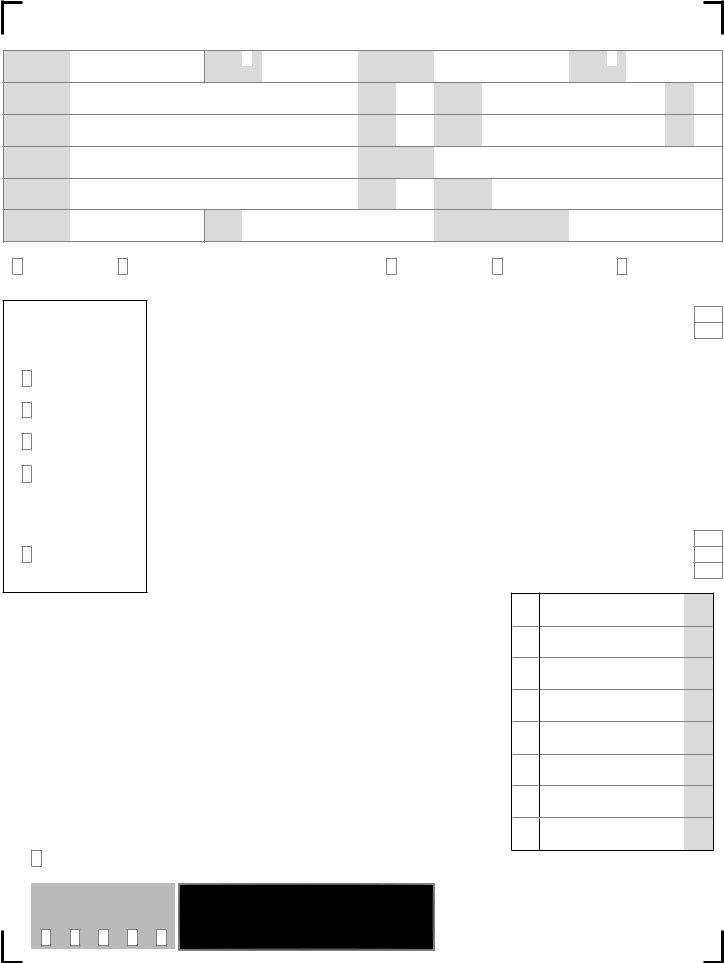

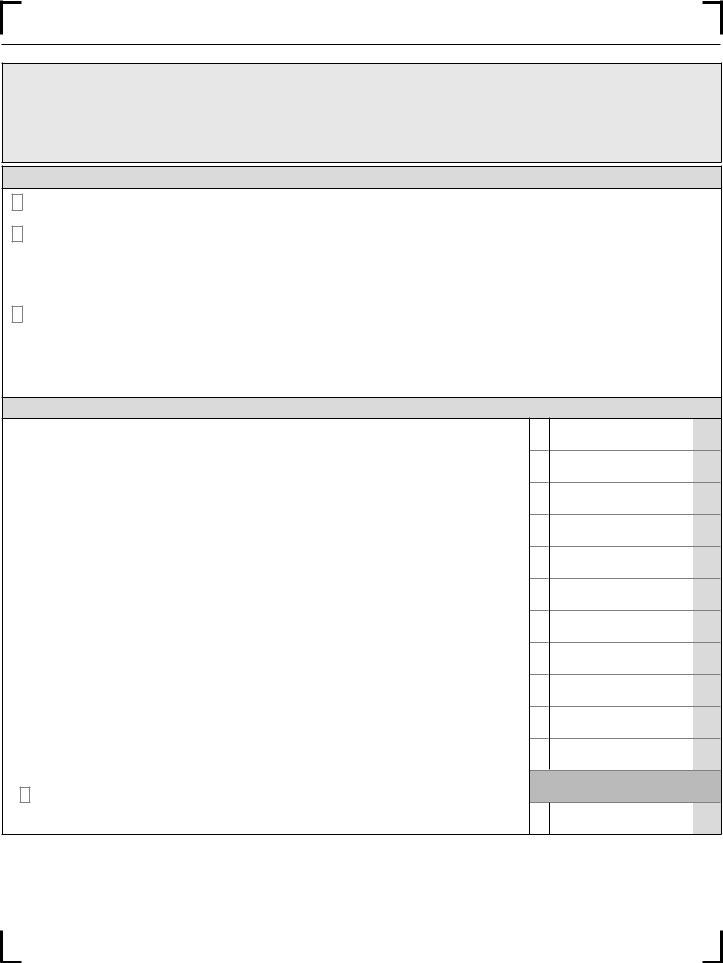

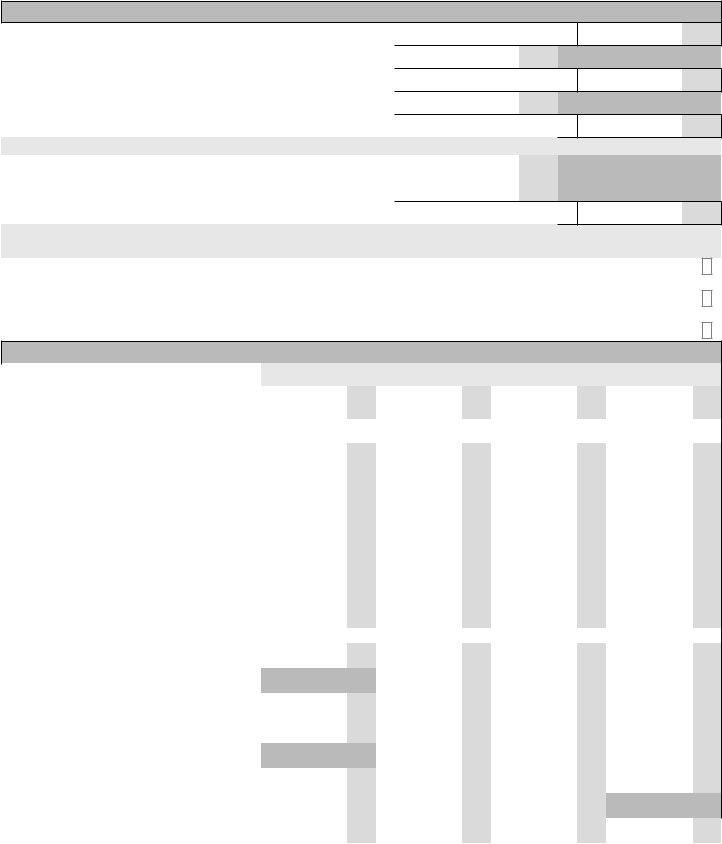

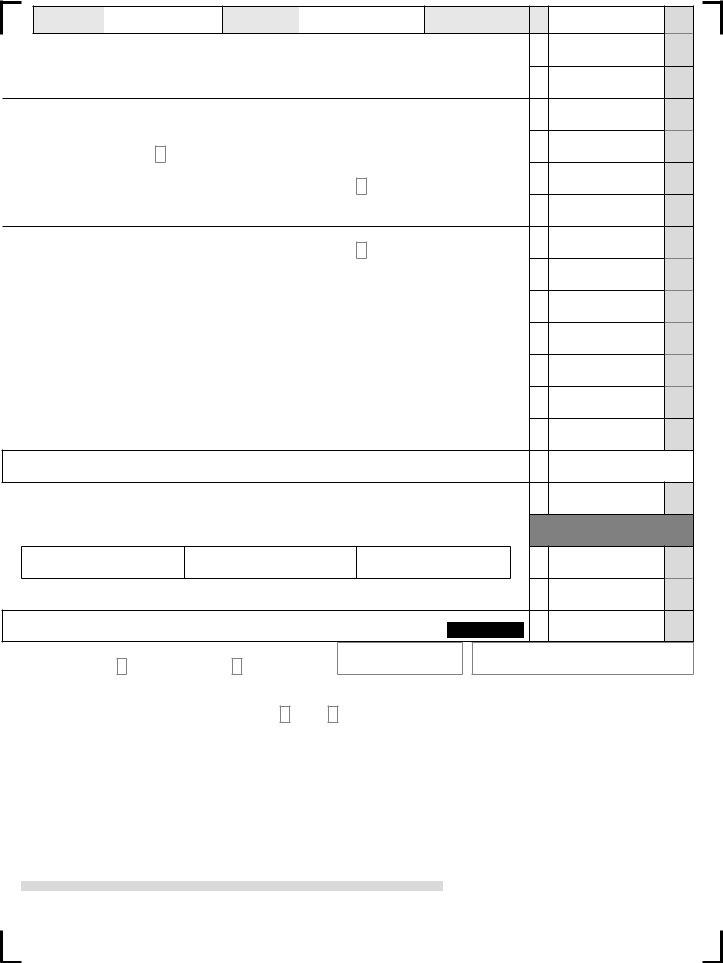

West Virginia Personal Income Tax Return |

2020 |

|

REV |

SOCIAL

SECURITY

NUMBER

LAST NAME

SPOUSE’S

LAST NAME

FIRST LINE OF

ADDRESS

CITY

TELEPHONE

NUMBER

Deceased |

|

|

*SPOUSE’S |

|

|

Deceased |

|

|

|

|

|

|

|

SOCIAL SECURITY |

|

|

|

|

|

|

|

Date of Death: |

|

|

Date of Death: |

|||||||

NUMBER |

|

|

||||||||

|

|

|

|

|

YOUR |

|

|

|

|

|

|

|

|

SUFFIX |

|

FIRST |

|

|

|

|

MI |

|

|

|

|

|

NAME |

|

|

|

|

|

|

|

|

|

|

SPOUSE’S |

|

|

|

|

|

|

|

|

SUFFIX |

|

FIRST |

|

|

|

|

MI |

|

|

|

|

|

NAME |

|

|

|

|

|

|

|

|

SECOND LINE |

|

|

|

|

|

|

|

|

|

|

OF ADDRESS |

|

|

|

|

|

|

|

|

|

|

STATE |

|

ZIP CODE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

EXTENDED DUE DATE |

|

|

|

|

|

|||

|

|

|

|

|

|

|

||||

|

|

MM/DD/YYYY |

|

|

|

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amended return

Check before 4/15/21 if you wish to stop the original debit (amended return only)

Nonresident Special

Nonresident/

Form

1

2

3

4

5

FILING

STATUS

(Check One)

Single

Head of Household

Married, Filing Joint

Married, Filing

Separate

*Enter spouse’s SS# and name in the boxes above

Widow(er) with dependent child

|

Enter “1” in boxes a |

Yourself |

(a) |

Exemptions (If someone can claim you as a dependent, leave box (a) blank.) |

{ Spouse |

|

|

and b if they apply |

(b) |

c. List your dependents. If more than five dependents, continue on Schedule DP on page 40.

