Georgia General Financial Power of Attorney Form

Georgia general (financial) power of attorney is a legal form that lets a person appoint another individual to make financial decisions on their behalf. The person who delegates the powers is called “the principal.”

The other person is called “the agent” or “attorney-in-fact” in such documents, although you may see other terms. In Georgia, the principal can assign several agents. The second agent is often called “the successor agent.” There could also be “co-agents” who can act simultaneously.

The co-agents do not need to agree on how they use their right to make decisions for the principal. The principal also has the right to explicitly state in the form if they want one agent to have more powers.

The agents do not need to have any legal experience to act as somebody’s attorney-in-fact because, typically, they would be dealing with common and straightforward financial operations. Some operations that individuals may consider as actions related to finances cannot be included in Georgia’s power of attorney form. For example, no agent can create a will for the principal.

If perhaps you require other Georgia power of attorney forms, go to our dedicated state page linked in this paragraph.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

The state of Georgia recommends that the principal and the agent talk through the details of a power of attorney. The principal can still make decisions regarding their financial matters, even when the Georgia general power of attorney is effective. Moreover, they can always revoke the form, which would terminate a power of attorney. The principal should then notify all the financial organizations that, in their opinion, should be aware that a power of attorney has been revoked.

Note that the Georgia financial power of attorney cannot cover health-related matters. A different form exists for such purposes. A power of attorney can be durable, meaning that it will continue holding power after the principal becomes incapacitated. “Incapacitated,” according to the instructions on the power of attorney form issued by the Georgia Department of Human Services, relates to individuals who are:

- Unable to receive and process information or make and communicate decisions

- Missing or detained (for example, incarcerated)

- Unable to return to the United States

The principal should think carefully about whether they want their power of attorney to be durable. The principal specifies the decision on the duration of a power of attorney in the form. The statutory power of attorney form in Georgia creates a durable power of attorney unless the principal states in the form that they do not wish it to continue being effective after their incapacitation.

The Georgia general (financial) power of attorney should always be signed not just by the principal but also by at least one witness. The witnesses in Georgia must be:

- Of sound mind

- At least 14 years old.

All signatures must be provided in front of a notary public. For a power of attorney form to be effective in Georgia, it must be notarized.

Use our form-building software to create your printable power of attorney form quickly and effortlessly.

Georgia General Power of Attorney Form Details

| Document Name | Georgia General Power of Attorney Form |

| Other Name | Georgia Financial Power of Attorney |

| Relevant Laws | Georgia Code, Sections 10-6-140 to 10-6-142 |

| Where to File? | Not necessary to file in most cases (but it may be needed to record the form with the County Recorder’s Office) |

| Avg. Time to Fill Out | 10 minutes |

| # of Fillable Fields | 41 |

| Available Formats | Adobe PDF |

Filling Out Georgia General (Financial) POA

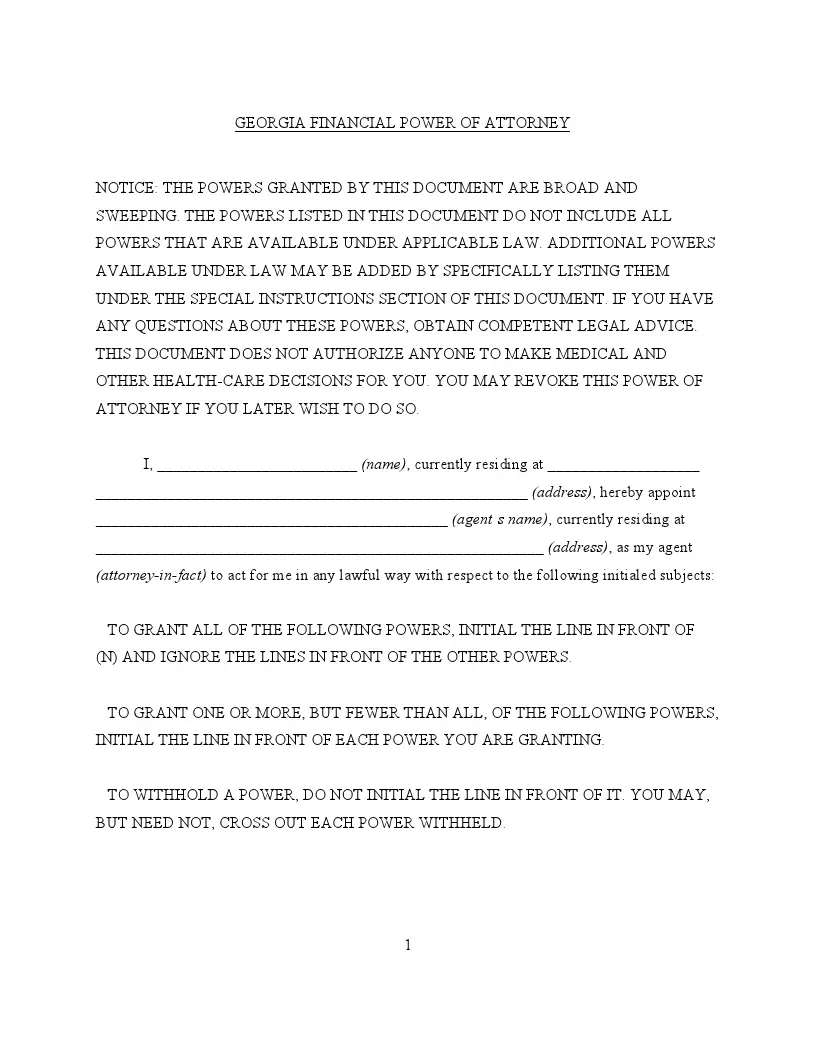

1. Read the Important Information

Read the notice at the beginning of the form to ensure that you have understood all the main requirements and basic information about creating a power of attorney form.

