Alabama Motor Vehicle Power of Attorney Form

The Alabama motor vehicle power of attorney is a legal document that allows a vehicle owner to delegate authority to another person to handle specific matters related to their vehicle. This form is helpful in situations where the vehicle owner cannot be present to perform necessary duties, such as registration or title transfer.

This form must comply with regulations outlined in Alabama’s statutes. Understanding how to execute these Alabama power of attorney forms properly is essential for their recognition as valid in legal and administrative settings.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

The following steps must be followed to execute a valid power of attorney for motor vehicles in Alabama:

- Signature of the principal. The vehicle owner, the principal in this arrangement, must personally sign the form.

- Notarization. The principal’s signature must be notarized. The notary confirms the signer’s identity and ensures the signature was made willingly and without coercion.

- Complete vehicle information. Detailed and accurate information about the vehicle, such as the make, model, year, Vehicle Identification Number (VIN), and license plate number, must be included.

The creation and use of motor vehicle POA forms in Alabama are regulated by several sections within the Alabama Code, primarily under Title 32, which deals with motor vehicles and traffic. These requirements are essential for the power of attorney form to be respected and recognized by third parties, such as the Alabama Department of Motor Vehicles and potential buyers or sellers.

Alabama Motor Vehicle Power of Attorney Form Details

| Document Name | Alabama Motor Vehicle Power of Attorney Form |

| State Form Name | Form MVT 5-13 |

| Relevant Link | Alabama Department of Revenue – Motor Vehicle Division |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 20 |

| Available Formats | Adobe PDF |

Filling Out Alabama Vehicle POA

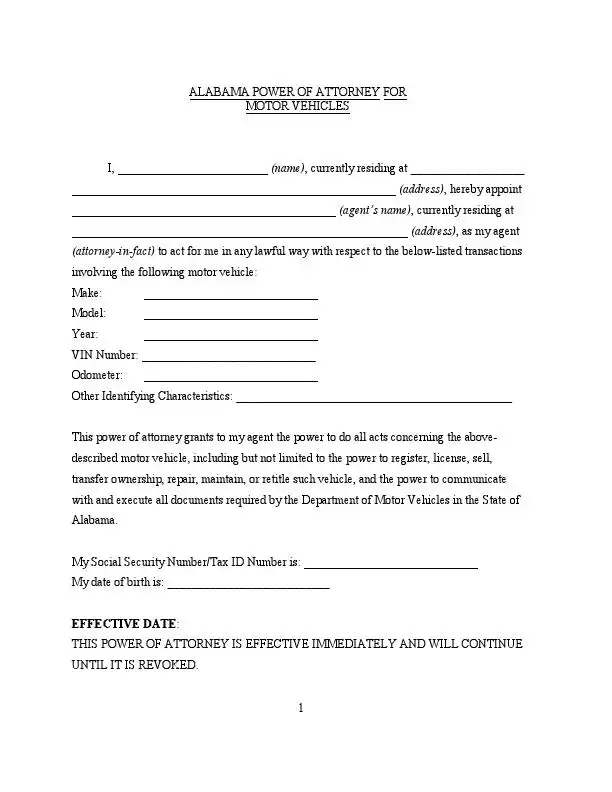

Completing the Alabama motor vehicle power of attorney form (MVT 5-13) allows vehicle owners to grant authority to handle specific tasks related to their vehicle. These tasks may include title transfers, registration applications, and other related activities. Here is a step-by-step guide to fill out this form.

1. Identify the Taxpayer and Vehicle Information

Begin by providing the full name and address of the taxpayer, the vehicle owner granting the power of attorney. This section must also include the VIN, year, make, model, body type, license plate number, and state of issuance of the vehicle. All this information helps identify the ownership and details of the vehicle concerned.

2. Specify the Purpose of the Power of Attorney

Indicate the specific tasks the appointed agent is authorized to perform. It may include applying for a vehicle title, transferring the title, filing liens, handling International Fuel Tax Agreement (IFTA) transactions, registering the vehicle, purchasing license plates, or other specified purposes. If selecting ‘other purpose,’ clearly describe the additional powers granted.

3. Appoint the Representative

Enter the name and address of the individual or entity appointed as the power of attorney. This person, referred to as the attorney-in-fact, will have the authority to perform the tasks specified in the previous step. If the appointee is a business firm or corporation, the signature of an authorized representative who will act on the firm’s behalf must be provided.

4. Signature of the Taxpayer

The taxpayer must sign the form to validate it. The signature must be executed in the presence of a notary public. This step is crucial as it confirms the taxpayer’s consent to and execution of the power of attorney.

5. Notarization

The form must be notarized to be legally effective. This involves the taxpayer signing the form before a notary public, who then attests to the signer’s identity and the signing’s voluntariness. The notary will also fill out their section, including the date and commission expiration.

6. Signature of the Appointee

The appointed attorney-in-fact must sign the form, acknowledging their acceptance of the responsibilities granted under the power of attorney. This signature is required to validate the form.

Ensure that all information provided is accurate and that there are no alterations or strikeovers, as these can void the power of attorney. Review the document thoroughly before submitting it to the relevant Alabama Department of Revenue office or other appropriate authority.