First name |

Last name |

Social Security |

Date of Birth |

|

Number |

(MM DD YYYY) |

|||

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

d. Additional exemption if surviving spouse (see page 17) |

Enter total number of dependents |

(c) |

Enter decedents SSN: ______________________ Year Spouse Died: _____________________ |

(d) |

|

e. Total Exemptions (add boxes a, b, c, and d). Enter here and on line 6 below. If box e is zero, enter $500 on line 6 below. |

(e) |

|

1.Federal Adjusted Gross Income or income to claim senior citizen tax credit from Schedule

2.Additions to income (line 55 of Schedule M).............................................................................................

3.Subtractions from income (line 48 of Schedule M)....................................................................................

4.West Virginia Adjusted Gross Income (line 1 plus line 2 minus line 3)......................................................

5.

6.Total Exemptions as shown above on Exemption Box (e) ________ x $2,000 ........................................

7.West Virginia Taxable Income (line 4 minus lines 5 & 6) IF LESS THAN ZERO, ENTER ZERO ............

8.Income Tax Due (Check One) .................................................................................................................

Tax Table |

|

Rate Schedule |

|

1

2

3

4

5

6

7

8

.00

.00

.00

.00

.00

.00

.00

.00

TAX DEPT USE ONLY

PAY COR SCTC NRSR HEPTC PLAN

MUST INCLUDE WITHHOLDING

FORMS WITH THIS RETURN

*P40202001W*

P |

4 |

0 |

2 |

0 |

2 |

0 |

0 |

1 |

W |

|

PRIMARY LAST NAME |

|

|

|

|

|

|

SOCIAL SECURITY |

|

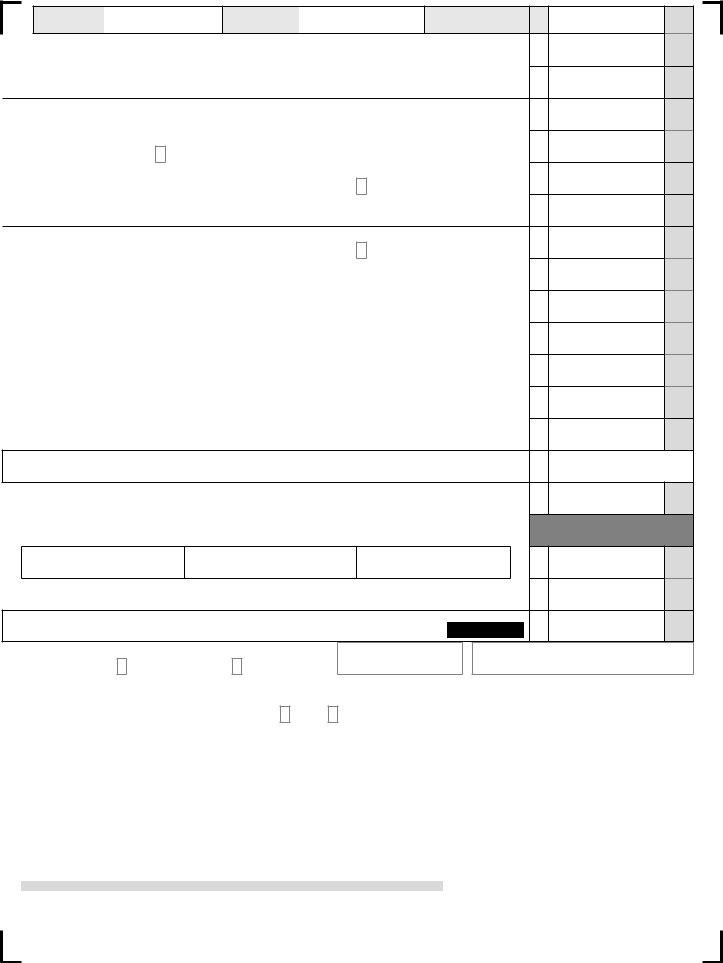

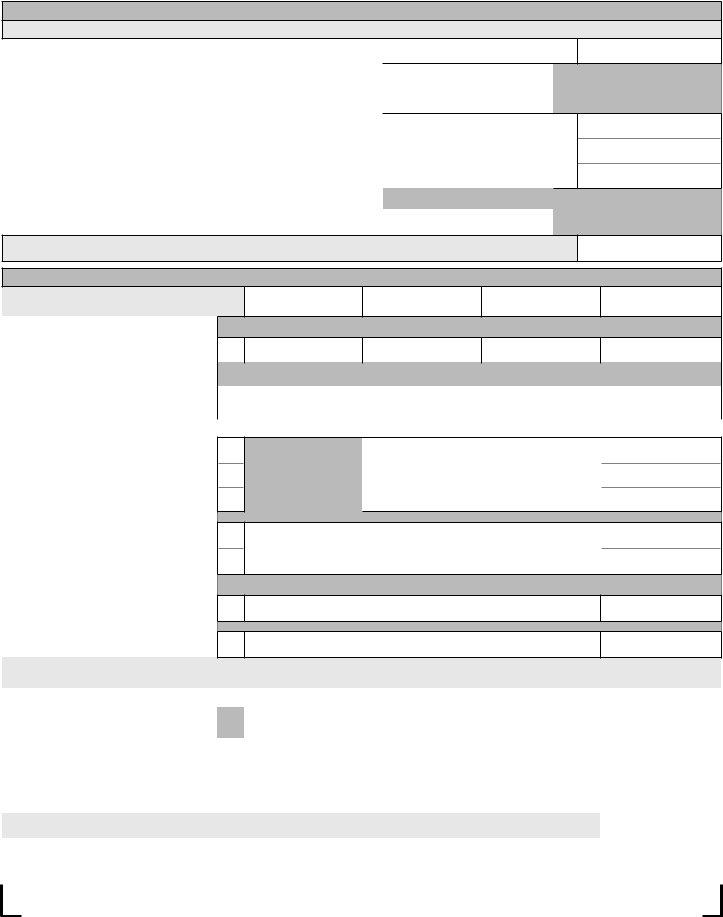

8.Total Taxes Due |

|

|

SHOWN ON FORM |

|

|

|

|

|

|

NUMBER |

|

|

|

|

|

|

(line 8 from previous page) |

8 |

|

9. |

Credits from Tax Credit Recap Schedule (see schedule on page 5 ) (now includes the Family Tax Credit) |

9 |

|||

10. |

Line 8 minus 9. If line 9 is greater than line 8, enter 0 |

|

|

10 |

|

11. |

Overpayment previously refunded or credited (amended return only) |

........................................................... |

11 |

||

12. |

Penalty Due from Form |

12 |

|||

13. |

West Virginia Use Tax Due on |

|

|

|

|

|

(See Schedule UT on page 9). |

|

CHECK IF NO USE TAX DUE |

13 |

|

14. |

Add lines 10 through 13. This is your total amount due |

|

14 |

||

|

|

|

Check if withholding from NRSR |

|

|

15. |

West Virginia Income Tax Withheld (See instructions) |

(Nonresident Sale of Real Estate) |

15 |

||

16. |

Estimated Tax Payments and Payments with Schedule 4868 |

|

16 |

||

17. |

17 |

||||

18. |

Senior Citizen Tax Credit for property tax paid (include Schedule |

18 |

|||

19. |

Homestead Excess Property Tax Credit for property tax paid (include Schedule |

19 |

|||

20. |

Amount paid with original return (amended return only) |

|

20 |

||

21. |

Payments and Refundable Credits (add lines 15 through 20) |

|

21 |

||

22. |

Balance Due (line 14 minus line 21). If Line 21 is greater than line 14, complete line 23 |

PAY THIS AMOUNT |

22 |

||

23. |

Line 21 minus line 14. This is your overpayment |

|

23 |

||

24. |

Donations of part or all of line 23. Indicate below and enter the sum of columns 24A, 24B, and 24C on Line 24 |

|

|||

|

24A. WEST VIRGINIA |

24B. WEST VIRGINIA DEPARTMENT OF |

24C. DONEL C. KINNARD MEMORIAL |

|

|

|

CHILDREN’S TRUST FUND |

VETERANS ASSISTANCE |

|

STATE VETERANS CEMETERY |

|

|

|

|

|

|

24 |

25. |

Amount of Overpayment to be credited to your 2021 estimated tax |

|

25 |

||

26. |

Refund due to you (line 23 minus line 24 and line 25) |

REFUND |

|

||

|

|

|

|

|

26 |

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

Direct Deposit

of Refund

CHECKING

SAVINGS

ROUTING NUMBER |

ACCOUNT NUMBER |

PLEASE REVIEW YOUR ACCOUNT INFORMATION FOR ACCURACY. INCORRECT ACCOUNT INFORMATION MAY RESULT IN A $15.00 RETURNED PAYMENT CHARGE.

I authorize the State Tax Department to discuss my return with my preparer

YES

NO

Under penalty of perjury, I declare that I have examined this return, accompanying schedules, and statements, and to the best of my knowledge and belief, it is true, correct and complete.

Your Signature |

|

Date |

Spouse’s Signature |

Date |

Telephone Number |

||

|

|

Preparer: Check |

|

|

|

|

|

|

|

HERE if client is |

|

|

|

|

|

|

|

requesting that form |

|

|

|

|

|

|

|

NOT be |

Preparer’s EIN |

Signature of preparer other than above |

Date |

Telephone Number |

|

|

|

|

|

|

|

||

Preparer’s Printed Name |

|

Preparer’s Firm |

|

|

|

||

FOR REFUND, MAIL TO THIS ADDRESS: |

FOR BALANCE DUE, MAIL TO THIS ADDRESS: |

WV STATE TAX DEPARTMENT |

WV STATE TAX DEPARTMENT |

P.O. BOX 1071 |

P.O. BOX 3694 |

CHARLESTON, WV |

CHARLESTON, WV |

Payment Options: Returns filed with a balance of tax due may pay through any of the following methods:

•Check or Money Order payable to the WV State Tax Department - Enclose check or money order with your return.