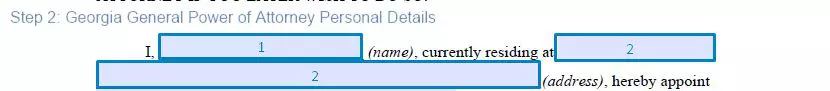

2. Identify Yourself

Provide your name to identify yourself as the principal.

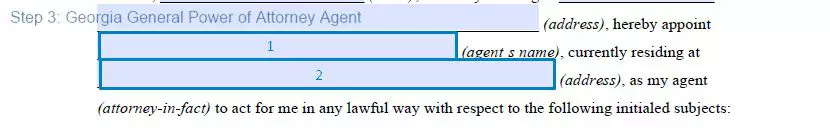

3. Provide the Details of the Agent

You should include their name, address, and other details such as phone number and e-mail address.

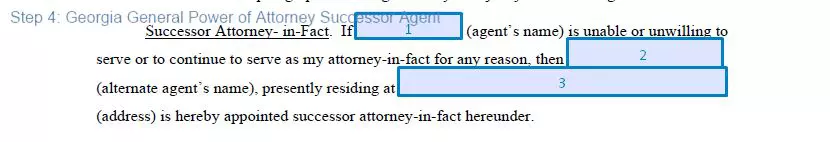

4. Designate the Successor Agent (If Applicable)

Suppose you wish to assign more than one agent for situations when the first assigned attorney-in-fact is not available or does not want to act on your behalf. In such a case, specify who will take over from them by providing their details (name, address, phone number, and e-mail).

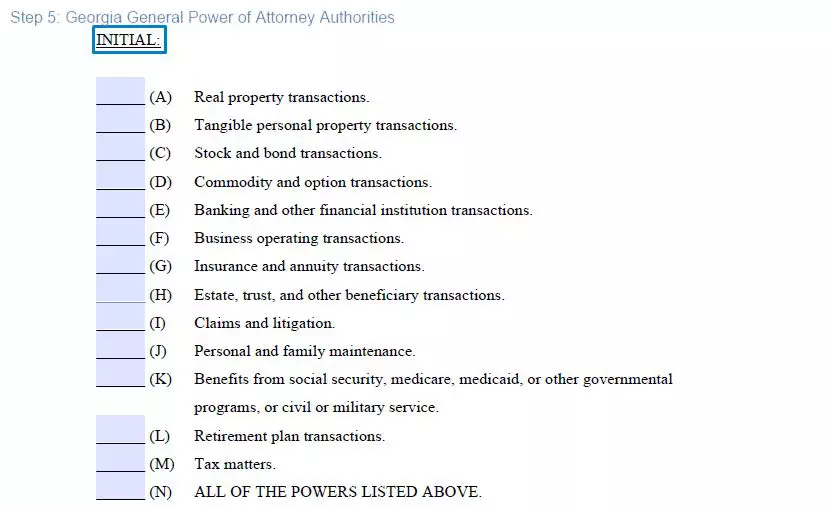

5. Grant the Authorities

Look carefully at the list of suggested powers that you can delegate to your agent—initial your choice. You can also choose all of them at once by initialing the appropriate line.

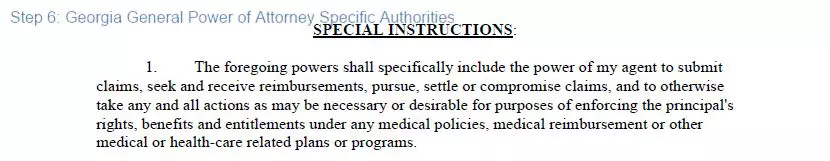

6. Add Specific Authorities (If Applicable) and Additional Instructions

Look at the options offered to you and initial the ones that apply again. You can also write any additional instructions you have for your agent. Furthermore, you can even name a conservator for your estate.

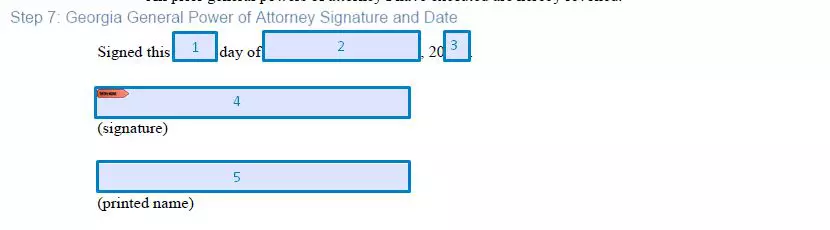

7. Sign and Date the Form

Provide your details (name, address, and phone number), signature, and specify the date of signing.

8. Let the Witnesses Sign the Form

At least one witness should provide their details and a signature to confirm that they have witnessed the principal signing the form.

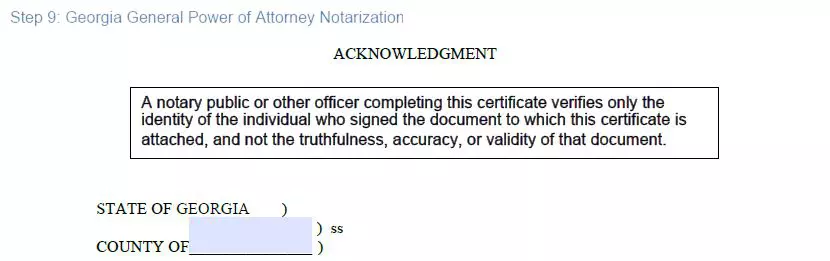

9. Notarize the Form

Let a notary public complete the form and make it effective by filling out the last section of the document.