Massachusetts General Financial Power of Attorney Form

The Massachusetts general financial power of attorney is a legal document that allows you (the “principal”) to designate another person (the “agent” or “attorney-in-fact”) to manage your financial affairs. This might involve processing financial transactions, overseeing property holdings, submitting tax documents, and determining investment choices. The powers given may vary in scope, depending on how the document is structured.

A general power of attorney in Massachusetts is usually non-durable. It will automatically terminate if the principal becomes incapacitated or mentally incompetent. If the principal desires the arrangement to continue despite such conditions, they must use another Massachusetts power of attorney form.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

In Massachusetts, the general powers of attorney guidelines are outlined under Chapter 190B, Article V of the General Laws. These legal instruments grant agents broad powers to manage the principal’s financial affairs effectively and securely.

While Massachusetts law does not specify exact signing requirements for executing these documents, it is highly recommended that a power of attorney document be acknowledged by two witnesses and/or notarized to ensure its validity and prevent any challenges. Key legal requirements include:

- Ideally, two witnesses and/or a notary public must reinforce the document’s authenticity.

- Per Section 5-504, the principal must provide written notice to revoke the power granted to their agent.

Compliance with these provisions will help ensure that the power of attorney remains enforceable and accurately reflects the principal’s intentions.

Massachusetts General Power of Attorney Form Details

| Document Name | Massachusetts General Power of Attorney Form |

| Other Name | Massachusetts Financial Power of Attorney |

| Relevant Laws | General Laws of Massachusetts, Chapter 190B, Article V |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 41 |

| Available Formats | Adobe PDF |

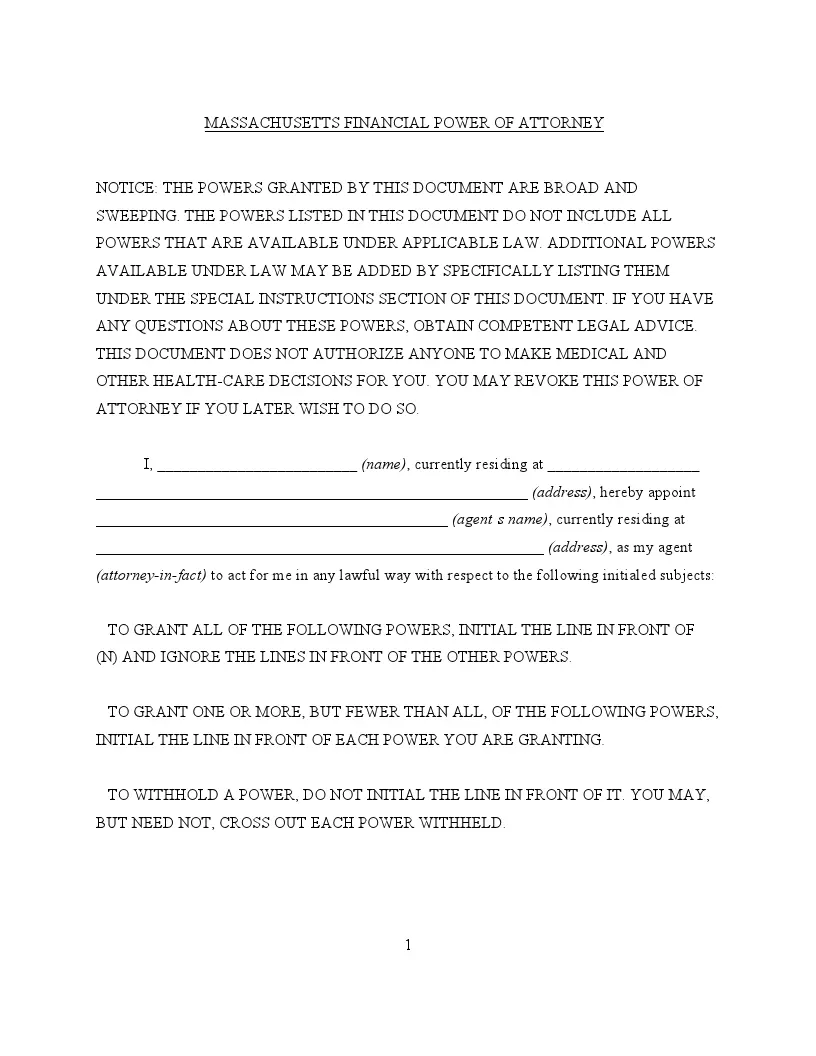

Filling Out Massachusetts General (Financial) POA Form

Completing the Massachusetts general power of attorney form involves a series of steps to ensure it is legally binding and accurately reflects your wishes.

1. Identify the Principal and Attorney-in-Fact

Start by filling out your full name and address as the principal, as well as the full name and address of the person you designate as your attorney-in-fact. Make sure the information is accurate to prevent any issues with identity confirmation.

2. Granting of Powers

You will see a list of powers you can grant to your attorney-in-fact. These powers include handling financial transactions, managing property, and making healthcare decisions, among others. Initial next to each option you wish to grant.

3. Signatures and Witnesses

You must sign the document once you have filled out the form and initialed the powers you grant. Massachusetts law does not explicitly require witnesses for a power of attorney to be valid. Still, having the document notarized and signed by two witnesses is highly recommended to reinforce its legitimacy.

4. Notarization

Take the completed form to a notary public. The notary will verify your identity and ensure you sign the form voluntarily.

5. Inform Relevant Parties

After the form is completed and notarized, inform any relevant institutions or individuals (like banks or medical facilities) that your attorney-in-fact has the authority to act on your behalf. Providing them with a copy of the notarized document can help facilitate transactions and decisions.

6. Safe Storage

Store the original document in a safe place, such as a safe deposit box or with a trusted attorney. Also, provide your attorney-in-fact with a copy of the document to ensure they can prove their authority when needed.