•Electronic Payment - May be made by visiting mytaxes.wvtax.gov and clicking on “Pay Personal Income Tax”.

•Credit Card Payment – May be made by visiting the Treasurer’s website at: epay.wvsto.com/tax

*P40202002W*

P |

4 |

0 |

2 |

0 |

2 |

0 |

0 |

2 |

W |

|

|

|

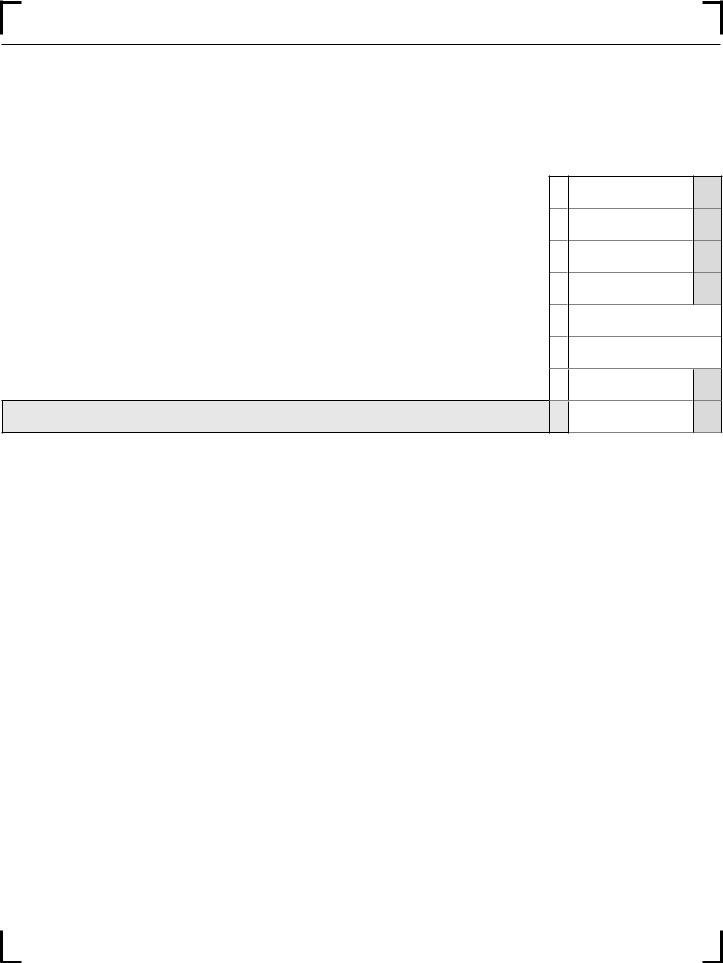

SCHEDULE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2020 |

|

||||

|

|

|

|

M |

|

|

|

|

Modifications to Adjusted Gross Income |

|

||||||||||||||

|

|

|

F |

W |

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|||||||||||||||||||

|

Modifications Decreasing Federal Adjusted Gross Income |

|

Column A (You) |

Column B (Spouse) |

||||||||||||||||||||

|

27. |

Interest or dividends received on United States or West Virginia obligations, or |

|

|

|

|

|

|

||||||||||||||||

|

|

|

allowance for government obligation income, included in federal adjusted gross income |

27 |

|

.00 |

|

.00 |

||||||||||||||||

|

|

|

but exempt from state tax |

|

|

|

|

|

|

|

|

|

||||||||||||

|

28. |

Total amount of any benefit (including survivorship annuities) received from certain |

28 |

|

|

|

|

|

||||||||||||||||

|

|

|

federal retirement systems by retired federal law enforcement officers |

|

.00 |

|

.00 |

|||||||||||||||||

|

29. |

|

Total amount of any benefit (including survivorship annuities) received from WV state or local |

|

|

|

|

|

|

|||||||||||||||

|

|

29 |

|

|

|

|

|

|||||||||||||||||

|

|

|

police, deputy sheriffs’ or firemen’s retirement system, WV DNR. Excluding PERS |

|

.00 |

|

.00 |

|||||||||||||||||

|

30. |

.....................................................................................Military Retirement Modification |

|

|

|

|

|

30 |

|

.00 |

|

.00 |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

31. |

Other Retirement Modification |

|

|

Column A (You) |

Column B (Spouse) |

|

|

|

|

|

|

||||||||||||

|

(a) West Virginia Teachers’ and Public |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

Employees’ Retirement |

|

|

|

|

|

|

.00 |

|

.00 |

|

Add lines 31 (a) and (b). If that sum is greater than $2000, enter $2000 |

||||||||||

|

(b) Federal |

Retirement |

|

Systems |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

(Title 4 USC §111) |

|

|

|

|

|

|

|

|

.00 |

|

.00 |

31 |

|

.00 |

|

.00 |

|||||

|

32. |

Certain assets held by subchapter S Corporation bank |

.................................................. |

|

|

32 |

|

|

|

|

|

|||||||||||||

|

33. |

|

Social Security Benefits Modification |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

(a) TOTAL Social Security Benefits. |

|

|

|

.00 |

|

.00 |

|

You cannot claim this modification if your Federal AGI exceeds |

|||||||||||||||

|

(b) Benefits exempt for Federal tax |

|

|

|

|

|

|

|

$ 50,000 for SINGLE or MARRIED SEPARATE filers |

|||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

$100,000 for MARRIED JOINT filers |

||||||||||||||||

|

|

|

purposes |

|

|

|

|

|

|

|

|

|

|

.00 |

|

.00 |

|

Multiply 33 (c) by 0.35 |

|

|

|

|||

|

(c) Benefits taxable for Federal tax |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

|

|

|

purposes (line a minus line b) |

|

|

|

|

.00 |

|

.00 |

33 |

|

.00 |

|

.00 |

|||||||||

|

34. |

Active Duty Military pay for personnel with West Virginia Domicile |

34 |

|

.00 |

|

.00 |

|||||||||||||||||

|

|

|

(See instructions on page 22) |

........................................................................................ |

|

|

|

|

|

|

|

|

||||||||||||

|

35. |

Active Military Separation (see instructions on page 22) |

|

|

|

|

|

|

|

|

||||||||||||||

|

|

|

35 |

|

.00 |

|

.00 |

|||||||||||||||||

|

|

|

Must enclose military orders and discharge papers |

|

|

|

|

|||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||

|

36. |

Refunds of state and local income taxes received and reported as income to the IRS ... |

36 |

|

.00 |

|

.00 |

|||||||||||||||||

|

|

|

|

|

|

|

|

|||||||||||||||||

|

37. |

Contributions to the West Virginia Prepaid Tuition/Savings Plan Trust Funds |

37 |

|

.00 |

|

.00 |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

38. |

Railroad Retirement Board Income received |

.................................................................. |

|

|

|

38 |

|

.00 |

|

.00 |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

39. |

|

|

|

|

|

|

39 |

|

.00 |

|

.00 |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

40. |

IRC 1341 Repayments |

......................................................................................................... |

|

|

|

|

|

|

|

40 |

|

.00 |

|

.00 |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

|

41. |

Autism Modification (instructions on page 22) |

..................................................................... |

|

|

|

41 |

|

.00 |

|

.00 |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

42. |

ABLE Act |

....................................................................................................................... |

|

|

|

|

|

|

|

|

|

|

|

42 |

|

.00 |

|

.00 |

|||||

|

43. |

.....................PBGC Modification |

|

|

|

|

|

.00 |

|

.00 |

|

|

|

|

|

|

||||||||

|

(a) retirement benefits that would have been |

|

|

|

|

|

Subtract line 43 (b ) from (a) |

|

|

|

||||||||||||||

|

|

|

paid from your |

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

|

(b) retirement benefits actually received |

|

|

|

.00 |

|

.00 |

43 |

|

.00 |

|

.00 |

||||||||||||

|

|

|

from PBGC |

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

44. |

Qualified Opportunity Zone business income |

|

|

44 |

|

.00 |

|

.00 |

|||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

(a) |

Year of |

birth |

(b) |

Year |

of |

(c) Income not included in |

(d) Add lines 27 through 31 |

|

|

|

|

|

|

|||||||

|

45. |

|

|

(65 or older) |

|

|

disability |

|

lines 32 and 34 to 44 |

and 33 |

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

Subtract line 45 column (d) from (c) (If less than zero, enter zero) |

|||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

(NOT TO EXCEED $8000) |

|

|

|

|||||||||

|

You |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

.00 |

|

|

.00 |

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

Spouse |

|

|

|

|

|

|

|

|

|

|

|

|

.00 |

|

.00 |

45 |

|

|

|

.00 |

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

*P40202003W* |

46. Surviving spouse deduction |

46 |

|

.00 |

|

.00 |

|||||||||||||||

|

|

|

Continues on next page |

|

|

|||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(instructions on page 23) |

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Modifications Decreasing Federal Adjusted Gross Income |

||||||||

|

|

|

|

P |

4 |

0 |

2 |

0 |

2 |

0 |

0 |

3 |

W |

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

SCHEDULE |

|

|

2020 |

|

|

|

M |

Modifications to Adjusted Gross Income |

|

||

|

|

F |

|

|||

|

|

|

|

|||

|

Modifications Decreasing Federal Adjusted Gross Income |

Column A (You) |

Column B (Spouse) |

|||

47. Add lines 27 through 46 for each column |

47 |

|

.00 |

48.Total Subtractions (line 47, Col A plus line 47,Col B) Enter here and on line 3 of FORM |

48 |

|

|

|

|

|

|

.00

.00

Modifications Increasing Federal Adjusted Gross Income |

|

|

49. |

Interest or dividend income on federal obligations which is exempt from federal tax but subject to state tax |

49 |

50. |

Interest or dividend income on state and local bonds other than bonds from West Virginia sources |

50 |

51. |

Interest on money borrowed to purchase bonds earning income exempt from West Virginia tax |

51 |

52. |

Qualifying 402(e) |

52 |

53. |

Other income deducted from federal adjusted gross income but subject to state tax |

