Colorado General Financial Power of Attorney Form

The Colorado general financial power of attorney form is a legal document that allows an individual (known as the “principal”) to designate another person (known as the “agent” or “attorney-in-fact”) to manage their financial affairs. This power of attorney form grants broad powers to the agent, including handling financial transactions, managing property, and making decisions related to the principal’s assets. Unlike its “durable” counterpart, a general power of attorney becomes ineffective if the principal becomes incapacitated.

In Colorado, the general power of attorney must be completed in compliance with state laws. This document ensures that a trusted person can act on the principal’s behalf in various financial and legal matters.

If you need other Colorado power of attorney forms, please visit our dedicated state page in this paragraph.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

In Arkansas, the general power of attorney is governed under the Uniform Power of Attorney Act, which defines this document as any writing or other record authorizing an agent to act in the principal’s stead. The main aspects of Arkansas’s regulations include:

- Statutory reference. The law is detailed in the Colorado Revised Statutes, Sections 15-14-701 through 15-14-745.

- Signing requirements. The general power of attorney must be signed in the presence of a notary to be legally binding.

- Scope of authority. An agent can perform duties as wide-ranging as expressly permitted by the power of attorney document.

- Revocation. As specified in Section 15-14-710, the principal retains the right to revoke the power of attorney at any time.

These provisions aim to protect the integrity of the agent’s financial actions, guaranteeing that all transactions are legally valid and align with the principal’s wishes.

Colorado General Power of Attorney Form Details

| Document Name | Colorado General Power of Attorney Form |

| Other Name | Colorado Financial Power of Attorney |

| Relevant Laws | Colorado Revised Statutes, Sections 15-14-701 to 15-14-745 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 41 |

| Available Formats | Adobe PDF |

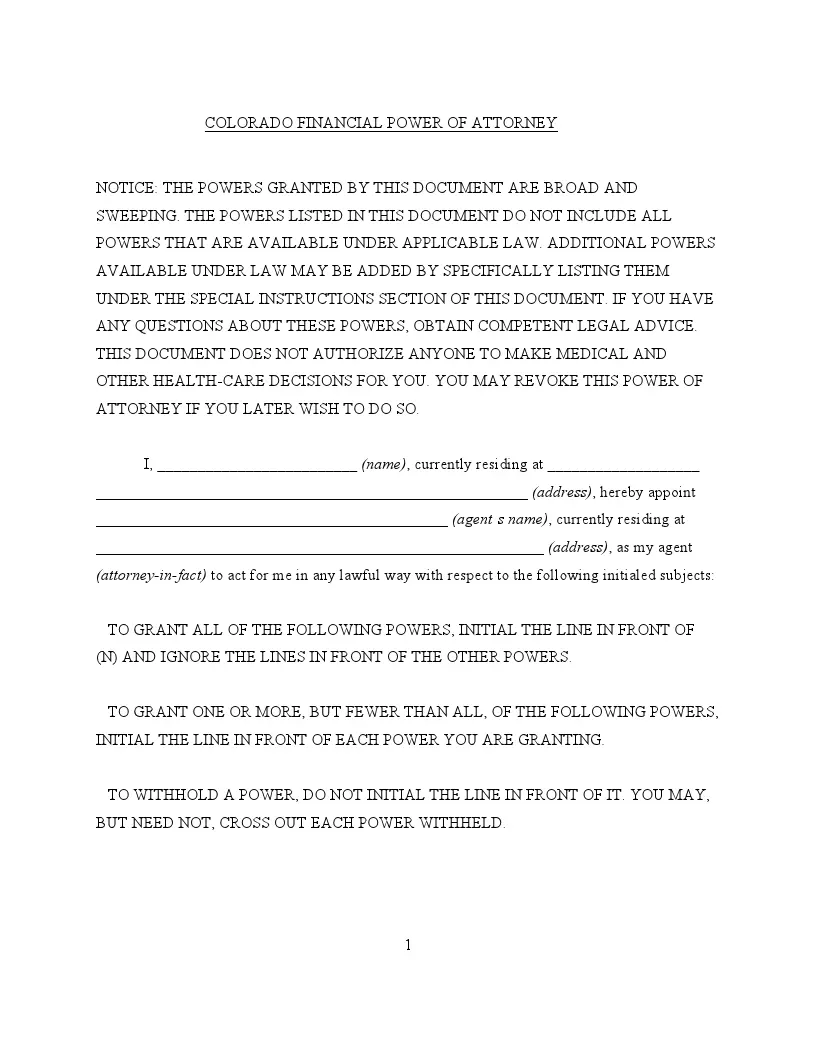

Filling Out Colorado General (Financial) POA Form

Completing the Colorado general power of attorney form is straightforward but requires attention to detail to ensure it meets legal standards and accurately reflects the principal’s wishes.

1. Principal and Attorney-in-Fact Information

Begin by filling in the principal’s name and address in the designated fields. Next, enter the name and address of the person you appoint as your attorney-in-fact. This individual will have the authority to act on your behalf.

2. Granting Powers

You will encounter a list of powers you can grant to your attorney-in-fact. Each power is associated with a checkbox that you must initial to activate that authority. These powers include, but are not limited to:

- Financial transactions. Handling banking, investments, and ongoing financial obligations.

- Property management. Buying, selling, renting, or managing real estate and other personal property.

- Tax matters. Dealing with tax filings, disputes, and other legal matters.

Carefully review each item and initial next to the powers you wish to assign.

3. Signatures and Notarization

Once all the necessary fields are filled and you’ve designated the powers, the principal must sign the document in the presence of a notary. This step is crucial as it validates the authenticity of the power of attorney.

4. Attorney-in-Fact Acceptance

The appointed attorney-in-fact must also sign the document, acknowledging their acceptance of the responsibilities granted by the principal.

5. Notary Acknowledgment

The form will conclude with a section for the notary public. The notary will fill out this part, confirming that the principal has signed the document of their own free will and that they verify the principal’s identity through appropriate means.

6. Secure Storage and Copies

Once notarized, store the original document in a secure location. It’s advisable to provide copies to the attorney-in-fact and perhaps a trusted advisor like an attorney or financial consultant. Ensuring relevant parties have access to the power of attorney can prevent delays or issues when needed.