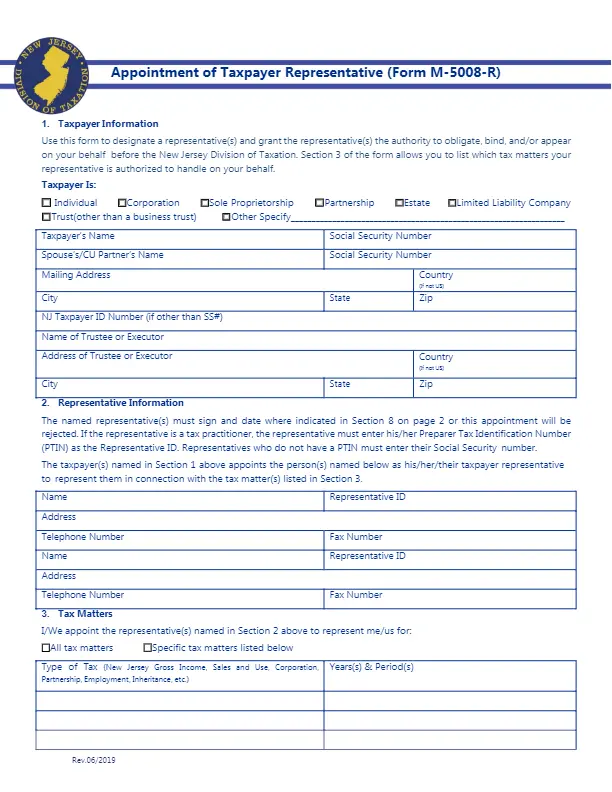

The New Jersey Tax Power of Attorney Form (also known as Form M-5008-R) is a document that a Taxpayer needs to officially appoint a Designee liable for examining the books, records, vouchers, accounts of the Principal, along with all the tax-related matters. The form thoroughly describes what kind of powers the Agent is granted. Suppose the Principal does not wish to share his or her confidential information with the Agent or grant the Representative the right to sign returns or delegate the authority. In that case, e these details must be specified in the document. Providing no additional terms and conditions conveys all tax-related rights and responsibilities without any limit to the Attorney-in-Fact.

Find out all the New Jersey POA forms you can fill out by following this link to our New Jersey guide.

According to Section 54:50-2.1 of the state law, the Attorney-in-Fact should possess written authorization to act on the Taxpayer’s behalf when communicating with the Division, unless:

- An individual appears with the principal or with a representative authorized to act on the principal’s behalf;

- A trustee has been appointed by a court that has jurisdiction over a debtor;

- An individual merely furnishes tax info;

- A fiduciary stands in the position of and acts as the Taxpayer.

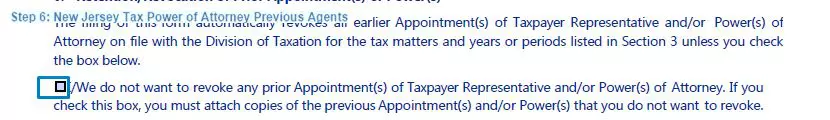

By creating a New Jersey Tax Power of Attorney form, you are revoking all previously executed M-5008-R forms (and thus all of the previously designated representatives). However, if you do not wish to revoke the Agent(s) you have chosen before, it is possible to indicate the particular Representatives in a new paper.

If the form is being created by an individual acting as a corporate member, the president, vice-president, treasurer, or assistant treasurer should sign the form.

New Jersey Tax Power of Attorney Form Details

| Document Name | New Jersey Tax Power of Attorney Form |

| State Form Name | New Jersey Form M-5008-R |

| Relevant Link | New Jersey Treasury Division of Taxation |

| Where to File? | New Jersey Division of Taxation PO BOX 269 Trenton, NJ 08695-0269 |

| Avg. Time to Fill Out | 12 minutes |

| # of Fillable Fields | 66 |

| Available Formats | Adobe PDF |

Filling Out New Jersey Tax POA

Use our form-building software to create your personalized NJ Tax POA.