53 |

54. |

Withdrawals from a WV Prepaid Tuition/SMART529© Savings Plan NOT used for payment of qualifying expenses |

54 |

55. |

ABLE ACT withdrawals not used for qualifying expenses |

55 |

56.TOTAL ADDITIONS (Add lines 49 through 55). Enter here and on Line 2 of Form |

56 |

|

.00

.00

.00

.00

.00

.00

.00

.00

*P40202004W*

P |

4 |

0 |

2 |

0 |

2 |

0 |

0 |

4 |

W |

RECAP

(F

Tax Credit Recap Schedule |

2020 |

This form is used by individuals to summarize tax credits that they claim against their personal income tax. In addition to completing this summary form, each tax credit has a schedule or form that is used to determine the amount of credit that can be claimed. Both this summary form and the appropriate credit calculation schedule(s) or form(s) MUST BE ENCLOSED with your return in order to claim a tax credit. Information for all of these tax credits may be obtained by visiting our website at tax.wv.gov or by calling the Taxpayer Services Division at

Note: If you are claiming the Schedule E credit(s) or the Neighborhood Investment Program Credit you are no lon- ger required to enclose the other state(s) return(s) or the

WEST VIRGINIA TAX CREDIT RECAP SCHEDULE

|

|

TAX CREDIT |

SCHEDULE |

APPLICABLE CREDIT |

|||||||

|

|

|

|

|

|

|

|||||

1. |

................................................Credit for Income Tax paid to another state(s) |

E |

1 |

|

.00 |

|

|||||

|

|

|

|

|

|

|

|

|

|

||

** For what states? |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2. |

....................................................................Family Tax Credit (see page 39) |

2 |

|

.00 |

|

||||||

|

|

|

|

|

|

|

|||||

3. |

......................................................General Economic Opportunity Tax Credit |

WV |

3 |

|

.00 |

|

|||||

|

|

|

|

|

|

|

|||||

4. |

..........................................WV Environmental Agricultural Equipment Credit |

WV |

4 |

|

.00 |

|

|||||

|

|

|

|

|

|

|

|||||

5. |

............................................................................WV Military Incentive Credit |

J |

5 |

|

.00 |

|

|||||

|

|

|

|

|

|

|

|||||

6. |

.....................................................Neighborhood Investment Program Credit |

6 |

|

.00 |

|

||||||

|

|

|

|

|

|

|

|||||

7. |

........................................Historic Rehabilitated Buildings Investment Credit |

RBIC |

7 |

|

.00 |

|

|||||

|

|

|

|

|

|

|

|||||

8. |

.......................................Qualified Rehabilitated Buildings Investment Credit |

8 |

|

.00 |

|

||||||

|

|

|

|

|

|

|

|||||

9. |

................................................................Apprenticeship Training Tax Credit |

WV |

9 |

|

.00 |

|

|||||

|

|

|

|

|

|

|

|||||

10. |

10 |

|

.00 |

|

|||||||

|

|

|

|

|

|

|

|||||

11. |

..................................................................Conceal Carry Gun Permit Credit |

11 |

|

.00 |

|

||||||

|

|

|

|

|

|

||||||

.........................................................................12. Farm to Food Bank Tax Credit |

|

12 |

|

.00 |

|

||||||

|

|

|

|

|

|

|

|||||

13. |

.................Downstream Natural Gas Manufacturing Investment Tax Credit |

DNG- 2 |

13 |

|

.00 |

|

|||||

|

|

|

|

|

|

|

|||||

14. |

...........................................................Post Coal Mine Site Business Credit |

14 |

|

.00 |

|

||||||

|

|

|

|

|

|

||||||

15.TOTAL CREDITS — add lines 1 through 14. Enter on Form |

15 |

|

.00 |

|

|||||||

**You cannot claim credit for taxes paid to KY, MD, PA, OH, or VA unless your source income is other than wages and/or salaries.

*P40202005W*

P |

4 |

0 |

2 |

0 |

2 |

0 |

0 |

5 |

W |

THIS PAGE INTENTIONALLY LEFT BLANK.

SCHEDULE |

Statement of Claimant to Refund Due Deceased Taxpayer |

2020 |

|

(F |

|||

(Attach completed schedule to decedent's return) |

NAME OF

DECEDENT

DATE OF |

SOCIAL SECURITY |

|

|

DEATH |

NUMBER |

|

|

|

|

|

|

ADDRESS |

|

|

|

(permanent residence or |

|

|

|

domicile at date of death) |

|

|

|

|

|

|

|

CITY |

STATE |

ZIP |

|

CODE |

|||

|

|

||

|

|

|

NAME OF

CLAIMANT

SOCIAL SECURITY

NUMBER

ADDRESS

CITY |

STATE |

ZIP |

|

CODE |

|||

|

|

||

|

|

|

I am filing this statement as (check only one box):

A. Surviving wife or husband, claiming a refund based on a joint return

B. Administrator or executor. Attach a court certificate showing your appointment.

C.Claimant for the estate of the decedent, other than above. Complete the rest of this schedule and attach a copy of the death certificate or proof of death*

ATTACH A LIST TO THIS SCHED-

ULE CONTAINING THE NAME AND ADDRESS OF THE SURVIV- ING SPOUSE AND CHILDREN OF THE DECEDENT.

TO BE COMPLETED ONLY IF BOX C ABOVE IS CHECKED

YES NO

1. Did the decedent leave a will?....................................................................................................................................................................

2(a).Has an administrator or executor been appointed for the estate of the decedent?......................................................................................

2(b) If "NO" will one be appointed?......................................................................................................................................................................

If 2(a) or 2(b) is checked "YES", do not file this form. The administrator or executor should file for the refund.

3.Will you, as the claimant for the estate of the decedent, disburse the refund according to the laws of the state in which the decedent

was domiciled or maintained a permanent residence?.................................................................................................................................

If "NO", payment of this claim will be withheld pending submission of proof of your appointment as administrator or execu- tor or other evidence showing that you are authorized under state law to receive payment.

SIGNATURE AND VERIFICATION

I hereby make request for refund of taxes overpaid by, or on behalf of the decedent and declare under penalties of perjury, that I have examined this claim and to the best of my knowledge and belief, it is true, correct and complete.

Signature of claimant _____________________________________________________ Date _______________________________

*May be the original of an authentic copy of a telegram or letter from the Department of Defense notifying the next of kin of death while in active service, or a death certificate issued by the appropriate officer of the Department of Defense.

*P40202015W*

P |

4 |

0 |

2 |

0 |

2 |

0 |

1 |

5 |

W |

SCHEDULES |

Certification for Permanent and Total Disability |

2020 |

(F |

W and Credit for Income Tax Paid to Another State |

|

H & E |

|

|

SCHEDULE H CERTIFICATION OF PERMANENT AND TOTAL DISABILITY

TAXPAYERS WHO ARE DISABLED DURING 2020 REGARDLESS OF AGE

If you were certified by a physician as being permanently and totally disabled during the taxable year 2020, OR you were the surviving spouse of an individual who had been certified disabled and DIED DURING 2020, read the instructions to determine if you qualify for the income reducing modification allowed on Schedule M.

If you qualify, you must (1) enter the name of and social security number of the disabled taxpayer in the space provided on this form, (2) have a physician complete the remainder of the certification statement and return it to you, (3) enclose the completed certification with your West Virginia personal income tax return, and (4) complete Schedule M to determine your modification.

A COPY OF YOUR FEDERAL SCHEDULE R (PART II) MAY BE SUBSTITUTED FOR THE WEST VIRGINIA SCHEDULE H.

If you have provided the West Virginia State Tax Department with an approved Certification of Permanent and Total Disability for a prior year AND YOUR DISABILITY STATUS DID NOT CHANGE FOR 2020, you do not have to submit this form with your return. However, you must have a copy of your original disability certification should the Department request verification at a later date.

I Certify under penalties of perjury that the taxpayer named below was permanently and totally disabled on or before December 31, 2020.

|

Name of Disabled Taxpayer |

Social Security Number |

|

||

|

|

|

|

|

|

|

Physician’s Name |

Physician's FEIN Number |

|

||

|

|

|

|

|

|

|

Physician’s Street Address |

|

|

||

|

|

|

|

|

|

|

City |

State |

Zip Code |

||

Physicians |

|

Date |

|

|

|

|

|

|

|||

|

|

|

|

|

|

Signature |

|

|

MM |

DD |

YYYY |

|

|

|

|||

|

|

|

|

|

|

INSTRUCTIONS TO PHYSICIAN COMPLETING DISABILITY STATEMENT

A PERSON IS PERMANENTLY AND TOTALLY DISABLED WHEN HE OR SHE IS UNABLE TO ENGAGE IN ANY SUBSTANTIAL GAINFUL ACTIVITY BECAUSE OF A MENTAL OR PHYSICAL CONDITION AND THAT DISABILITY HAS LASTED OR CAN BE EXPECTED TO LAST CONTINUOUSLY FOR AT LEAST A YEAR, OR CAN BE EXPECTED TO LEAD TO DEATH. IF, IN YOUR OPINION, THE INDIVIDUAL NAMED ON THIS STATEMENT IS PERMANENTLY AND TOTALLY DISABLED DURING 2020, PLEASE CERTIFY SUCH BY ENTERING YOUR NAME, ADDRESS, SIGNATURE, DATE, AND FEIN NUMBER IN THE SPACES PROVIDED ABOVE AND RETURN TO THE INDIVIDUAL.

ANOTHER STATE

RESIDENCY STATUS

Resident

Nonresident – did not maintain a residence in West Virginia during the taxable year (NO CREDIT IS ALLOWED)

MM DD YYYY Moved into West Virginia

Moved out of West Virginia, but had West Virginia source income during your nonresident period Moved out of West Virginia and had no West Virginia source income during your nonresident period

SCHEDULE E CREDIT FOR INCOME TAX PAID TO

1.INCOME TAX COMPUTED on your 2020 _________________ return. Do not report Tax Withheld State Abbreviation

2.West Virginia total income tax (line 8 of Form

3.Net income derived from above state included in West Virginia total income.....................................................

4.Total West Virginia Income

5.Limitation of Credit (line 2 multiplied by line 3 divided by line 4).........................................................................

