Mississippi General Financial Power of Attorney Form

The Mississippi financial power of attorney is a legal document that enables the principal to authorize the agent to handle their financial affairs. This form of power of attorney provides comprehensive authority to manage various financial tasks, such as accessing bank accounts, purchasing or selling real estate, overseeing investments, and handling personal property transactions.

The agent is legally obligated to act in the principal’s best interest, keep accurate financial records, and avoid conflicts of interest. Also, the principal can revoke the power of attorney at any time as long as they are mentally competent. Revocation should be done in writing and communicated to the agent and any institutions or parties that may be affected.

If you need more forms for estate planning and managing your financial affairs, see all Mississippi power of attorney templates.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

This state’s general framework for powers of attorney is outlined under the Mississippi Code, Sections 87-3-1 to 87-3-113. The main aspects to keep in mind are:

- Actions taken in good faith under a power of attorney remain valid after the principal’s death or incapacity until the agent is notified.

- The general power of attorney should clearly define the powers granted and the conditions for revocation.

Notably, while the law does not mandate specific signing requirements for general powers of attorney, it is highly recommended that the document be notarized to ensure its acceptance by financial institutions and other entities.

Mississippi General Power of Attorney Form Details

| Document Name | Mississippi General Power of Attorney Form |

| Other Name | Mississippi Financial Power of Attorney |

| Relevant Laws | Mississippi Code, Sections 87-3-1 to 87-3-113 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 41 |

| Available Formats | Adobe PDF |

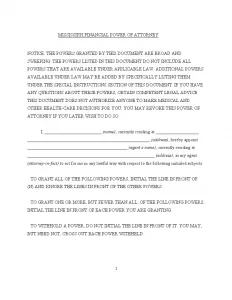

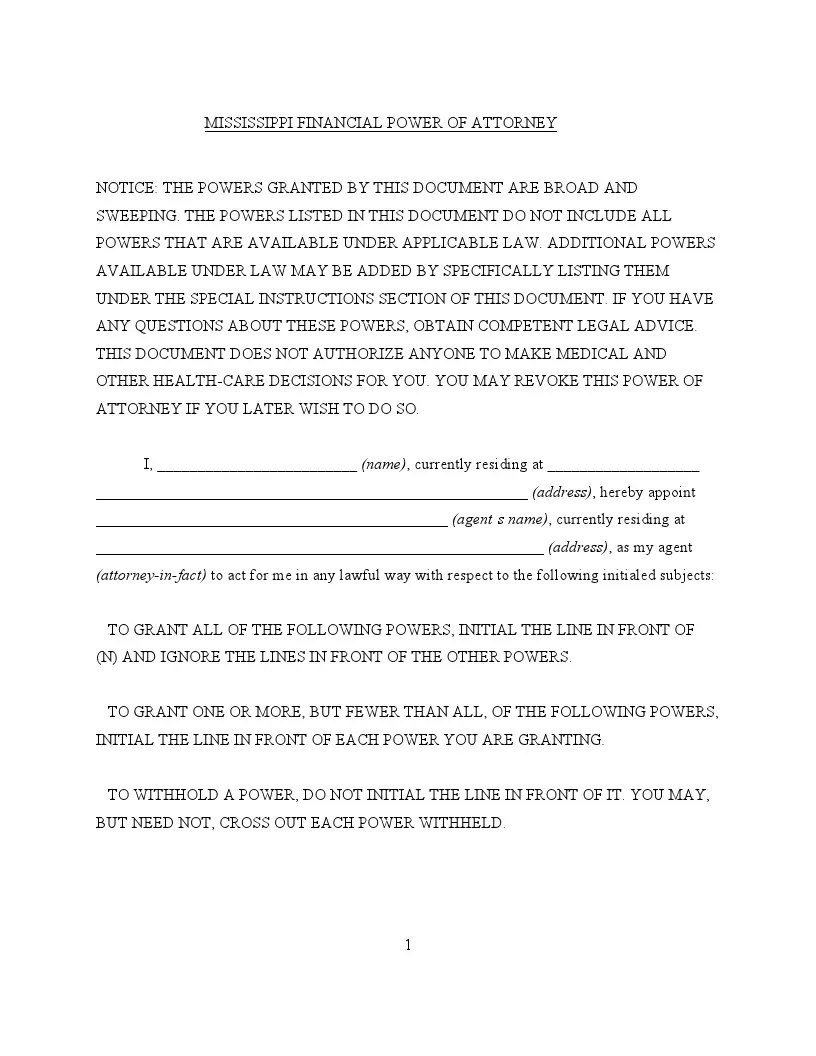

Filling Out Mississippi General (Financial) POA Form

This guide will walk you through filling out a general power of attorney form in Mississippi, ensuring you understand each section and its implications.

1. Fill in the Principal’s and Agent’s Details

Begin by entering your full legal name and residential address at the top of the form. You will then need to provide the name and address of the person you appoint as your attorney-in-fact or agent. This person will have the authority to handle your financial affairs.

2. Granting Powers

You will see a list of powers you can grant to your agent. These range from real property transactions to tax matters. Initial next to each power you wish to grant. If you wish to grant all listed powers, initial only next to the option that includes all powers, typically marked with an “(N).”

3. Special Instructions

This section allows you to provide specific instructions or limitations not covered by the standard powers. If you have specific wishes regarding handling your affairs, detail them here.

4. Effective Date and Termination

Decide when the POA will become effective. You can choose for it to be effective immediately or start on a specific future date. Similarly, determine how the POA will be terminated — whether upon a written revocation, death, or incapacitation.

5. Signatures

You, the principal, must sign the form in the presence of a notary. The notary will then fill out the acknowledgment section, confirming your identity and the voluntariness of your signing.

6. Notarization

After you sign the form, the notary public will complete their section, verifying your identity and the authenticity of your signature. This formalizes the document, making it legally binding.

7. Distribution

Sign and date the form in the presence of a notary. This step legally binds the document and verifies your identity as the principal.