Tennessee General Financial Power of Attorney Form

The Tennessee general financial power of attorney form allows a principal to appoint an agent to manage their financial affairs. This document helps manage financial affairs during extended absences, health issues, or when simplifying complex financial management. The authority granted through this power of attorney form is broad, covering tasks such as buying or selling real estate, managing bank accounts, and handling investments.

Choosing a reliable agent is essential because they will have significant control over the principal’s finances. The general power of attorney will end automatically if the principal becomes incapacitated or unable to make decisions. Furthermore, it’s important to note that the principal can revoke the form at any time as long as they are mentally competent.

Using a general financial power of attorney in Tennessee ensures that financial matters can be handled efficiently without court intervention, saving time.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

In Tennessee, the laws governing the General Power of Attorney are outlined under the Tennessee Code Annotated, Sections 34-6-101 to 34-6-112. This legislation, part of the Uniform Durable Power of Attorney Act, also includes provisions for general powers. These laws enable individuals to designate agents to manage their financial and legal affairs. For example, Section 34-6-109 outlines the specific powers that can be granted to the attorney-in-fact, detailing the scope and limits of their authority.

Although there are no explicit statutory requirements for signing a general power of attorney, it is recommended that the document be notarized to prevent potential disputes.

Tennessee General Power of Attorney Form Details

| Document Name | Tennessee General Power of Attorney Form |

| Other Name | Tennessee Financial Power of Attorney |

| Relevant Laws | Tennessee Code Annotated, Sections 34-6-101 to 34-6-112 |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 41 |

| Available Formats | Adobe PDF |

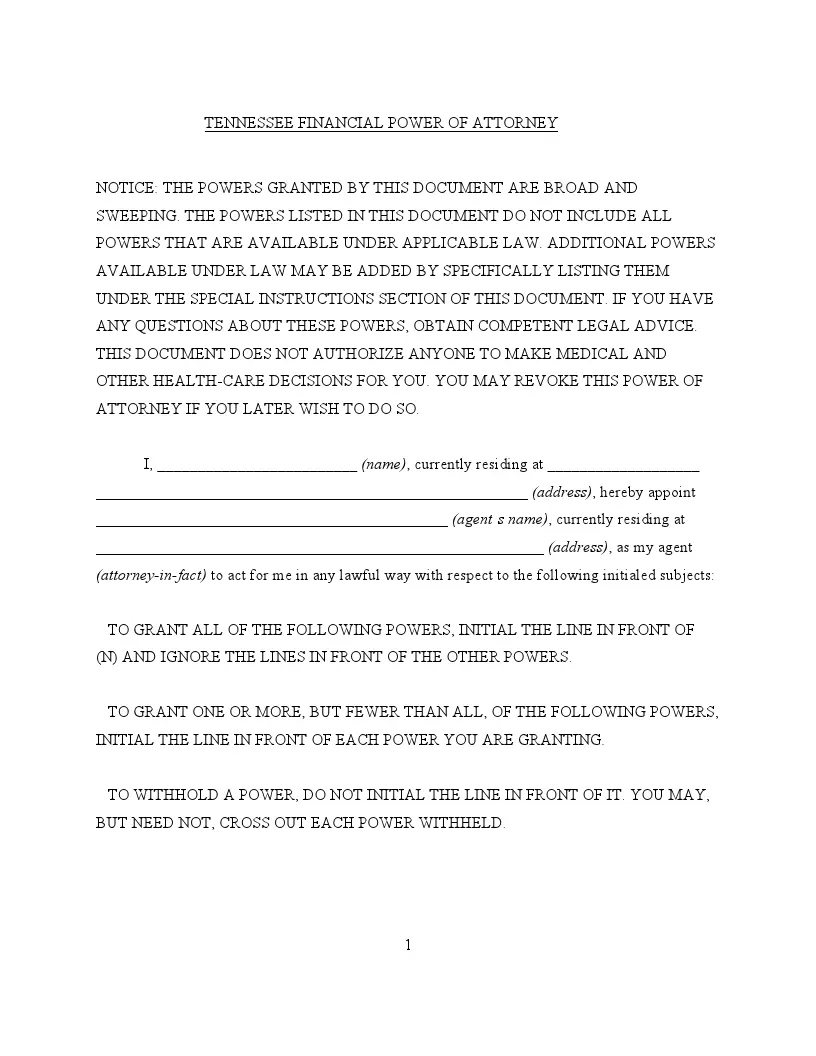

Filling Out Tennessee General (Financial) POA Form

By diligently following these instructions, you can be sure that your Tennessee general Financial power of attorney document is accurately completed and has legal validity.

1. Principal’s Information

Begin by entering your full name and current address in the spaces provided. This field identifies you as the principal granting the power of attorney.

2. Agent’s Information

Next, fill in the name and address of the person you appoint as your agent (attorney-in-fact). Ensure the details are accurate; this individual will have authority over your financial matters.

3. Powers Granted

Decide which powers you want to grant to your agent. You can choose specific powers by initialing the line next to each desired power or granting all listed powers. Leave the lines blank for any options you do not wish to grant.

4. Special Instructions

In the “Special Instructions” section, you can specify any additional powers or limitations for your agent. This part might include specific permissions regarding retirement plans, digital assets, or other financial matters that are important to you.

5. Effective Date

Determine when the power of attorney should take effect. Initial the line indicating whether it is effective immediately or on a specified future date. Fill in the future date if applicable.

6. Termination Date

Specify when the power of attorney will terminate. Initial the appropriate line to indicate whether it ends up on your written revocation, a specified future date, or if you become incapacitated. Define “incapacitated” as required by the form.

7. Signature and Notarization

Finally, the document must be signed and dated in the presence of a notary public. This step ensures the legality of your general financial power of attorney. The notary or witnesses will complete the acknowledgment section, verifying your identity and signature.