6. Alternative West Virginia taxable income Residents – subtract line 3 from line 7, Form

7.Alternative West Virginia total income tax (Apply the Tax Rate Schedule to the amount shown on line 6).........

8.Limitation of credit (line 2 minus line 7)...............................................................................................................

9.Maximum credit (line 2 minus the sum of lines 2 through 14 of the Tax Credit Recap Schedule)

10.Total Credit (SMALLEST of lines 1,2, 5, 8, or 9) enter here and on line 1 of the Tax Credit Recap Schedule.

1

2

3

4

5

6

7

8

9

10

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

A SEPARATE SCHEDULE E MUST BE COMPLETED FOR EACH STATE FOR WHICH CREDIT IS CLAIMED. YOU MUST MAINTAIN A COPY OF THE OTHER STATE TAX RETURN IN YOUR FILES. IN LIEU OF A RETURN YOU MAY MAINTAIN AN INFORMATION STATEMENT AND THE WITHHOLDING STATEMENTS PROVIDED BY THE PARTNERSHIP, LIMITED LIABILITY COMPANY OR

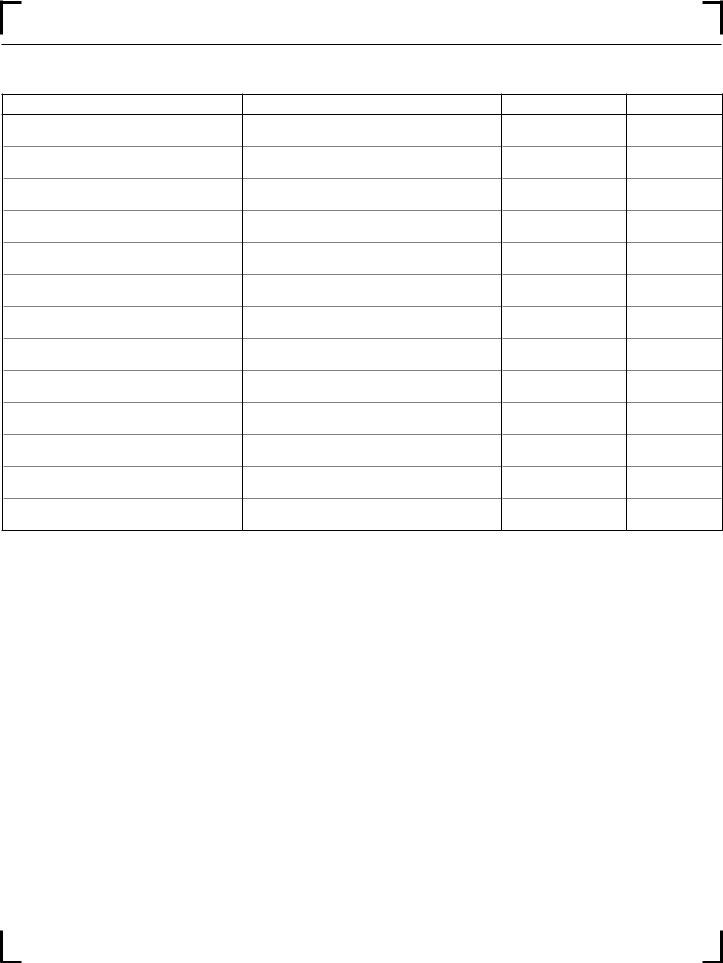

SCHEDULE |

2020 |

UT |

|

(F |

INSTRUCTIONS

Purchaser’s Use Tax is a tax on the use of tangible personal property or services in West Virginia where Sales Tax has not been paid. Use Tax applies to the following: internet purchases, magazine subscriptions,

For detailed instructions on the Schedule UT, see page 10.

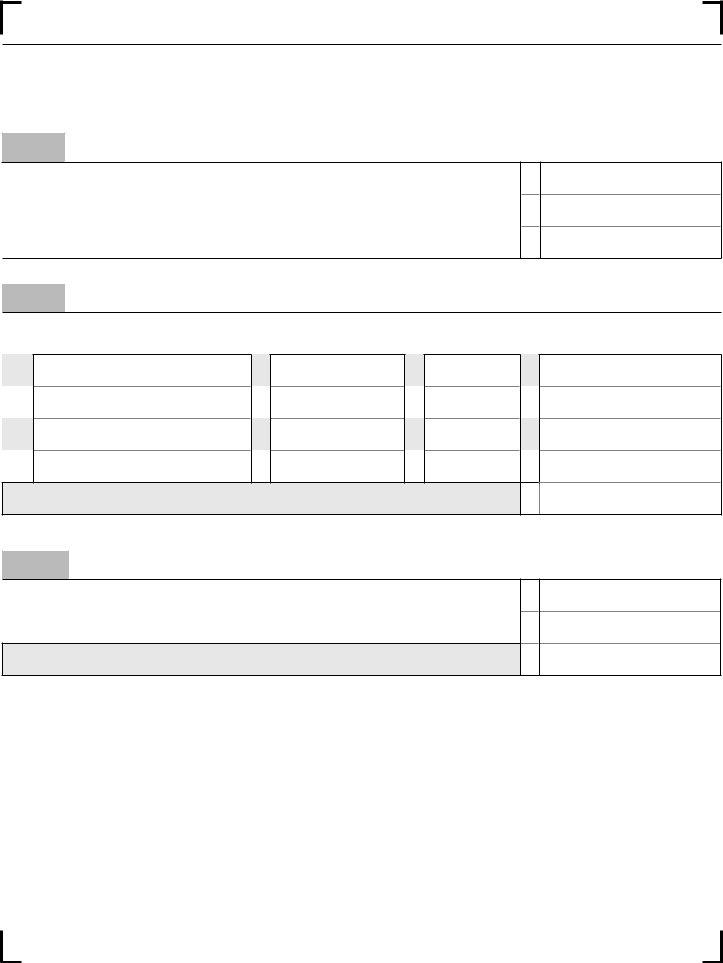

Part I State Use Tax Calculation

1. Amount of purchases subject to West Virginia Use Tax.................................................................................

1

$

2. West Virginia Use Tax Rate..........................................................................................................................

2

.06

3. West Virginia State Use Tax (Multiply line 1 by rate on line 2. Enter amount here and on line 9 below).......

3

$

Part II Municipal Use Tax Calculation

City/Town Name* |

Purchases Subject to |

Tax Rate |

Municipal Tax Due |

|

Municipal Use Tax |

(Purchases multiplied by rate) |

|||

|

|

4a

4b

$

4c

4d

$

5a

5b

$

5c

5d

$

6a

6b

$

6c

6d

$

7a

7b

$

7c

7d

$

8. Total Municipal Use Tax (add lines 4d through 7d and enter here and on line 10)

8

$

Part III Total Amount Due

9.Total State Use Tax due (from line 3)............................................................................................................

10.Total Municipal Use Tax due (from line 8)....................................................................................................

11.Total Use Tax Due (add lines 9 & 10 and enter total here and on line 13 of Form

9

10

11

$

$

$

*Visit www.tax.wv.gov for a complete list of West Virginia municipalities that impose a Use Tax.

*P40202006W*

P |

4 |

0 |

2 |

0 |

2 |

0 |

0 |

6 |

W |

SCHEDULE UT INSTRUCTIONS

You owe use tax on the total purchase price of taxable tangible personal property or taxable services (hereinafter called property) that you used, stored, or consumed in West Virginia upon which you have not previously paid West Virginia sales or use tax. The use tax applies to the following: internet purchases, magazine subscriptions,

The example provides information on how to use the amount of sales tax paid to the other state as a credit against West Virginia state and municipal use taxes imposed and how to compute and report the West Virginia state and municipal taxes due.

You bring equipment into West Virginia for use in a municipality which imposes municipal sales and use tax. You can determine the West Virginia state and municipal use tax as follows:

Examples of reasons you may owe use tax:

1.You purchased property without paying sales tax from a seller outside of West Virginia. You would have paid sales tax if you purchased the property from a West Virginia seller.

2.You purchased property without paying sales tax for resale (to sell to others) or for a nontaxable use. You then used the property in a taxable manner.

3.You purchased property without paying sales tax and later gave the property away free to your customers.

USE TAX – STATE

1.Purchase price

2.6.0% West Virginia State use tax ($10,000 x .06)

3.Less 4.0% sales/use tax paid to State B ($10,000 x .04)

4.Net use tax due to West Virginia

5.Measure of tax ($200 ÷ .06 tax rate)

$10,000.00

600.00

(400.00)

200.00

$ 3,333.34

Pඉකග I. Sගඉගඍ Uඛඍ Tඉච Cඉඔඋඝඔඉග ඖ (includes purchases or

You should include the $3,333.34 in Part I, line 1 of the West Virginia Purchaser’s Use Tax Schedule.

lease of tangible personal property or taxable service made using direct pay permit)

Line 1 – Enter the total dollar amount of all purchases made during the 2020 tax year that are subject to the 6% use tax rate.

Line 3 – Multiply the amount on line 1 by the use tax rate on line 2.

Pඉකග II. Mඝඖ උ ඉඔ Uඛඍ Tඉච Cඉඔඋඝඔඉග ඖ

You owe municipal use tax on the total purchase price of taxable tangible personal property or taxable services that you used, stored, or consumed in a municipality that has imposed sales and use tax upon which you have not

USE TAX – MUNICIPAL

1.Purchase price

2.1.0% Municipality A sales/use tax ($10,000 x .01)

3.Less .5% sales/use tax paid to Municipality B ($10,000 x .005)

4.Net use tax due to municipality A

5.Measure of tax ($50 ÷ .01 tax rate)

$10,000.00

100.00

(50.00)

50.00

$ 5,000.00

previously paid sales or use tax.

For municipal tax paid in another municipality. West Virginia sales and use tax law provides a credit for sales or use taxes that are properly due and paid to another state or municipality on property or services purchased outside of the State or municipality in which you are located and subsequently stored, used or consumed inside the State or municipality. The credit is allowed against the total of West Virginia state and municipal use taxes imposed on the same property or services purchased in the other state or municipality.

