Alabama General Financial Power of Attorney Form

The Alabama general financial power of attorney is a legal form that allows an individual (referred to as the “principal”) to appoint another person (known as the “agent” or “attorney-in-fact”) to handle their financial affairs. This arrangement can be beneficial if the principal cannot manage their finances due to illness, absence, or other reasons.

Using a power of attorney form, the agent can perform various financial activities, such as accessing bank accounts, buying or selling property, and managing investments. This document is essential for estate planning, ensuring the principal’s affairs are managed according to their instructions.

Check out our dedicated state page if you need other Alabama power of attorney forms.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

This state’s general power of attorney is governed by the Code of Alabama, Sections 26-1A-105 to 26-1A-404. This legal framework ensures that persons can authorize others to manage their financial affairs effectively. The main aspects of this statute include:

- The term “power of attorney” is defined broadly, including any document allowing an agent to act on the principal’s behalf (Section 26-1A-102).

- The law mandates that all power of attorney documents be accompanied by the principal’s signature, which must be notarized to confirm authenticity (Section 26-1A-105).

- The principal retains the right to revoke the power at any time, provided they are competent to do so (Section 26-1A-110).

These provisions aim to protect the integrity of the agent’s financial actions, guaranteeing that all transactions are legally valid and align with the principal’s wishes.

Alabama General Power of Attorney Form Details

| Document Name | Alabama General Power of Attorney Form |

| Other Name | Alabama Financial Power of Attorney |

| Relevant Laws | Code of Alabama, Sections 26-1A-105 to 26-1A-404 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 41 |

| Available Formats | Adobe PDF |

Filling Out Alabama General (Financial) POA Form

Here’s a step-by-step guide to help you fill out the Alabama general financial power of attorney form correctly and effectively.

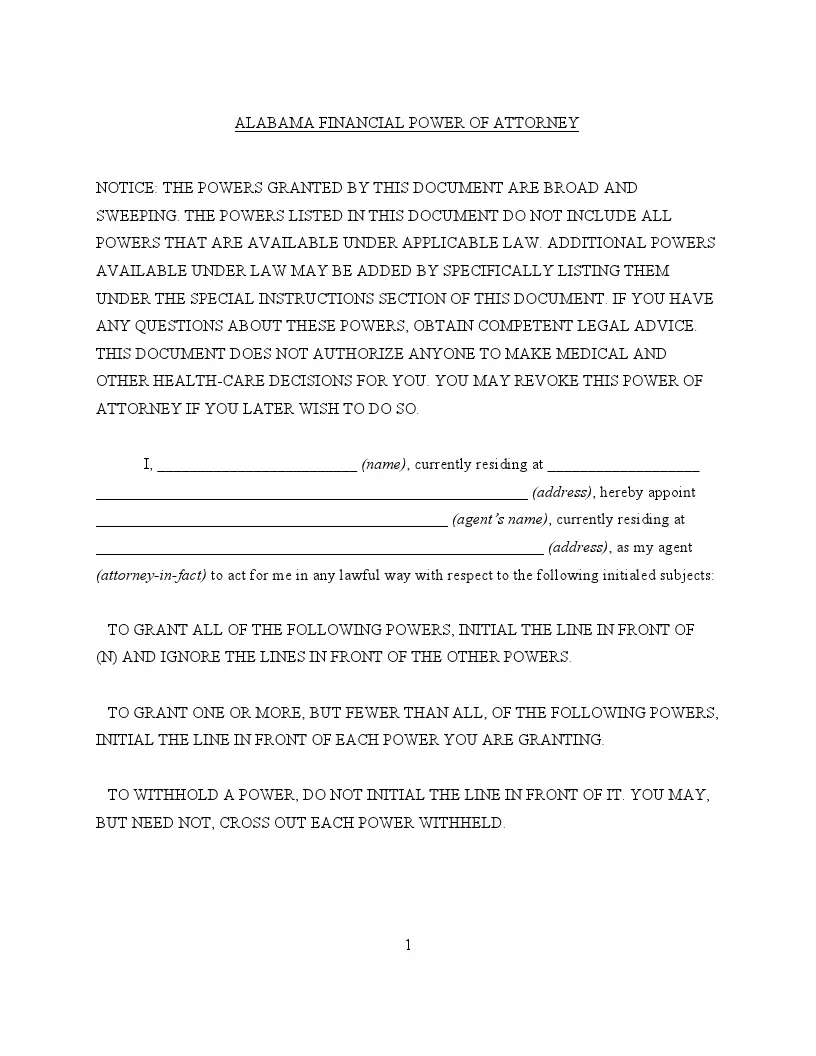

1. Understand the Document

Before you begin, read the notice at the beginning of the form carefully. It explains the broad and sweeping powers you grant and emphasizes that this form does not cover medical decisions. This initial understanding will help you decide how to proceed.

2. Fill Out the Principal and Agent Information

Enter your full name and current residence under the principal’s details. Then, enter the name and address of the person you appoint as your agent under the agent’s details. This individual will have the authority to handle your financial matters.

3. Assign Powers

You will see a list of powers from (A) to (N), each relating to different types of financial transactions. You can grant all listed powers by initialing (N) or select specific powers by initialing each corresponding line. To withhold power, simply leave the line blank.

4. Add Special Instructions

If you want to apply specific conditions or limitations to the powers granted, you can list them in the “Special Instructions” section. This part allows you to tailor the powers to fit your needs more closely.

5. Choose the Effective and Termination Date

Indicate whether a power of attorney should take effect immediately or start on a specified future date by initialing the appropriate line.

Decide how the power of attorney will terminate. You have options such as ending upon your written revocation, on a specified date, or if you are determined to be incapacitated. Select the option that best suits your needs by initialing it.

6. Signatures and Acknowledgments

Sign the document in the presence of a notary public. Your agent does not need to sign. Ensure the notary completes their section, verifying your identity and the voluntariness of your signing.

7. Distribute Copies

Provide a copy to your agent and any financial institutions where they will act on your behalf. Keep the original safe, such as a deposit box or with your attorney.

If you wish to revoke the power of attorney in the future, be sure to do so in writing and notify any third parties who might be affected.