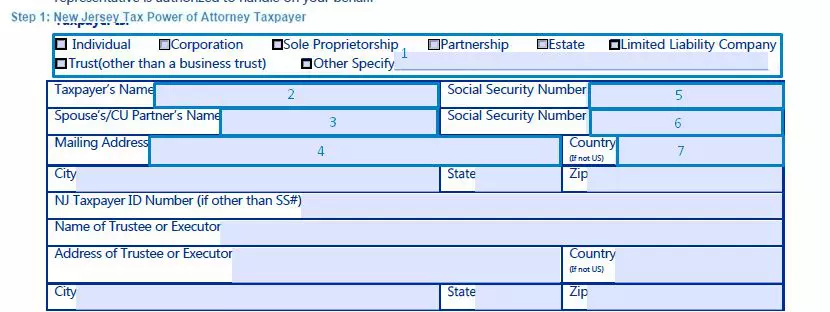

1. Input Taxpayer’s Data

Choose whether you are:

- An Individual

- A Corporation

- A Sole Proprietorship

- A Partnership

- An Estate

- An LLC

- A Non-Business Trust

- Another Specific Taxpayer

Enter all the essential data herein, including the full name, mailing address, ID number, and SS number.

2. Submit Representative’s Information

You may choose to designate more than one Attorney-in-Fact. Provide the data of all the representatives you are appointing: their names, ID numbers, mailing addresses, telephone numbers, and fax numbers.

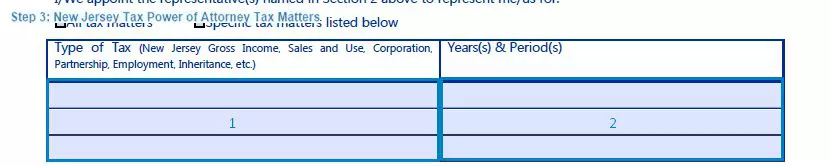

3. Indicate the Tax Matters

You need to indicate what matters you are allowing the Agent to access. If there are any specifications, list them herein.

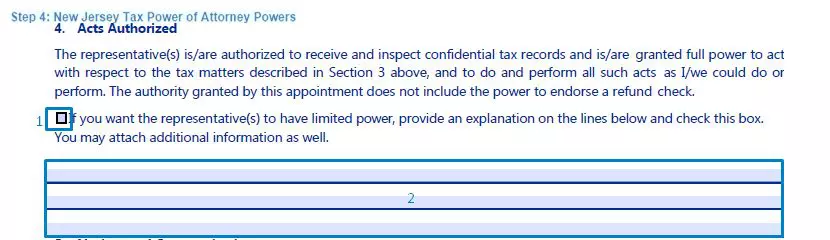

4. Grant the Agent Certain Powers

The Attorney-in-Fact should have full power to act in the Taxpayer’s interest unless the latter limits the powers in this section.

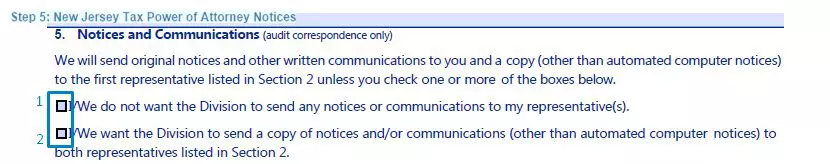

5. State Your Preference Concerning Notices and Communications

All written notices and communications may be addressed to the first Representative you are designating if you check the corresponding box.

6. Revoke Prior POAs and Agents

The previous Agents you have appointed will be revoked unless you state your wish to remain responsible for their duties as your Attorneys-in-Fact by checking the corresponding box. Attach copies of the previous relevant documents in such a case.

7. Put Taxpayer’s Signature

The Taxpayer is supposed to affix his or her signature, printing the name, indicating the date of the agreement, and providing the title herein (if applicable), claiming to have provided true and correct information.

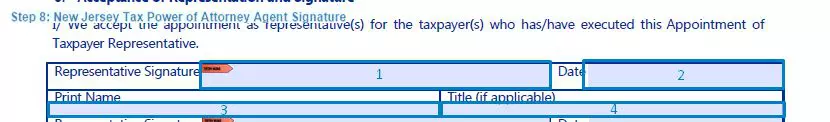

8. Affix the Representative’s Signature

The Agent confirms the appointment as the Taxpayer’s Representative by signing the paper, printing the full name, indicating the date of the agreement, and providing the title herein (if applicable).