Note: When the combined state and municipal taxes paid to the other state/municipality equals or exceeds the combined West Virginia state and municipal use tax, no entry is required on the West Virginia Purchaser’s Use Tax Schedule (Schedule UT) to report the purchase or the credit for tax paid to the other state/municipality on the same purchase. Example: You purchase an item subject to tax in Ohio and pay 7% sales tax (6% state tax and 1% local tax). You live in an area in West Virginia that imposes a 1% municipal use tax with the State rate 6%, for a total 7%. You would not report the purchase on the schedule nor on your Personal Income Tax return since the combined rates are the same in Ohio and the city in West Virginia.

The following example includes a situation a person may encounter with respect to West Virginia state, and municipal sales and use taxes, if they purchase items outside West Virginia or from a different municipality and are required to pay sales or use taxes to the other state and/or municipality.

You should include the $5,000 in Part II, line

Line 4a – 7a – Enter the name of the municipality.

Line 4b – 7b – Enter total purchases subject to the use tax.

Line 4c – 7c – Enter the tax rate. See www.tax.wv.gov for a complete list of municipalities and rates.

Line 4d – 7d – Multiply total purchases by the tax rate and enter total.

Line 8 – Add lines 4d through 7d and enter total.

Pඉකග III. Tගඉඔ Aඕඝඖග Dඝඍ

Line 9 – Enter total State Use Tax due (from line 3).

Line 10 – Enter total Municipal Use Tax due (from line 8).

Line 11 – Enter total Use Tax due. Add lines 9 and 10 and enter total here and on line 13 of Form IT 140.

|

|

|

SCHEDULE |

|

2020 |

|

|

|||||||||||||||

|

|

|

|

A |

|

|

|

|||||||||||||||

|

|

|

(F |

W |

Schedule of Income |

|

|

|

||||||||||||||

|

|

|

|

|

||||||||||||||||||

|

|

|

|

|

FROM: |

|

|

|

|

|

TO: |

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

|

|

|

|

|

Enter period of West Virginia residency |

MM/DD/YYYY |

|

|

|

|

MM/DD/YYYY |

|

|

|

|

|

|

|||||

|

(To Be Completed By Nonresidents and |

|

|

|

COLUMN A: |

|

COLUMN B: |

|

|

COLUMN C: |

|

|

||||||||||

|

|

|

|

ALL INCOME DURING PERIOD OF |

WV SOURCE INCOME DURING |

|

||||||||||||||||

|

|

|

|

|

INCOME |

|

AMOUNT FROM FEDERAL RETURN |

|

||||||||||||||

|

|

|

|

|

|

WV RESIDENCY |

|

NONRESIDENT PERIOD |

|

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

1. |

|

Wages, salaries, tips (withholding documents) |

1 |

|

.00 |

|

|

|

.00 |

.00 |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

2. |

|

Interest |

|

|

2 |

|

.00 |

|

|

|

.00 |

.00 |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

3. |

|

Dividends |

|

|

3 |

|

.00 |

|

|

|

.00 |

.00 |

|

|

|

|||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

4. |

|

IRAs, pensions and annuities |

4 |

|

.00 |

|

|

|

.00 |

.00 |

|

|

|

|||||||||

5. |

|

Total taxable Social Security and Railroad Retirement |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

benefits (see line 33 and 38 of Schedule M) |

5 |

|

.00 |

|

|

|

.00 |

|

|

|

|

|

|

|

|||||

6. |

|

Refunds of state and local income tax |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

|

|

|

(see line 36 of Schedule M) |

6 |

|

.00 |

|

|

|

.00 |

|

|

|

|

|

|

|

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

7. |

|

Alimony received |

7 |

|

.00 |

|

|

|

.00 |

|

|

|

|

|

|

|

||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

8. |

|

Business profit (or loss) |

8 |

|

.00 |

|

|

|

.00 |

.00 |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||

9. |

|

Capital gains (or losses) |

9 |

|

.00 |

|

|

|

.00 |

.00 |

|

|

|

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

10. |

Supplemental gains (or losses) |

10 |

|

.00 |

|

|

|

.00 |

.00 |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

11. |

Farm income (or loss) |

11 |

|

.00 |

|

|

|

.00 |

.00 |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||

12. |

.............Unemployment compensation insurance |

12 |

|

.00 |

|

|

|

.00 |

.00 |

|

|

|

||||||||||

13. |

Other income from federal return (identify source) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||

|

|

|

.00 |

|

|

|

.00 |

.00 |

|

|

|

|||||||||||

|

|

|

|

|

|

|

|

13 |

|

|

|

|

|

|

|

|||||||

14. |

Total income (add lines 1 through 13) |

14 |

|

.00 |

|

|

|

.00 |

.00 |

|

|

|

||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ADJUSTMENTS

15. |

Educator expenses |

................................................ |

|

|

|

|

15 |

.00 |

|

.00 |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

16. |

IRA deduction |

......................................................... |

|

|

|

|

|

16 |

.00 |

|

.00 |

||||

|

|

|

|

|

|

|

|

|

|||||||

17. |

............................... |

|

17 |

.00 |

|

.00 |

|||||||||

|

|

|

|

|

|

||||||||||

18. |

Self Employed SEP, SIMPLE and qualified plans... |

18 |

.00 |

|

.00 |

||||||||||

|

|

|

|

|

|

||||||||||

19. |

19 |

.00 |

|

.00 |

|||||||||||

|

|

|

|

|

|

|

|||||||||

20. |

Penalty for early withdrawal of savings |

.................. |

20 |

.00 |

|

.00 |

|||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

21. |

Other adjustments (See instructions page 25) |

21 |

.00 |

|

.00 |

||||||||||

|

|

|

|

||||||||||||

22. |

Total adjustments (add lines 15 through 21) |

22 |

.00 |

|

.00 |

||||||||||

23. |

Adjusted gross income |

|

|

|

|

|

|

|

|

|

|||||

|

|

|

|

|

23 |

.00 |

|

.00 |

|||||||

|

|

(subtract line 22 from line 14 in each column) |

|

||||||||||||

|

|

|

|

|

|

||||||||||

24. |

West Virginia income (line 23, Column B plus column C) |

.............................................................................. |

|

24 |

|||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

25. Income subject to West Virginia state tax but |

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||

|

|

*P40201907W* |

|

......................................exempt from federal tax |

25 |

||||||||||

|

|

26. Total West Virginia income (line 24 plus line 25). |

|

||||||||||||

|

|

|

Enter here and on line 2 on the next page |

26 |

|||||||||||

|

|

P |

4 |

0 |

2 |

0 |

2 |

0 |

0 |

7 |

W |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

|

|

SCHEDULE |

2020 |

|

|

|

|

|

A |

|

|

||

|

|

(F |

Schedule of Income |

|

|

|

|

|

|

SCHEDULE A (CONTINUED)

PART I:

1. |

Tentative Tax (apply the appropriate tax rate schedule on page 37 to the amount shown on line 7, Form |

1 |

2. |

West Virginia Income (line 26, Schedule A) |

2 |

3. |

Federal Adjusted Gross Income (line 1, Form |

3 |

4. |

Tax (divide line 2 by line 3, round to 4 decimal places and multiply the result by line 1). Enter here and on line 8, |

|

|

Form |

4 |

PART II: SPECIAL NONRESIDENT INCOME FOR RESIDENTS OF RECIPROCAL STATES AND CERTAIN ACTIVE MILITARY MEMBERS

ELIGIBILITY: Complete this section ONLY if ALL THREE of the following statements were true for 2020.

•You were EITHER a resident of Kentucky, Maryland, Ohio, Pennsylvania or Virginia

OR a member of the military assigned to active duty in West Virginia whose domicile is outside West Virginia

•Your only West Virginia source income was from wages and salaries.

•West Virginia income tax was withheld from such wages and salaries by your employer(s).

.00

.00

.00

.00

If you were a

NOTE: If you were a resident of any state other than Kentucky, Ohio, Maryland, Pennsylvania, or Virginia, you are ineligible to complete Part

II.You must check the box Filing as Nonresident or Filing as a

I declare that I was not a resident of West Virginia at any time during 2020, I was a resident of the state shown OR was in West Virginia pursuant to active duty military orders, my only income from sources within West Virginia was from wages and salaries, and such wages and salaries were subject to income taxation by my state of residence.

Commonwealth of Kentucky

YOUR STATE OF RESIDENCE (Check one):

Commonwealth of Pennsylvania |

Number of days spent in West Virginia |

State of Maryland

Commonwealth of Virginia |

Number of days spent in West Virginia |

State of Ohio

Active Military, stationed in West Virginia but not domiciled here (Must enclose military order and DD2058)

|

|

|

(A) |

(B) |

||||

|

|

|

Primary Taxpayer's Social |

Spouse's Social Security |

||||

|

|

|

Security Number |

Number |

||||

|

|

|

|

|

|

|

|

|

5. |

Enter your total West Virginia Income from wages and salaries in the appropriate column |

5 |

|

.00 |

|

.00 |

|

|

6. |

Enter total amount of West Virginia Income Tax withheld from your wages and |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

salaries paid by your employer in 2020 |

6 |

|

.00 |

|

.00 |

|

|

|

|

|

|

|

|

|

|

|

7. |

Line 6, column A plus line 6 column B. Report this amount on line 15 of Form |

7 |

|

.00 |

|

|||

|

|

|

|

|

|

|

|

|

*P40202008W*

P |

4 |

0 |

2 |

0 |

2 |

0 |

0 |

8 |

W |

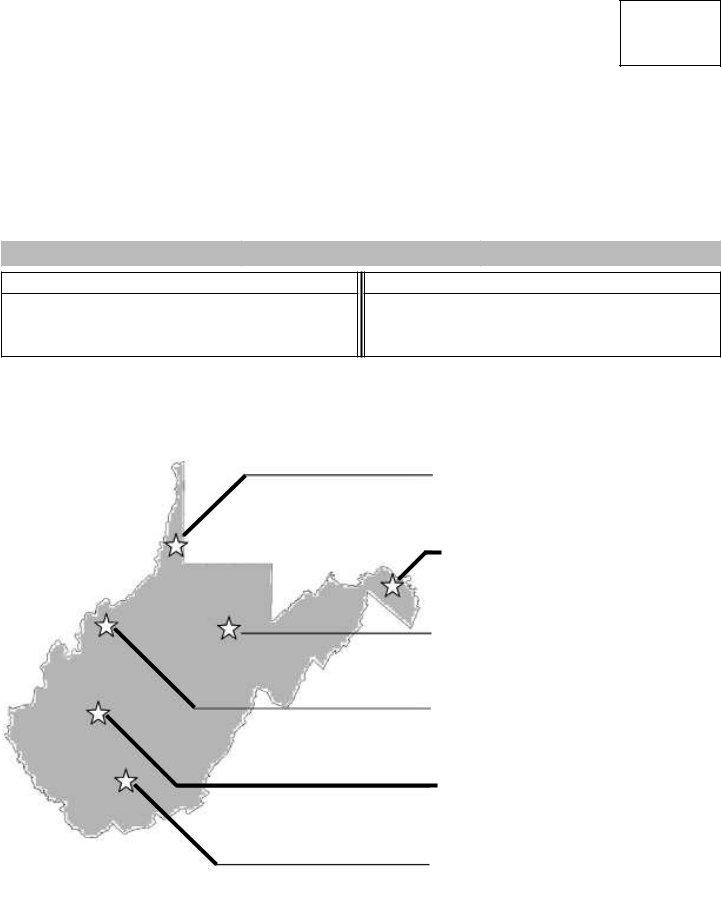

IMPORTANT INFORMATION FOR 2020

•You are required to submit your original withholding documents, such as

•Additional municipalities are now subject to the Municipal Use Tax. Visit www.tax.wv.gov for a complete list of West Virginia municipalities that impose a Use tax.

