Colorado Limited Power of Attorney Form

A Colorado limited power of attorney is a legal document that allows an individual (the principal) to grant specific powers to another person (the agent or attorney-in-fact) to act on their behalf. This type of power of attorney is “limited” because it restricts the agent’s authority to specific matters, tasks, or periods, unlike a general power of attorney that grants broad powers.

In Colorado, like in other states, the limited power of attorney is beneficial for situations where the principal cannot be present to handle certain affairs or prefers someone else to take care of specific tasks. It could include managing real estate transactions, handling financial accounts, or dealing with government agencies. To create a valid limited POA in Colorado, you must specify in the document the powers granted and comply with state legal requirements.

Check out all Colorado power of attorney forms and ensure your financial and health decisions are securely managed.

Build Your Document

Answer a few simple questions to make your document in minutes

Save and Print

Save progress and finish on any device, download and print anytime

Sign and Use

Your valid, lawyer-approved document is ready

The laws governing the creation and use of a limited POA are detailed under the Uniform Power of Attorney Act, found in the Colorado Revised Statutes, §§ 15-14-701 through 15-14-745. This act provides a framework for the principal and the agent to operate within clearly defined legal boundaries. Key aspects of these statutes include:

- The agent’s authority, as per § 15-14-724, allows acting on the principal’s behalf but only within the limits set out in the limited power of attorney.

- Revocation processes are established under § 15-14-710, stipulating how a principal can terminate a power of attorney.

Colorado law mandates that any POA must be notarized to be considered valid. This is specified under § 15-14-705. Notarization confirms the principal’s identity when signing, safeguarding all parties involved.

Colorado Limited Power of Attorney Form Details

| Document Name | Colorado Limited Power of Attorney Form |

| Other Name | Colorado Special Power of Attorney |

| Relevant Laws | Colorado Revised Statutes, Section 15-14-724 |

| Avg. Time to Fill Out | 8 minutes |

| # of Fillable Fields | 32 |

| Available Formats | Adobe PDF |

Filling Out Colorado Limited POA

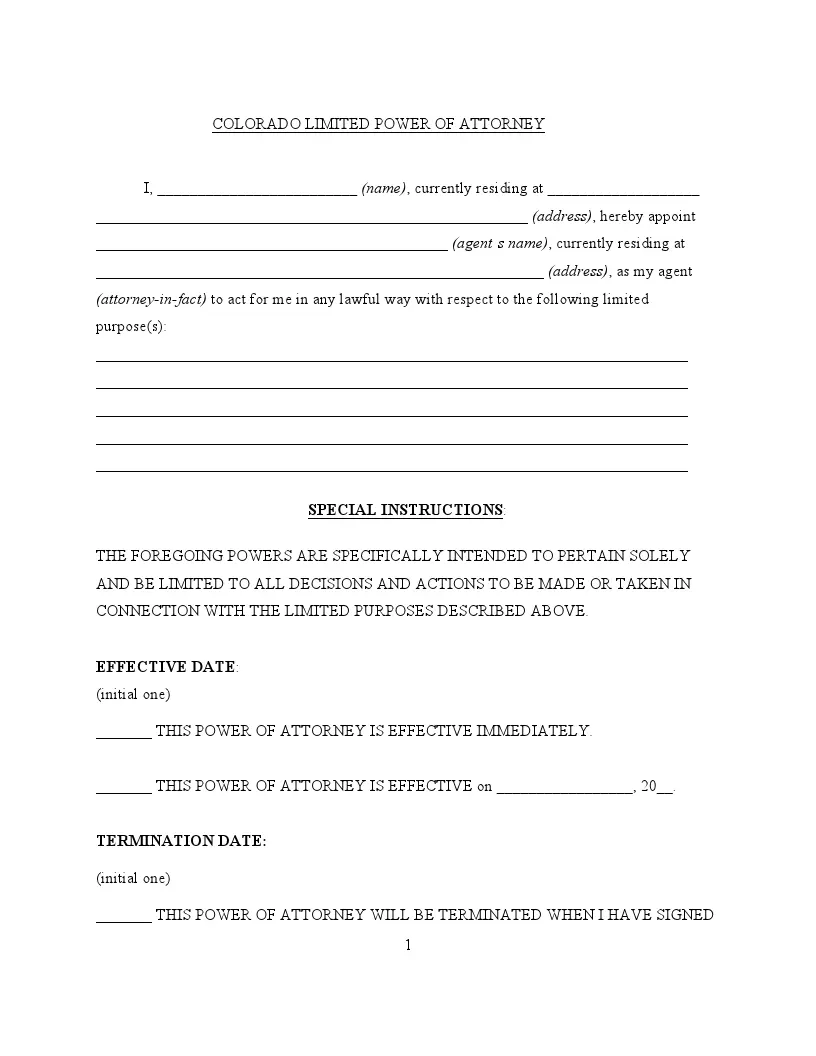

Creating a Colorado limited power of attorney involves a few steps to ensure the form is filled out correctly and meets all legal requirements. Here’s a detailed guide to help you complete the form.

1. Identify the Principal and Agent

First, enter your full name and current address at the designated spots on the form where it prompts, “I, (name), currently residing at (address).” Then, specify the name and address of the person you are appointing as your agent. These details must be accurate to identify both parties involved clearly.

2. Define the Powers

The section labeled “Special Instructions” describes the powers and responsibilities you are delegating to your agent. These powers must be clearly stated to ensure they are limited to the intended scope of the power of attorney, avoiding any overreach by the agent.

3. Set the Effective Date

Choose when the power of attorney will become active. This can be immediate or on a specified future date. Make sure to mark the appropriate line to indicate your choice, as this will govern when your agent can start making decisions on your behalf.

4. Establish the Termination Date

You must also decide when the power of attorney will expire. This could be upon signing a written revocation, on a predetermined date, or upon your incapacitation as defined in the document. Clearly marking your choice here ensures no ambiguity about when the agent’s power ceases.

5. Appoint a Successor Attorney-in-Fact

Optionally, you may appoint an alternate agent to take over if the primary agent cannot serve for any reason. This involves writing the alternate agent’s name and address in the provided space. This step helps ensure continuity in managing your affairs should the initial agent become unavailable.

6. Signature and Date

Sign and date the form in the presence of a notary public. This signature verifies that you understand and agree to the terms laid out in the document. Be sure to print your name below the signature to confirm your identity.

7. Notarization

The final section of the form requires a notary public to complete. This process involves verifying your identity and witnessing your signature, which adds a legal layer of authenticity and prevents fraud.

Once the document is fully executed and notarized, distribute copies to any necessary parties, such as banks or legal entities that need to recognize the agent’s authority.