•You can now interact with us online at mytaxes.wvtax.gov. Services offered include bill pay and secure communication about your return. Before you call, please use our MyTaxes portal. At this time, we do not offer online filing through that portal. Online filing options are available on our website.

RETURNED PAYMENT CHARGE

The Tax Department will recover a $15.00 fee associated with returned bank transactions. These bank transactions include but are not limited to the following:

•Direct Debit (payment) transactions returned for insufficient funds.

•Stopped payments.

•Bank refusal to authorize payment for any reason.

•Direct Deposit of refunds to closed accounts.

•Direct Deposit of refunds to accounts containing inaccurate or illegible account information.

•Checks returned for insufficient funds will incur a $28.00 fee.

The fee charged for returned or rejected payments will be to recover only the amount charged to the State Tax Department by the financial institutions.

Important: There are steps that can be taken to minimize the likelihood of a rejected financial transaction occurring:

•Be sure that you are using the most current bank routing and account information.

•If you have your tax return professionally prepared, the financial information used from a prior year return often carries over to the current return as a step saver. It is important that you verify this information with your tax preparer by reviewing the bank routing and account information from a current check. This will ensure the information is accurate and current in the event that a bank account previously used was closed or changed either by you or the financial institution.

•If you prepare your tax return at home using tax preparation software, the financial information used from a prior year return often carries over to the current return as a step saver. It is important that you verify this information by reviewing the bank routing and account information from a current check. This will ensure the information is accurate and current in the event that a bank account previously used was closed or changed either by you or the financial institution.

•If you prepare your tax return by hand using a paper return form, be sure that all numbers entered when requesting a direct deposit of refund are clear and legible.

•If making a payment using MyTaxes, be sure that the bank routing and account numbers being used are current.

•If scheduling a delayed debit payment for an electronic return filed prior to the due date, make sure that the bank routing and account numbers being used will be active on the scheduled date.

•Be sure that funds are available in your bank account to cover the payment when checks or delayed debit payments are presented for payment.

tax.wv.gov |

2020 Personal Income Tax Information and Instructions — 13 |

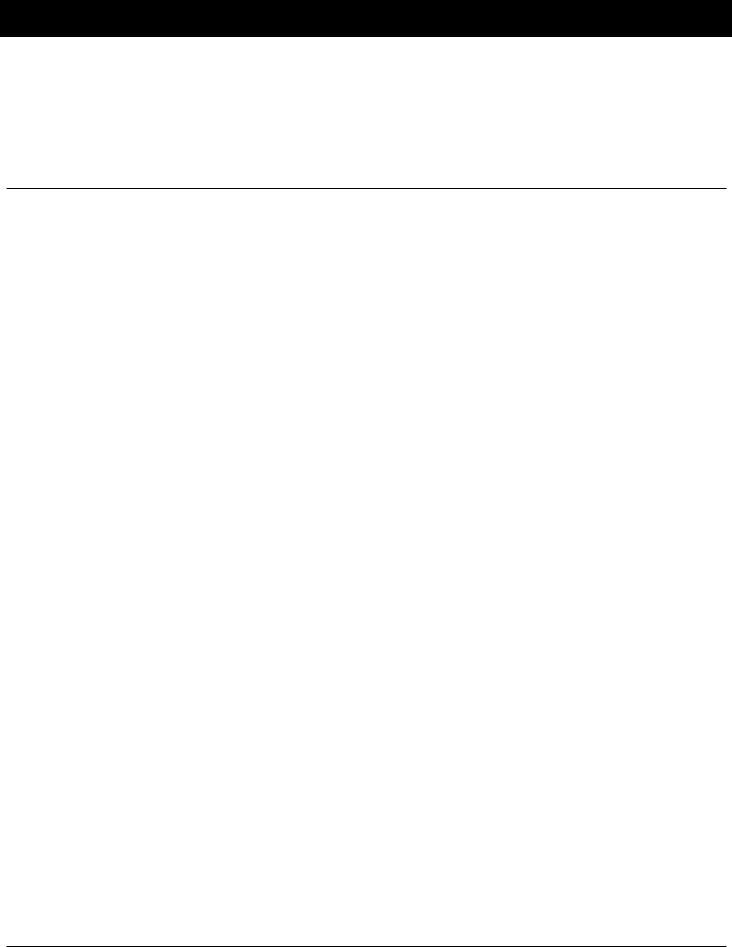

TIPS ON FILING A PAPER RETURN

The State Tax Department processes

•Make sure you have received all

•Complete your federal income tax return first.

•Do not use prior year forms.

•IT 140W has been discontinued. SEND all

•Paper returns are electronically scanned. The processing of the return (and any refund) is delayed when information on the return is not clear.

•Use BLACK INK. Do not use pencils, colored ink, or markers.

•Do not write in the margins.

•Always put entries on the lines, not to the side, above or below the line.

•Do not submit photocopies to the Department.

•Lines where no entry is required should be left blank. Do not fill in with zeros.

•Do not use staples.

•Make sure all required forms and schedules are included with the tax return.

•Sign your return.

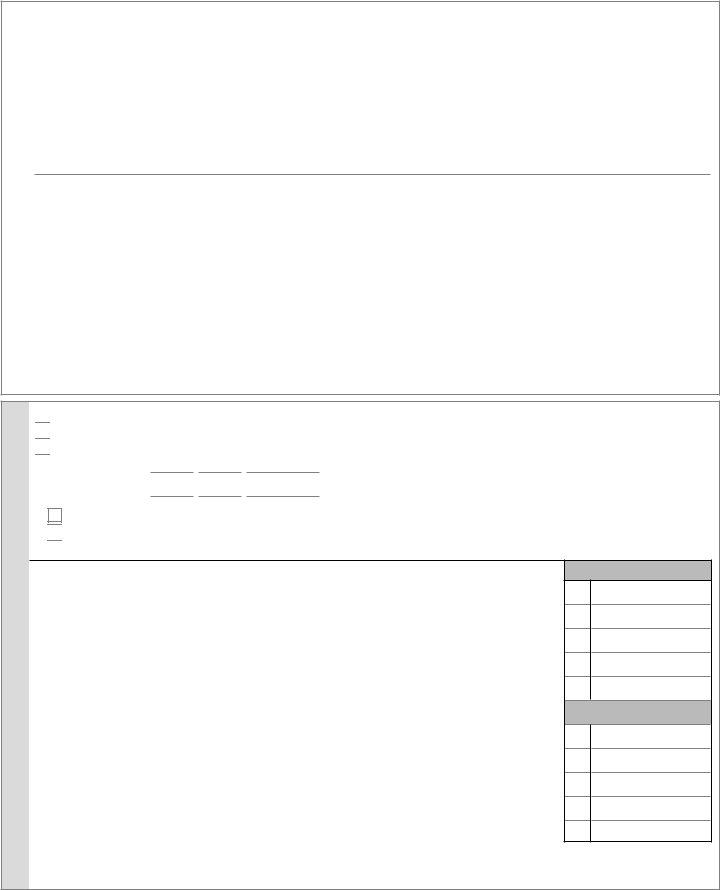

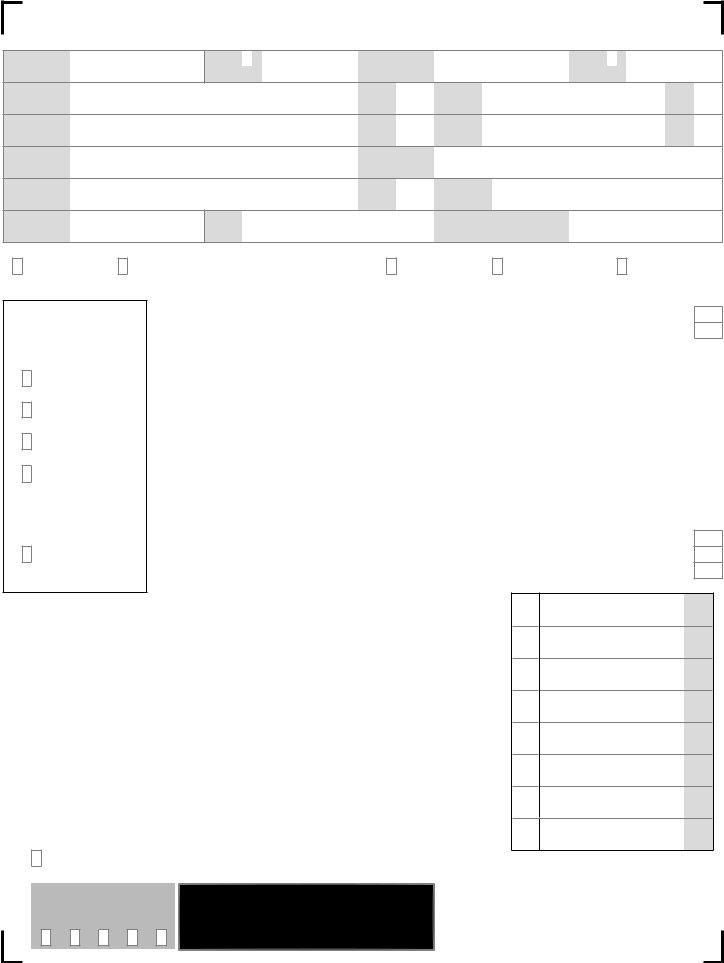

•Write your name and address clearly using BLOCK CAPITAL LETTERS as in the following example:

HUGHES

Last Name |

|

Suffix |

|

|

|

|

|

|

Spouse’s Last Name – Only if different from Last Name above |

|

Suffix |

2L 34N5THST |

|

|

First Line of Address |

|

|

ANYWHERE |

|

|

City |

|

|

|

JODY |

|

|

|

|

M |

||

|

|

|

|

Your First Name |

|

|

|

MI |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Spouse’s First Name |

|

|

|

MI |

|

|

|

|

|

|

|

||

|

|

|

|

|

|

|

|

|

|

|

|

|

Second Line of Address |

||||

|

|

|

|

|

|

|

|

|

|

WV |

|

55555 |

|

6789 |

|

|

|

|

State |

Zip Code |

|

|

|

|

||

•NEVER USE COMMAS when filling in dollar amounts.

•Round off amounts to WHOLE DOLLARS – NO CENTS.

•Do not use parentheses ( ) for a negative number. Use a dark, bold negative sign:

• |

Print your numbers like this: 0 L 2 3 4 5 6 7 8 9 Do not use: 0 1 4 7 |

• |

Do not add cents in front of the preprinted zeros on entry lines. Numbers should be entered as shown below: |

Federal Adjusted Gross Income

Additions to Income

Subtractions from Income

West Virginia Adjusted Gross Income

40000.00

.00

8000.00

32000.00

14 — 2020 West Virginia Personal Income Tax Information and Instructions |

tax.wv.gov |

GENERAL INFORMATION

WHO MUST FILE

You must file a West Virginia income tax return if:

•You were a resident of West Virginia for the entire taxable year.

•You were a resident of West Virginia for a part of the taxable year

•You were not a resident of West Virginia at any time during 2020, but your federal adjusted gross income includes income from West Virginia sources (nonresident).

You are required to file a West Virginia return even though you may not be required to file a federal return if:

•Your West Virginia adjusted gross income is greater than your allowable deduction for personal exemptions ($2,000 per exemption, or $500 if you claim zero exemptions). Your income is to be determined as if you had been required to file a federal return. Your exemptions are to be determined following the rules on page 16.

•You are claiming a SCTC or HEPTC credit OR

•You are due a refund.

You are not required to file a West Virginia return if you and your spouse are 65 or older and your total income is less than your exemption allowance plus the senior citizen modification. For example, $2,000 per exemption plus up to $8,000 of income received by each taxpayer who is 65 or older. However, if you are entitled to a refund you must file a return.

RESIDENCY STATUS

A resident is an individual who:

•Spends more than 30 days in West Virginia with the intent of West Virginia becoming his/her permanent residence; or

•Maintains a physical presence in West Virginia for more than 183 days of the taxable year, even though he/she may also be considered a resident of another state.

A

•From West Virginia to another state, or

•From another state to West Virginia during the taxable year.

A

•A resident of West Virginia who spends less than 30 days of the taxable year in West Virginia, and maintains a permanent place of residence outside West Virginia; or

•A resident of another state who does not maintain a physical presence within West Virginia and does not spend more than 183 days of the taxable year within West Virginia.

A Special Nonresident is an individual who is:

•A resident of Kentucky, Maryland, Ohio, Pennsylvania, or Virginia for the entire taxable year; and

•Your only source of West Virginia income was from wages and salaries.

Nonresidents who DO NOT have West Virginia source income or withholdings are not required to file a West Virginia return.

Mark the nonresident special box on the front of the return and complete Part II of Schedule A.

Nonresident individuals who are partners in a partnership, shareholders in a S corporation or beneficiaries of an estate or trust that derives income from West Virginia sources may elect to be included on a nonresident composite return. If the election is made, the

If a separate individual return is filed, the nonresident must include the West Virginia income derived from the

This form is available on our website at tax.wv.gov.

AMENDED RETURN

Use the version of Form

You must file a West Virginia amended return if any of the following conditions occur:

•To correct a previously filed return; or

•You filed an amended federal income tax return and that change affected your West Virginia tax liability; or

•The Internal Revenue Service made any changes to your federal return (i.e., change in federal adjusted gross income, change in exemptions, etc.).

If a change is made to your federal return, an amended West Virginia return must be filed within ninety (90) days. A copy of your amended federal income tax return must be enclosed with the West Virginia amended return. Do not enclose a copy of your original return.

If you are changing your filing status from married filing jointly to married filing separately or from married filing separately to married filing jointly, you must do so in compliance with federal guidelines. If your original return was filed jointly and you are amending to file separately, your spouse must also file an amended separate return.

If the amended return is filed after the due date, interest and penalty for late payment will be charged on any additional tax due. An additional penalty will be assessed if you fail to report any change to your federal return within the prescribed time.

Space is provided on page 47 to explain why you are filing an amended return.

A

•Taxable income received from ALL sources while a resident of West Virginia;

•West Virginia source income earned during the period of nonresidence; and

•Applicable special accruals.

WEST VIRGINIA SOURCE INCOME

The West Virginia source income of a nonresident is derived from the following sources included in your federal adjusted gross income:

•Real or tangible personal property located in West Virginia;

•Employee services performed in West Virginia;

•A business, trade, profession, or occupation conducted in West Virginia;

•A S corporation in which you are a shareholder;

•Your distributive share of West Virginia partnership income or gain;

•Your share of West Virginia estate or trust income or gain and royalty income;

•West Virginia Unemployment Compensation benefits;

•Prizes awarded by the West Virginia State Lottery.

West Virginia source income of a nonresident does not include the following income even if it was included in your federal adjusted gross income:

•Annuities and pensions;

•Interest, dividends or gains from the sale or exchange of intangible personal property unless they are part of the income you received from conducting a business, trade, profession, or occupation in West Virginia.

•Gambling winnings, other than prizes awarded by the West Virginia State Lottery as described above, unless you are engaged in the business of gambling (file a Schedule C related to gambling activity for federal income tax purposes) and you engage in that business, trade, profession, or occupation in West Virginia.

tax.wv.gov |

2020 Personal Income Tax Information and Instructions — 15 |

NONRESIDENTS AND

INCOME

In Column A of Schedule A, you must enter the amounts from your federal return. Income received while you were a resident of West Virginia must be reported in Column B. Income received from West Virginia sources while a nonresident of West Virginia must be reported in Column C.

ADJUSTMENTS

The amounts to be shown in each line of Column B and/or Column C of Schedule A are those items that were actually paid or incurred during your period of residency, or paid or incurred as a result of the West Virginia source income during the period of nonresidence. For example, if you made payments to an Individual Retirement Account during the entire taxable year, you may not claim any payments made while a nonresident unless the payments were made from West Virginia source income. However, you may claim the full amount of any payments made during your period of West Virginia residency.

SPECIAL ACCRUALS

In the case of a taxpayer changing from a RESIDENT to a NONRESIDENT status, the return must include all items of income, gain, or loss accrued to the taxpayer up to the time of his change of residence. This includes any amounts not otherwise includible on the return because of an election to report income on an installment basis. The return must be filed on the accrual basis whether or not that is the taxpayer’s established method of reporting.

For example, a taxpayer who moves from West Virginia and sells his West Virginia home or business on an installment plan must report all income from the sale in the year of the sale, even though federal tax is deferred until the income is actually received.

FILING STATUS

There are five (5) filing status categories for state income tax purposes. Your filing status will determine the rate used to calculate your tax.

•Single

•Head of Household

•Married Filing Jointly. You must have filed a joint federal return to be eligible to file a joint state return. If you filed a joint federal return, you may elect to file your state return as either “Married Filing Jointly” using the state’s tax Rate Schedule I or as “Married Filing Separately” using Rate Schedule II.

•Married Filing Separately. If you are married but filed separate federal returns, you MUST file separate state returns. If you file separate returns you must use the “Married Filing Separately” tax Rate Schedule II to determine your state tax.

•Widow(er) with a dependent child.

When joint federal but separate state returns are filed, each spouse must report his/her federal adjusted gross income separately as if the federal adjusted gross income of each had been determined on separately filed federal returns.

If one spouse was a resident of West Virginia for the entire taxable year and the other spouse a nonresident for the entire taxable year and they filed a joint federal income tax return, they may choose to file jointly as residents of West Virginia. The total income earned by each spouse for the entire year, regardless of where earned, must be reported on the joint return as taxable to West Virginia. No credit will be allowed for income taxes paid to the other state.

A joint return may not be filed if one spouse changes residence during the taxable year, while the other

DECEASED TAXPAYER

A return must be filed for a taxpayer who died during the taxable year. Check the box “DECEASED” and enter the date of death on the line provided. If a joint federal return was filed for the deceased and the surviving spouse, the West Virginia return may be filed jointly. The surviving spouse should write on the signature line for the deceased “filing as surviving spouse”. If a refund is expected, a completed Schedule F must be enclosed with the return so the refund can be issued to the surviving spouse or to the decedent’s estate. Schedule F may be found on page 7.

EXEMPTIONS

While you can no longer claim personal exemptions on your federal income tax return, West Virginia has retained personal exemptions under the same rules applicable under federal law in prior years. The West Virginia personal exemption allowance is $2,000 per allowable exemption, or $500 if someone else can claim an exemption for you on their return. See the rules for personal exemptions on page 20.

ITEMIZED DEDUCTIONS

The State of West Virginia does not recognize itemized deductions for personal income tax purposes. Consequently, itemized deductions claimed on the federal income tax return cannot be carried to the West Virginia return. Gambling losses claimed as itemized deductions on the federal income tax return cannot be deducted on the West Virginia tax return. Consequently, there is no provision in the West Virginia Code to offset gambling winnings with gambling losses.

PROPERTY TAX CREDITS

The Senior Citizen Tax Credit and Homestead Excess Property Tax Credit are available to